JGBs Are No Longer Technically Stretched: Citadel Macro Maven Says April Is Live For BoJ

Authored by Frank Flight via Citadel Securities,

Long end JGBs have performed well since we turned constructive earlier in the week, but sustained performance will be more challenging.

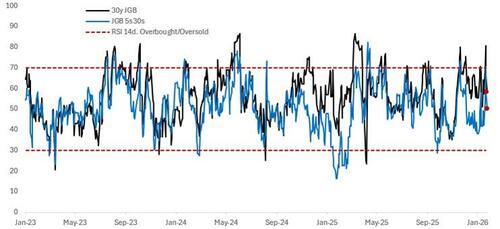

As a result of the long end driven rally/flattening in the second half of this week, our momentum indicators have normalized as one would expect.

Technical Indicators That Caught the Turn in Long End JGBs are Now Neutral

14d RSI on 30y JGB and 5s30s JGB Curve

This suggests that some of the market functioning risk premium has come out of the curve and implies the path forward for long end JGBs will be more challenging as valuations are no longer as stretched on a technical basis.

The core pillar of our constructive view was that the policy options to lean into the price action were not out of reach and comments from Gov.

Ueda in Friday’s post meeting presser did indeed imply a relatively low bar for the temporary long end purchases we thought the BOJ would be inclined to hint towards, as well as for co-ordination with the MoF.

“We will conduct nimble market operations to respond to irregular moves”

– Gov Ueda, BOJ Presser, Jan26

“Regarding the pace of long-term interest rate increases — whether it is fast or too fast, and whether it warrants flexible operations — we will make judgments while closely co-ordinating with the government and carefully monitoring the situation,”

– Gov Ueda, BOJ Presser, Jan26

On a standalone basis, this kind of intervention on the long end clearly skews negative for trade weighted JPY, although reports of a rate check on USDJPY perhaps imply a two sided intervention strategy (link).

In the medium term, both international and domestic asset manager sponsorship are the key to unlocking sustained performance in Japanese duration and JPY FX.

On the policy rate outlook, the BOJ’s forecast upgrade (growth revised +0.2% and +0.3% higher to 0.9% and 1% in 2025 and 2026, inflation revised +0.2% higher in 2025 and 2026 to 3% and 2.2% respectively) is consistent with the faster pace of hikes we had been flagging.

Ueda highlighted spring price data and greater confidence in the outlook as relevant for the policy path however we think April is the most likely meeting for the next hike.