JPMorgan Delta-One Desk Remains 'Tactically Bullish'; Here's Their Bull Vs Bear Case

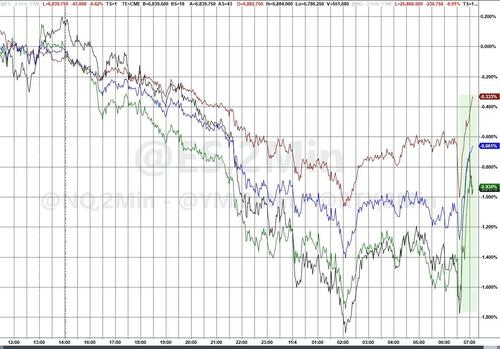

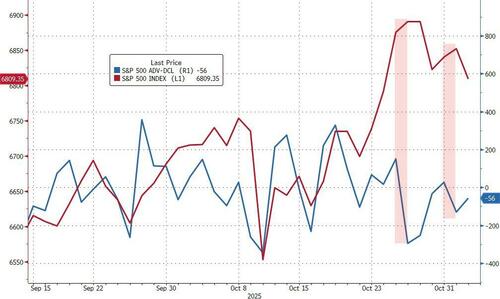

US equities are bouncing strongly off very weak overnight lows (but remain firmly in the red)...

...driven, we suspect, by the fact that there was a big drop in Standing Repo usage (suggesting less imminent risk of a liquidity crisis)...

Another big drop in standing repo usage for Nov 3, down to $2.8BN from $22BN. Funding normalizing for now pic.twitter.com/TX6bX8VrTb

— zerohedge (@zerohedge) November 4, 2025

Despite the recent weakness, JPMorgan's Delta-One desk maintains their Tactical Bullish call as they see:

(i) the macro picture improving in the near-term,

(ii) earnings printing materially above expectations, and

(iii) Trump’s Asia trip leading to lower net effective tariff rates and unlocking the rare earth supply chain.

We see the key risks coming from:

(i) AI exhaustion and

(ii) higher bond yields / spike in bond volatility.

Here's their full breakdown of the bull and bear case right now:

BULL CASE

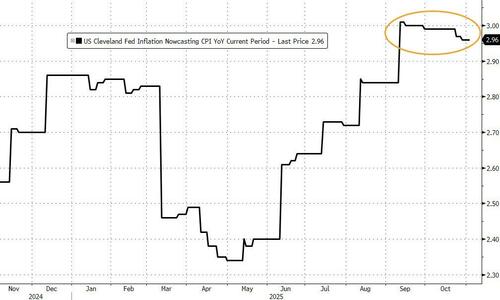

(i) Resilient / Improving Macro Data – the key is the labor market and while we don’t have official nonfarm payrolls other indicators, including ADP, have pointed to hiring improving beyond expected holiday seasonal increases. Also, if inflation remains contained around current levels, stocks will remain unbothered. The Cleveland Fed’s inflation Nowcaster see October CPI at 2.96% and Core CPI at 2.99% vs. 3.0% prior month for both metrics

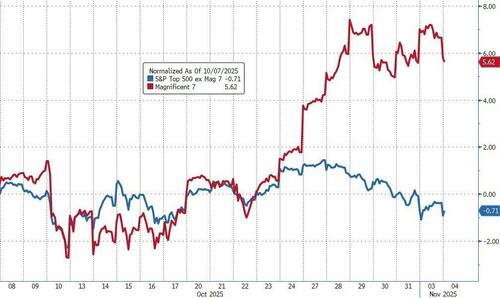

(ii) Mag7 / AI theme maintains its leadership position – some clients are increasingly nervous about narrow market breadth but, similar to 2023, if Mag7 are appreciating it is unlikely that the index declines. Many are focused on the capex spend and eventual ROI of AI investments, but these companies continue to see increased profitability assuaging fears of a Dot Com like implosion.

(iii) Robust Buybacks – FY25 is expected to have a record level of buybacks, in the $1.1T - $1.2T range and they should resume in the near-term providing a significant demand source.

(iv) Retail Investor Momentum Continues – Arun Jain tells us that October saw ~$27bn in purchases vs. $22bn average from May – Sep. If the retail investors maintains this level of activity into year end, this will support MegaCap Tech.

(v) Government Reopens – the shutdown may not have a material impact on the economy (the 2018-19 shut down cost ~$11bn with $8bn recouped via backpay vs. ~$30T economy) but a reopening is likely to boost both consumer and investor sentiment.

BEAR CASE

(i) Economic Stress – this would likely come from an increase in layoff announcements, which have not materialized despite the recent headlines, coupled with another increase in inflation. Similarly, increases in consumer defaults weakening consumption is another element.

(ii) Investors Demand AI ROI – at some stage, investors will want to see AI translate into increased revenue from the end users; whereas, most of the improvements appear to be in the form of cost cutting which has a limit on how much value can be added.

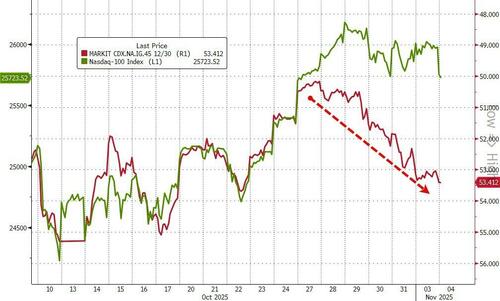

(iii) Credit Stress – despite the recent increase in Tech issuance the at-risk parts of the market may exist more within private credit and non-public businesses (BBG). This could lead to a similar outcome to last month’s fears surrounding BDCs / financial system contagion.

(iv) Worsening Trade War Rhetoric – Similar to the recent US / Canada Reagan Ad controversy discussions are volatile and in other agreements it is possible that parties fail to deliver on their promises leading to retaliation. The market has not reacted to negative headlines as we see the Administration continued to find solutions ahead of deadlines, it is possible that this changes.

(v) Narrow Breadth Triggers Rotation away from US Equities – some clients have flagged that the narrow breadth despite improving earnings from SPX493 points to increased fears and/or overvaluation. This could trigger a flight to safety (Rates / Credit) and / or to international options especially if the USD resumes its decline; Mislav tells us that the Eurozone is cheap compared to the US.

(vi) Spike in Bond Yields / Bond Vol – this could be triggered by accelerating growth or increased inflation. This week, the SCOTUS may rule on tariffs, which could be another source of vol should they be struck down. Sudden moves in bond yields tend to hurt stocks, potentially taking weeks to digest.

Finally, the JPM traders suggest the following ways to monetize their views:

We like MegaCap Tech and Cyclicals plays but think it makes sense to have a bias towards large-cap plays irrespective of sector.

We may see a rise in rates, especially if the market consensus on macro / labor markets is one of increased growth / hiring albeit with inflation remaining sticky.

Further, this would reduce the probability of a December rate cut, further pressuring yields higher.

If so, this would tend to favor large-caps over small-caps.

Professional subscribers can find the full note at our new Marketdesk.ai portal