JPMorgan's Delta-One Desk Reveals Its Top "AI Disruption" Trade

Yesterday, US markets recovered their steep early losses around the time of the EU close, and that momentum has carried through to global markets today with what appears to be re-grossing in EU and continued momentum in the Japan trade. At least some of the bullish shift in sentiment has been attributed to JPM's Market Intel desk saying the selling among Software/AI Disruption stocks is almost over as we discussed first yesterday.

This morning, capitalizing on this "bottom" call by the Market Intel team, JPMorgan's DeltaOne team published its latest favorite trade idea: long the top "mispriced" stocks amid AI disintermediation, while shorting the AI vulnerable stocks. Effectively this is a rehash of what Goldman's thematic team did last week and which we covered in "Goldman Reveals How To Profit From The Ongoing Collapse Of Software Stocks."

Below we except from the JPMorgan note (available to pro subs).

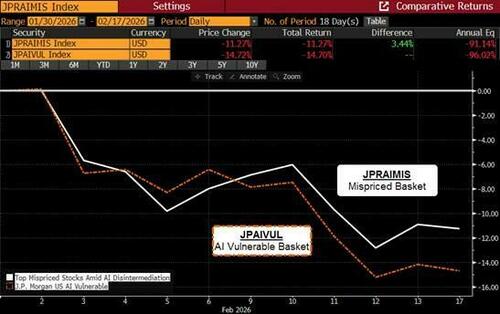

Following the market's ongoing re-rating around AI disruption themes, a meaningful divergence has begun to emerge between companies insulated from AI displacement and those facing existential business model risks. In Top Mispriced Stocks Amid AI Disintermediation note today (Feb 17), JPM's Equity Research analysts have constructed JPRAIMIS (Long Top Mispriced Stocks Amid AI Disintermediation), a set of high-conviction equities trading at attractive valuations despite being structurally protected from AI disintermediation. Meanwhile, JPAIVUL (AI Vulnerable) continues to deliver as a short, capturing companies where AI-driven disruption is accelerating and competitive pressures are mounting.

According to the JPM Delta-One team, this trade offers a compelling asymmetric opportunity: the long leg captures mispriced quality names with durable moats that the market has overlooked or mispriced in the broader AI volatility. The short leg benefits from the ongoing repricing of vulnerable business models as AI capabilities continue to advance. With AI disruption still in early innings and market differentiation between winners and losers beginning to sharpen, we see attractive risk/reward in this cross-sector thematic spread.

LEGS OF THE TRADE

- Long Mispriced Stocks Amid AI Disintermediation (JPRAIMIS): Comprises equities identified as structurally insulated from AI disruption yet trading at compelling valuations, expected to re-rate higher as the market increasingly differentiates robust vs vulnerable business models

- Short AI Vulnerable (JPAIVUL): Comprises companies whose business models face heightened exposure to AI disruption, expected to continue to be soft as AI capabilities accelerate and displacement risks materialize

MONTH TO DATE PERFORMANCE OF JPRAIMIS INDEX VS JPAIVUL INDEX

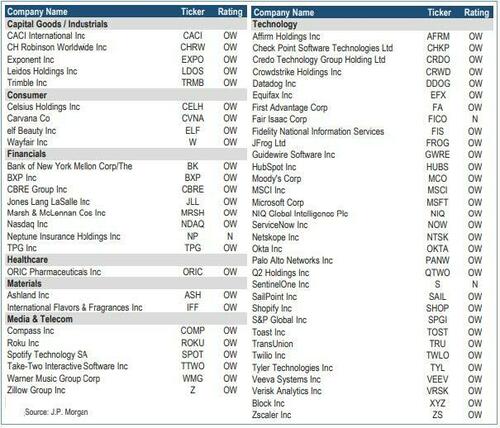

For those who missed it, here are the components of the JPRSAIMIS Index:

Tied to that, here is the latest note from JPM's Bram Kaplan recapping the bank's most notable Delta-One Flows and Positioning

- Futures Flows: Last week we saw large net buying (>1.5z) in DAX, CSI 500 and Germany 2y futures, and large net selling (<-1.5z) in FTSE 100, Hang Seng, HSCEI, UST 5y, Germany/Italy 10y, Nickel, Aluminum, Soybean and JPY futures.

- CTAs likely de-levered in US equities over the past week as we crossed some key signals, though they remain broadly long global equities. Additionally, CTAs likely bought global rates w/w, and now appear long across the US curve, but retain mixed exposures in international rates. Furthermore, CTAs likely bought JPY w/w and remain long oil, metals, and global FX vs USD.

- CFTC Positioning: Asset managers bought Dow Jones and VIX futures w/w, and added to longs in US rates across the curve. Meanwhile, leveraged funds trimmed shorts in US equity futures and sold EM equities w/w. Managed money bought Soybean and Gasoline futures w/w.

- ETF Flows: Last week, we saw above-average inflows into Equities ($26.6Bn, 0.5z), strong inflows into Fixed Income ($15.5Bn, 1.8z), and below-average inflows into Commodities ($0.5Bn, -0.5z) and Currency/Multi-asset funds ($0.3Bn, -0.3z).

- Regionally, we saw continued strong inflows into international equities, led by DM ETFs ($12.4Bn, 2.4z), while EM equities ($4.2Bn, 1.4z) saw a reacceleration in inflows after decelerating the prior week. At a country level, stand-outs included record inflows into Korea ($1Bn, 4.7z) on memory stock strength, the highest inflows into Japan ($1Bn, 3.7z) in 2.5 years following its election, and strong inflows to Mexico (2.5z).

- In Equity styles, Value, Dividend, and Defined Outcome ETFs recorded ~1z inflows last week.

- In Equity sectors, we saw strong inflows into Staples (2.2z), Real Estate (1.6z), Materials, Energy, and Industrials.

- In Fixed Income ETFs, we saw ~1.5z inflows into Agg, Corporate, and International bonds, as well as a rotation from long-term to short-term gov’t bonds.

- Broad Commodities (2.9z) recorded strong inflows last week, while Precious Metals saw near-flat net flows with a moderate rotation from silver to gold. Crypto ETFs saw moderate outflows.

Finally, we recap the thoughts from several JPM specialist on how they view the AI "Obsolescence Narrative."

1. ENTERPRISE AI ADOPTION INSIGHTS (BREDA DUVERCE)

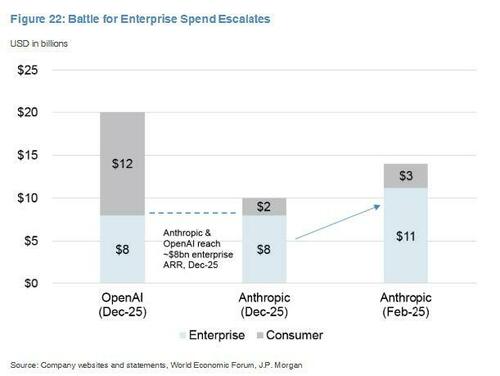

- AI adoption surging across U.S. businesses. Recent third-party data cites companies with paid AI subscriptions grew to ~47% in Jan 2026 (~26% 12 months ago). Over the next year, avg. AI contract value is projected to rise 1.9x (Ramp), and ~90% of organizations are expecting to increase AI spending (Wharton, Oct 2025).

- Pent-up employee demand for broader AI deployment. ~53% of computer-based workers in our survey receive employer-provided AI services, and of those who do not, ~38% are using personal AI services at work.

- Improved model capabilities driving adoption and use. User preference ranking data shows Google’s Gemini held the top spot overall (or tied #1) from July 2025 until this month, when Anthropic’s Claude Opus 4.6 surpassed it.

- Agentic tools gaining traction beyond coding. Claude Cowork and tools like OpenClaw are broadening agentic reach and raising SaaS disruption potential, but security and tech fragmentation factors still hinder adoption.

2. SOFTWARE (MARK MURPHY) – “Overall, our view remains to recognize the narrative shift we identified three years ago and position accordingly with a barbelled approach spanning value and growth, avoidance of overly-generous valuation frameworks, and consideration of top performers in our CIO survey work with appropriate FCF valuation support and resilient/sticky revenue streams.”

A few selected excerpts from Mark’s note:

- “We have recognized the difficulty of resolving the current debate because it is “difficult to prove a negative” (i.e., “prove that AI WON’T disrupt software companies in a few years”) and because the established software industry remains in a sluggish period of deceleration while US payroll growth has slowed from 5% five years ago to zero today. In addition, one fair criticism is that insider buying activity has largely failed to emerge, and that isn’t helping to instill confidence.”

- “We have further noted the difficulty of the current rules of the road – it is widely being stated that ‘traditional software has to accelerate, to disprove the AI-disruption thesis,’ and in many cases, the buy-side bars have magically RISEN while the stocks have dropped – while the broader software landscape, as noted above, has been consistently decelerating in the wake of the 2021 COVID pull-forward and subsequent cost-of-capital reset, while the US economy has stopped adding the jobs that usually drive software seat-based subscription volumes.”

3. WEALTH MANAGERS (ENRICO BOLZONI) – “On Tuesday, Altruist, a US tech platform for independent advisors, introduced an AI-powered Tax Planning tool for Hazel, its AI platform. The tool will help advisers create personalized tax strategies for clients based on their financial information.” Some more excepts from Enrico's view:

- “While we believe that the market generally underestimates the importance that clients of financial advisers place on the personal relationship with their advisers, we note that different market structures across regions could lead to different levels of penetration of AI solutions, and we believe that financial advice firms will have to be proactive in adjusting their business models to cater for the needs of younger cohorts of clients, who are more likely to use technology to manage their finances, and are the recipients of the ongoing generational transfer of wealth. In a bull-case scenario, we also believe that AI could contribute to meaningfully increasing adviser productivity.”

4. AI RISKS IN LIFE SCIENCE TOOLS (CASEY WOODRING) “AI risk has also bled into the tools conversation, although this dynamic is more of a clear-cut debate in CROs in our view. Over the past two weeks we have also seen the tools group get caught up in the broader market AI sell-off, as investors weigh how pharma could use AI in drug development and manufacturing to potentially improve productivity and efficiency and thereby impact demand for tools and service providers. From our perspective, while we are not AI experts, it is more unclear to us how AI would apply to tools in its current state and over what time horizon. That said, we do acknowledge that the AI debate holds more near-term weight in the CRO space, particularly given some of the commentary we’ve heard this earnings season from the likes of MEDP, which said that internal AI-related productivity gains across pharma customers on the surface seem like a net-negative for a service company providing that same work externally.”

5. FREIGHT / LOGISTIC SERVICES (ALEXIA DOGANI) “On February 12th, the Freight Forwarding stocks (DSV, KNIN, DHL) significantly underperformed the market, down on average 10% vs. SXXP down 0.5% driven by the market’s reaction to the risk of AI disintermediating the asset light business model. This was triggered by a sell-off in US peer, CHRW, down 25% following a press release by Algorhythm Holdings highlighting that its SemiCab AI platform (an AI-driven collaborative transportation platform) can enable an individual operator to manage 2,000 loads pa, compared to a traditional broker of c. 500 delivering 4x productivity. The company noted that it is looking to expand the platform in the US and plan future international deployments, highlighting that ‘Freight is one of the largest industries in the world, yet it still operates on antiquated, labor-intensive models, by applying artificial intelligence at scale, we’re unlocking a new level of productivity, profitability, and resilience for the entire freight ecosystem.’.” Some more details from Alexia's view:

- “The press release this afternoon highlighted that this new tool could potentially disintermediate the need for a broker / forwarder to transact and access capacity. We are skeptical on this point, especially as a forwarder is a service provider who is currently virtually integrating physical infrastructure which otherwise would be inaccessible. Freight remains very low on the digitalization curve (unlike the airline / hotel industry for instance where the travel agent business model has been structurally challenged).”

6. JAPAN IT SERVICES (MATTHEW HENDERSON) – “In Japan, large corporations are still heavily dependent on SIers, and in-house development of IT by Japanese corporations lags significantly behind that of other industrialized countries. Combined with a shortage of IT talent, Japan is already behind other countries in terms of AI adoption rates… we believe Japanese corporations are unlikely to independently accelerate their use of generative AI. As a result, we believe major structural changes are unlikely to occur in this environment, at least in the medium term. Over the long term, we see a high likelihood that companies will accelerate insourcing in response to SIers raising prices (improving margins through price hikes), as seen in overseas markets in the past. In this respect, advances in generative AI are likely to dramatically boost the productivity of IT talent, help alleviate the IT talent shortage, and support greater insourcing by companies.”

* * *

More in the full JPM note available to pro subs.