'Headline Roulette Has Returned' But Goldman Trader Says Macro Outlook 'Inherently Favorable'

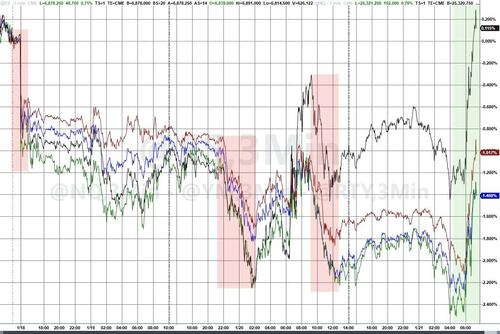

As stocks recover from Trump-driven chaos (and Japanic), thanks to Trump-driven calming this morning...

...Goldman Sachs head of hedge fund coverage, Tony Pasquariello, offers a few short (and timely) observations on the markets, stripped down his market framework to the frame:

The pace of change these days -- be it technological or geopolitical -- is plainly stunning. multiple constituencies are moving at warp speed, and with that comes tensions and crosscurrents. in effect, financial assets are open market referendums for debating and weighing the key issues of the day. the month of January has been a case study for all of this, containing elements of both elation and anxiety.

Now, despite all of that action, the world’s largest asset markets were remarkably steady in the new year -- at least through last Friday. on the equity side, S&P was locally realizing just 6% volatility; on the fixed income side, the MOVE index was melting towards multi-year lows. if you flash forward to today, the sensation has changed and the tails feel wider.

Be it (1) renewed cross-border arm wrestling or (2) the backup in JGBs, volatility has reignited from patently low levels.

Of those two concerns, I’m more focused on the protraction of the latter. for all of the twists and turns of last year, the US Treasury market was remarkably stable, which provided ballast for risky assets. to borrow an observation from a client, consider these snapshots of US 10-year note yields at quarter end: Q1 = 4.21% ... Q2 = 4.23% ... Q3 = 4.15% ... Q4 = 4.17%. again, all I’m saying is this: stock operators should keep a close eye on global fixed income markets, and I’d argue your equity risk taking should embed an expectation of steeper curves and more term premium.

One more dimension of risk to consider: positioning.

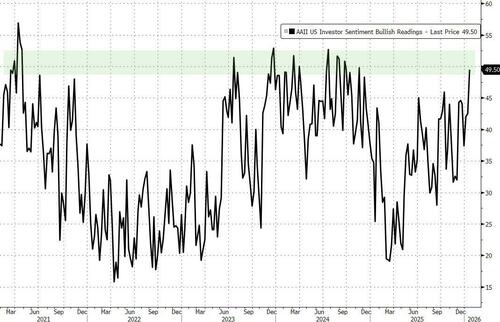

As mentioned a few times recently, the trading community -- inclusive of both households and professionals -- has added a significant amount of risk. be it single stocks or index futures, be it gross exposure or net exposure, most all of the measures that I track are pushing the upper boundary of recent history.

Alongside this, various sentiment surveys had drifted into happy territory (e.g. AAII was the most bullish since November of 2024).

None of these are a reason to run for the hills, but they contribute to a tactical setup where there’s a less room for error.

Here’s the executive summary at this point in the note: headline roulette around tariffs has returned, global bond markets are having a moment in the washing machine and speculators are carrying a bunch of risk.

All of these stories are cause for contemplation.

Furthermore, they’re now part and parcel of a trading environment where risk/reward in US equities had seemed tricky for the past few months.

So, planet Earth feels like an increasingly wild place and the market narrative has locally changed.

At the very least, I wouldn’t be surprised to see a bit more risk transfer in the very short-term.

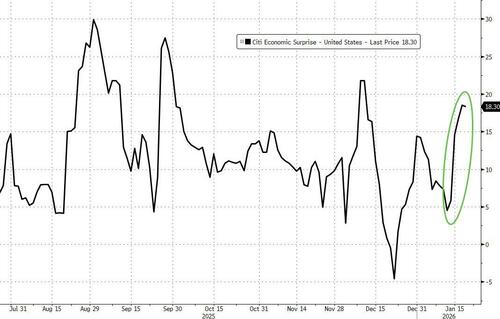

With that established, I don’t want to lose sight of the big ball: US growth is trending higher and the Fed is dialing up their provision of liquidity.

As distinct from the daily flow of noise and news, that interplay is the key macro driver of the stock market over the medium-term.

To put a line under it, the US economy is picking up speed.

A few prints stuck out last week, namely the rise in ISM services (54.4 was the highest reading in over a year) and the drop in initial jobless claims (198k qualifies as notably healthy). alongside this, various measures of housing activity are showing signs of stabilization. Taken together, our US Current Activity Indicator is up to levels not seen since late 2024.

I find this all encouraging, while noting it’s not necessarily lost on the market (if anything, stock operators rightly sniffed out this upswing several months ago, hence the rip in cyclical exposures).

Working from there, I spent 15 good minutes with Joseph Briggs discussing the US economic outlook. This conversation focused on our growth outlook (very positive on the near-term, given ~ $100bn is flowing back to households via tax refunds in the next three months) and the trajectory of policy rates (still headed towards 3% given a new Fed chair and an expected slide in core PCE to 2.1%).

Pasquariello's bottom line...

I’ve been using the word choice “responsibly bullish” for several months.

Here’s the problem with that: when the market rips, you feel dumb about the “responsibly” part; when the market breaks, you feel dumb about the “bullish” part.

Well, this is not the first time I’ve felt dumb, and it’s certainly not the last, and we keep trading these same levels, so I’m sticking with it.

In more formal terms: US equities should be supported by a macro outlook that’s inherently favorable, yet risk/reward remains tricky until we see better levels.

In the doing, I suspect the tactics of navigation this year will favor the buying of dips, as distinct from the chasing of rips.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal