"Largest Short Selling In History" Transforming Into Brutal Short Squeeze

Last week, when observing the bizarre relentless liquidations across asset classes, starting with the historic rout in software stocks, then moving to the biggest plunge in gold and silver in decades (and in the case of the latter, biggest ever) before settling on bitcoin which saw its largest daily smash since the Nov 2022 collapse of FTC, only to then slam semiconductor stocks before taking out such Mag 7 giants as GOOGL and AMZN, we said (half joking) that "Someone is just rotating from asset class to asset class and summarily blowing them all up with a barrage of price indiscriminate, bid-crushing market order liquidations."

Someone is just rotating from asset class to asset class and summarily blowing them all up with a barrage of price indiscriminate, bid-crushing market order liquidations

— zerohedge (@zerohedge) February 5, 2026

In retrospect, our tongue-in-cheek comments were rather spot on.

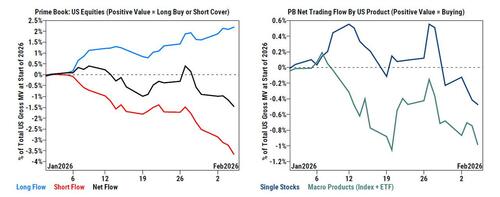

According to the latest Goldman Equities Weekly Rundown note (a weekly must read, available for pro subs here), while last week saw a lot of selling, it was only a fraction of the shorting that took place and according to Goldman Prime Brokerage calculations, hedge funds net sold US equities for a fourth straight week and at the fastest pace since Liberation Day, driven by short sales outpacing long buys (2.5 to 1).

The frenetic shorting was furious and relentless across all products, starting with Macro Products (Index and ETF combined) which were net sold for a second straight week (-0.7 SDs one-year) and made up 30% of the total net selling, driven entirely by short sales.

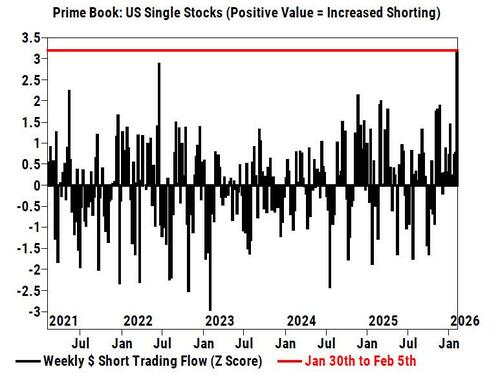

But it was single stocks where the activity was off the charts: according to Goldman, single stocks were heavily net sold (-2.0 SDs one-year) and made up 70% of the total net selling, driven by short sales outpacing long buys (2 to 1). In fact, Goldman's Prime Brokerage notes that "this week’s notional short selling in US Single Stocks was the largest on our record (since 2016, +3.2 -sigma score five-year)"...

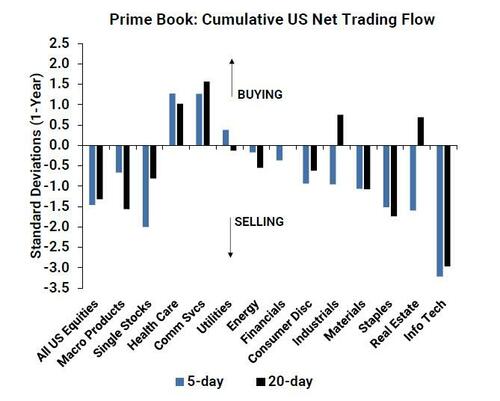

... as 8 of 11 sectors were net sold, led in $ terms by Info Tech, Consumer Disc, Staples, Industrials, and Real Estate, while Health Care, Comm Svcs, and Utilities were net bought.

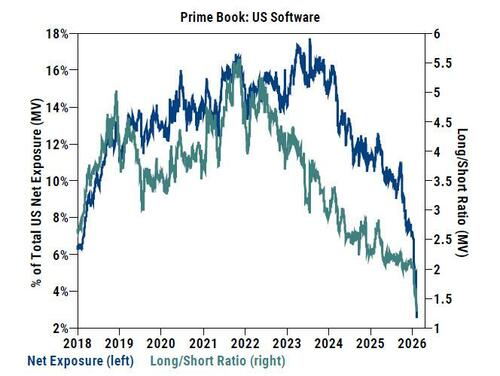

Info Tech was the worst performing sector and the most net sold (the second largest $ net selling in the past five years, -3.2 SDs one-year), driven by short sales far outpacing long buys (5.4 to 1). Software was by far the most net sold subsector and made up 75% of $ net selling in Info Tech, followed by Comms Equip and Tech Hardware, while Semis & Semi Equip and IT Services were the most net bought. Aggregate net exposure in Software (as % of total US Net MV) and long/short ratio now stand at 2.6% and 1.3, respectively, both of which are at new record lows.

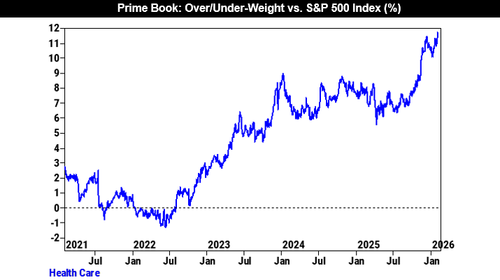

Not everything was sold: Health Care was among the best performing sectors and the most net bought driven by long buys outpacing short sales (3.4 to 1). Nearly all subsectors were net bought (sans HC Providers & Svcs), led by Pharmaceuticals, HC Equip & Supplies, and Life Sciences Tools & Svcs. Health Care is now the most $ net bought US sector YTD (surpassing Industrials) as hedge funds have net bought for 5 consecutive weeks – net exposure in Health Care (as % of total US net MV) now stands at 21.3%, near 5-year highs in the 99th percentile.

Still, the main feature of last week was the unprecedented pace and magnitude of hedge fund shorting of everything - not just of stocks, but also precious metals and crypto as well.

JPMorgan's Positioning Intel team, which last week warned precisely about the kind of violent degrossing observed this week, writes in its latest Weekly Wrap note (available to pro subs), that the decline in equities and factor swings weighed on HF returns as they’re down in line with equity markets MTD — i.e., -1.8% globally across All Strats with Eq L/S -2.0%, Multi-Strats around -2 to -2.5%, and Quants -1% on mkt neutral basis.

From a flows standpoint, like Goldman, JPMorgan saw net selling (-1.3z) globally by hedge funds with modest selling across all major regions. The bank's US Tactical Positioning Monitor saw a 1 wk decrease of -2-sigma while the 4wk dipped to -0.7-sigma on a spot basis. The level of positioning also dipped to +0.4-sigma or 69th %-tile since 2015 (vs. 80th %-tile a week ago). .

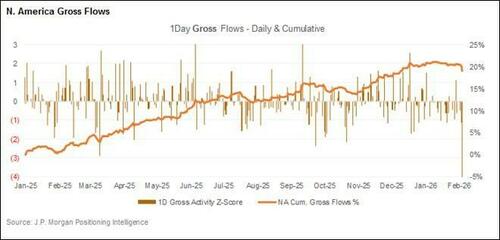

Mos timportant were JPM's observations on recent de-grossing, which the bank believes has the potential to continue. Indeed, as JPM writes, "after the 4-sigma de-grossing on Wed in N. Am., we saw another 1.8 sigma de-grossing on Thurs (led by Multi-Strats), which brought the 1wk de-grossing to about -3 sigma, in line with some of the most extreme we’ve seen." And while JPM saw momentum and crowding perform better on Thurs, this was all due to the short side and the HF impacts were more mixed.

Understandably, the JPM Positioning Intel did not want to get run over by the market tide, and ended its note with a wishy-washy cautious conclusion, saying risk may rise... or fall - to wit:

Ultimately, we remain a bit wary of sounding the all clear just yet for a few reasons:

1. HF leverage was high coming into this unwind (and remains high)

2. The magnitude of de-grossing on a 4wk basis in N. America is only -1.1z and we haven’t yet seen this go global

3. There are macro events (e.g., NFP, CPI) that could drive further rotations

4. Momentum exposure among HFs remains elevated (still 95th %-tile)

5. Momentum’s drawdown looks very small compared to Analyst Sentiment (the two often see correlated drawdowns though Analyst Sentiment sometimes precedes the Momentum drawdown)

Others, like Goldman's trading desk in this case, had far more conviction in a reversal, and as we first reported late on Thursday, Goldman's veteran ETF traders timestamped their contrarian view and - daring to go against the grain of massive bearish market flow into Friday morning - said the bottom was in for Software. They were right, and here's why:

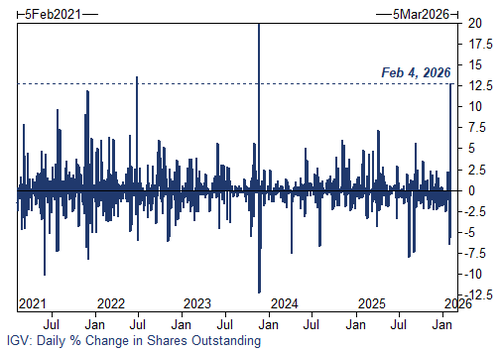

Goldman correctly observed on Thursday that the bank had "finally seen buyers of IGV across the institutional community yesterday and today." The fund also registered a 12% increase in shares outstanding on Wednesday (its largest 1-day change since 2023) which felt "like a culmination of outright purchasers trying to find a bottom and potentially participants covering shorts."

This was precisely what happened and Friday saw not only the bottom in Software which exploded higher along with momentum, bitcoin, silver, and countless other high beta/momentum/retail favorite assets, but we also saw the start of what Goldman warns could be a brutal short squeeze, with the Goldman most shorted basket already surging on Friday...

... up a whopping 8.8% for its second best daily return since 2022!

The bad news for the bear is that Friday's short covering at best unwound ~20% of the recent short overhang, which means that unless the sellers/shorts triple down on their bearish crusade, Monday could see a monster rally not just across the most beaten up parts of the market, but everywhere else too.

More in the full Goldman Weekly Rundiwn and JPM Positioning Intel notes available to pro subs.