Inside The PJM Auction Report, Something Crazy: Without Price Controls, Electricity Bills Would Explode

Ever since the start of 2025 we have been warning, repeatedly, that the single biggest risk for the Trump admin and republicans ahead of next year's midterms, are soaring electricity costs due to the unsustainable proliferation of data centers which simply do not have the required power grid infrastructure (the mainstream media, with its usual 6 month delay, has also figured this out).

In retrospect, we may have been optimistic.

That's because while data center power demand capacity has continued its significant expansion, the energy required to power up all those racks is simply not there, and what's worse, is brutally slow in coming on line despite Trump's vows for a nuclear renaissance...

This brings the total nuclear reactors under construction in China to 30, followed by India (6) and Russia (5).

— zerohedge (@zerohedge) December 12, 2025

There are no new nuclear reactors under construction in the US currently. https://t.co/f9O1m7HGTN pic.twitter.com/vkXUWp8YW3

... which means the only way to meet supply and demand is through price (i.e., higher).

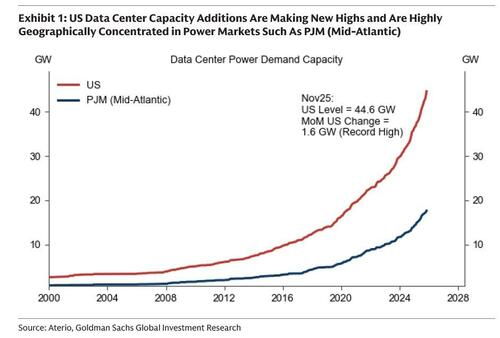

As the chart below shows, November saw another record monthly data center power demand capacity addition of 1.6 GW (+4% month over month).

This substantially exceeded the average monthly additions of 0.26 GW in 2017-2024, pushing the total US data center capacity to 44.6 GW.

As usual, the PJM (Mid-Atlantic) power market which feeds Virginia's Data Center Alley, had the largest addition of 0.45 GW across regional power markets, with a 0.27GW contribution from the state of Virginia, the largest addition across US states.

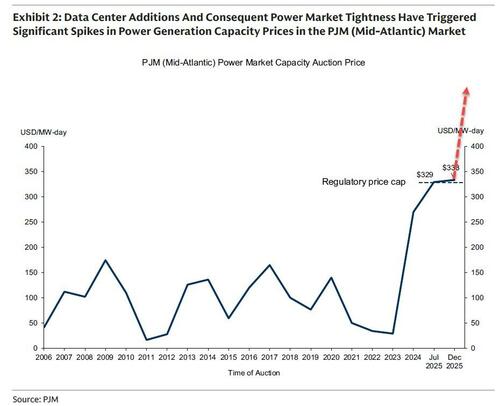

As Goldman notes, the rapid growth in US data centers has further tightened US power markets and has triggered spikes in real-time power prices last summer and power generation capacity prices in the PJM market.

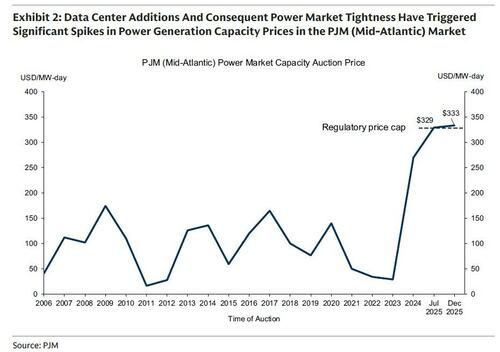

Last Wednesday (Dec 17), the PJM power generation capacity auction (known as the 2027/2028 Base Residual Auction) witnessed its record-high price (recently set in July) surpassed by the December auction with an even higher level of 333.4/MW-day, hitting the FERC-approved cap (hit in both July and December auctions) and well above the 2017-2024 average of 108 USD/MW-day.

Commenting on the auction, Goldman writes that while the clearing price of $333.40/MW-day was in-line with expectations, the supply procured again fell short of reliability requirements, increasing resource adequacy concerns (yes, the US is woefully behind in building out nuclear/coal/gas you name it capacity).

