Hartnett: This Is How To Trade The 2026 "Run It Hot" Market

Last week, in his most recent Flow Show note, Michael Hartnett - who flipped fully-bullish around the time the Fed launched QE lite - wrote that "Markets Are Frontrunning 2026's "Run It Hot" Economy", and summarized his thesis in one of his zeitgeist quotes, to wit: “Fed QE, Nvidia chips to China, $2k stimmy checks, gas prices back below three bucks, no wonder we’re all max bullish.”

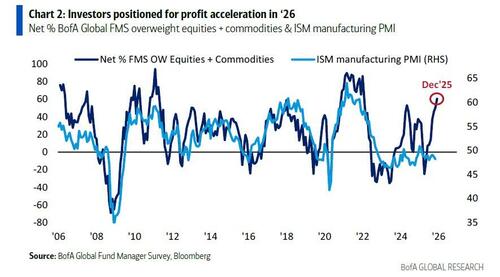

That view was confirmed a few days later when BofA published its latest, and last for 2025, Fund Manager Survey (full note available to pro subs) which found that investors are "bull positioned for "run-it-hot" PMI & EPS acceleration on rate cuts, tariff cuts, tax cuts." At the same time the BofA strategist cautioned that while he expects global EPS growth to be 9% in ’26 it was unlikely to "surprise to the upside given US unemployment up and bond vigilantes slowing AI capex boom, unless big surprise China stimulus."

Fast forward to the latest Flow Show, and last for 2025, note (full report available to pro subs), in which the BofA strategist echoes the main points from last week's Flow Show, and repeats the trading playbook for the first half of 2026 is framed on the upper end by such bullish "positive surprises" as CPI dropping to 2%...

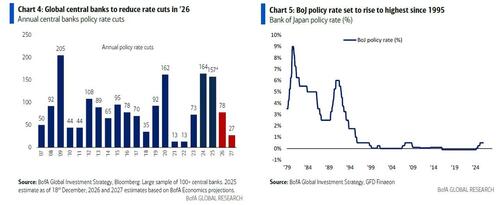

.... and 10Y yields to 3.5%; This is offset by bearish risks such as the potential downside from peak global liquidity (rate cuts <80 not >150, highest BoJ policy rate since ‘95)...

... yet the risks are mitigated by the unexpected re-launch of Fed QE, declining oil prices, Trump's policy needs to improve affordability ahead of the midterms, and the fact that employers not employees are in charge of the labor market for the 1st time since COVID, all of which leads to lower CPI, yields, US$.

And while Hartnett says that he is not chasing the risk-on "run it hot" consensus, he is playing lower CPI via long zero coupon bonds, mid-caps, EM equities, and natural resources.

But while he may not be chasing the bullish consensus, others are, and the Santa Rally which we predicted would emerge after the news that Abu Dhabi would backstop OpenAI's massive spending plans, is now seeing massive inflows, led by a massive $98.2 billion inflow into stocks, of which $77.9bn inflow was into US stocks, the 2nd biggest ever (largest was $82.2bn week of Dec 18th 2024); this was trailed by a more modest $7.9bn to bonds, $3.1bn to gold, while $0.5bn was pullsed from crypto (1st outflow in 4 weeks, but expect this to reverse very soon). All this was funded by a $43.9bn outflow from cash, the biggest outflow since Apr’25.

Here are the key Flows to Know according to Hartnett in his last Flow Show report of the year:

- US stocks: $77.9bn inflow…2nd biggest ever (largest was $82.2bn week of Dec 18th 2024);

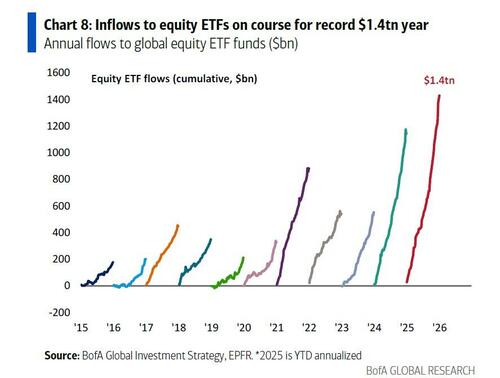

- Equity ETFs: $145bn inflow…record weekly inflow (led by $59bn to VOO and IVV ETFs likely related to S&P 500 rebalancing);

