Hartnett: Soon All Commodity Charts Will Look Like Gold

It's end of year time, and with the (useless) year-ahead forecasts out of the way, with just three weeks to go in 2025, strategist notes are getting shorter... and in his latest Flow Show report titled with the very Marilyn Monroe-esque "Some like it hot", BofA Chief Investment Strategist Michael Hartnett does not disappoint - or he does, if one expects another burst of lengthy financial inspiration.

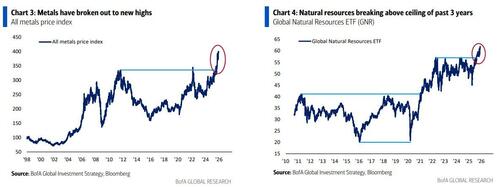

So two weeks after Hartnett left us thinking about Bitcoin as the early warning indicator of the looming Fed capitulation (which his colleague Mark Cabana now ascertained by predicting that the Fed will not only cut 25bps on Wednesday but also launch $45 billion in Bill purchases), the BofA strategist focuses on commodities, the one sector largely left for dead by most, predicting that "soon all the commodity charts will look like gold", a concept encapsulated by this week's Zeitgeist quote, to wit:

"Trump runs it hot, oil bounces post Russia-Ukraine fix, China keeps yuan cheap, soon all the commodity charts will look like gold; what LatAm stocks telling you."

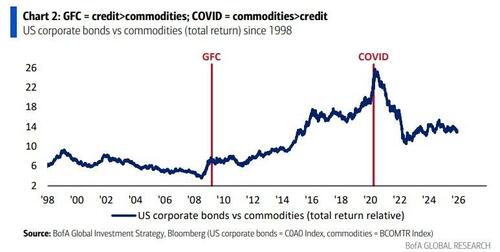

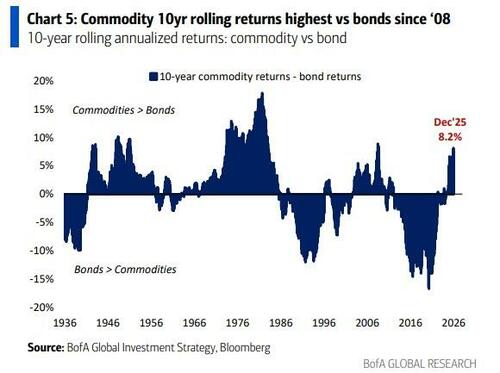

Sure enough, commodities - especially the combustible ones - like it hot… the global financial crisis caused monetary excess, fiscal austerity = bonds smoked commodities in era of secular stagnation...

... but COVID caused fiscal excess, less monetary excess, plus end of globalization = commodities smoking bonds in 2020s era of political populism & inflationary growth.

Which brings us to today: natural resources, metals...

... LatAm stocks (up 56% YTD) are all breaking out. Hartnett says long commodities the best “run it hot” trade in 2026, and long despised oil/energy without question the best “run-it-hot” contrarian trade.

Turning to the tale of the tape, Hartnett writes that investors are again bullish risk on Trump/Fed/Gen Z “puts” & tax/tariff/rate “cuts”, while bond markets are policing “run-it-hot” trade; the biggest threat to consensus is that 2026 upside in stocks & credit all coming in H1; but in Q4’25 Treasury vol remains at new lows, the US dollar is falling again, and the new highs in bank stocks, are all allaying liquidity/credit concerns. In fact, according to Hartnett, the only thing that can stop Santa Claus rally is a "dovish" Fed cut causing a sell-off in long-end.

Going back to "some liking it hot", Hartnett drills a little deeper and explains that's not the case at all, at least in the case of bonds.

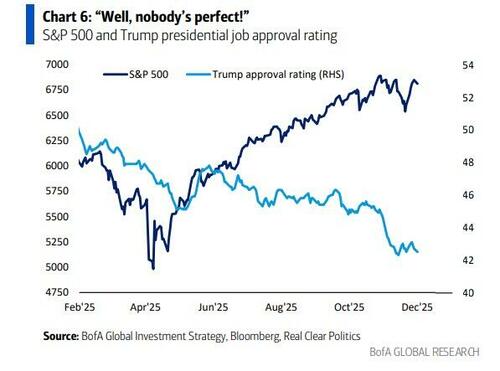

Bonds don’t like “run it hot”; as Hartnett notes previously, BofA is tactically long zero coupon bonds on coming Fed cuts, Trump intervention in economy to drive CPI lower to arrest drop in approval rating (Chart 6), and weaker labor market (US private sector job growth weakest since Oct'20, youth unemployment up to 9.2% from 5.5% in '23)...

