Hartnett: Markets Are Frontrunning 2026's "Run It Hot" Economy

Extending his recent theme of bond markets policing the market in "Some Like It Hot", BofA Chief Investment Strategist Michael Hartnett's latest Flow Show focuses on the discontinuities growing wider in the market (for better or worse) after he warned that the only thing that can stop a Santa Claus rally is a “dovish” Fed cut causing a sell-off in long-end... and that's what we got.

'Everything is awesome' is one half of the zeitgeist as Hartnett sees it:

“Fed QE, Nvidia chips to China, $2k stimmy checks, gas prices back below three bucks, no wonder we’re all max bullish.”

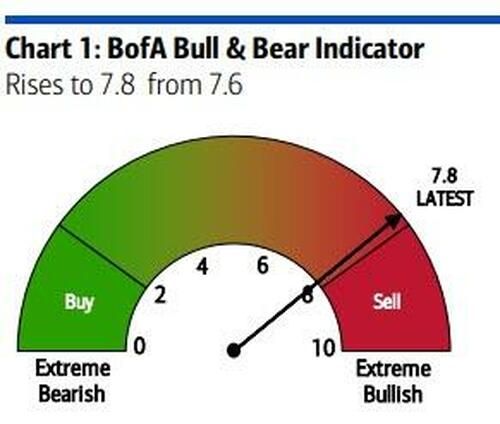

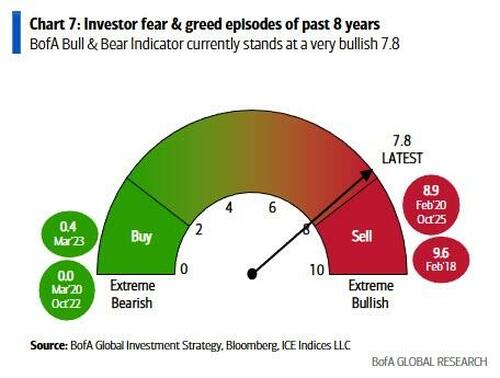

Which is certainly reinforced by BofA's Bull & Bear Indicator redlining...

Although we did get an awakening this week:

“Crazy how TMT dynamics flip when you go from asset-light to asset-heavy."

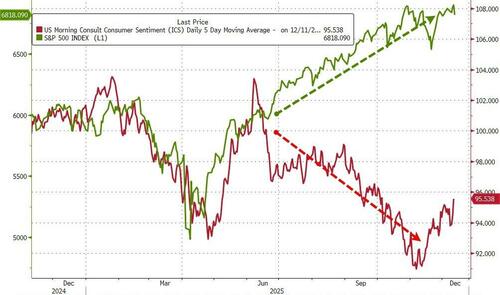

But, of course, as is increasingly discussed, there is one side of the world (the real world) that is less excited by that zeitgeist...

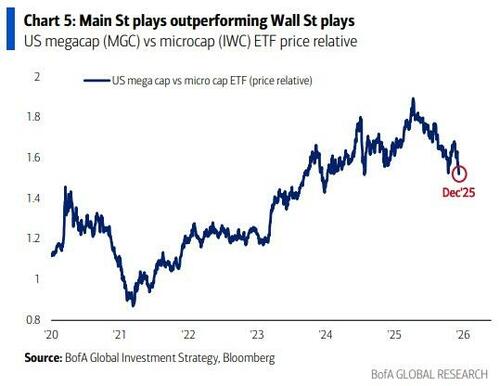

The K-shaped “rich vs poor” consumer narrative was all the rage in ’25, but the BofA strategist poignantly remarks that markets are front-running “run-it-hot” in ’26 via rotation to “Main St” (MDY MidCap, IYR Small-Cap, IWC Microcap) from “Wall St” (MGC Mega Cap)...

Interestingly, Ferrari has crashed relative to General Motors as this frontrunning of rich-to-poor accelerates ahead of the Midterms...

Which is why President Trump wants all the boom with no rise in bond yields (cue YCC, gold reval, stablecoin, energy, pharma, utilities price intervention).

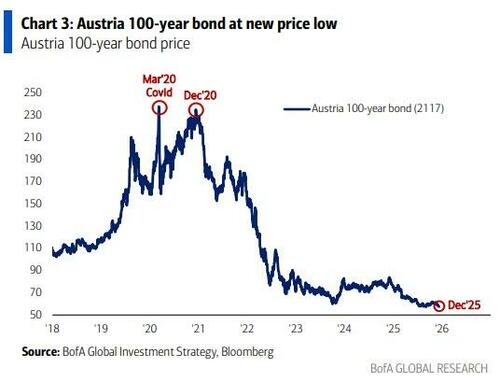

But the 2020s global bond bear continues - Austria 100-year bond at new price low (-76% since Mar’20 peak)…

With all hopes on a productivity jump = boom & lower yields, otherwise square circled by much weaker US dollar...

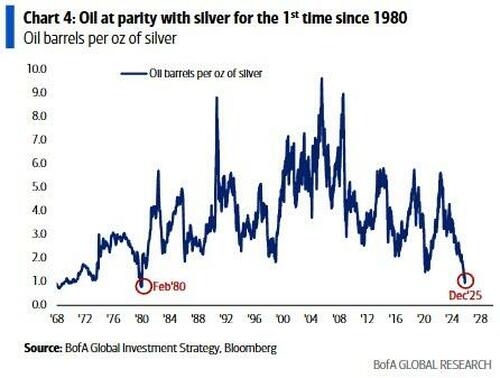

...which is why silver hit parity vs oil for 1st time since 1980...

