Japan To The Polls

Japan's first female prime minister, Sanae Takaichi, is seeking to secure her grip on power in a national election on Sunday, with polls suggesting a big win for her conservative party.

Voting for Japan's 51st House of Representatives election is set to begin nationwide at 7:00 a.m. local time on the 8th.

The main issues at stake include Takaichi's "responsible active fiscal policy," economic policy including the handling of the consumption tax cut, security, and the issue of "money and politics."

As Reuters reports, her modest background and nationalistic rhetoric have struck a chord with a disenchanted youth hopeful she can pull Japan out of a decades-long economic funk.

A conservative who draws inspiration from Britain's Margaret Thatcher, Takaichi has harnessed the power of social media and become an unlikely fashion icon, with fans clamoring to buy the bag she carries and the pink pen she scribbles with.

Whether younger Japanese bother going to polling stations on Sunday may determine the size of her expected win. In the October general election that preceded her rise to prime minister, just 36% of those aged 21 to 24 in the capital Tokyo voted, versus 71% of those aged 70 to 74.

The results are expected to be known by late at night.

Voting will close at 8 p.m. except in some areas, and the votes will be counted on the same day.

According to the Ministry of Internal Affairs and Communications, approximately 20.79 million people had completed early voting in single-seat constituencies between the day after the election announcement and the 6th.

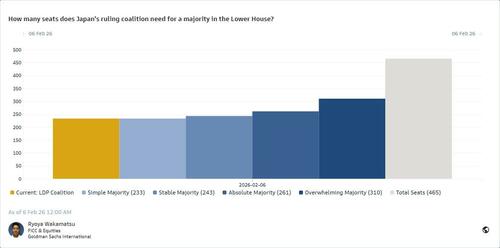

A total of 465 seats are up for grabs, with 289 single-seat constituencies and 176 proportional representation seats.

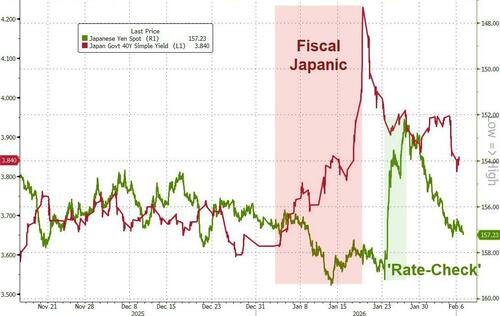

Takaichi's election promise to help households cope with rising prices by suspending the 8% sales tax on food sparked a market selloff last month.

Investors balked at the vagaries of how an economy with the heaviest debt burden in the developed world would pay for the estimated 5 trillion yen ($30 billion) hit to annual revenue.

Her comments on how she will implement those plans will be pored over by those same investors that fled Japanese government bonds and sent the yen sinking into crisis mode.

If she sets off a market rout, Takaichi may not be able to count on the Bank of Japan's help to tame it, Reuters reported this week.

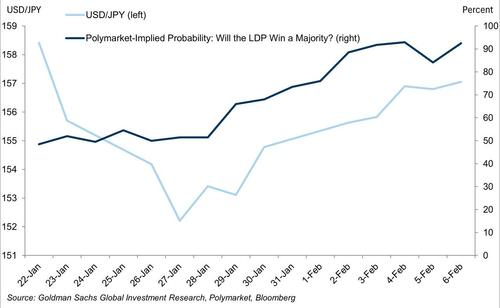

As Goldman Sachs Rikin Shah and Cosimo Codacci-Pisanelli explain, an LDP majority is close to fully priced by prediction markets, the question and delta for the market will be the extent of the win and the degree to which this will impact the fiscal policy path.

Polls vary, but suggest that an absolute stable majority is possible (261 seats), which if achieved would reduce reliance on coalition partners and mean an easier route for Taikaichi to pursue her fiscal plan.

The right tail is to a bigger, two-thirds majority (310 seats) which would allow the party or ruling coalition to pass bills that are rejected by the Upper house – where LDP do not currently have a majority.

Both these scenarios would lead to an extension (to different degrees) of the Takachi/Abenomics trades: JGB yields, USDJPY and Japanese equities all higher.

Anything less than a simple majority (233 seats) and we’d expect the reverse of those moves initially... but would note that even in that scenario working with potential coalition partners would likely lead back to fiscal expansion.

If the polls have it all wrong and she loses her lower house majority, Takaichi has said she will resign.

The path of least resistance and our bias remains towards higher belly rates, but wait to add on a pull back from current levels.

The FX picture is trickier, a drift higher is the base case, but intervention risks increase as USDJPY creeps back up towards rate-check levels from the end of Jan and will keep moves higher in check for the time being.

Professional subscribers can read much more from Goldman's Research and Trading teams here at our new Marketdesk.ai portal