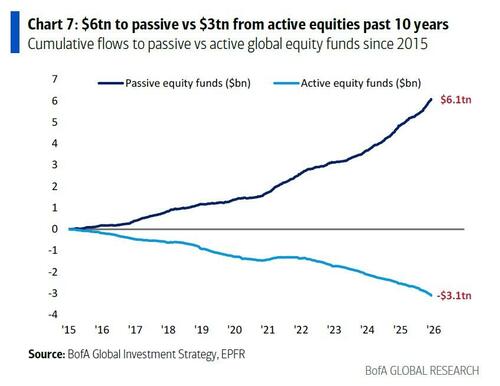

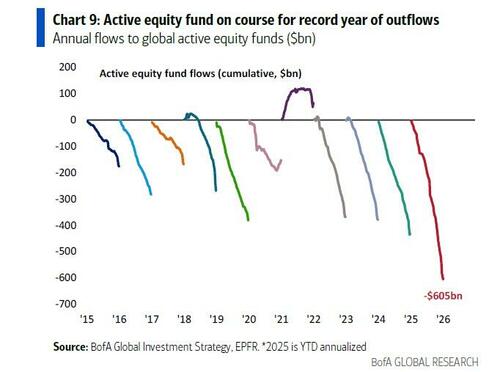

- Long-only equities: $46bn outflow…record weekly outflow (note past 10 years $3tn outflow from active equity funds vs. $6tn inflow to passive equity funds)

- Tech: $6.0bn inflow…1st inflow in 3 weeks;

- Healthcare: $0.5bn outflow…biggest in 5 months.

- Bank loan: $1.1bn outflow…biggest 2-week outflow ($2.5bn) since Apr’25;

- EM debt: $4.0bn inflow…biggest inflow since Jul’25;

So while sentiment has again flipped (making a Christmas Rally almost certain), money is flowing at a near record pace into US stocks, and even such former bears as Hartnett expect upside into 2026, there is one notable risk: sentiment is once again euphoric.

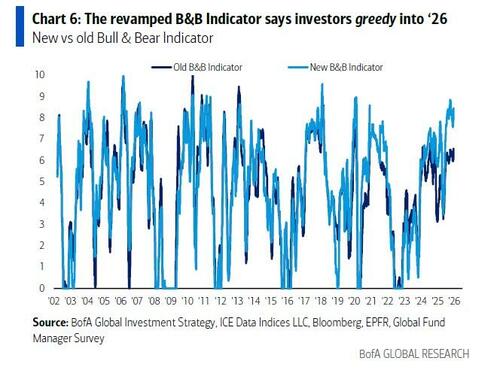

According to Hartnett, the BofA Bull & Bear indicator rises from 7.9 to 8.5, triggering the contrarian “sell” signal for risk assets (triggered on huge inflow to equity ETFs, rising global stock index breadth, hedge funds cutting length in VIX futures). For those unfamiliar, a Bull & Bear Indicator reading >8.0 = extreme bullishness = contrarian sell signal.

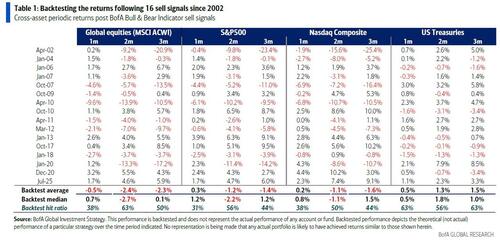

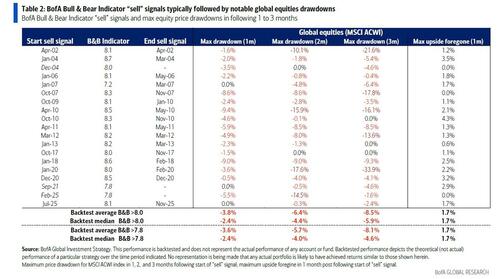

For context, the strategist does a backtest to find that the 16 sell signals since 2002 have been followed on average by 2.4% loss in ACWI, while the max drawdowns in 1 month, 2 months, 3 months after sell signal = 4%, 6%, 9% respectively (vs. max upside foregone <2% - see Table 2). Finally, the hit ratio is 63% but the last two triggers were notable misses, with stocks surging both in Dec 2020 and July 2025 when the Bull and Bear sell signal was triggered the last two times.

... and a max drawdown of 6.4% (Table 2).

Bottom line: between fiscal (ahead of the midterms), and monetary easing (Fed rate cuts to continue indefinitely especially as CPI measured inflation continues to drop, coupled with the Fed's new QE lite), the probability of a meltup into the new year is back front and center; the only potential risk: so is euphoria, and with the BofA Bull and Bear indicator entering Sell territory, the probability of an immediate air pocket spikes... after which expect dip buyers to flood the zone.

Much more in the final Flow Show of 2025, available to pro subs.