That's a lot of hope! And hope is not a strategy

Hartnett also remains optimistic with expectations that central bankers won't screw it all up from here into year-end:

Fed QE (buying $40bn short-dated USTs per month) nixes “peak liquidity” concerns;

BoJ hike on Dec 19 (plus SCOTUS) last risk to easy financial conditions;

So long as JGB yield up = Japan bank stocks up, it’s back on for risk & carry trade.

Weekly flows were dominated by bond inflows (and headline by a potential rotation or momentum shift between stocks and crypto):

-

$8.8bn to bonds,

-

$5.8bn to stocks (smallest in 3 months),

-

$2.3bn to gold,

-

$1.2bn to crypto (biggest in 9 weeks),

-

$8.5bn from cash.

Flows to Know:

-

US large cap: $0.1bn outflow, 1 st outflow in 3 months;

-

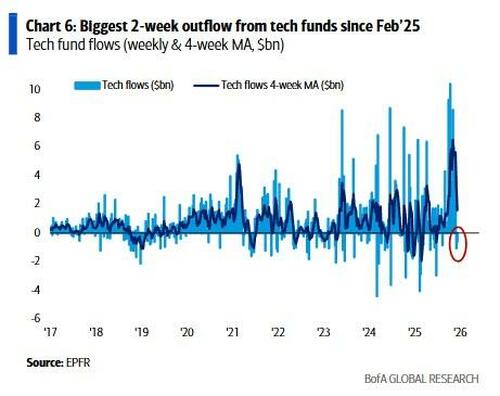

Tech: $0.6bn outflow (Chart 6), biggest 2-week outflow ($1.7bn) since Feb’25;

-

Financials: $1.1bn outflow, biggest since May’25;

-

Real estate: $0.7bn inflow, biggest since Oct’24. BofA

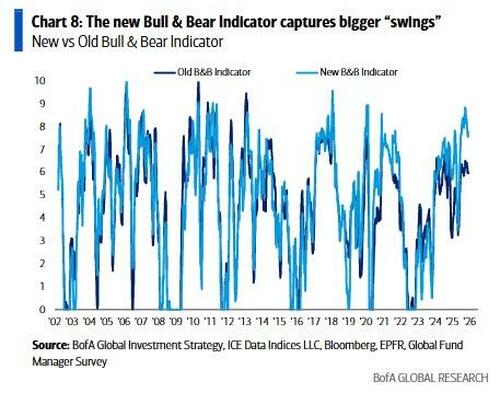

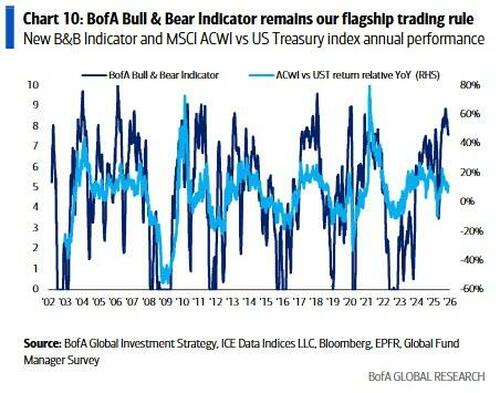

Finally, back to where we started, BofA's revamped Bull & Bear Indicator better reflects market structure and investor liquidity & risk preferences…rise of ETF investing, changing beta of equity sectors, evolving hedging strategies, better measures of risk-taking in credit markets.

The latest reading of revamped Bull & Bear Indicator is 7.8, i.e., investor sentiment back close to extreme bullish.

Note that the new Bull & Bear Indicator hit a recent high of 8.9 on Oct 1st , 2025, an extreme bullish level last seen in Feb’18 & Feb’20; most recent examples of extreme bearish readings were Mar’20, Oct’22 & Mar’23.

Hartnett says that The BofA Bull & Bear Indicator remains their best measure of investor positioning; its revamp involves some new data inputs on flows, positioning & market technicals, but broad methodology unchanged…indicator ranges from max bearish reading of 0 to max bullish reading of 10

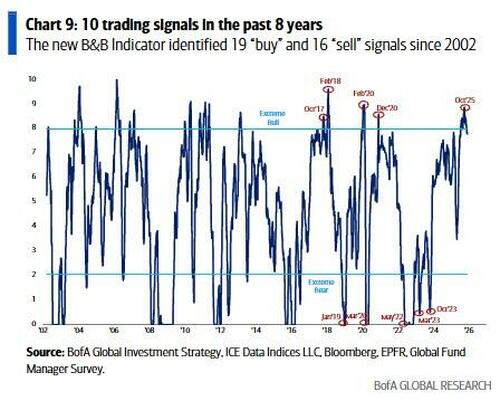

B&B Indicator has and we believe will continue to provide actionable contrarian trading signals (buy when BB below 2, sell when BB above 8);

Since 2002 the new Bull & Bear Indicator would have triggered 35 trading signals, 19 “buy” recommendations and 16 “sell” recommendations

So with the world bulled up to (almost) the max, the question is how long can the 'frontrunning' of next year's 'Midterm encouraging' mantra of 'run it hot' maintain the market's momentum as the reality of AI's 'asset-heavy' new world starts to crack.