Here's What Trump Needs To Do For Powell To Quickly Cut Rates

We had a feeling this would happen.

Back in December, we knew that Trump would need a rate cut by the Fed (the same Fed that cut rates two months before the election when stocks were at all time highs, when the economy was reportedly growing much faster and when the unemployment rate was lower but refuses to do so now), but that Powell would prove to be... uncooperative. That's why we said that all Trump needed to do, is to pull an "anti-Biden" (as in the opposite of the previous president's persistent massaging of the labor market higher to make it seem his economy was stronger than it actually was), and instruct the BLS to show a loss of 200,000 workers at the first possible opportunity (in this case February would have been a good starting point), to force the Fed to ease.

Trump pulls an anti Biden: tells BLS to show loss of 200,000 workers in February, Fed cuts 50

— zerohedge (@zerohedge) December 19, 2024

Problem solved

Well, it turns out we were right, because as one of Goldman's top strategists, Dominic Wilson, wrote this week - some five months after us - what needs to happen for the Fed to hike rates is a sharp deterioration in the labor market, i.e., "any significant upward pressure on the unemployment rate would see the Fed shift firmly toward action."

Below we excerpt from Wilson's note, "Along the Knife Edge" (available to pro subscribers):

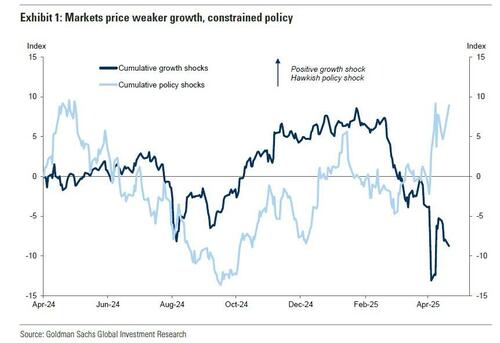

The April 9 pause in reciprocal tariffs helped to arrest the sharp tightening in financial conditions and pull the US economy back from the brink of a clear slide into recession... But with levels of policy-induced uncertainty still high, consumer and business confidence at lows, and real income growth likely to compress, there is still a good chance that the economy tips into recession. We think full-blown recession would likely see the S&P 500 trade around 4600, HY credit spreads above 600bp and shorter maturity yields below 3%.

Financial fragilities revealed by the recent turbulence, including in Treasury markets, could also easily resurface. It may take time for the inflationary impacts of the implemented tariffs and any impact on hiring and firing in the labor market to become clearer. So we are likely to remain firmly on ‘recession watch‘ for at least the next two or three months.

Uncertainty over the ultimate path for trade and fiscal policy also makes it harder for the Fed to act decisively. Most Fed speakers—including Chair Powell last week—have emphasized these tensions, highlighted the importance of keeping inflation expectations anchored, and endorsed a cautious approach. Although surveyed consumer inflation expectations have risen sharply, market-based measures have fallen except at very short horizons where the immediate impact of tariff-induced inflation will be felt.

So on net, a recession is likely coming, with the only thing holdings the Fed up is the threat of tariff-induced inflation, if only in the short term. But, as even Minneapolis Fed economist Javier Bianchi recently concluded, Tariffs are a negative demand shock, which means deflation, and also that the Fed has to look through the brief inflation episode and engage in expansionary monetary policy (i.e., rate cuts), to avoid a far more damaging economic outcome. That was also Goldman's conclusion (source):

We continue to think that any significant upward pressure on the unemployment rate would see the Fed shift firmly towards action and that a recession could easily see 200bp of cuts in relatively short order. This would be much less than in a typical recession, but significantly more than the market is pricing.

In other words, all Trump needs is a jump in the number of unemployed people which translates in "upward pressure" on the unemployment rate for Powell to fold. Or just as we said last December.

But it's not just Goldman that agrees with us: Fed vice chairman Waller yesterday also confirmed that while it is unlikely that by July there will be a clear view of the impact of tariffs - and instead we would have to wait until the second half of 2025 - by then it could well be too late, even though in his view tariffs will have a one-time price level effect, adding that "it would take courage to stare down tariff price increases and see them as transitory."

While it is abundantly clear that right now Powell has zero courage, especially since there is a clear political element to his "reaction-function calculus", what would prompt the Fed chair to act quickly, according to Waller, is the same trigger as laid out above by Goldman, namely that Waller would not be surprised to see more layoffs and higher unemployment as a result of tariffs, and that while the level of unemployment is less important, it is the speed of its increase which is of focus, and "tariffs could push up unemployment quickly."

Waller's conclusion: just like in 2021, but this time in the opposite direction, the data focus brings a risk of the Fed being once again late on policy action, and as a result, once events are in motion, sharp rate cuts could come from rising unemployment.

Finally, if Trump is wondering how to orchestrate the spike in unemployment he needs to get Powell to capitulate, all the president needs to do is... more of the same. Recall last summer we first noted that much of the strength in the job report came on the back of a surge in government job openings and hiring.

This is how the Biden Department of Labor is fudging the data now: all job openings are government. pic.twitter.com/udxQSeKj0f

— zerohedge (@zerohedge) July 2, 2024

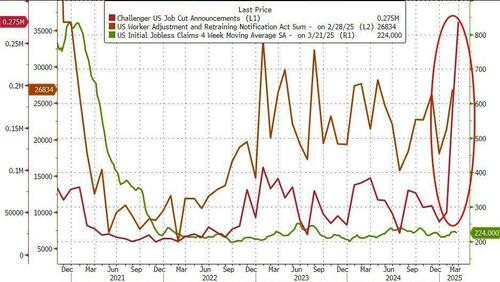

Well, the Biden era ended with a whimper, and sure enough earlier this month we learned that Federal Government layoffs resulted in the biggest March job losses on record. This is how Challenger, Gray described the government layoffs:

“Job cut announcements were dominated last month by Department of Government Efficiency [DOGE] plans to eliminate positions in the federal government. It would have otherwise been a fairly quiet month for layoffs,” Andrew Challenger, Senior Vice President and workplace expert for Challenger, Gray & Christmas.

And visually:

In other words, all Trump has to do is simply maintain the current level of sharp layoffs - i.e., fully unleash Musk's DOGE - in the parasitic government sector which will more than offset gains everywhere and lead to a spike in total unemployment, and Powell will have no choice but to finally capitulate. Once he does and eases US financial conditions (something the PBOC has been aggressively doing ever since the trade war started as we described earlier) making it far easier for the US to wage a lengthy trade war against China, Beijing will very soon follow in Powell's footsteps.

More in the full Goldman note "Along the Knife Edge" available to pro subscribers.