"A Hawkish Surprise": Goldman's First Take On The Implications Of Warsh's Pick

President Trump has announced former Fed Governor Kevin Warsh as his nominee for Fed Chair, following reports overnight suggesting a Warsh nomination was imminent.

The Pick

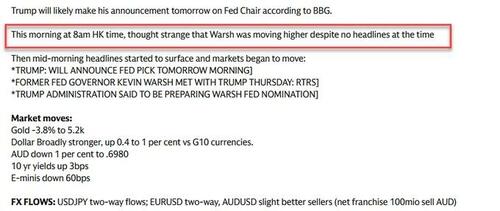

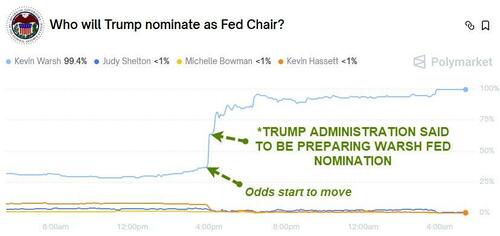

Prediction markets swung sharply to pricing Warsh as the heavy favorite for nominee (starting to rise before the headlines actually hit)...

Following the initial headlines overnight, the broad Dollar modestly strengthened, alongside a slight bear steepening in the US curve, and a slight decline in US equities.

Why Warsh?

Goldman Sachs' Delta-One desk-head, Rich Privorotsky, offered some color on 'Why Warsh'?

It’s a surprising pick, but from a long-term perspective arguably the right tone.

It puts questions around Fed independence largely to bed.

The big asset the US system has is the USD system, and without a credible central bank that would eventually fracture.

You have to ask why the pendulum is swinging toward Warsh now.

One interpretation is reflexivity…

...in the 70s Volcker wasn't Carter's preference, it was the market's.

Market Implications

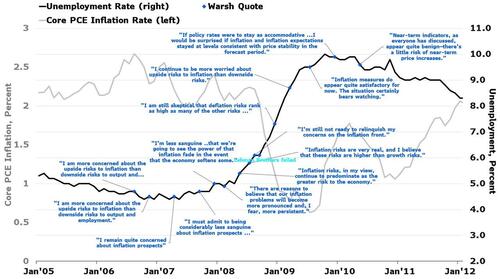

Top Goldman FX trader, Stuart Jenkins noted that the market’s read of the Warsh nomination is likely primarily through the lens of his previous policy positions during his tenure as Fed Governor from 2006-2011, and from his recent commentary on Fed policy.

In both instances, Warsh has expressed scepticism or resistance toward increases in the Fed’s balance sheet, including highlighting “significant risks” at the time of the balance sheet expansion under QE2 starting in late 2010.

Recent policy comments: On November 17, Warsh wrote that the Fed should reduce its balance sheet - arguing that this is the cause for elevated inflation - and lower interest rates to support households and businesses.

Warsh has also more recently called for a “new Treasury-Fed accord” to better define the role of the Fed’s balance sheet, and has been critical of the Fed’s “hesitancy to cut rates” in July 2025.

But, as Bloomberg economist Anna Wong pointing out Warsh has historically exhibited a not-so-easy-on-inflation outlook:

Here we chart his inflation assessment during the FOMC meeting from 2006-2011 (along the unemployment rate, with core PCE inflation in the background).

One standout one:

April 2009 - 7 months after Lehman, core PCE inflation at 0.8%, unemployment at 9%, he said:

"I continue to be more worried about upside risks to inflation than downside risks."

Economics views:

-

Warsh holds a low real rates and low fiscal spending stance, somewhat like ECB/Europe.

-

He has argued that inflation is not caused by easier monetary policy or strong growth, but fiscal spending.

-

His strongest view is that the Fed should not have a balance sheet or interfere in markets.

-

He frequently espouses the need for “regime change” at the Fed, often arguing that the Fed has acted too far outside of its mandate. In July 2025, Warsh suggested an alliance between the Fed and the Treasury to manage debt issuance and the Fed’s balance sheet (which he argues is the cause of inflation). He has also claimed that the Fed ought to be working with Treasury to help lower borrowing costs.

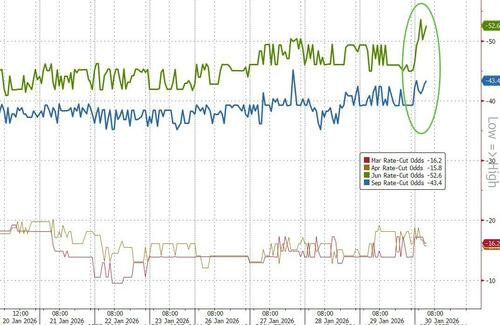

The Reaction (so far)

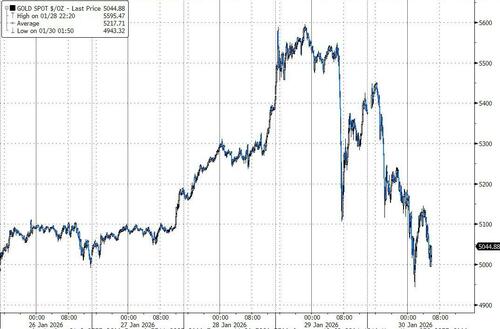

On metals, gold with a near 8% reversal from yesterday’s highs and -3.5% today. Classic blow-off dynamics, range expansion, vol explosion. You could feel the herding. Metals specialists point to aggressive buying yesterday from Chinese speculative accounts. The whole complex is reversing hard today.

Even EM, where we’ve seen a cascade of inflows, feels vulnerable here. A Warsh confirmation today would exacerbate that.

It’s hard to know how much capital was chasing the trade purely on the belief that Fed credibility was under threat.

The real risk to the party is that rates come in and pull the punchbowl.

Five-year breakevens are up almost 30bp since start of January.

With Warsh as chair, there’s a non-trivial risk the committee acts independently and shifts the discussion from cuts back toward hikes.

As the market parses the implications of Warsh as Fed Chair, there remain important caveats for the path ahead.

Republican Senator Thom Tillis has announced opposition to the confirming a new Fed Chair while the legal investigation into the current Chair is ongoing, and holds a key vote on the Senate Banking Committee.

Markets will also need to assess how Warsh’s policy views align with those of the broader committee.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal