JPMorgan Is Bank Behind The Repo Crisis And The Fed's Decision To Launch QE Lite... Again

In early September 2019, not long after the Fed had started its first post-GFC easing cycle, both stocks and bonds were rocked by a series of violent, sharp and unexpected meltdowns, sparked by turmoil in the all-important repo market - the plumbing that connects the tens of trillions in assets that make up the US capital market and which is used by the Fed to set and adjust the cost of money on any single day. At one point during that fateful September, overnight funding rates exploded as high as 10%, and in a Sept 18, 2019 article titled "Fed loses control of its own interest rate as it cut rates", CNBC quoted Michael Schumacher, director, rate strategy, at Wells Fargo, who said that “this just doesn’t look good. You set your target. You’re the all-powerful Fed. You’re supposed to control it and you can’t on Fed day. It looks bad. This has been a tough run for Powell."

But how was this possible: after all the Fed had just started easing, stocks were rising, and there was no indication that the market's all-important plumbing had clogged up? We laid out the answer just days after the Repo market crash, when we quoted from a Reuters analysis "which found the one bank that may was the reason for the repo market to lock up on the 11th anniversary of Lehman when the repo rate exploded as high as 10%."

According to Reuters, "JPMorgan Chase has become so big that some rival banks and analysts say changes to its $2.7 trillion balance sheet were a factor in a spike last month in the U.S. “repo” market, which is crucial to many borrowers."

Specifically, the analysis found that the direct culprit for the sudden liquidity vacuum that sparked the repo conflagration is that JPMorgan reduced the cash it has on deposit at the Federal Reserve, from which it might have lent, by $158 billion in the year through June, a 57% decline (and, as we noted at the time, the discovery that JPMorgan was responsible for the first repo market crisis, explained why Jamie Dimon said, just days after the Sept 16 repo shock "that the Federal Reserve did the "right thing" in injecting funds to support overnight funding needs for banks. Well, we now know why it was the "right thing" to Jamie.")

We concluded our 2019 write up by saying that while JPMorgan’s moves were seen as logical responses to interest rate trends - with the Fed expected to cut aggressively in the coming year and thus forcing JPMorgan out of the safety of overnight rates and buying longer-duration treasuries, "the data shows its switch accounted for about a third of the drop in all banking reserves at the Fed during the period", with the slide in bank cash levels taking the Fed's reserves to the lowest level since 2012.

Two months later, very unironically, during the bank's quarter-end earnings call, we had a question for Jamie Dimon: "when will JPMorgan cause another repo market crisis"

Q for Jamie: when will JPM cause another repo market crisis?

— zerohedge (@zerohedge) November 5, 2019

Well, we now have the answer: it took just under 6 years for JPMorgan to spark another repo market crisis, one which has so far culminated in QE Lite, although this particular chapter of the 2025 repo crisis is only just starting.

Let's back up a bit.

As regular readers will recall, two months ago, on October 15, we wrote that the US was yet again -"On The Verge Of A Funding Crisis: Fed's Emergency Liquidity Facility Unexpectedly Soars Most Since COVID" because as we explained, "a few days after the Fed cut rates in September (but without Powell committing to more rate cuts, which is why some in the market viewed the FOMC decision incorrectly as a hawkish cut) we said that the conversation whether the Fed will cut and how much, is moot for a very simple reason: Fed reserves had just fallen below $3 trillion, a level which most Fed officials view as the red line between "abundant" to "scarce" reserves (for those unfamiliar, when reserves become "scarce", banks fail, repo markets go haywire, and generally the market crashes, so it's largely viewed in a negative light except by the bears)."

We also highlighted that - just like in 2019 - the current repo crisis was preceded by a sharp and unexpected drop in Fed reserves...

The rate cut conversation just became moot: welcome back to the reserve-constrained regime. The countdown to SOFR going ape has begun pic.twitter.com/ubb9gfnKxM

— zerohedge (@zerohedge) September 25, 2025

... which is also what prompted us to predict - correctly, when it was still a extremely contrarian view - that the Fed would end QT imminently (see "QT Is Over: Goldman, JPMorgan See Fed Flipping As Reserves Tumble Below $3 Trillion") and more importantly, the Fed would also imminently restart Reserve Management Purchases (i.e., QE Lite) as it was forced to further cut rates (see "Repo Locking Up Again As Market Tries To Force Fed's "Reserve Management Purchases")

To summarize: just like in 2019 we got:

- a sudden collapse in Fed reserves

- a rapid deterioration in repo market functioning just as the Fed has restarted its easing cycle

- one or more banks had pulled reserves away from the Fed, resulting in a sudden liquidity/funding shortage, and

- a powerful dovish reaction from the Fed, prompted by "market forces" to dramatically expand its easing.

To all those who paid attention in 2019, the playbook was familiar and our conclusions - which were spot on about what would happen in both the repo market and beyond - would have been obvious to everyone who recalls the events of 2019 and the months that followed.

There was just one thing that was missing from our latest repo crunch analysis: the culprit, or "whoodunit"... perhaps because we are believers that while history may never repeat itself, it does rhyme.

Only in this case it shockingly repeated itself verbatim with zero humility, and we were shocked to learn that just like in 2019, it was none other than JPMorgan that was both the catalyst of the latest repo market crisis, and the biggest beneficiary.

Now that QT is history, and any pretense of a hawkish Fed died is quiet death a week ago when the Fed's first Bill monetization operation took place (the first of many), earlier today the FT reported that none other than "JPMorgan Chase has withdrawn almost $350bn in cash from its account at the Federal Reserve since 2023 and ploughed much of it into US government debt, as the bank tries to defend itself against rate cuts that threaten to erode its profits."

