How Trump's Greenland Tariffs Would Impact European Economies

Over the weekend, president Trump announced that the US will impose a 10% tariff on imports from eight European countries (Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland) from February 1. (One assumes this tariff would apply over and above any current tariffs.)

While implementation is highly uncertain - and according to Deutsche Bank, Europe could liquidate some of its record holdings of US assets as a deterrent to actual implementation - Goldman estimates that a 10% tariff would lower real GDP in the affected European countries by 0.1-0.2% via lower exports. At the same time, inflation effects would likely be very small and a Taylor rule would point to modestly lower policy rates, all else equal.

In a note from Goldman's economists (available to pro subs), they see three potential levels of EU retaliation, including

-

stalling the implementation of last year’s EU-US trade deal,

-

imposing counter-tariffs on US goods, and

-

launching the Anti-Coercion Instrument, which would allow for a broader range of non-tariff retaliation options.

Goldman sees a higher hurdle for UK retaliation, consistent with the UK's approach in last year’s trade negotiations.

Key Points

1. President Trump announced that the US will impose a 10% tariff on imports from eight European countries (Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland) from February 1. He plans to raise this tariff to 25% on June 1 and maintain the levy until the US has reached a deal to purchase Greenland. It remains highly uncertain, in our view, whether these tariffs will be implemented.

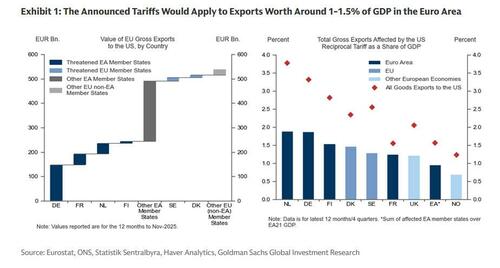

2. The announced tariffs would apply to EU member states accounting for around EUR 270bn of annual exports to the US, or roughly half of the EU’s exports to the US. The affected exports would be worth 3-3.5% of GDP in Germany, the Netherlands and Finland if implemented as a blanket tariff on all goods exports to the US and 1.5-2% of GDP if implemented only on goods that are currently subject to the US reciprocal tariff. In total, the exports affected would be worth 1-1.5% of GDP for the Euro area and 1-2% of GDP for the UK.

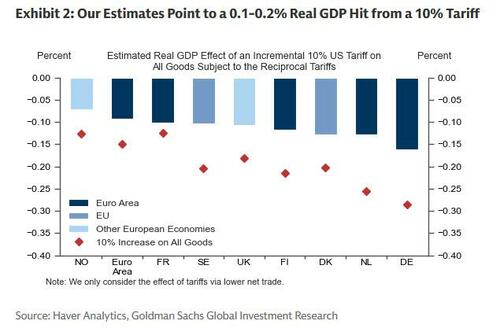

3. Goldman estimates that a 10% US tariff (if implemented) would lower real GDP by 0.1-0.2% among the affected countries via reduced trade. Goldman estimates the largest hit for Germany worth about 0.2% if implemented as a 10% incremental reciprocal tariff (which seems most likely) and 0.3% if implemented as a blanket tariff. For the Euro area as a whole, the implied GDP drag is around 0.1%, similar to the UK. The hit could be larger should there be adverse confidence or financial market effects. But the drag would be smaller if countries rerouted trade through EU countries not subjected to the additional tariff. The GDP hit across countries would rise to a 0.25-0.5% hit for a 25% tariff. All of these GDP hits would come on top of the 0.4% real GDP drag we estimated from last year’s tariff increases.

4. The inflation effects would likely be very small via lower demand (assuming no retaliation). A simple Taylor rule—in which central banks respond to GDP and inflation—would point to modestly lower policy rates.

5. Goldman sees three potential levels of EU retaliation against further US tariffs:

- Stalling the implementation of the EU-US trade deal, as the agreed reduction of US tariffs requires ratification in the EU Parliament. There is a low hurdle for the EU to do so.

- Imposing counter-tariffs on US goods using the approved lists from last year. These include a €25bn list which matched the value of US steel and aluminium tariffs (including soybeans, copper, iron, motorbikes, orange juice); or previous plans to target up to €93bn of US imports (with tariffs covering a much wider set of goods, including aircraft, cars, agricultural products, etc). Counter-tariffs would imply modest mechanical upward pressure on European inflation.

- Launching the Anti-Coercion Instrument (ACI), which is designed for cases like this. Starting the activation does not mean implementation (which requires several steps) but signals potential EU action and allows time for negotiation. The ACI could involve a range of policy tools broader than tariffs, such as investment restrictions, taxation of US assets and services, like digital services, etc. See here for more details.

6. The hurdle for UK retaliation is higher, consistent with the UK’s approach during the trade negotiations last year. We would expect the UK to focus on engaging diplomatically with Trump, as suggested by Culture Secretary Nandy in an interview earlier today.

More in the full Goldman note available to pro subs.