"I Just Love Trading Daily SPX Options In My Brokerage Account..."

The trading environment remains very fluid and there are a number of shifting variables in the market equation, according to Goldman Sachs head of hedge fund coverage, Tony Pasquariello,

To mark a key waypoint in the sequence, ex post this seems quite clear: the central catalyst for the recent backup was the October FOMC meeting.

In the absence of trauma, one can reasonably debate why a 25 bps cut here or there should matter all that much to an asset that lives 18-24 months in the future, but I don’t think it’s a coincidence that the market peaked that exact week.

In practical terms, here’s why it matters: retail enthusiasm for stocks also peaked that exact week.

Pasquariello reflects that he spends most of my weekends in a small town, and the Wall Street market is converging with his day-to-day...

When recently speaking with a neighbor over a delivery of firewood, the conversation turned to the stock market.

My neighbor then said something, unprompted, that applies to the present day:

“I just love trading these daily SPX options in my brokerage account.”

I mention this with a nod to a point that Brian Garrett made: SPX options now average $3.5tr of notional exposure traded per day.

You can see this very clearly in the profile of demand for short-dated upside calls (on high velocity names).

If you want to begin the timeline a few weeks earlier with the peak in BTC, I won’t quibble, but it was the Fed that principally dented household risk appetite (from admittedly feverish levels).

Risk Transfer

In the weeks that followed, as the market chopped lower, we saw a steady pattern of risk transfer from professional investors that gradually picked up speed (that supply reached a local apex last Thursday).

What follows from there is a pattern that’s as clear as day: our franchise has seen a significant rotation into healthcare.

To be sure, in both our PB data and on our trading floor, professional investors are selling tech to buy healthcare (inclusive of BOTH real money and hedge funds). I don’t know how long this lasts, but if earnings inflect higher, I suspect there’s still plenty of runway in this space.

Bigger picture, I expect these types of rotations will be more of a feature -- and not an oddity -- in the months ahead.

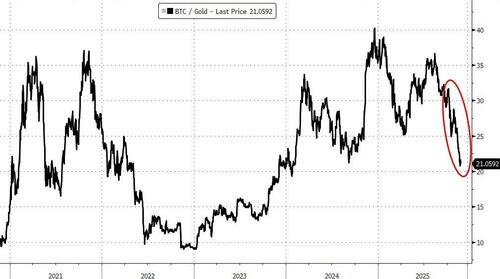

Gold Vs BTC

In the context of inflows to stores-of-value, gold and BTC carried the same flag throughout much of 2025.

Since the infamy of October 10th, however, the former has held its ground, while the latter had fallen apart.

To an extent, you can tell yourself whatever stories you want about these two assets -- there is no intrinsic value, nor is there any available yield -- so price is principally driven by narratives and flows.

In that regard, the fact is this: BTC has clearly been very heavily sold, while gold continues to be accumulated.

Two Big Questions

So, at this point in the note, there are two central questions for the trading community to address: what will the Fed do next ... and what’s the flow-of-funds?

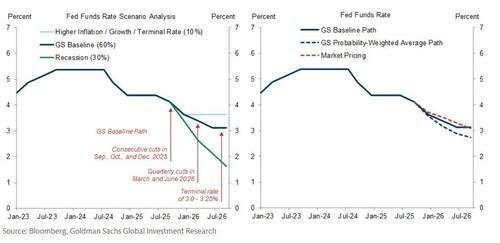

1. On the former, we expect the Fed will go in December (so does the interest rate strip after back-to-back sessions of dovish messaging).

When coupled with what I noted last week on QT and TGA, the liquidity impulse is set to improve in December.

Beyond that, our US economics team retains their call for two additional cuts next year, taking the funds rate to 3-1/8% by the middle of next year.

While it’s a guarantee of nothing, again the history book clearly suggests that bull markets don’t end with cutting cycles.

2. On the latter, as mentioned on Friday, last week had elements of genuine capitulation (from both hedge funds and real money).

Contrary to certain interpretations, I’d argue that is progress unto itself.

In addition, corporates and certain households should be buyers down the stretch.

This is not, however, an all-clear, as the systematic community has been in sell mode; the risk is S&P trips the next significant trigger for CTA supply (down around 6460).

Taken together, this is effectively a story of path dependency: lower prices would bring inelastic supply; flat-to-higher prices should bring discretionary demand.

With appreciation for how much the market has already moved since last Thursday’s close, I think both skew net positive for stocks.

Growth

Beyond those two variables, the trajectory of US growth will surely hold sway.

Again, our team is calling for GDP growth of 2.0-2.5% next year, which I’d argue is a fine temperature for risky assets.

In addition, if you squint, local measures of economic data surprises are inching in a more positive direction.

I’m not saying all of the news is good (e.g. an 8.5% unemployment rate for college graduates aged 20-24 is halting); I’m saying that the market went from a bit too sanguine on the growth outlook to, on the margin, a bit too worried (you can see this in cyclicals-vs-defensives).

What’s going on in tech?

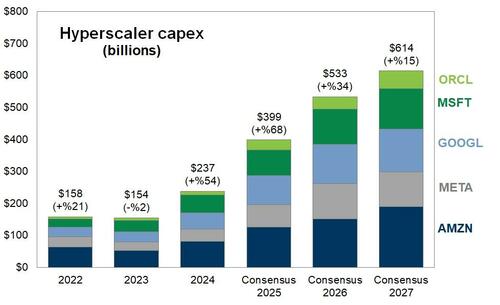

It seems clear that investors are wrestling with three items:

(1) the ROIC for the spenders;

(2) the forward capital requirements for the spenders;

(3) the revenue growth rate for the providers.

In effect, the market is asking whether the collection of perceived leaders -- both public and private -- can live up to high expectations.

To echo my humble take from last week:

(1) I still don’t think you want to limit your imagination on the commitment of the hyperscalers to stay on the capex gas;

(2) at the same time, however, the market priced in a lot of optimism up front -- and not all of the spenders are created equal;

(3) therefore, I expect more intra-cohort dispersion, particularly along the axis of funding constraints.

In the end, I’m a believer that you want to remain structurally long US tech, while preparing for a world where its outperformance gap narrows vs the rest of the field.

This plots the dollars (and growth rate) attached to hyperscaler capex.

To be sure, growth rates for last year / this year / next year are wildly attractive (and consistently underestimated).

In addition, $614bn of expected spend in 2027 is still an immense opportunity set for their providers. With that said, deceleration in the second derivative is partly what seems to be in the air right now.

I’m not smart enough to know what the right answer is here, but I still don’t want to fight the flow of capital to the providers of AI infrastruture, but I’m lowering my expectations for how much this will excite the market on a going forward basis.

Finally, Pasquariello says he enjoyed reading Warren Buffett’s final annual letter.

I chuckled at this line:

“I wish all who read this a very happy Thanksgiving. yes, even the jerks; it’s never too late to change.”

I attached more importance to this line:

“choose your heroes very carefully and then emulate them.”

I consider myself fortunate to have more heroes than jerks in my world.

Happy Thanksgiving to all.

Professional subscribers can read more from Goldman's Sales & Trading team at our new Marketdesk.ai portal