The auction procured ~350.7 MW of new generation and ~423.6 MW of uprates with a total amount of cleared capacity of ~134,747 MW. This magnitude reflects a tightening market with little new capacity bid into the auction, according to Goldman. The types of generation cleared were fairly in line with the last auction, with increased battery resources. An increase in the ELCC value from 69% in the last auction to 92% this auction drove higher demand response by 1,847 MW. Lastly, reserve margin shifted from 18.9% to 14.8% in this auction which is ~5% below the target reserve margin of 20%, further signaling tight supply and concerns around reliability.

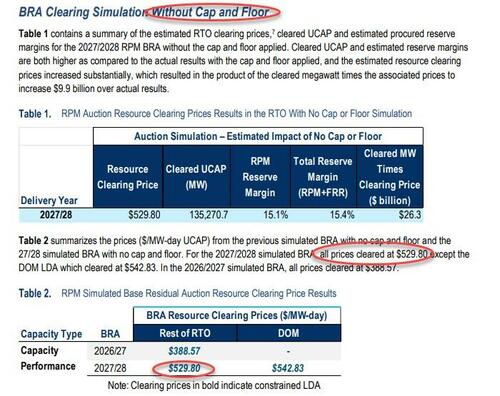

However, by far the biggest risk was the shocking revelation in the auction report appendix that the simulated clearing price without the cap is $529.80/MW-day, about 60% higher than where price controls helped keep the clearing price.

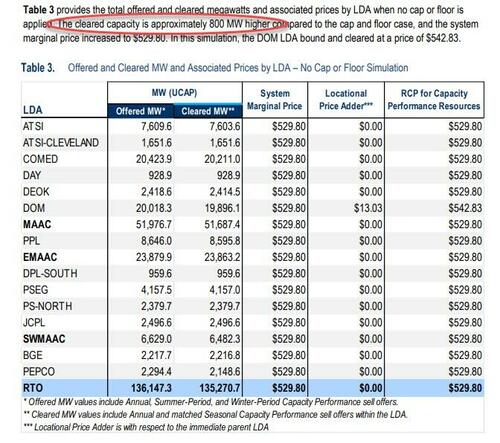

Below is the key section from the latest PJM BRA, conveniently found in the appendix on the second to last page. What it reveals that instead of the $333.40 clearing price, "for the 2027/2028 simulated BRA, all prices cleared at $529.80 except the DOM LDA which cleared at $542.83." This means that uncapped prices would be 60% higher than market-cleared. Also, for context, in the 2026/2027 simulated BRA, all prices cleared at $388.57, in other words on an apples to apples basis, data centers would have pushed electricity prices 40% higher, all else equal... and assuming there were no price controls.

Yet what may be even more troubling is that even assuming fully unregulated markets, with no cap or floor, the "cleared capacity is approximately 800 MW higher compared to the cap and floor case." Which means that even at much higher prices, there is only less than 1GW capacity in the largest US grid system, which is catastrophic for an AI and data center cycle which expect dozens if not hundreds of GWs will be added magically over the next 5 years!

Here is what the uncapped wholesale power bill, the one that adds "$9.9 billion in associated prices" would look like...

... and why PJM's price controls may be all that stand between the status quo and a furious mob burning down every data center they find.

Goldman concludes by warning that it sees "mounting uncertainty around the next BRA for the 2028/2029 delivery year, scheduled for June 2026 as it does not currently have a FERC-mandated floor and cap." To put it mildly, this would have "negative implications for utility bills if the next auction is not capped and tightness continues." Indeed, extrapolating the current growth rate of simulated uncapped prices, PJM would be looking at a number in the low to mid $600s, or about a doubling from the current rate.

Which is why in parting we go back to our favorite "dilemma" meme of 2025, because unless something changes ahead of next year's BRA, in 2026 the US will finally have to chose between AI and AC.

More in the full Goldman PJM analysis reports (available here and here to pro subs).