It's A Market Of "More Noise & Less Signal" But Goldman Macro Trader Warns 'Rate Of Change Is Accelerating'

Authored by Bobby Molavi, Goldman Sachs Macro Trader,

To try and summarize last the last couple of weeks would be too hard... and would make an already ‘wordy’ note unacceptable in length.

5 weeks into 2026...not sure if it has gone by quickly or whether each week has felt like a year in and of itself! 150 miles per hour. Perpetual change. A market of more noise…. and arguably…. less signal.

Case in point - last week...

-

A headline index level change of virtually zero for S&P

-

A VIX that ended the week at 17

-

But a world of change beneath the surface

-

Sectors getting disrupted, stocks moving 10% to 20% and themes/factors having 3x to 6x standard deviation moves

-

The sum of which left many bruised and battered.

Sector/theme/factor vol blow-out...

-

Tues, Weds, Thurs = the worst 3-day stretch for the NDX since last April.

-

Tues = the best day in ~5 years for the GS High Beta Mo’ Pair.

-

Weds = the worst day in ~4 years for the pair.

-

Friday = best day since November...

-

...only to end the week Flat.

So here we go as a form of summary...

Gold and silver meltdown, software woes accelerating and then metastasising, ai capex worries, Microsoft bad, meta good…but even then ai capex made good numbers have bad share px reactions, broadening theme continues, rotation in terms of sectors and factors, initially gross remaining high but net coming down, challenges of var making gross hard to carry, then gross coming down also, $ weakness, $ weakness maybe resulting in reflexive fed chair choice and then $ bounce, bitcoin weakness, job cuts, positioning and consensus pain, dispersion rising, single stock vol high, 2026 a year for laggards with small/mid, cyclicals, miners, oil and gas and rest of world all o/p. And breathe.

Trying to be a bit more articulate...

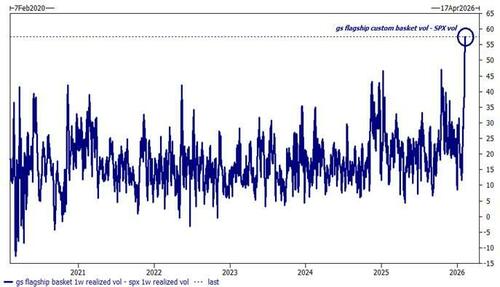

It felt like the unwind in Gold and silver a week last Friday was the trigger…then we saw a Bitcoin unwind…before a week of extreme and dramatic sector, factor, theme and single stock volatility. Momentum was hit hard, software became the epicenter of Ai loser angst and earnings came with a number of 10% plus high octane moves with Microsoft giving back over $350bn of Mkt cap post print just one of many examples. The 10 day realized vol of many themes are in the 99th percentile going back to 2010 including: High beta momentum (GSPRHIMO Index), AI Winners vs At Risk (GSPUARTI Index), Quality (GSPUQUAL Index)…with some others not far behind….Software versus Semis (GSPUSOSE Index, 97th percentile), Cyclicals vs Defensives (GSPUCYDE Index, 94th percentile), L/S Beta (GSPUBETA Index, 96th percentile). The quantum of volatility across asset classes and within asset classes causing a var shock that resulted in a huge amount of pnl volatility and a variable ability to carry gross as things moved that violently. Ultimately.. decisions around gross, nets and risk tolerance ultimately determined whether it was a good, ok or bad week.

Performance.

A challenging week. we saw momentum down 3 stan deviations, Growth down 3.3, Value up 3.9 to name but a few wrong way moves for investors. We also saw outsized moves in concentrated longs and crowded positions reflecting a de-gross and unwind tilt to the activity. (Crowded shorts up 2.6 stan devs). As a result…not a surprise to see GS prime brokerage stats reflected extreme pain across Hedge fund segments on wednesday….(Marco Laicini) - Systematic L/S down 76 bps, worst day since 10/2/25, Fundamental L/S down 84 bps (alpha: -64 bps), worst day since 11/13/25, MultiStrats equity portfolios (assuming 4.5x leverage) down 190 bps, worst day since 4/9/25. Worth noting…the last time all three strategies were down >75bps on a single trading session was during the initial COVID drawdown in early 2020. Only to see a huge bounce back onf Friday resulting in a less painful week overall….. Global Fundamental L/S HF -74bps on the week to finish +199bps ytd, Global Systematic HF: -56bps on the week to finish +209bps ytd, and finally, Mulitstrat HF (assuming 4.5x leverage): -206bps on the week to finish +284bps year to date.

