Hedge Funds Have Geared Up For A Treasury Rally Ahead Of Warsh

Authored by Simon White, Bloomberg macro strategist,

Hedge fund exposure to Treasuries across multiple strategies has risen sharply in recent weeks.

It’s Kevin Warsh for the next Federal Reserve Chair.

Expected to be less dovish than some of the other favorites for the position, when it comes to hedge funds, their exposure to Treasuries has nevertheless been rising.

[ZH: ...and Treasury yields have been falling since the leak last night...]

They may be proven right: after all, Warsh “never lets you down,” in President Trump’s own words.

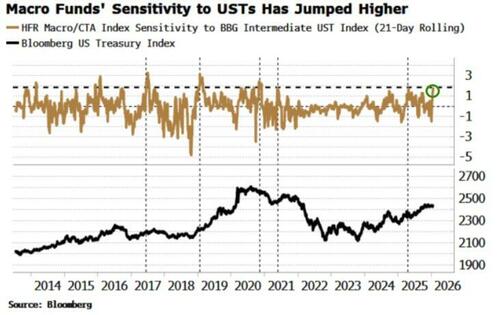

The chart below shows the 21-day sensitivity of daily returns in Hedge Fund Research’s index of macro funds and the daily returns of Bloomberg’s Treasury Index of intermediate maturity bonds. It’s recently hit a five-year high, suggesting macro funds are getting longer Treasuries.

As the vertical lines in the chart show, the timing of such moves to long UST positioning is a mixed bag, performance wise.

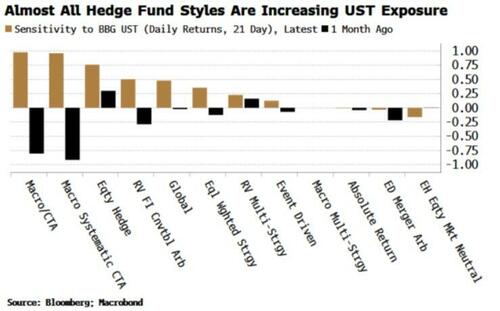

The long positioning looks to be case across the main fund styles covered by HFR. From multi-strat to equity long/short to quant funds, the sensitivity of their returns to Treasuries has picked up notably over the last month.

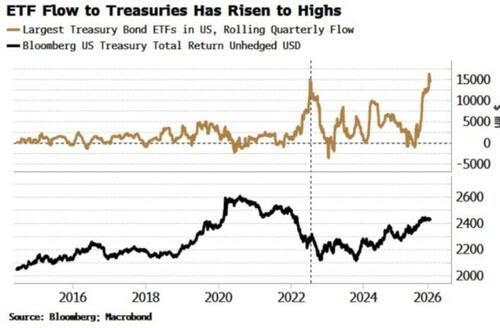

Retail too looks like it’s expectant of lower yields, assuming ETFs are mainly used by retail investors. The quarterly flow into such ETFs recently eclipsed the level it reached in 2022.

As with funds, the timing was not always perfect, with Treasuries continuing to sell off after the rise in flow in 2022 (see vertical line in chart below).

Hedge funds’ warming sentiment to Treasuries stands in contrast to the clients polled by JPMorgan in its Treasury survey. The sentiment of “all clients” has fallen to a low last seen briefly in late 2024, and before that in early 2023, driven by more clients taking short positions.

The sentiment of “active clients” is higher, matching the message we get from the hedge-fund analysis above.

As noted in Thursday’s column, hedge funds in the aggregate are now trading Treasuries procyclically.

Before, they’d have been more likely to be selling US government debt currently, as it has been rallying in recent months (in total-return terms).

But in a sign they no longer believe that stimulative rates will be confronted by a pliant Federal Reserve whoever leads it, they’re going with the trend, ie for Treasuries to keep rallying.

Whether hedge funds (or retail) will be right this time is another matter.

But given the reactivity of funds to price, another push higher in yields would be likely to gain further momentum as their recent increase in exposure to Treasuries is dialled back down again.