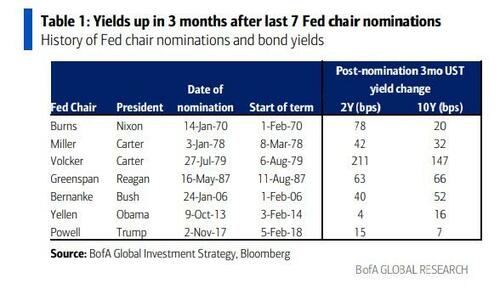

... but the strategist expects to end his tactical long in the long-end before May 15th (start of term for next Fed Chair) on following…

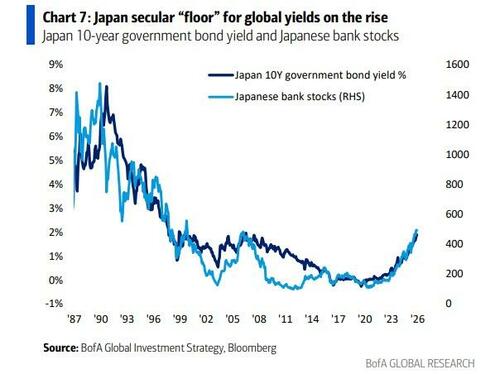

- Bond yields in Japan & China (the secular “floors” for global yields) on the rise (in Japan, to great benefit of Japanese banks).

- Markets now pricing in a 2nd major central bank to hike in ’26 (Australia), and

- In three months after seven nominations since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell), yields up every time (2-year yield up on average 65bps, 10-year yield up on average 49bps)

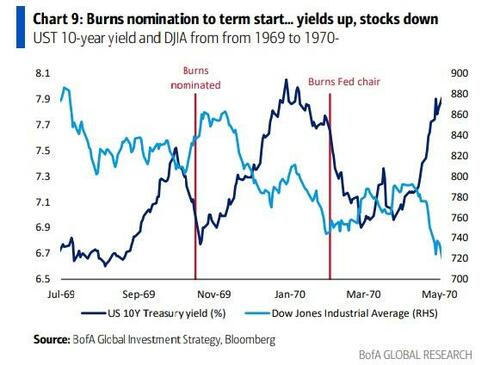

Note from Nixon nomination of Arthur "run it hot" Burns in Oct'69 to Feb'70 start of term UST 10-year yield up 100bps, Dow Jones down 11%.

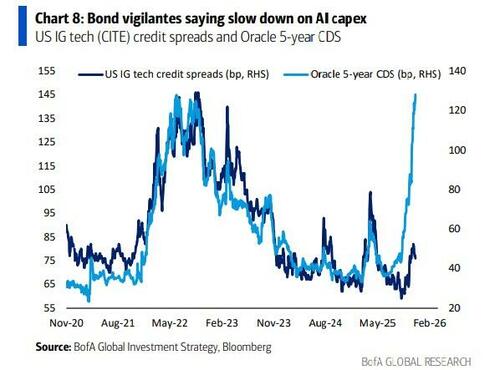

Stocks are more forgiving: some stocks like it hot, some don’t; peak liquidity = trough credit spreads, and according to Hartnett, bond vigilantes are now the new regulators of AI capex, saying slow the growth as hyperscaler capex % cash jumps from 50% ($240bn) in ’24 to 80% ($540bn) in ’26;

Looking ahead, Hartnett is long AI adopters over spenders; and to position for the Trump administration intervening to prevent 4% CPI & 5% U-rate, the BofA strategist is long mid-caps into ’26 (Mag 7 could gobble up entire market cap of small cap 600 & mid cap 400 indices in US… they inexpensive), and see best relative upside trade in Main St cyclicals (homebuilders, retail, paper, transportation, REITs).