Positioning and valuations.

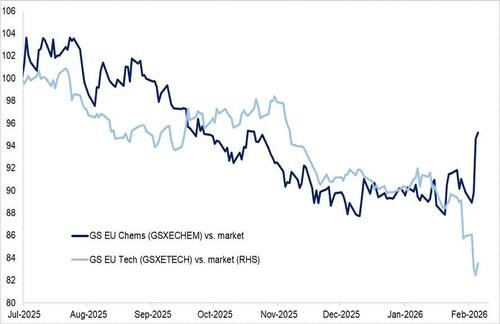

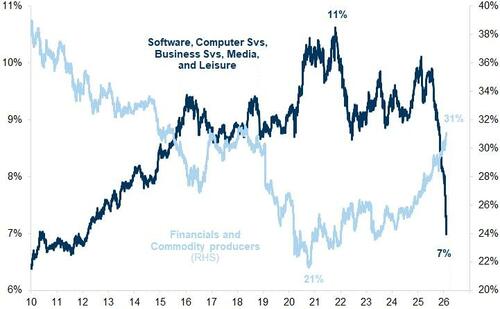

Nasdaq has gone from 28x to 29x PE in Nov 2025 to around 24x to 25x. Hedge funds have net sold US equities for 4 straight weeks..and after last weeks volatility positioning backdrop is much cleaner than it was heading into earnings season. Europe as a safe haven light on ‘tech’ now outperforming (just saying)…especially as reflation and cyclicals start to catch a bid (see Chems vs Software spread as a case and point).

Chems vs Software and a proxy for peoples books (wrong way) heading into last week.

Volumes.

Gold, silver, bonds, Equities. Across futures and cash, index and single stock…we saw elevated volumes everywhere. Records for Gold/Silver a week ago…records for Software and Bitcoin last week (software (IGV) and bitcoin (IBIT) ETFS)..and records or US equities more broadly. Some of these volumes driven by volatility, some by flow of funds, some by fundamentals, some by rotation and some by de-grossing….each with its own reason, goal, duration and/or ‘alpha’ target…whether that be 10bps or 50%, one minute or one year. The output of those dynamics extreme. John Flood notes that last week an average of 22.5bn shares traded daily across all US equities exchanges. For context, last year was the highest trading volume year in the history of the US stock market with a daily average of 17.3b shares hitting the tape (FWIW this number was 10.8b shares in 2020). From a notional perspective, the US market traded $1.3T daily last week (the highest weekly aggregate ever).

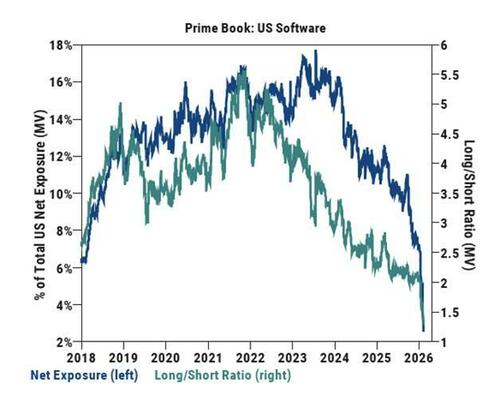

Software-egeddon.

