Hartnett: The "Trump Boom" Has Led To A New World Bull Market, But It Ends If This Happens

"Only three certainties are death, taxes, and new highs in Japanese banks.”

That was one of the zeitgeist quotes in Michael Hartnett's Flow Show (available to pro subs), and it is an appropriate one because just a few days ago, when highlighting the unstoppable meltup in gold in recent years, coupled with a similar surge in Japanese yields, we said that "Japan was always the endgame", and the attempts by the land of the rising sun to kick the can for another day, week, quarter or year is why gold just continues levitating in anticipation of what is now the all too obvious endgame for the country that made central bank experimentation a way of life for three decades running. The experiment is almost over though...

Japan was always the endgame https://t.co/Aa2Z1PAwu2 pic.twitter.com/MVzGkZfB1G

— zerohedge (@zerohedge) January 14, 2026

It's also why we have been saying for the past 3 years that the ongoing collapse of the yen is inevitable, periodic BOJ/MOF intervention notwithstanding, and double down on this call especially when the entire Wall Street community including countless hedge funds. turned long and very wrong the yen one year ago...

Hedge Funds Have Been Piling Into Long Yen Trades, Say Traders: BBG

— zerohedge (@zerohedge) February 7, 2025

160 coming

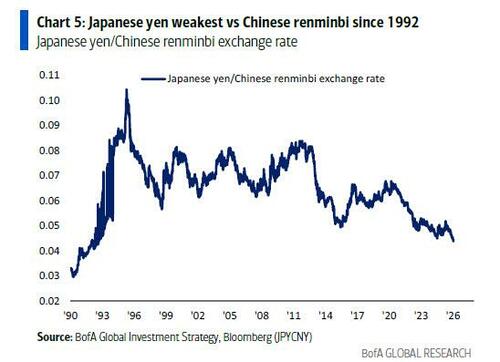

... and sure enough, with the yen now just shy of 160 and approaching the weakest on record, Hartnett warns that it's all about the yen, which is trading the weakest vs. China renminbi (another country which relies heavily on exports to distract from the sorry domestic economy) since 1992.

And as we discussed many times in the past two years, Hartnett warns that the "biggest risk to a max bull Q1 consensus is a rapid appreciation of super-weak yen, Korea won, Taiwan dollar" - driven by either a BoJ hike, US QE, Japan-China geopolitics, or bad hedging - which would trigger global liquidity tightening as Asia capital outflows into US/EU/EM assets to recycle $1.2tn current account surpluses reverse (as we discussed in "China Sees Largest Ever FX Repatriation As Record $1.2 Trillion Trade Surplus Quietly Seeps Into Global Markets").

How to know it's time to get out of Dodge? Watch for “JPY up, MOVE up” risk-off combo, is Hartnett's answer.

But assuming the yen does not carter any time soon, is there a reason to panic? Well, no. Extending on what he said last week in "Normally This Would Be The Time To Sell... But Not This Time," Hartnett writes that the market is entering a “new world order = new world bull” as Trump now drives global fiscal excess (replacing Biden who did precisely the same).

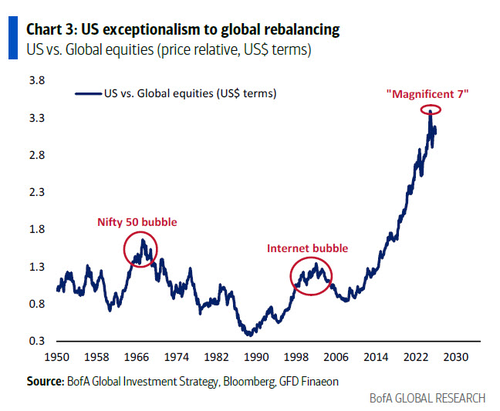

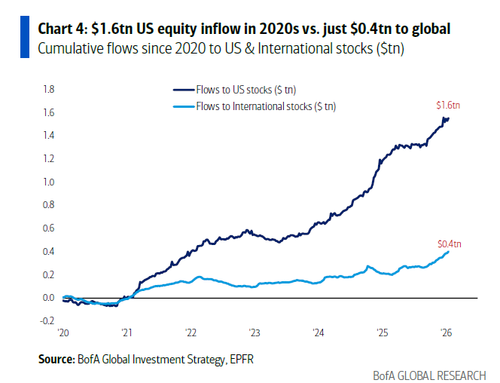

To take advantage of this new world bull, the BofA strategist says to stay long international stocks ..

