Last Full Trading Week Of The Year Ends With Record OpEx, Record Volume, & Record Precious Metals Prices

This week's economic data had the flavor of benign inflation set against some strains in the economy that suggest the Fed may find the room and a reason to cut rates further in 2026. Indeed, Goldman's Jan Hatzius and team continue to expect that the Fed will cut rates again at its March and June meetings next year...

Source: Bloomberg

Here's what we learned this week:

-

Inflation is benign. The November CPI report indicated that core CPI fell to 2.63% from 3.02% in September. For 2026, our economists are looking for Core CPI to fall further as the impact from tariffs fades and home price and wage inflation recedes.

-

Business sentiment is challenged. The Philly Fed Index dropped to -10.2 from -1.7 this week and the Empire Index declined even more, to -3.9 from +18.7 a month ago.

-

Consumer sentiment slips. The University of Michigan Consumer Sentiment Index fell to 52.9 from 53.3 a month ago with signs of affordability concerns, as 1-year inflation expectations ticked up by a tenth to 4.2%.

On net, decelerating inflation coupled with falling business and consumer sentiment may suggest that a little stimulus in the economy may be needed.

Stock markets seemed to think so this week with the S&P 500 rebounding off of lows earlier in the week.

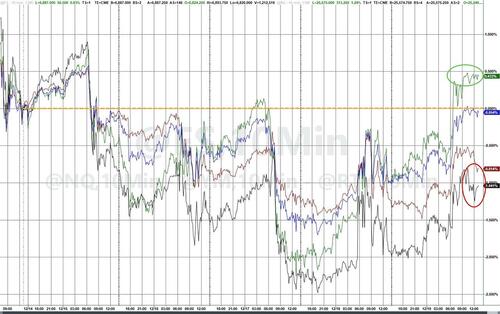

...and that wraps the last full trading week of the year with the Nasdaq managing to scramble into the green (and S&P hovering around unch) while Small Caps lagged...

Nasdaq's outperformance was mainly thanks to AI's resurgence (thanks to MU earnings and Abu Dhabi saving OpenAI and the entire AI ecosystem from certain debt-fueled doom)...

Source: Bloomberg

With both the TPU and GPU AI ecosystems rebounding strongly...

Source: Bloomberg

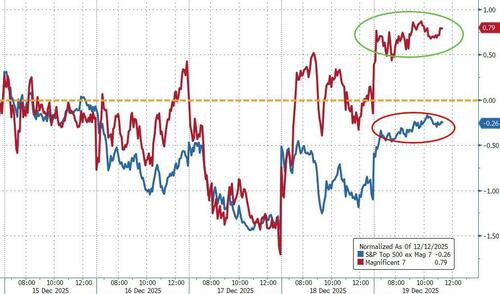

Notably, the S&P 493 was down on the week...

Source: Bloomberg

There are a number of superlatives this week as top Goldman Sachs trader, John Flood, points out:

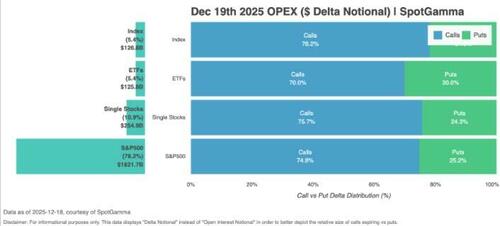

Today has an outside shot at winning the crown as highest trading volume session in history of the US stock market on the heels of OPEX and index rebals.

Current record is 30.4b shares that traded across all US equity exchanges on 4/9 of this year (reminder this was the sharpest point reversal in history of stock market after Trump announced 90day tariff pause).

Today’s options expiry will be the largest EVER with over $7.1 trillion of notional.

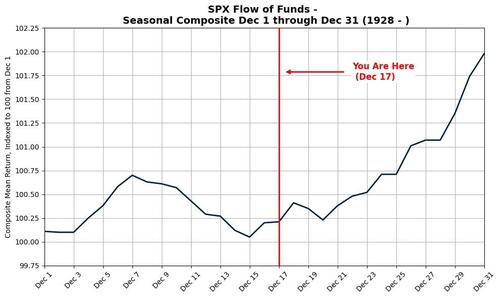

There are still plenty of believers in the Santa Rally...