What happened last week. In short Anthropic released a new model that seem to trigger a bout of anxiety that translated to round of Software related selling, de-grossing and multiple re-evaluation. Traditional Saas has always been viewed as extremely valuable because of the embedded intelligence, workflow efficiencies, decision augmentation and business logic that it/they provide. Ai agents potentially disrupt this. In the Agentic world…the Ai agent can potentially become the layer that reasons, plans and orchestrates actions…whereas software becomes a data storage centre, place where records are kept, a place where more basic functions are carried out. The risk here is that ‘intelligence’ and insight get lifted up out of the software layer and the application layer and therefor reduces its potency and/or value and risks commoditisation. Does value shift from feature depth to agent performance…and from licenses to apps. In the old world apps contain intelligence and humans operate them and leverage the output. In the new world, potentially, agents contain and harness the intelligence and apps obey/service them. This shift couldn’t happen until agents developed the ability to remember, the ability to do what they are told (no hallucinations) and the ability to carry out multi step rather than single step functions. I’m not saying i agree with this…in fact there are a huge number of questions left unanswered but it is a scary prospect for software and people….one where software might be the infrastructure layer on top of hard infra, intelligence becomes the the product…and Ai agents being the new workers…leaving humans hopefully as the beneficiaries…or….leaving them….erm…ugh.

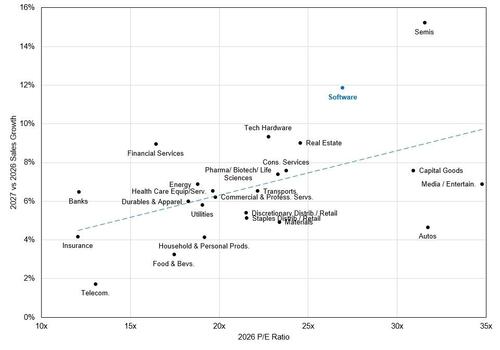

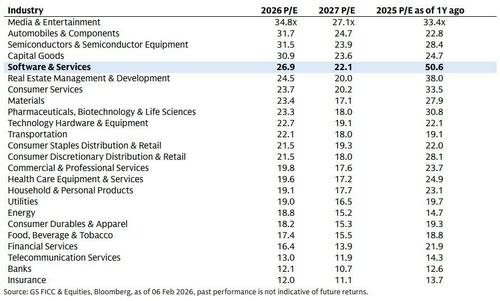

Growth expectations and multiples…..From a Sales growth perspective, Software is stands out significantly relative to the rest of the equity market.

Software part 2.

So what happened. A collection of 164 stocks in the software, financial services and asset management sectors shed $611 billion in market value last week. . A GS basket of software stocks hit a record low of 21 times estimated profits, down from a peak of more than 100 in 2021. Salesforce is trading at 14 times profit 1 yr forward, compared with an average of 46 over the past decade. Overall, even with the end-of-week rebound, the damage was substantial….to name but a few casualties….Thomson Reuters sold off 20% on the week, their steepest fall ever. Morningstar Inc recorded its worst week in over 15 years. Software makers HubSpot Inc., Atlassian Corp. and Zscaler Inc. each sold off more than 15% on the week. Software trading at an all time low in terms of revenue multiple but also fcf multiple. Interestingly…this all at a time when rev estimates are going up. Salesforce just posted $12.9bn in trailing free cash flow….+22% yoy with op margins at 35% and the company just signed a $5.6bn contract with the US Army. This doesn’t sound like a company or a segment that is in distress. Yet the markets last week ‘decided’ that Software in aggregate was an Ai loser and that the sector could be reclassified from ‘growth’ to ‘utility’.

What is clear…is that Ai is making people question the certainty and durability of those future revs/cash flows. Instead of forecasting out 3,5,10 years....people pulling forward what they believe to be certain and as such multiples compressing. Some of last weeks selling may have been investors looking at weightings and adjusting for uncertainty and inability to predict the future with confidence. Software is not going from eating the world to death in the space of a year, a month or a year. That being said, the profit pool available for software may be less certain and decreasing...while the profit pool available for the agentic layer increasing. As a result., the discount rate goes down and so the multiple applied for future earnings compresses hard and fast. Another factor is that, like other themes - defence, banks, ai capex - all boats rise on a rising tide....this software de-gross hit many if not all. In reality some of these businesses , earnings and margins will be disrupted by Ai....while others may use Ai to accelerate growth and gain more pricing power, higher margins. Again Brad Gerstner talks about likes of Databricks accelerating growth again...at scale...by being a software winner that is leveraging Ai to get bigger, better, faster.

“ NDX …. I watch the fwd P/E multiple of the NDX relatively closely … in the post ZIRP era, it has generally topped out at ~28x-29x – and, on the wides, tries to find its footing in the ~24x-25x range (outside of market “events” like Liberation day in the Spring’25 or the rates mania Fall’23)…” - Pete Callahan

The rate of change is accelerating.

Maximum flexibility and reflexivity around the future. You have to be willing to accept things are changing faster than ever before...and the scale of change so big that it changes everything. Portfolios that make sense on a 3 yr view in Jan might be 100% wrong by March depending on geopolitical change, Tariff regime or Technological innovation and disruption.

Dispersion.

Gone are monolithic winner/loser dynamics at the theme level. If 2025 was driven by banks, tanks and Ai….then you could say that 2026 is much more nuanced. We see cyclicals, small and mid, broadening, rest of world AND some but not all banks, tanks and Ai. The early innings of 2026 are showing a much more nuanced approach to all trades…in Ai…capex vs revs vs costs more important than just headline Ai soundbites and capex, on the defence side…it feels like it is more about which regions (eg Korea), and which sub groups (land vs air) and which names (more US less Europe) have tailwinds and then finally the big one….Ai. Last week once again reflected the disruptive power of Ai in all its forms…for jobs, for the market, for the ‘winners’ and for the spenders. A heady mix of product releases that ‘change everything’ (Anthropic) ….again. Then more job cuts as efficiencies come through. The impact on software and software owners on the back of a shift in sentiment around product utility and earnings sustainability and a much more nuanced market response to spending. (See Mag 7 earnings reactions)

Var shock/vol shock.

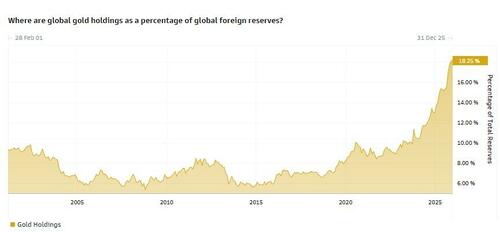

In the last two weeks we’ve seen 10 to 15% moves for Microsoft, SAP, Meta and Swatch, we’ve seen a 15% move in Gold, a 40% move in silver, a 10% intraday reversal for ASML, elevated volatility for $ and Oil. Just to name a few. Single stock moves vs index trading at largest spread seen in recent years. When you look at cross asset dynamics a few things stand out as proof points that there is structural change. Equities up and gold up, Equities up and yields up, Single stock vol exploding but index vol calm. Last week...was perhaps so extreme from a x asset perspective that gross needed to come down everywhere. Whether it was navigating 100 to 200 vol Gold/Silver market, or a 5 standard deviation move in Software or continued $ whipsaw...the pnl swings felt extreme and unhealthy. Gross remains high...somewhat everywhere you look...and it has paid. Whether that be underpinned by debasement and dedollarisation (Equities and Gold) or retail momo (silver, quantum, space) but last week a reminder of how fast things can reset...especially when you factor the increased retail and 'gamefied' market backdrop we live in. More on that later.

Fall from grace.

US Tech stocks on thurs last week vs recent record highs. Microstrategy -80%, Coinbase -66%, Netflix -40%, Palantir -36%, AMD -27%, Microsoft/Tesla/Broadcom/Nvidia/Meta all down 17% to 25%. In fact Mag 7 stocks had lost roughly $3 trillion of market cap since their recent highs at one point last week. To add to this, Crypto markets had given back over $1 trillion in market cap over last 20 or so days. Then friday came….and the S&P and Crypto combined added $1.5 trillion of market cap back…for yet another round to the yolo buy the dip warriors.

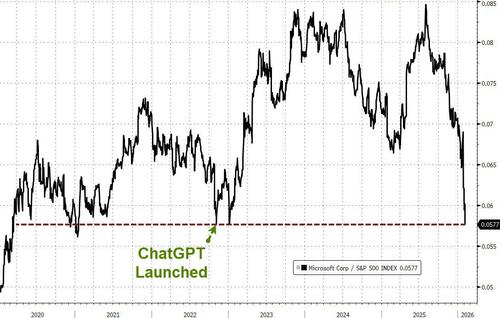

“ MSFT .. now ~30% off the highs (over the last 10+ years, the only ‘drawdown’ larger than this was in 2022); MSFT has given up all of its relative outperformance (vs the S&P500) dating back to Nov’22 – the launch of ChatGPT… enough? “ - Pete Callahan

Circularity.

