"January's Been A Barn-Burner": Goldman Trader Questions "Sustainability"

January has been a barnburner, according to Goldman Sachs head of hedge fund coverage, Tony Pasquariello.

"...be it equities, rates, currencies or commodities, there’s serious action most everywhere you look."

The hedge fund honcho begins his final note of the month by pointing out that while each day is its own adventure - as today will be - the broad pattern of fact is this: the prevailing macro trends of 2025 had very forcefully extended in 2026.

If anything, this paragraph understates just how blistering certain moves have been (here I’m again nodding towards assets like silver, copper, KOSPI, Bovespa, the entire Japanese macro complex and a number of equity themes -- memory, nuclear, defense, on and on).

More fundamentally, what’s the core story of the month?

As we walked out of the office yesterday, it was a very clear pattern of reflation:

-

cyclical equities command the top of the leaderboard...

-

emerging markets have outperformed...

-

interest rates have risen (and inflation breakevens have widened)...

-

and both precious and industrial metals have melted higher (spot up / vol up is an understatement).

YTD performance of the eleven mainline sectors that comprise S&P. The pro-cyclical bias is not subtle:

It’s been a tough stretch for the quality factor. In fact, this has been the worst drawdown since the post-COVID reopening period:

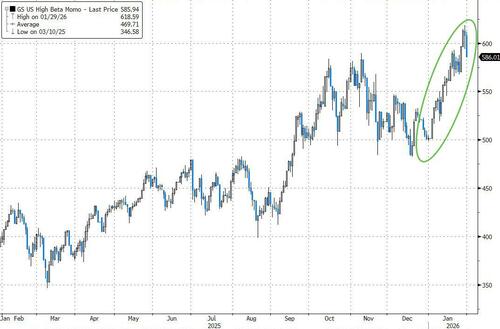

Set against that, it’s been a terrific run for the momentum factor:

For all of the debate around AI capex and returns, our basket of leaders-vs-laggards has, yet again, broken out to make higher highs:

Working from there, note the powerful breakout in Emerging Market equities -- now the question is whether it proves more lasting than the failed breakout in 2021:

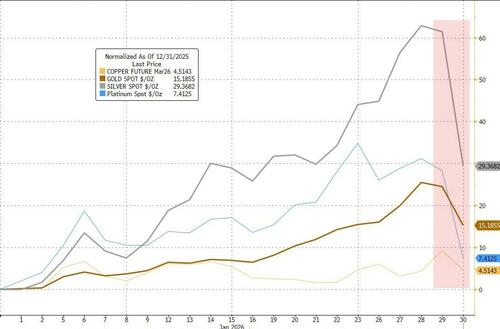

Precious Metals

You can’t tell a story about the past month without addressing price action in the precious metals.

After a 148% rally last year, silver is was up over 60% YTD, with some wild intraday swings throughout this week (the overnight is case-in-point).

Like gold, I suspect the rally is one part fiat concerns, one part reflation trade, one part central bank demand and one part speculative engagement.

While you have NOT been paid to underestimate the upside convexity of the metals complex, again the ferocity of the rally is cause for contemplating some options strategies.

Korea.

Speaking of high velocity assets, while most every major global equity market had something to offer in January, KOSPI stole the show, again.

Note the clean break to close over the 5,000 level for the first time and +24% YTD. Also note that domestic retail investors have turned buyer (they were conspicuous net sellers into last year’s rip).

To repeat a sentiment from last year, this country offers a set of critical assets that the West very much needs (if Europe is tanks-and-banks, this is ships-and-chips).

And, while price action invites some of the same questions as precious metals do, to put a line under a point from last week, this rally has been driven by an immense upgrade to earnings estimates (per Tim Moe, 2026 earnings growth is over 70%, with upside risk following strong prints from the semi stocks).

Japan.

The scores on the door for January: NKY +6%, TPX +5% (local FX). Again, in a trading environment that clearly rewards cyclical properties, Japan is a natural place to hunt.

Following on from the prior paragraph, it also offers leverage to industries that are currently attracting capital (defense contractors, semis).

At the same time, the sensation is different from Korea, and the setup is certainly more complicated given the volatility in both JGBs and JPY.

I don’t want to go too far with this -- as Dom Wilson rightly pointed out, when 5-year real rates are negative 83 bps, the starting point isn’t so bad -- but the degree of difficulty is rising.

The Dollar.

While today may stem some of the bleeding, the dollar exits January near multi-year lows and has blown through a series of trendlines.

There are several ways to illustrate the recent pressure in the dollar; consider this break of the 15-year bull up trend:

In the context of my note earlier this week on foreign demand for US assets, consider this take from Karen Fishman:

The implications are more nuanced for the Dollar.

You mention some of the many reasons not to worry about massive capital flight from US assets, and our house view is still fundamentally constructive on the US economy and the equity market. o

Our macro outlook for the year ahead implies a more benign market environment vs 2025 (albeit with risks skewed towards higher vol).

But the Dollar can still weaken modestly in a world of more balanced return prospects, even if the US still ranks near the top. it just tends to have a more procyclical tilt than the flow-driven European FX outperformance of last year, and that’s our baseline.

We’ve repeatedly stressed that repatriation is not required for Dollar depreciation when prices can simply adjust as investors demand a higher premium than before—or as investors raise hedge ratios or shift towards non-US markets in fresh capital allocations, even if only to avoid overexposure to particular themes, like AI.

The US economy.

The big variables in the equation:

-

our above-consensus GDP call (+2.9% for 2026),

-

the terminal Fed Funds rate (3-1/8% by September),

-

and the trajectory of inflation (core PCE back nearly to target by the end of the year).

One other point stood out to me: the wedge between growth and jobs...

US Tech.

A large chunk of market cap announced this week, including four of the largest companies on planet Earth. for the takeaway from mega cap tech, enter Pete Callahan:

If the underlying flavor of Mag7 action has been one of dispersion and zero sum price action over the last several quarters, this week furthered that narrative with META +10% vs MSFT -10% post earnings.

Key takeaway is that as the capex figures continue to climb, the market has become increasingly discerning re: evidence of payback and ROI, preferably in the form of faster revenue growth -- cue META being rewarded for guiding revenues to a meaningful re-acceleration in 1Q (think 5+ pts of faster y/y growth), helping to underwrite another year of 80%+ y/y capex growth (or as much as ~$135+ bn of forecasted capex in 2026).

Our US portfolio strategy team worked through the state of the broadening trade, and I will highlight one conclusion:

“following the strong returns of the Russell 2000, valuations appear more attractive for the S&P Mid Cap 400 and Small Cap 600”.

Something I learned from Bobby Molavi (the second part really struck me):

“Nvidia is now worth more than Walmart, JP Morgan, Oracle, Cisco, GE, Coca-Cola, Nike, Ford, McDonalds, Starbucks, IBM and Intel COMBINED.

What is more interesting is that each and every one of these companies was bigger than Nvidia on a standalone basis 20 years ago.”

Finally, Pasquariello says, all of this heat invites two key questions...

On a tactical basis, is this sustainable - given the magnitude of certain moves, it’s fair to ask if the tachometer had tipped into the red in a few places.

The answer is simple and frustrating: It depends, as Pasquariello has detailed above on each asset class.

The other question is less tactical: what continues to unsettle me is the disconnect between assets and macro pricing.

Risk assets are screaming late cycle, run it hot, with markets reaching for fiat alternatives everywhere, while inflation and rate expectations look oddly complacent (we are still pricing 1.7 cuts).

If there’s a real risk to the current equilibrium, it’s that disconnect snapping back into focus.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal