JPM's Trading Desk 2026 Market Outlooks By Sector

Last week JPMorgan, along with most other investment banks, published its various 2026 outlook reports. In a separate note, the bank's market intel desk led by trader Andrew Tyler, who has been stubbornly (and correctly) bullish global stocks and the economy for much of 2026, also published his own annotated cross-asset version of the bank's various 2026 outlooks.

Here is an abbreviated summary of what Tyler expects:

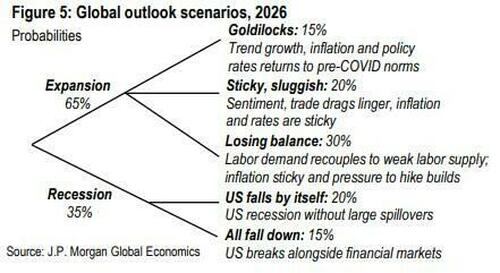

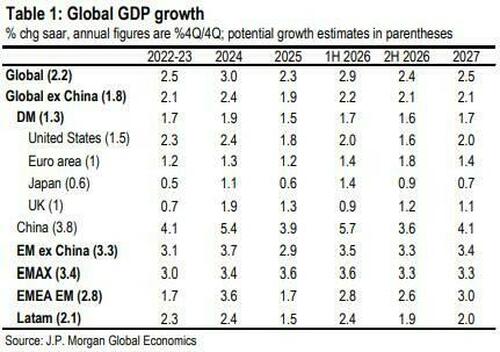

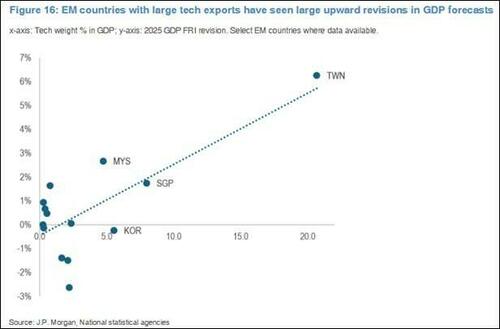

ECON: Global GDP growth is expected to receive a boost in 1H26 from front-loaded fiscal stimulus, concentrated in the US and China. This lift should promote a rebound in sentiment and a recoupling of labor demand to GDP gains. AI spending should deliver a second year of solid capex gains but productivity dividends will be limited next year.

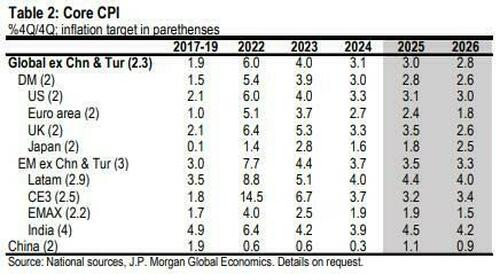

2026 Growth and inflation for the US are in line with this year (+1.8% for real GDP, +2.7% for core PCE inflation). We have Fed cuts in Jan and May but policy will pause once labour demand picks up. We project faster Euro area growth in 2026 as German fiscal expansion steps up from 4Q25 onwards and as earlier ECB rate cuts feed through. The inflationary consequences of faster growth are likely to be modest. (full note available to pro subs).

* * *

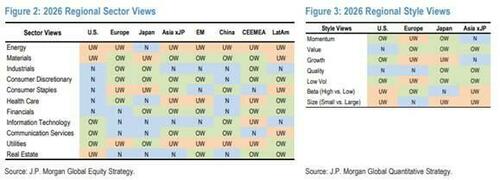

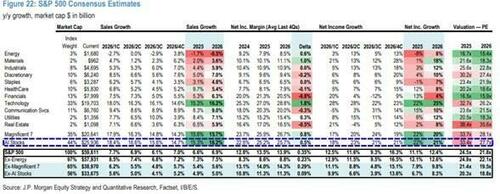

EQUITIES : We are positive on global equities expecting double-digit gains across DM and EM supported by robust earnings growth, lower rates, and declining policy headwinds (full note available to pro subs)..

- In the US, we have above-trend earnings growth of 13-15% for at least the next two years and S&P 500 at 7,500 by YE26. Should the Fed ease policy more than expected (on improving inflation dynamics), the S&P 500 can surpass 8,000 in 2026.

- Eurozone earnings are expected to grow by 13%+ next year, supported by improving activity momentum, stronger operating leverage, reduced tariff headwinds, easier comps, and better financing conditions. Investor skepticism and low valuations are good starting points.

- In Japan, Sanaenomics and corporate reforms will likely propel Japanese equities in 2026. Major risks could come from yen and long-term interest rates

- EM equities are positioned for robust performance in 2026. China could show green shoots of recovery in the private sector; Korea remains supported by governance reforms and AI; and LatAm could see strong upside on outsized monetary stimulus and key political shifts.

* * *

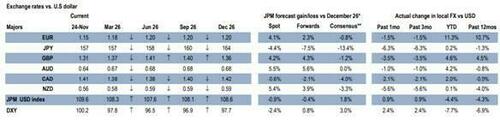

FX: We have a bearish dollar bias in 1H26 on Fed asymmetries, twin deficits and global recovery, but with weakness constrained by US resiliency. Risks of dollar strength if Fed hikes are in play or RoW growth momentum turns negative. EUR should be higher on growth / German fiscal (EUR/USD 4Q’25/ 1Q’26 1.16-1.18; 2Q 1.20) but gains are limited vs. 2025. GBP should gain (GBP/USD 2Q 1.41, 4Q 1.36), assuming a major disappointment from the UK budget is avoided. JPY should be lower (USD/JPY 2Q 158, 4Q 164) on end of easing cycles in RoW, fiscal expansion and room for short positioning to increase further. Global cyclical resilience should support EM carry from a starting point of no material positioning or valuation concerns (full note available to pro subs).

* * *

RATES: UST Yields be higher by end of 2026 (10Y UST at 4.35%) because there is too much Fed easing priced-in (full note available to pro subs).

* * *

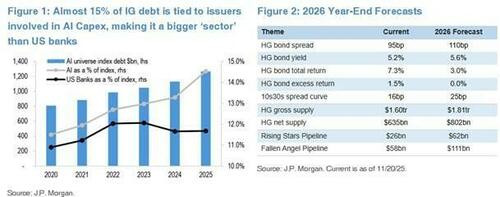

CREDIT: Demand, technical and the macro backdrop should support Credit spreads. We expect spreads modestly wider in the US (110bp for US High Grade, 375bp for US High Yield) and a touch tighter in EUROPE (90bp for HG and 300bp for HY). US HY bond and leveraged loan default activity in 2026 should resemble 2025. In EM, EMBIGD and CEMBI BD spreads should be little changed by end of 2026 but have potential to outperform other other credit markets in 1H26.

* * *

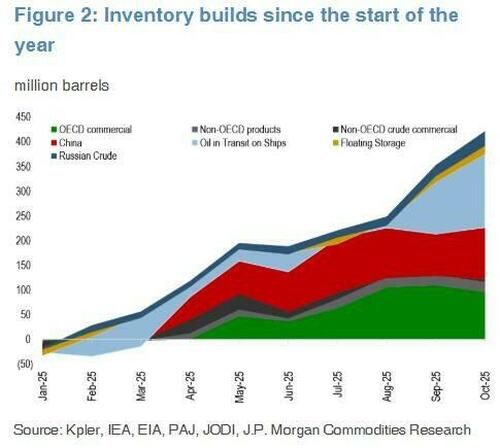

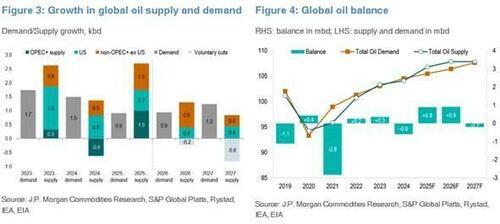

COMMODITIES: Oil should move lower (Brent at $56/bbl in Dec 2026) because supply is set to expand at 3x the rate of demand. Absent any intervention, the surplus is projected to climb to 2.8 mbd in 2026. Under these conditions, Brent prices are likely to slip below $60 in 2026, drop into the low $50s by the final quarter, and close the year with a $4 handle. We expect the market will find equilibrium through a combination of rising demand—driven by lower prices—and a mix of voluntary and involuntary production cuts. In line with this outlook, we maintain our price forecast of $58 for Brent ($54 for WTI) in 2026 (full note available here). We forecast continued robust demand from the un-exhausted, long-term trend of official reserve and investor diversification into Gold to push prices towards $5,000/oz by 4Q26. We remain bullish on Copper ($12,000/mt in 1H26) and aluminum on acute supply disruptions and dislocated global inventory (full note available here).

More in the full Market Intel note available to pro subs.