...as US exceptionalism positions rotate to global rebalancing (note $1.6tn US equity inflow in 2020s vs. just $0.4tn to global funds);

Here, Hartnett says that China is his favorite long as end of deflation catalyst for Japan & Europe bull markets shifts to China.

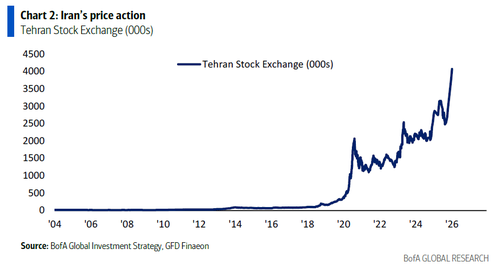

But what about geopolitics, which (not that long ago) could and would impact stocks severely, if not so much any more? As Hartnett shows in the next chart, the Tehran stock exchange is up 65% since August ...

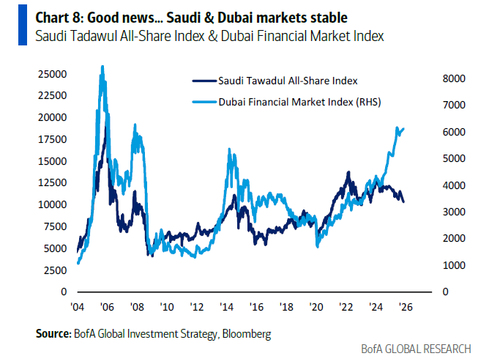

... while stable Saudi & Dubai markets say “no revolution” imminent…

Which is good news as Iran is 5% of global oil supply, 12% of oil reserves, and in the 12 months after the last Iran revolution (Jan 1979 Shah overthrow) oil price up 95%, gold price up 244%, and Treasury yields up 149bps (although many will counter that this time is very different).

New Gold Bull

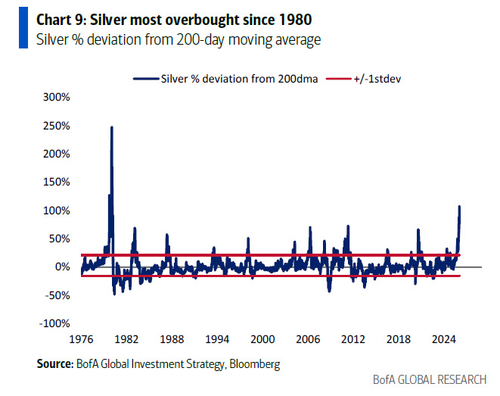

Of course, Trump's new order is not just a not new stock bull: Hartnett says that the new world order = new gold bull. Consider this: short-term gold and especially silver are very overbought short-term (and why bitcoin isnow playing catch-up) - silver 104% above 200-day moving average = most overbought since 1980...

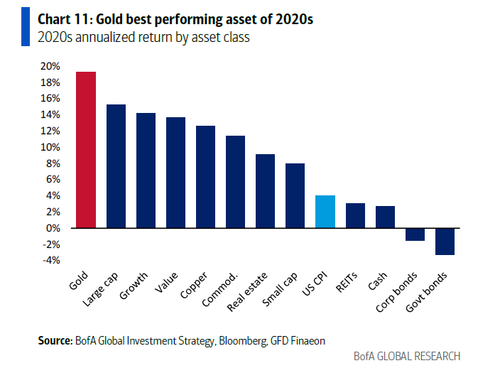

... while gold is the best performing asset of 2020s....