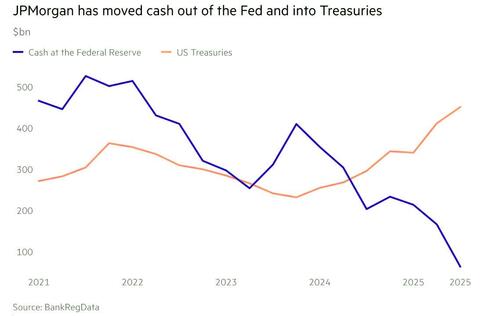

Citing data from BankRegData, the FT notes that JPMorgan - the largest US bank with more than $4 trillion in assets - slashed its balance at the Fed from $409bn at the end of 2023 to just $63bn in the third quarter of this year. At the same time, and just like in 2019, the bank increased its holdings of US Treasuries over the same period from $231bn to $450bn, a move that allowed it to lock in higher yields in anticipation of the central bank cutting interest rates.

The transfers, the FT goes on to note, "reflect how the largest bank in the US has been preparing for the end of a period of easy profits in which it was paid to park cash at the Fed while having to pay many of its depositors close to nothing."

Indeed, as shown in the chart below, the more JPM withdrew its Fed reserves (ahead of and during Fed rate cuts which meant less free money handed from the Fed to Jamie Dimon), the more funds JPM allocated to long duration paper, locking in rates ahead of further rate declines.

“It’s clear JPMorgan is migrating money at the Fed to Treasuries,” said BankRegData’s founder Bill Moreland. “Rates are going down and they’re front-running.” Which is correct, until it isn't: just look at what is going on with long duration bonds in Japan where the BOJ has completely lost the plot and a full blown bond market crisis is now just a matter of time.

The FT goes on to note that "the scale of JPMorgan’s withdrawals was so large as to offset the movement of cash in and out of the Fed by all of the rest of America’s 4,000-plus banks. Since the end of 2023, the total amount of cash banks have on deposit at the Fed fell from $1.9tn to about $1.6tn."

More importantly, JPM's capital moves reflect that absolutely nothing has changed in the past 6 years, and the liquidity drain by just one bank was sufficient to spark another repo market crisis, and in the process, force the Fed to engage in yet another QE (lite) and further rate cuts.

That's not the only way JPMorgan benefited: shortly after its yanked liquidity from the market and sparked the 2019 repo crisis, the bank sold out its US paper holdings, and avoided investing heavily in long-term Treasuries when interest rates were low in 2020 and 2021, unlike rivals such as Bank of America which suffered steep paper losses from their investments when interest rates rose sharply in 2022 during the period of Biden galloping inflation. Then, JPMorgan’s sticky deposit base enabled it to earn a greater return on its cash at the Fed during the period of high interest rates than it had to pay its depositors.

And now, the latest shift from cash to Treasuries ahead of the Fed's latest rate cuts (of which many more are coming) helped JPM lock in higher interest rates, limiting the hit to earnings from falling rates.

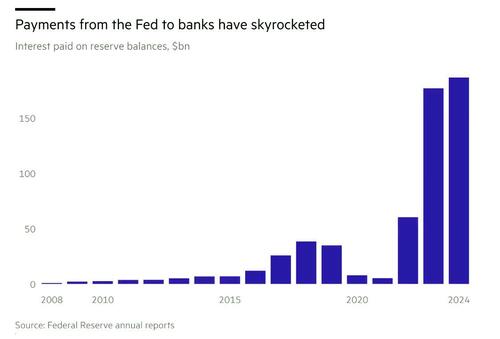

To be sure, JPMorgan is not alone to benefit from the Fed's "interest on reserve" generosity: as we have been reporting for the past 15 years, banks have earned hundreds of billions in interest from cash kept at the Fed since 2008, giving the central bank a mechanism by which to influence short-term interest rates and liquidity in the financial system, but more importantly to keep the US financial system solvent as the lender of last resort continues to pump billions of risk-free interest income in the coffers of hundreds of domestic and foreign banks. Interest payments soared in the past two years, with a record $186.5BN paid out as interest on reserves in 2024.

With ZeroHedge having first decried the practice in 2010, the Fed's payment of interest on reserve balances has become extremely controversial, much to the banks' chagrin, yet the Senate voted down a bill in October that would have banned the Fed from paying it. Senator Rand Paul, who pushed for the change, argued that the Fed was paying hundreds of billions of dollars to banks to keep money idle. Other Republican senators including Ted Cruz and Rick Scott have also voiced opposition.

In a report earlier this month, Paul claimed that the 20 largest recipients of interest payments from the Fed had received $305bn since 2013 and that JPMorgan received $15bn in 2024, a year in which its total profits were $58.5bn.

He is of course, right. But what is even more amazing is how Jamie Dimon, with one capital allocation decision - to move reserves out of the Fed and into Treasuries - launched a chain of events which led to the recent repo market crisis, the blow out in various repo rates, forced the Fed to keep cutting and end QT prematurely, and last but not least, got Powell to launch QE Lite.

All just like in 2019.

Which begs the question: back in 2019, 6 months after the Fed started "NOT QE" (as it was called back then by the press to pretend that the monetization of securities by the Fed is... well, not what it seems to be), we lived through the biggest financial crisis in modern history, when covid not only shut down the global economy but the Fed was at one point injecting trillions (not a typo) every single day into the market to keep the western financial system alive.

Do we have something identical to look forward to for May/June 2026?