Hedges For AI Mania Are Breaking Out To Higher Prices

Authored by Simon White, Bloomberg macro strategist,

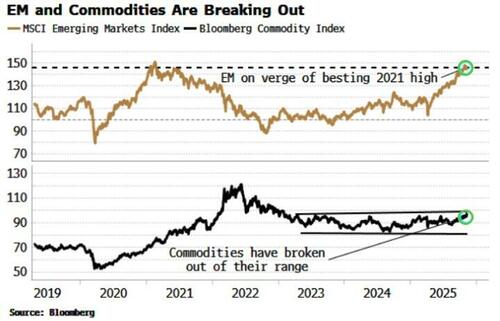

Commodities and EM stocks are breaking out of their previous long-term ranges, in a sign investors are increasingly seeking to diversify away from US large-caps, which are single-handedly being driven higher by AI mania.

US stocks had a sickly day Thursday, dropping 1.7% in their biggest daily fall for over a month. The market has been in the grip of AI-fueled exuberance, with the hyperscalers spending eye-watering sums on a root-and-branch overhaul of processing infrastructure, and multi-billion dollar deals being announced on a daily basis.

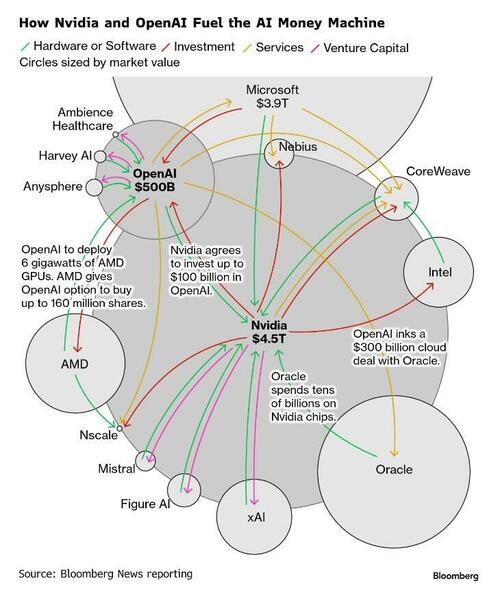

Never mind that much of the investment is on a carousel, with Peter promising to pay Paul if Paul promises to buy GPUs or compute from Peter.

Also never mind that one firm, OpenAI, seems to be at the nexus of it, with commitments to spend over $1 trillion over the next decade.

Not even vibe accountants can make this add up.

It’s perhaps no wonder, then, that some are seeking alternatives should the whole edifice implode at some point. As noted yesterday, commodities broke out of the range they had been stuck in for two-and-a-half years. But EM stocks are breaking out too.

Commodities’ breakout is not just a precious metal story, as almost three-quarters of Bloomberg’s Commodity Index isn’t in gold, silver, platinum or palladium.

Commodities serve not only as a hedge against inflation, they should also benefit from the voracious appetite for power from AI models and the move to accelerated computing.

Most of the big tech firms still have net zero or gross zero carbon commitments, but expect that to get silently shelved if their very survival (in their minds) depends on securing enough power to run energy-intensive GPUs, whether that power comes from renewable sources or not.

EM equities are still predominately about China, with over a quarter of the MSCI EM index in Chinese or Hong Kong stocks. But that’s no bad thing from a hedging perspective, as the Chinese market is one of the few that displays a low-to-negative correlation to global and US stock markets.

Excess liquidity in China has been rising this year, helping to support domestic stocks.

As the market gets more comfortable that the worst of the China-US trade war is potentially behind us, and that capital is less likely to be seized, then Chinese stocks, along with commodities, start to look like viable safe spaces from AI fever.