"Lazy Longs" Forced Through "Skinny Exits" But Nomura Offers Some 'Good News' (For Now)

Nomura cross-asset strategist, Charlie McElligott has some good news, and some bad news for traders wending their way through today's quagmire in the markets - the bad news is 'everything is crowded' and fragile; the good news is triggers for systematic flows are a good distance away... but (he warns), given the crowds, things could change fast.

Tl;dr:

Crowded Stuff that EVERYBODY is into (CTA Trend to Macro Tourists / Retail Long Gold, Silver, Equities, EM and Short USD) has continued to “load” with more positioning / exposure because it’s the only thing that keeps working (versus Rates and Vol being DEAD, feeding-back into further “low conviction”)…

Hence, the risk is a day like today, where a lot of “Lazy Longs” in Equities and Metals have enjoyed extremely high Sharpe “smooth glide,” which then risks a “Profit-Take” spilling-over into a larger “Risk Management Exercise” of forced selling into “Skinny Exits."

But the “Good News” is that most of these trends remain “Deep In The Money” vs risk-management triggers.

So here's the meat:

As we detailed earlier from Morgan Stanley's QDS team, there is extreme positioning in CTAs: Crowded into "Long Stocks, Long Metals, Short USD"...

-

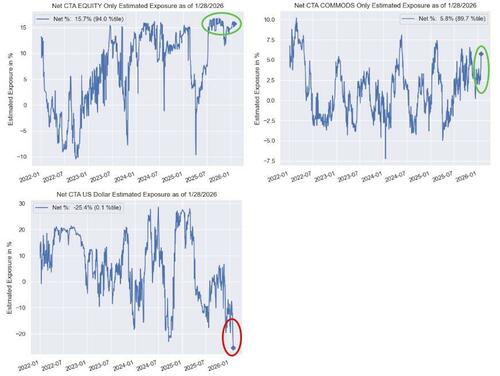

-CTA TREND "NET LONG" AGGREGATE ACROSS EQUITIES AT 94%ILE

-

-CTA TREND "NET LONG" AGGREGATE ACROSS COMMODITIES (MAJORITY "METALS LONGS") AT 90%ILE

-

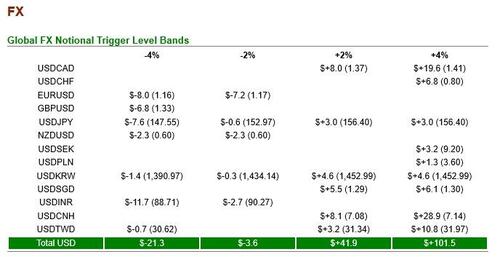

-CTA TREND "NET SHORT USD" AGGREGATE ACROSS FX AT 0.1%ILE

The year-to-date themes in US equities have been all about 'animal spirits' re-risking built around Trump administration's fiscal expansion to fund the economic nationalism where 'power = commodities security'.

Performance-chasing into high-beta, re-gearing into better growth outlook (small caps, cyclicals, crude- and economically-sensitive stocks), yet still respecting the ongoing 'gift' that is the AI boom and capex revolution, all as a function of U.S. shift into 'just-in-case' nationalism funded via fiscal spending surge (with Trump administration focus seeing second-order +++ impact on AI / chips / compute to defense to energy infra to rare-earths / miners)

But today saw pain across that crowded trade:

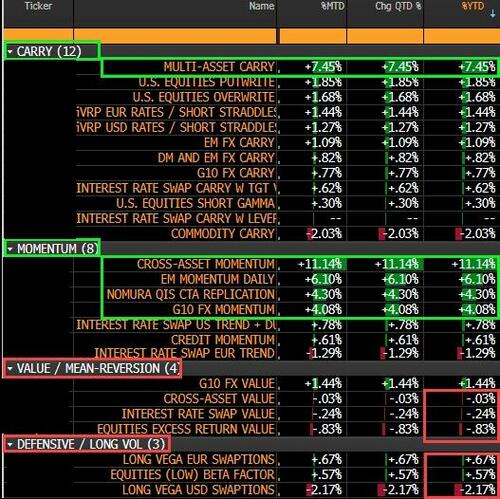

Before today's tumble, this “High Sharpe” backdrop of Asset rally but against “Low Vol” is allowing for the the “High Speculative / Max Degen” -stuff in US Equities to rage again too Jan / YTD (last year’s High-Beta / Retail themes reawakening: Rare Earths, Batteries, Semis, Space, Defense, Nuclear, Miners, Quantum, Autonomous), which is similarly being seen in Cross-Asset Risk-Premia...

...as “It’s a Carry & Trend / Momentum” world…as “Defensives / Long Vol & Value / Mean-Reversion” does nothing...

In-turn, McElligott notes that we’ve seen these tangible “rebalancing rotations” OUT of “The Stuff That Got You Paid” previous leadership over the past few years (O/W US Assets in general, O/W Quality / Profitability / MegaCap Tech / AI / Secular Growth -themes, against ho-hum Global Growth prospects and thus, previously little interest in Commodities to Cyclical Value / Small Caps with Economic Sensitivity) now instead acting as a partial “Source of Funds” into a meaningful slug of reversal within these multi-year themes, with many Discretionary / Generalist investors now pouring into stuff they don’t know well, getting “Uncomfortably Long-er” things that just keeps going higher (trades like Long Gold / Silver / Copper, Equities / EM).

But...here's the risk:

CTA's Macro Tourists and Retail are collectively crowding into the 'trend trades'.

But it’s the Systematic Managed Futures / CTA Trend -strats which are keeping many “IN” these various “Bubble Longs” in “Run It Hot” Equities and “Alt Reserve Currency” Precious Metals / “Short USD” -proxy trades during this unrelenting rally, allowing investors to remove themselves from the scar-tissue and psychological warfare of Discretionary traders trying to “guess” at picking tops when risk-managing these winning positions and how / what / when of monetizing +PNL…

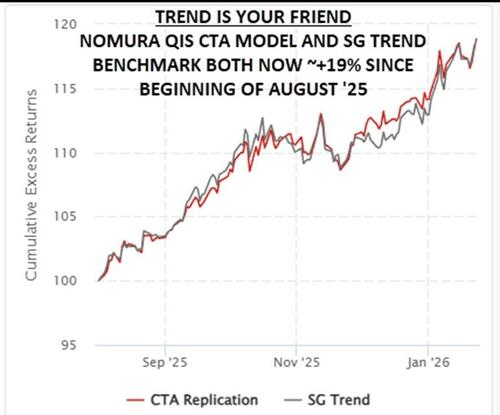

And being richly rewarded for sticking with these runners, both the Nomura QIS CTA model and the SG Trend benchmark are each ~+19% since start of August ‘25

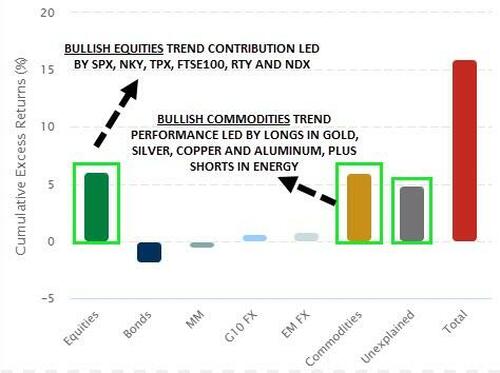

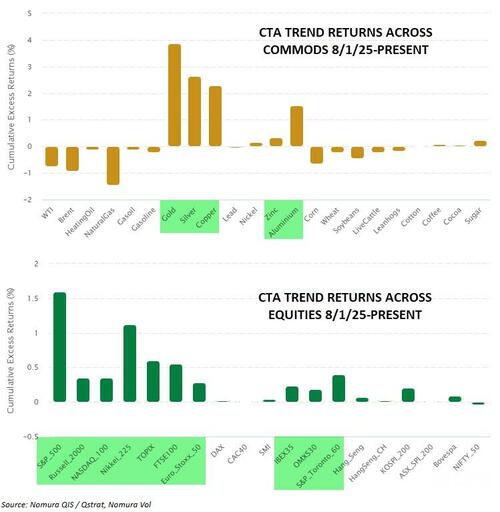

CTA trend “riding the bubble” - winners and staying engaged in big longs across equities & metals, with “short USD” positioned to lesser extent (while bonds and STIRs remain completely dead in water, contributing nothing):

CTA performance drivers beyond asset-class returns:

-

Convexity: trend profits grow in non-linear fashion from reflexive / self-reinforcing "bubble-like" euphoria in a few key positions (metals especially, along with equities to lesser extent), creating a "buyers are higher" convexity of returns

-

Vol-scaling / vol-alpha: high vol trend breakout in precious metals with "spot up, vol up" in early fall ‘25...although since 4025, trailing rvols specifically in positions like gold have re-compressed and allowed for the exposure to actually grow larger again, into new spot highs

-

Positive roll-yield / carry: from backwardation in precious metals curves

CTA trends across equities and commodities:

All of which sounds ominous (and fits with the warning from Morgan Stanley's QDS team earlier).

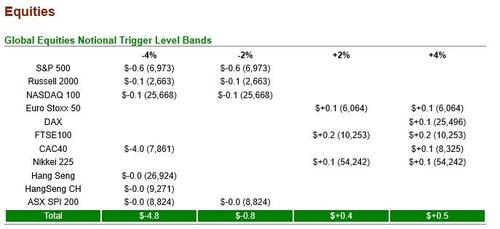

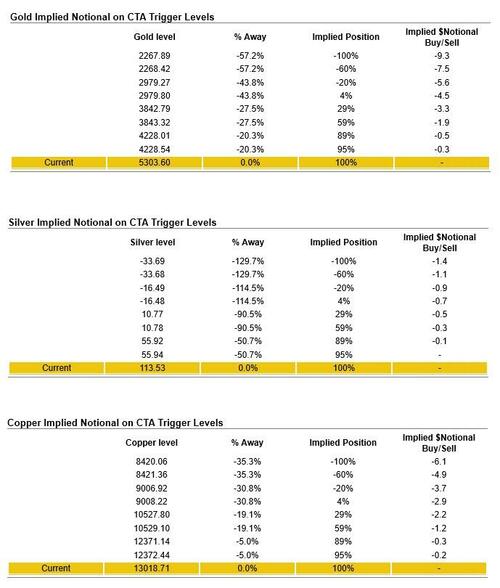

However, as the Nomura MD notes, the good news here is that from a CTA perspective, all of these large position signals remain DEEPLY “In The Money” hence far from deleveraging risk-management triggers, where even if triggering in say “Equities,” the $notionals are relatively “meh” as the most “loaded / weighted” signals are far away from Spot.

CTA Trigger Levels

CTA trigger levels on at least initial time series signal flip levels across key “trend” positions in equities, metals and USD:

Equities:

Metals:

FX:

But, McElligott warns that, although with how crowded these trades have become with Macro Tourists and Retail….it could get weird even without huge PRICE movement, especially if the VOL still shocks on risk-management unwind.

Professional subscribers can read the full Nomura note here at our new Marketdesk.ai portal