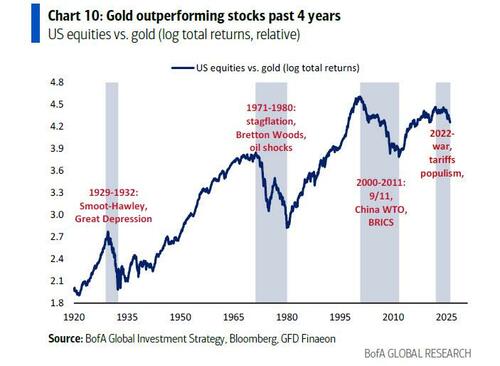

... as a result of war populism, end of globalization, fiscal excess, debt debasement (Fed and Trump are set to add $0.6 tn of fresh QE liquidity in ’26 via T-bill, MBS buying/reinvestment) catalysts… it's why gold is outperforming bonds and US stocks past 4 years and none reversing

And while there are always strong pullbacks in overbought bull markets, one can also make the case for higher allocation to gold intact (currently only 0.6% for BofA high net worth clients); and since the average price gain in the 4 gold bull markets of past century ≈300%, would indicate that gold peaks above $6K.

New Small Bull

Gold is not the only asset benefiting from the New World Bull: According to Hartnett rate, tax, tariff “cuts” and Fed/Trump/Gen Z “puts” are why the Oct 29th Fed rate cut and Nov 4th Trump election defeat triggered rotation to “debasement” (e.g., gold, Nikkei) and “liquidity” trades (e.g., space, robotics). In response, Hartnett is long “Main St Boom” exposure (MDY MidCap, IJR Small-Cap, homebuilders, retail, transportation), and short “Wall St” exposure (MGC Mega Cap), and will remain so until…

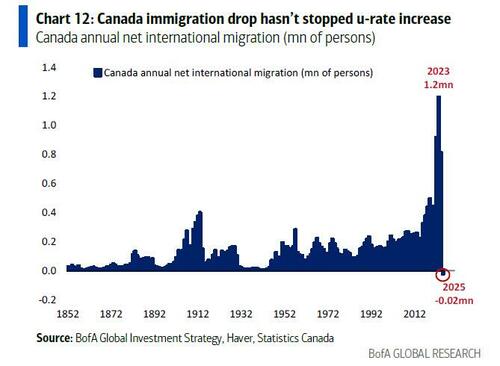

- 1. US u-rate at 5% driven by corporate cost cuts, AI (note youth U-rate up from 4.5% to 8%), and failure of immigration restrictions to stop job losses (note huge drop in Canada immigration has not stopped unemployment rate up from 4.8% to 6.8% past 3 years); tax cuts saved not spent not positive cyclicals.

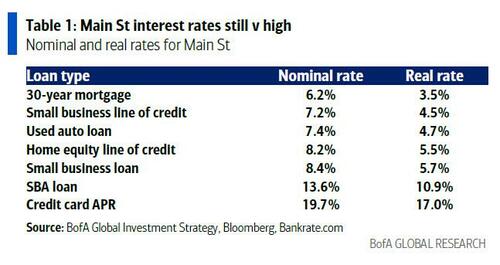

2. Trump policy focus on affordability via big intervention to reduce price of money (Main St interest rates still very high)...

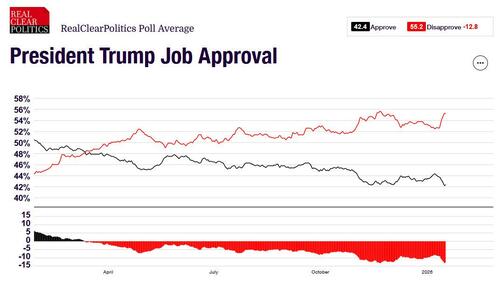

... price of energy, insurance, health care, and now high AI-driven price of electricity, fail to improve low Trump approval ratings (on Trump 42%, on economy 41%, on inflation 36%, per Real Clear Politics); note “Nixon Shock” of Aug 1971 freeze on prices and wages to improve cost of living did work… Nixon’s approval rose from 49% in Aug’71 to 62% by time of Nov 1972 re-election; but if Trump approval doesn’t improve by end-Q1, mid-term election risks grow and tougher for investors to remain long “Trump boom” cyclicals.

After all, as we said in "Fast And Furious 47", The Midterm Elections Are Driving Everything"

More in the full Hartnett Flow Show available to pro subs.