"Is It Over?": Big Bounce Ends Bad Week With Dow Topping 50K Ahead Of Super Bowl

All's well that end's well...right?

As Goldman's flows gurus noted: "This week’s tape can only be categorized as adult swim... and then some."

Traders took a breath to end the week on an optimistic note (ahead of The Super Bowl) after the SaaSpocalypse-driven chaos (combined with Warsh's nomination) prompted an explosion in vol across asset-classes (but note that bonds and the broad equity market only saw modest increases)...

Source: Bloomberg

But, after such a shitshow in big-tech, bullion, and bitcoin, some of the week over week changes may surprise you.

Stocks

The Dow and Small Caps ended the week considerably higher (Dow record high) while Nasdaq was the week's laggard. A late day panic-bid ([perhaps driven by this - *FED'S DALY SAYS 1 OR 2 MORE RATE CUTS MAY BE NEEDED: REUTERS) lifted the S&P 500 to unchanged on the week...

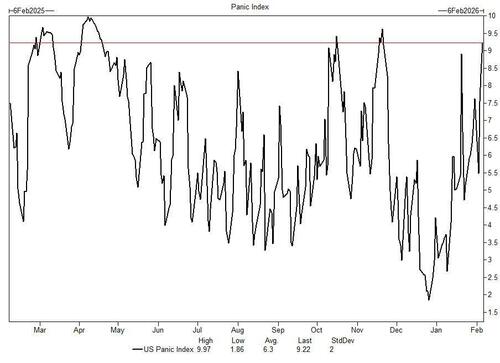

We warned last night that a bounce was coming, and Goldman's flows gurus suggested "listening to the markets" as they pointed out that vol metrics signal that investors were "close to max fear"...

Source: Goldman Sachs

The Dow topped 50,000 for the first time ever (tell me about Greenland again?)...

The S&P 500 bounced almost perfectly off its 100DMA, accelerating back above its 50DMA too...

But Nasdaq remains well below its 100DMA (despite today's big bounce)...

Here's how Goldman's trading desk described the scene today:

Screen filled with green today as a week of factor Armageddon comes to a close.

AMZN (-6.9%) and GOOGL (-1.9%) are weighing down Megacap tech, but broadly we are seeing notable reversals in performance with ~75% of the SPX trading in the green.

Standouts at the top of our leaderboard include Bitcoin Sensitive (GSCBBTC1 Index) + 17.1%, Non-profitable Tech (GSXUNPTC Index) +8.1%, Most Short (GSCBMSAL Index) + 7.8%, and Retail Favorites (GSXURFAV Index) +5.9%.

Hedge fund flows are in focus with their buy-skew hitting +25% this morning and now declining to 2%.

Prior to today, the highest HF buy skew recorded over the past 4 weeks was 5.59%.

It is worth noting that today is the first day this week LOs have had a buy-skew.

But under the hood, there was lots of pain trades (and lots of gain trades) in equity land.

-

*NVIDIA SHARES JUMP 7.8% TO ADD $325 BILLION IN MARKET VALUE

-

*STELLANTIS FALLS 24%, MOST ON RECORD, AFTER SURPRISE WRITEDOWNS

-

*MOLINA SHARES SINK 26% IN WORST ONE-DAY DROP SINCE JUNE 2012

-

*AMAZON SHARES POST 12% WEEKLY DECLINE, MOST SINCE 2022

-

*ISHARES SOFTWARE ETF DOWN 8.7% IN WORST WEEKLY DROP SINCE APRIL

Tech and Discretionary stocks were the week's biggest losers while Materials, Energy, and Industrials dominated the gains...

Source: Bloomberg

That is reflected in the massive outperformance of Value over Growth this week...

Source: Bloomberg

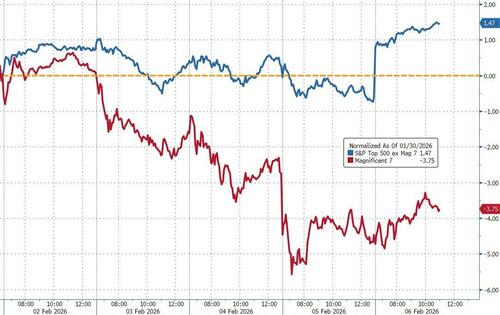

Mag7 massively underperformed the S&P493...

Source: Bloomberg

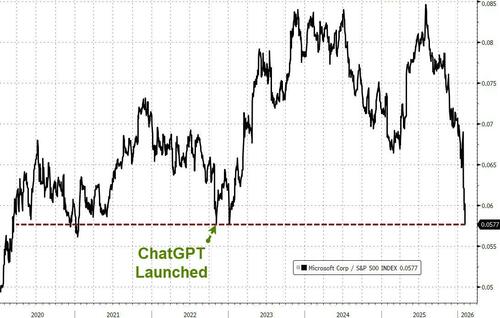

Microsoft has now given back all its relative outperformance vs the S&P500 going back to November 2022 (ChatGPT launch). The stock is now trading down 30% from its all-time highs...

