Hartnett: Normally This Would Be The Time To Sell... But Not This Time

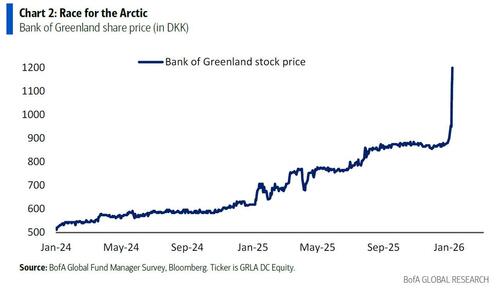

With discussion of Trump's "Greenland new deal" all the rage, it's hardly a surprise that BofA's Michael Hartnett leads off his first Flow Show of the year (available to pro subs), with a discussion on what until recently was considered unthinkable: a US takeover of the vitally important arctic state. He points to the stock of Bank of Greenland which is up 33% in the past 4 days (presumably as markets increasingly think Trump will offer the country's 50,000 citizens money to sway them toward the US)....

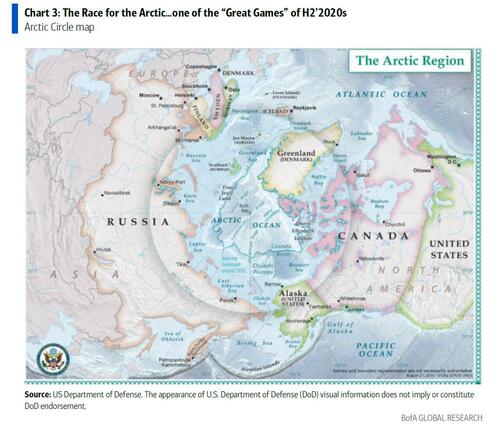

... and notes that investors are chasing geopolitical hedges and front-running global race to stockpile energy & materials (Venezuela = 17% of proven global oil reserves = 300bn barrels, Arctic = 13% world's undiscovered oil, 30% world's undiscovered natural gas)...

... adding that at a time when the Fed and Trump are doing everything they can to punish the dollar and inflate away the debt by currency devaluation, a "US flip from exceptionalism to expansionism is best case for a contrarian US dollar long."

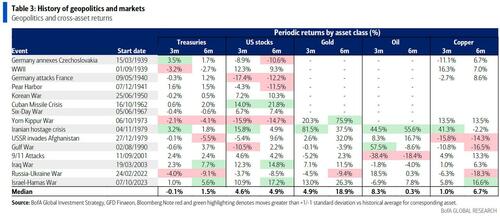

Of course, if a peaceful LBO of Greenland is unlikely, a war is likely, and Hartnett conveniently notes that since 1939, the best performing assets 3 months following war = oil 8.3%, gold 4.9%, stocks 4.6%; after 6 months gold 18.9%, copper 6.7%, stocks 4.9%.

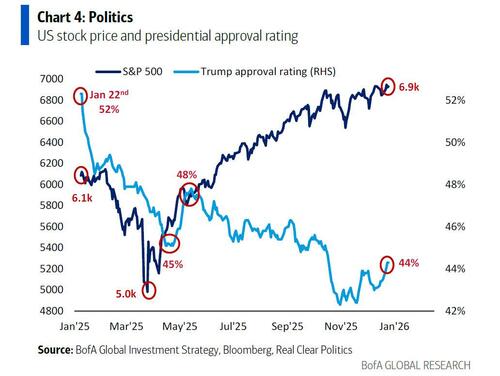

There is another reason why a major way is looming: to distract from Trump's dismal approval rating which is near the lows, at just 43%, (economy 41%, inflation 36%), and needs lower inflation to gain advantage ahead of the midterms.

That's why Trump is pushing for monetary policy to reduce price of money (Fed T-bill QE, Trump MBS QE), and why the US geopolitical policy is aimed at lower oil prices, why trade policy is now to lower tariffs, why industrial policy is intervention to lower pharma, housing, insurance, electricity prices…and why investors are long boom, long risk-parity bull, long breadth.

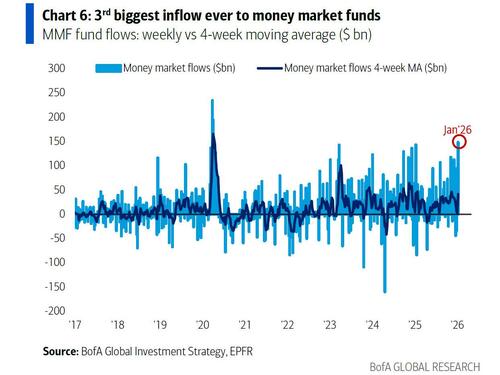

Tangentially, and as is customary every week, Hartnett analyzes the latest fund flow data, and observes that the first week of 2026 saw a massive $148.5bn inflow into cash money markets, the 3rd biggest ever (then again, the 1st week of year is always a big MMF inflow).

Here are some other notable fund flows:

- US stocks: $19.0bn outflow, 2nd outflow past 3 weeks

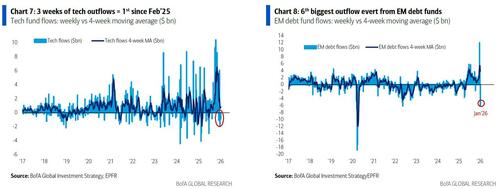

- EM debt: $6.0bn outflow, biggest since May'22 (follows biggest inflow ever 2 weeks ago)

- Municipals: $2.4bn inflow, biggest past 4 months;

- Tech: $0.9bn outflow, extends outflow streak to 3rd week for 1st time since Feb'25;

- Materials: $5.0bn inflow, biggest in 13 weeks;

- LatAm stocks: $0.2bn inflow, biggest since Dec’20.