People watched this in relation to Ai capex….but was again in focus last week in relation to software/pe and credit. Worth noting that Bloomberg highlighted that 14.5% of Tech loans are now ‘distressed’ and that the Tech bond distressed ratio is up to 9.5%…or the highest reading since Q4 2023.Elsewhere….software debt in CLOs recorded a 2.5% drop in January..for the biggest drop in over 12 months….and all the while PE Tech exposure is skewed to Software….Software is one of the largest sectors of the lev loan market (12% of the Bloomberg US lev loan index)…and Software a heavy weighting in aggregate for Nasdaq and S&P.

PE trajectories in the age of Ai….maybe.

Emerging markets.

Emerging markets continue to benefit from broadening, diversification, dedollarisation and rest of world re-focus. In fact EM ETFs hjave attracted over $20bn of inflows in Jan for the largest single monthly inflow on record for EM. We have also seen net inflows into GEM funds for 13 consecutive weeks and EM ETF for 12 consecutive months. The MCI EM ETF attracted $8.9bn in inflows or 43% of the total AUM…its largest single intake since 2012. Where flows go….performance follows. MSCI EM was up 8.8% in Jan…the best start to the year since 2012. One month in and Europe and Asia are once again outperforming. You have to factor unhedged $ exposure in rest of the world and how a structurally weaker $ will impact returns when that cash is re-patriated. This trend can run for quite a while longer.

Where flows go... asset prices follow.

All the world's a stage.

I think Mr Shakespeare had it right when saying all men and women merely players in a bigger infinite game. A week where gold, silver, oil, bonds, software, tech, ai, mag 7, factor, theme and single stocks all saw elevated (or extreme) amounts of volatility. The start of the week focussed on commods, the belly of the week on software and mag 7 earnings (Ai capex vs Revs) and the end of the week the often seen buy the dip impetus delivering , in equities, a round trip back to flat. Incredible to think that a week that saw so much violence ended the week with the S&P flat. Back to Mr S....last week many investors felt the part of being the 'poor player' that was doing less strutting and lots of fretting over the course of the last 5 days...but at least candle burns on.

M&A and the race to scale.

A tale of two halves last week. On one hand the Rio/Glen deal collapse a reflection of the challenges of inking transformative deals. On the other hand...we continue to see deals being printed. 2026 run rate showing $10bn deal count accelerating and trending at 15% up yoy. Last week we saw Devon and Coterra agree a $58bn deal and Santander announcing a $12.2bn deal for Webster bank in the US. We are starting to see these deals as both ways of acquiring product to fill gaps, addressing, or shifting regional exposure, creating scale in segment on a regional/global playing field, adding innovation and r&d capabilities in a fast moving tech first world...as well as the traditional reasons of growth, synergy and accretion. If markets play nice....suspect more to come...big and small.

The good news…or bad…is there is no respite to the sensory overload...

...with more Macro data in the form an important week with inflation and employment data (January jobs report, retail sales and the consumer price index) and more earnings. Job cuts seemingly accelerating with 108,435 job cuts, up from 35,553 a month earlier and 21% of those cuts coming from the Tech sector…so eyes on the Job report and a huge bid offer in terms of expectations (I’ve seen -10k at the low end and +135k at the high end). As well as more esoteric factors like…what next for Iran/US talks, UK politics, JD Vance speech at Munich security conf, China Lunar NY and Nvidia numbers for our next round of Ai capex bingo.

But finishing where we started….noise over signal….the degree of information, change and ‘noise’ in this market is unprecedented.

We are seeing political, geopolitical, technological, social changes driving macro and micro impacts across performance, flows and investor exposures/sentiment. Quite often, however, we are also seeing market participants seeing a short term signal…evaluating and/or extrapolating only to realise it was noise.

Revenge of the old economy...

The point to point continually being tested with headlines and mini shocks which make it harder to carry risk and stick to thesis... or put another way... focus on the outer points on which the investment was made... rather than the near and loud that grabs ones attention.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal