"Just When You Thought Markets Couldn't Get More Extreme..."

We’ve been discussing the “rotation” and “volatility under the hood” since the beginning of the year, but, as top Goldman Sachs trader Brian Garrett noted in his 'weekend prep' note to clients, "just when we thought it couldn’t get more extreme, a week like this happens.."

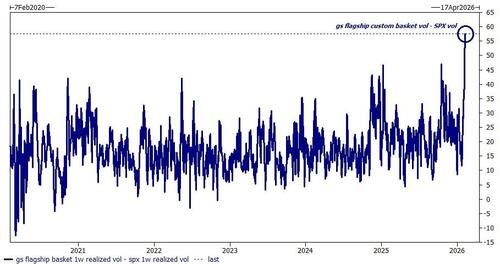

The 1 week realized volatility of Goldman's flagship equity baskets closed Friday at 80 (highest since liberation day).

These baskets are realizing 60 vol points more than the SPX itself (all time wides) every day this week felt like a battle, and yet to the avg 401k investor nothing happened

Extremes were everywhere...

Prime Book

Hedge fund community has net sold US stocks four straight weeks (fastest pace since liberation day).

Shorts are leading the way with this week bringing the largest $ shorting activity on record (not a typo)

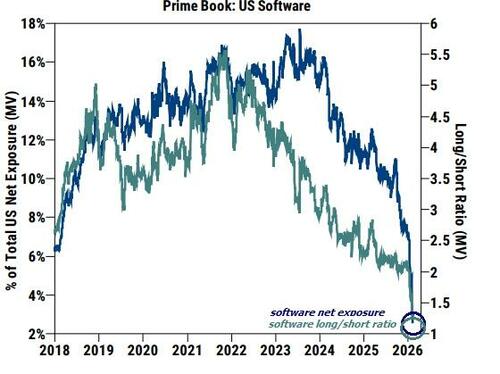

The chart of HF investment in software went from bad to worse, with both the long/short ratio and % MV allocation at all time lows.

Friday’s rally finally saw bottom fishing demand, but drop in the bucket overall context.

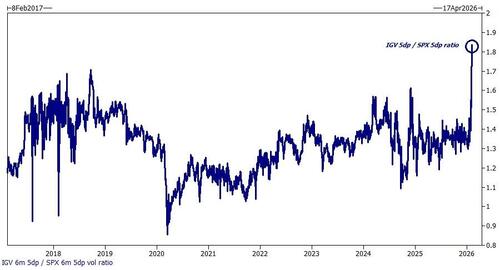

The market is charging a lot for IGV tail protection...

...one well timed Goldman research note compared potential “software disruption” of 2026 to “print newspaper disruption” of early 2000s

One Delta

Desk finished better sellers for both hedge funds and long onlys (~$4bn skew).

Continued rotation out of tech and into energy, materials, industrials, and staples.

Feels like we have been writing about this every week since November.

Reminder, if there is a true exodus from the technology sector is going to take a very long time.

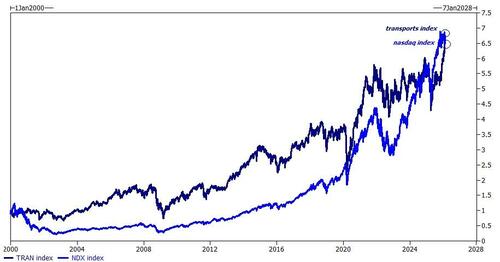

Hat tip to the transportation index, which overtook the NDX in % performance from Jan 2000 to present...

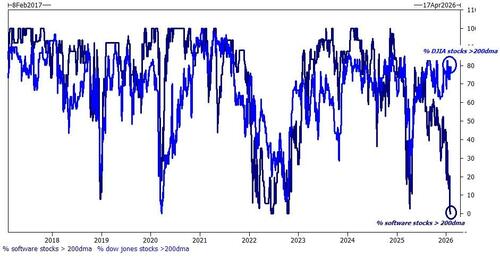

Not a single software name trading above its 200d moving avg … contrast that with the Dow Jones Industrial Average, which has ~80% of constituents above the 200d and just closed at an all-time high...

Derivs

Unlike prior bouts of volatility which have been viewed as headfakes, the desk had significant hedging this week.

Hedging has been more nuanced, with clients focused on NDX (QQQ) downside instead of blunt object SPX...

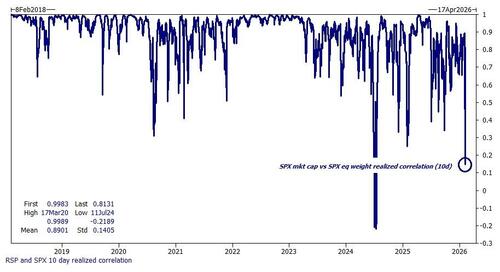

Reminder that the “market of stocks” and the “stock market” are two very different things … the correlation between SPX and RSP collapsed over the last two weeks, at the lows the two had almost 0.0 correlation with each other … recall, these indices have the exact same constituents...

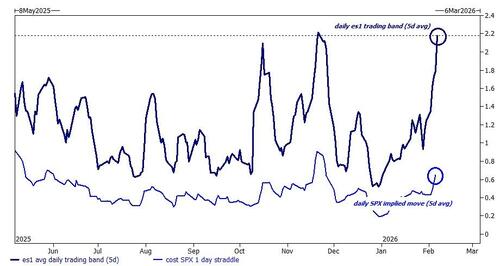

Gamma is still cheap, with the avg daily trading band for e-mini’s at 2.2% over the last week and yet the daily straddles are offered ~65bps...

ETFs

All about igv etf which as taken in $1.5bn in two days and became the macro investor weapon of choice for tactical exposure …

This was one of the first ETFs i’ve seen in a while “turn on” weekly expiry options in the middle of the trading week

Futures

Commodity focused this week:

1/ the CTA/momentum traders have repositioned from short to long in the oil complex (much like equity investors) and

2/ gold and silver length remains high, though the volatility in these assets is creating sell pressure from some legacy holders (risk parity / vol control)

However, with all that said, Garrett points out that if you take a very large step back and recognize that US fiscal policy is expansionary, government support for domestic investment is strong, gdp is set to grow by 250bps this year, and the average American is due to receive an extra $1,000 in tax refunds (+31% yoy) – this is a market in which one would want to remain invested.

That said, we’re in the early innings of a business model reckoning between those corporates insulated from AI obsolescence and those not.

Some have coined the market’s next era as “the revenge of the old economy."

I like to think of it as a classic “what would Warren Buffett buy” market (fantastic 1990s interview of the oracle – life / business / investing / etc)

There is opportunity in these markets, but for the first time in a long time it might not be in the “generals” (ie, megacaps).

Read Goldman's full Weekly Rundown here...

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal