Homebuilder Rally Looks Fragile As Policy Headwinds Grow

Authored by Michael Ball, Bloomberg macro strategist,

The recent rally in homebuilders, supported by lower mortgage rates, looks likely to hit problems from President Trump’s affordability policies.

Mortgage rates finally have a six handle, yet builders are paying up for demand through greater incentives while the White House is signaling it wants lower prices and faster supply increases - two things that usually pressure margins, and hence valuations.

Retail-investor activity is picking up for stocks in the residential-building business, exceeding typically norms.

Retail investors have been pouring money into builder stocks, betting that lower mortgage rates will benefit the housing industry. This has manifested in an uptick in retail fund flows into the State Street SPDR S&P Homebuilders ETF XHB, which has gained 11% since the start of January. Retail investors have also been buying more call options for home-builder stocks, according to financial research firm Vanda, which represents an aggressive bet that those stocks will climb in the near future.

"We are seeing a trend where Trump's 'improve affordability' agenda is driving sector rotations, especially given the lack of macro conviction. U.S. home builders have seen a rush of interest from the retail community as a bet on who benefits the most from lower housing costs. This has been particularly evident in retail buying of the XHB ETF, though there is plenty of room for retail to keep buying this theme," Jai Malhi, a senior strategist at Vanda, told MarketWatch.

The rate drop is real.

The nation’s average 30-year fixed mortgage fell to near 6% in the week ending Jan. 15, the lowest since September 2022.

The psychological threshold matters for buyer traffic, but the bigger constraint remains lock-in.

Roughly seven in 10 borrowers have mortgage rates below 5%, according to data tracker Ice Mortgage Technology.

That keeps would-be sellers pinned in place and limits how much the market “unfreezes” unless rates fall a lot more.

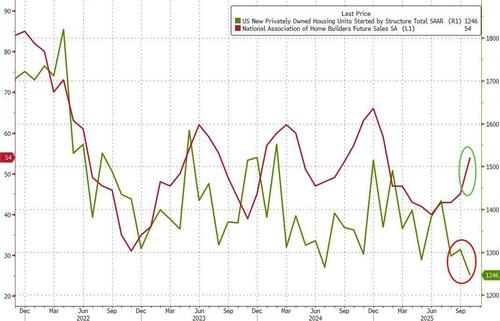

Homebuilder sentiment data is also pointing to a tougher operating backdrop.

The NAHB/Wells Fargo Housing Market Index unexpectedly fell to 37 in January. Below 50 means more builders see conditions as poor than good.

Builders are leaning hard on incentives and price cuts to keep volumes moving with 65% reported using incentives, and 40% reported cutting prices, according to NAHB.

That’s effective for clearing inventory but not maintaining margins.

That is why the sector’s recent rally is starting to look less like a rates trade and more like a policy-vibe trade.

President Donald Trump and FHFA Director Bill Pulte have publicly blamed big homebuilders for affordability.

Their message wasn’t subtle - build more, stop sitting on lots and expect more scrutiny.

However, despite a rise in Future Sales expectations, homebuilders are reluctant to build...

Trump’s recent push to let Americans tap 401(k)s for down payments without penalty fits the same pattern.

It helps first-time buyers but doesn’t address the core problem off more affordable supply.

Then there is the greater uncertainty over housing credit.

The more the administration uses Fannie and Freddie to achieve policy goals — including directing them to make mortgage-bond purchases — the harder it will be to fully privatize them. As a result, the IPO narrative is in flux, with no firm structure and no lead bank named.

Investors don’t love paying up for companies that still trade like policy utilities, and that uncertainty bleeds back into the whole housing-finance complex.

Even if the policy mechanics are opaque, the market takeaway is clear.

Homebuilders remain one bad headline away from being treated as the villain again in an election-year affordability push.