Source: Goldman Sachs

However, it is worth noting today is final day of corporate-buyback OPEN window...blackout starts on Monday and Goldman's trading desk's executions typically decline by ~30%.

Today they are seeing asset managers and SWFs use today’s liquidity as one of their final opportunities to move significant size around (dramatically so on the close).

Thematically we are seeing supply in consumer and fins and demand in HC and tech.

CTA’s have $7b of US stocks for sale over the next week.

FWIW YR End pension Rebal looking like a non-event with $1b of US equities to buy.

Reverting back to the record options expiration today, Bloomberg macro strategist Michael Ball notes that it removes negative gamma in the 6,700 to 6,800 zone, which should curb any potential for selloffs to accelerate.

As a result, new 0DTE positioning may have an outsized impact.

Calls outweigh puts, but there is no major imbalance that should add to volatility, which would pin the SPX around current levels rather than squeezing it in one direction.

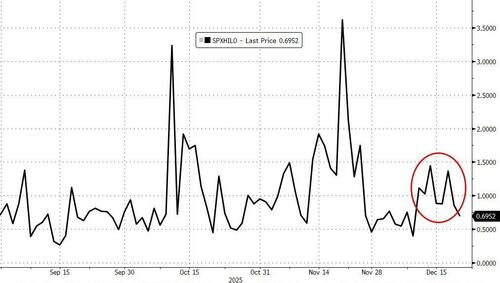

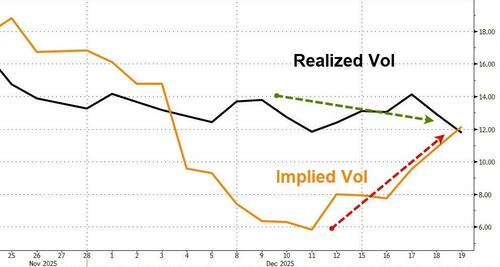

Daily realized vol has been outpacing implied this week as vol has been better supplied.

Source: Bloomberg

This is due to a lack of fear premium in the market, amid a shortened holiday schedule with few risk events and increasing time decay.

Source: Bloomberg

The VVIX, or “vol of vol” measure, shows no uptick in VIX call buying following Wednesday’s oOpEx, crashing to its lowest since before Liberation Day...

Source: Bloomberg

This implied that traders are not paying up for downside protection via SPX puts or VIX calls, even as the tape has looked heavy and traded sideways this week.

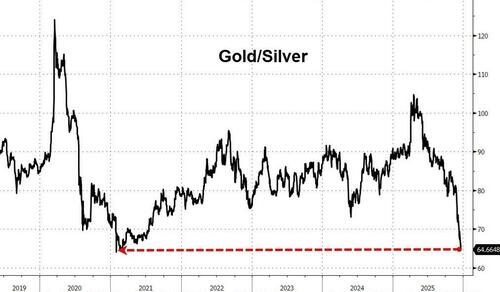

Gold and Silver surged to new record closing highs this week...

...with Gold topping $4350...

Source: Bloomberg

...and silver topping $67...

Source: Bloomberg

Which has dragged the Gold/Silver ratio to 64x - its lowest since Feb 2021...

Source: Bloomberg

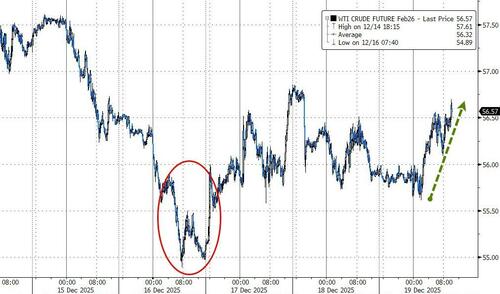

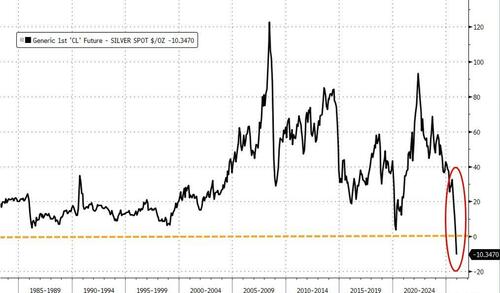

Crude oil prices plummeted to their lowest since Feb 2021 also this week before bouncing back a little. WTI tested down to $55 before bouncing...