Source: Bloomberg

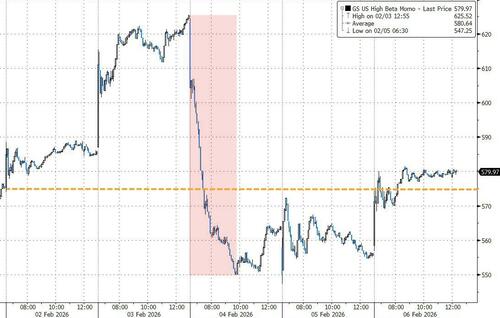

Momentum ended the week flat, rebounding strongly from Tuesday's puke...

Source: Bloomberg

We given the last word on equity-land to Goldman's Chris Hussey, who sums things up perfectly:

The direction of travel at the Index level this year has so far been best described as 'a circuitous path to nowhere'

...as investors have leaned into Value and sold Tech while the S&P 500 has actually gained 1% ytd.

The VIX briefly spiked above 20 earlier this week but now sits below 18 again and rates and USD/EUR are also only mildly changed so far this year.

But underneath the index level, of course, the story is much different with a big shift in sentiment hitting stocks that are vulnerable to being disrupted by new AI applications.

Investors are not liquidating equities to hold in cash though. Instead, they are just buying different equities -- stocks with little-to-no connection to AI disruption.

Behind the AI disruption fears is news from two new initiatives that were released in recent weeks, including GOOGL's Genie 3 AI model that is capable of generating interactive environments from a range of text and image prompts -- a disruptor to gaming applications among others.

SaaS stocks suffered bigly (with the main pain coming on Tuesday)...

Source: Bloomberg

BDCs had a choppy week but ended considerably lower amid the contagion from the level of Software-related loans they have on their balance sheets...

Source: Bloomberg

Peeling back the onion of the sell-off, the concern then appears to boil down to the following:

AI is advancing at a fast enough pace that it is time now to reconsider the sustainability of earnings from business models that appear to have attracted new competition.

Specifically, investors are concerned about the emerging ability of enterprise customers to create in-house applications that do the same thing as existing software packages.

Anthropic CEO:

— ₕₐₘₚₜₒₙ (@hamptonism) February 5, 2026

Software engineering will be completely obsolete in 6-12 months… pic.twitter.com/EwKq8l7HE7

As we highlighted earlier, the decline in Software P/E multiples to 20X from 35x implies that investors are discounting a decline in earnings that has not yet been forecast by the Street...

...investors need to become comfortable that earnings have reached a bottom -- a comfort level that is not likely to be proven out for 2-3 quarters.

TMT

IGV has taken in over $1.5 billion worth of inflows over the past two sessions...

The fund’s respective index has declined by more than 13% over the past 5 sessions… however over the latter half of the week, we’ve started to see a real-money bid come across out pad.

Seems like the narrative of “finding the bottom” was a wider theme beyond our desk and a reflection of sentiment in the broader market

But, Goldman's top TMT specialist, Peter Callahan, wasn't so sure...

While Friday’s bounce (read: squeeze) helped the scoreboard on the week (NDX only finished down ~2% last week), not sure it did much for investor convictions as this past week took its toll (elusive reversion in oversold areas like Internet & SW + choppy price action in AI Infra & Mag 7 longs).

End of the week debates centered around how much to read into the soggy price action on AMZN / MSFT / META / GOOGL types around higher capex trends – is this a ‘tell’ on market convictions or is this just a positioning clean-up on more measured EPS revisions.

Big picture, while the NDX is ‘only’ down ~1% on the year, the fwd P/E multiple of the NDX has de-rated from 28x-29x in Oct/Nov’25 (the HE of it’s multi-year range) back towards ~24x-25x today (more middle of the road) – a dynamic that investors could find supportive as we emerge from EPS season (esp with several Mag 7 names approaching ~20x fwd P/E on consensus, per bbg).

Crowded Longs: GOOGL, ASML, MU, STX/WDC, LITE

Shorts: ADBE, MNDY, HPQ, DELL, INTU, CAN

Finally, on the sell-off, while investors have been seeking out ways to avoid AI disruption candidates, the AI infrastructure trade has also been choppy.

GOOGL has traded down ~4% this week fueled by higher capex revealed in its December quarter results.

And AMZN is down even more (~14%) on the back of similar concerns.

AI Leaders ended lower but only after a massive rebound today...

Squeezy...

Today was the biggest short squeeze since Trump TACO'd Liberation Day (and 2nd biggest since Nov 2022)...

Where does that leave us?

Seeking alpha, perhaps.

The move toward Value and real economy corners of the market opens up opportunities to lean into stocks that are oversold (remember, software stocks now trade at 60% of the valuation multiple they had only a few weeks ago), as well as old economy stocks that we're never bought (or at least not for a long time). We updated our Conviction List on Monday and added DASH, GLNG, and NOW to the list. DASH and NOW are decidedly new economy, but we see opportunity in DASH's expanding presence as a general eCommerce company and NOW's position as a workflow engine for enterprises. As for GLNG, they operate floating LNG platforms that can help projects export gas from all sorts of places.

Bonds

US Treasury yields were all lower on the week with the belly outperforming...

Source: Bloomberg

Rate-cut expectations soared this week as stocks puked (and on weak labor market data)...

Source: Bloomberg

Currencies

Despite today's selling, the dollar ended the week higher testing two week highs (after falling for three straight weeks)

Source: Bloomberg

Across G10 FX, only Aussie managed gains against the dollar while the Yen tumbled most...

Source: Bloomberg

...leaving the yen almost back down at its pre-rate-check (interventionist) levels (ahead of Sunday's elections)...

Source: Bloomberg

And then there's the cryptocurrencies with Solana and Ethereum the hardest hit, even with today's big bounce...

Source: Bloomberg

Bitcoin managed to rip back above $70,000 today after touching $60,000 overnight - a massive day...

Source: Bloomberg

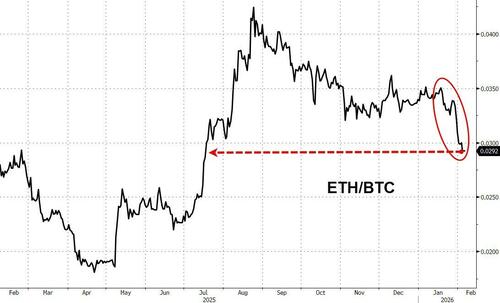

Ethereum has dramatically underperformed Bitcoin in the last couple of weeks, dragging the ETH/BTC pair down to 7 month lows...

Source: Bloomberg

Commodities

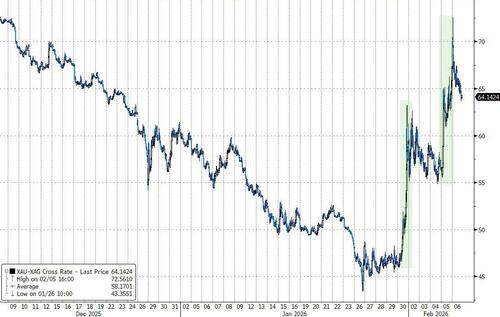

After all the carnage and coverage, gold managed to end the week in the green (admittedly only up 1%, but still) as Silver underperformed...

Source: Bloomberg

Gold pushed back up towards $5000 today, but is still down 9% since Warsh's nomination...

Source: Bloomberg

Since Warsh's nomination, the Gold/Silver ratio has exploded higher...

Source: Bloomberg

Crude oil prices ended the week lower after chopping around on every Iran headline...

Source: Bloomberg

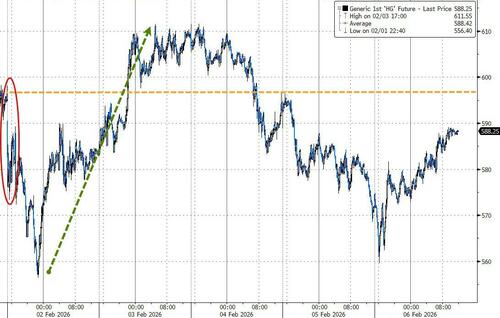

Copper ended the week basically unchanged as traders continued to monitor softening demand conditions following a speculative buying frenzy.

Source: Bloomberg

Bringing the last two sections together, 'digital' gold fell to its weakest relative to 'real' gold since June 2023...

Source: Bloomberg

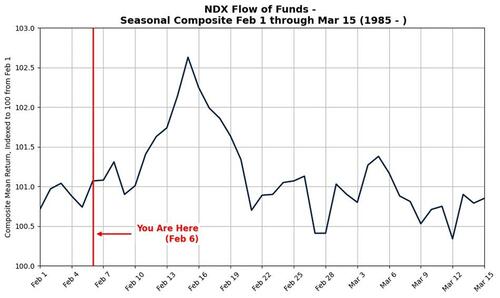

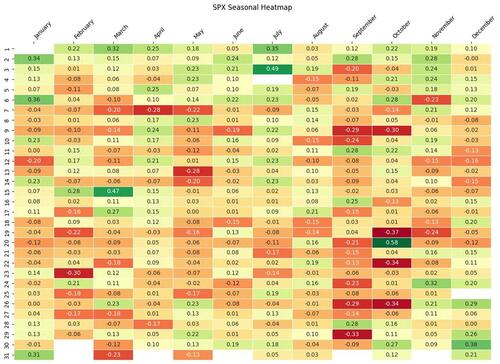

Finally, as Goldman's flows gurus noted earlier, the mid-February slump came early but it should come as no surprise for the month according to history.

Removing key supportive flows from the market (ie 401k/Retail/etc) post-January contributes to a softer February but also bursts of relief.

Source: Goldman Sachs FICC and Equities

The mean NDX return from mid-February (March 17) to March first is down 1.19% and down 1.36% out to mid-March.

February has typically seen a choppier mid-month and leans negatively to end off the month.

Source: Goldman Sachs FICC and Equities

Goldman expects this to continue until investor positioning has gotten cleaner and market froth has been comfortably flushed out.

Go Pats!