Hartnett then provides a snapshot of BofA's High Net Worth clients (Private Wealth) at the start of the year, which at $4.3tn AUM, is 64.2% stocks, 17.6% bonds, 11% cash; A peek under-the-hood reveals Mag 7 stocks = 17% of AUM, international stocks = 4%, US Treasuries = 4%, gold = 0.6%. In ETFs past 4 weeks, private clients buying high dividend, munis, and REITS, and selling bank loan, IG, & tech; Hartnett also notes that US household equity wealth rose roughly $9tn in ’25, and follows $9tn gain in ’24, $8tn gain in ’23, $10tn loss in ’22.

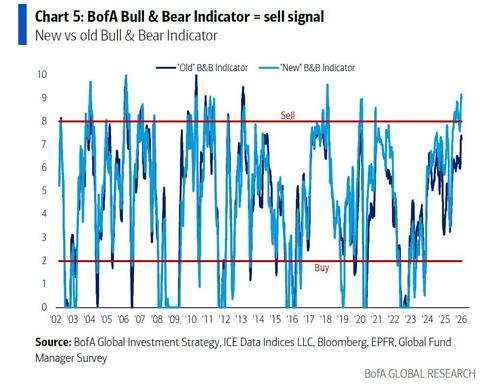

Turning to the (new) BofA Bull and Bear Indicator, here things haven't changed since the end of 2025 when we learned that the Sell signal has been triggered as the indicator is at at a "very bullish 9.0 as outflows from tech stocks & EM debt offset by very strong global equity breadth (98% of country indices above 200dma), super-low BofA Global FMS cash positions (record low 3.3%), hedge funds adding to S&P 500 longs via futures." As a result, Hartnett notes that the new revamped B&B Indicator 8.5 on Dec 17th, 8.8 on Dec 24th, 9.0 on Dec 31st.

The BofA CIO then reminds his clients of the 3Ps and Asset Allocation:

- Markets are driven by 3Ps of Positioning, Profits, Policy; optimal time to go max long assets when everyone positioned bearish, everyone expects recession, and Fed panic eases (e.g., Mar’20, Mar’23); optimal time to go max short when everyone positioned bullish, everyone expects boom, and Fed cuts (e.g., Jan’18, Jan’22, Apr’25);

- Fast forward to Jan’26 when everyone is positioned bullish (BofA Bull & Bear Indicator 8.9 = sell signal, BofA FMS Cash Rule 3.3% = sell signal; '25 = record inflows to IG, equity ETFs, gold, crypto…all scream sell, all say more downside than upside index risk): so yes, everyone expects boom (they do…consensus SPX EPS forecast = 14%), but Fed cutting not hiking, Fed restarting QE buying T-bills, and Trump starting QE buying MBS;

- US economic acceleration and US policy easing and US policy makers “fixing” fixed income, i.e., killing volatility and stopping disorderly bond moves (unlike say 2022)… this is why according to Hartnett, asset allocators are staying long stocks and commodities on 2026 rate cuts, tariff cuts, tax cuts. Against this background, Hartnett expects dips to be bought on i) Fed put, ii) Gen Z put, and iii) Trump put, and advises his clients not to reduce risk allocation until the Unemployment rate is heading above 5%, CPI up from 3% to 4%, and Trump approval rating heading below 40…

Putting it together, Hartnett believes that the correct Q1 strategy = “rotate not yet retreat”, and is why the asset allocation shift to “long boom, short bubble” trades has further to run…raising exposure to value cyclicals (banks, real estate, materials, industrials, small cap, mid cap…), maintaining but no longer adding to defensive Magnificent 7 (actually down since Oct 29th Fed cut & Nov “affordability” elections), and cutting the bubbly periphery or 2nd derivative or “can’t afford the capex” AI trades of ’25 (short AI hyperscaler bonds)... in short, a boom with no bond bust = breadth outperforms concentration.

Hartnett concludes with his core 2026 recommendation which is Long BIG, trading MID = long BIG (Bonds, International, Gold) & trading MID (long Mid-caps, short IG bonds, short Dollar) in '26.

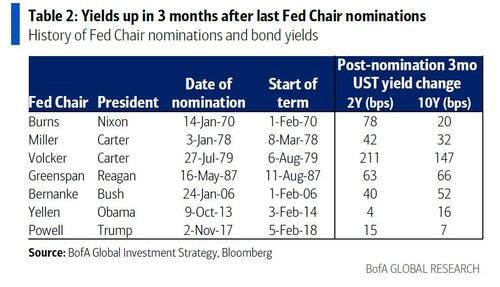

The strategist also recounts his client marketing feedback on BIG+MID from his latest London trip: he notes that bonds are most contrarian for clients…we counters that with US national debt rising $1tn next 100 day, that’s precisely why bonds work as the Trump administration has to QE to maintain bid for bonds and stop markets testing new Fed Chair (in 3 months after 7 nominations since 1970 yields up every time, 2-year yield avg +65bps, 10-year yield up ave +49bps).

Additionally, Trump needs to reduce CPI to gain advantage in midterms, and the Fed needs to cut to stop U-rate rising above 5% (youth U-rate already at 9%).

The client pushback on long international stocks (as secular not tactical theme) is “where” not “why” (Hartnett says UK & China consumer = best upside). Finally, London feedback was geopolitics = gold long, but investors increasingly think safe haven demand may spread to US dollar demand and Iran means oil price could surprise upside.

More in the full note available to pro subs.