Source: Bloomberg

But, as the chart shows below, outside of the chaotic negative pricing of April 2020 (COVID over-supply), it is now cheaper to buy a barrel of oil than an ounce of silver...

Source: Bloomberg

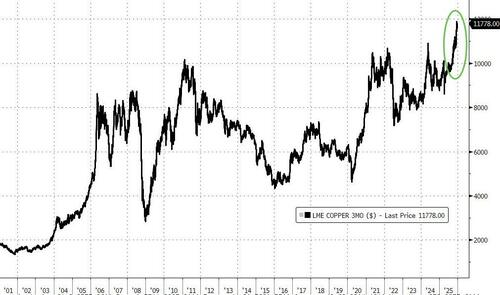

Copper is trading like the core macro commodity of the AI and electrification era, and policy is now as important as supply and demand fundamentals. Prices are back just below record highs, but production resumption and tariff uncertainty mean things could change quickly in 2026...

Source: Bloomberg

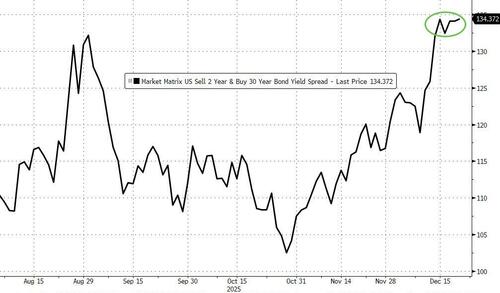

Treasury yields tracked broadly lower on the week (alongside crude) with the belly of the curve outperforming and the long-end lagging...

Source: Bloomberg

The yield curve didn't really move too much this week with 2s30s chopping along at its steepest since Nov 2021...

Source: Bloomberg

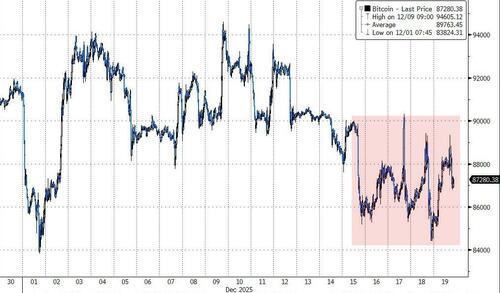

Bitcoin had another wildly volatile week to end just marginally lower for the third week in a row (7th of last 8 weeks down)...

Source: Bloomberg

Finally, despite this morning's risible collapse in UMich Current Conditions sentiment to a record (47 year) low, higher frequency (and perhaps less biased) sentiment data suggests the alligator's mouth of doom is closing...

Source: Bloomberg

...as sentiment picks up with stocks stable near record highs.

And talking of near record highs, this chart blew our minds as we hadn't checked it for a few months after the chaos in Q2. While the second Trump Tariff term has been more volatile, the car ended in the same place(ish)...

Source: Bloomberg

In Trump, we trust?

As Goldman's Mark Wilson concludes, when you check across the mega macro inputs that feed into your markets outlook...

1/ global GDP 2.8% (30bps > consensus),

2/ US GDP 2.6% (60bps > consensus),

3/ China GDP 4.8% (30bps > consensus),

4/ Euro area GDP 1.3% (20bps > consensus),

5/ an ongoing acceleration in productivity growth (great for earnings, more questionable for the labour market),

6/ inflation near target in most major economies (in fact, labour market & rent growth inflation in the US is already below pre-pandemic levels ...), and

7/ 50bps more of non-recessionary Fed cuts.

...that's not a bad set-up

As Citadel's Scott Rubner confirms, markets enter 2026 with a solid macroeconomic foundation. Retail participation is structurally higher, supported by record household wealth, broadening equity ownership, and substantial cash balances. Rotation across indices, sectors, and commodities signals healthier market breadth, while earnings momentum continues to diffuse beyond a narrow leadership cohort.

Policy dynamics reinforce this constructive outlook. Fiscal impulse is turning positive, monetary conditions are easing, and political uncertainty is diminishing. Positioning remains far from crowded, with persistent retail demand, rebuilding institutional exposure, and favorable seasonal dynamics in January.

The path forward may not be linear, but the ingredients for continued upside are in place. With participation broadening, profits expanding, and policy becoming more accommodative, we remain constructive on the macro and market structure outlook for Q1 2026 and beyond.