Let's Get Physical! Goldman Sees Rotation From 'Financial Assets' To 'Real' Economy

Amid the chaos of the last couple of weeks, it has been all too easy to lose a big picture focus as sector-by-sector, factor-by-factor, name-by-name, your portfolio is clubbed like a baby seal. Tactically managing risk (or surviving) has dominated strategic positioning as 'crowded' consensus trades have been sequentially sacrificed at the altar of 'AI disruption'.

With an eye to bringing the focus back to a more strategic one, Goldman Sachs Global Strategy team have laid out a dozen or posts top describe what they see as "The Return Of Physical Assets".

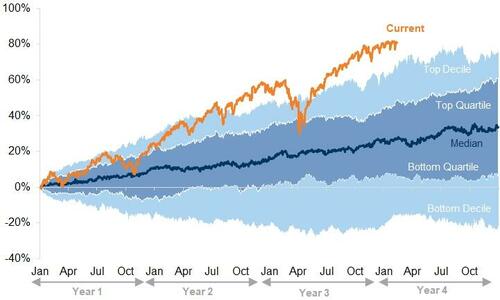

1. The global economic environment, fueled by robust growth (especially in the US), policy support, lower US interest rates, and a weakening dollar, continues to bolster equity markets. The post-pandemic bull market has been exceptionally strong, recovering from a bear market trough, and we appear to be in a late-cycle "optimism" phase where fundamental growth, combined with rising valuations, will drive equity returns higher (Exhibit 1).

Exhibit 1: Returns in equity markets have been unusually strong over the past years

Distribution of returns of S&P 500 since 1928

Source: Bloomberg, Datastream, Goldman Sachs Global Investment Research

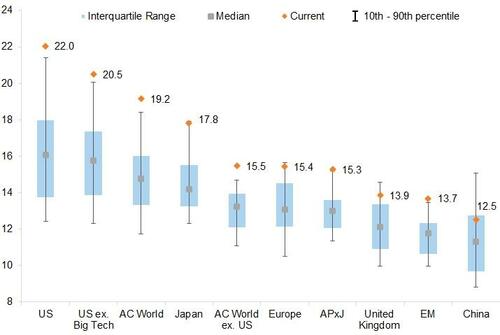

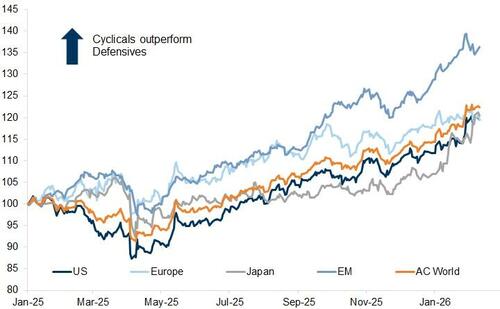

2. Although the bull market persists, 2025 marked a pivotal shift in equity markets. It was a strong year for investors overall, but the sources of returns broadened. For years post-Financial Crisis, US equities and technology stocks consistently outperformed. Zero interest rates, high tech returns, and low capital returns in the "old economy" meant Growth stocks dominated the markets and Value stocks lagged in particular. However, in 2025, the US, despite strong performance, underperformed other major markets in both local and dollar terms (Exhibit 2).

Exhibit 2: The US has underperformed other major markets

Price performance, in USD; indexed to January 1st, 2025

Source: Datastream, STOXX, Goldman Sachs Global Investment Research

Alongside this, Emerging Markets, historically an underperforming asset class, have seen a significant re-rating against Developed Markets (Exhibit 3) boosted by an improved mix of both macro and micro drivers, a trend we anticipate will continue. In addition, relative valuation of EM continues to look very attractive.

Exhibit 3: EM is regaining momentum after years of underperformance

EM vs. DM relative price performance; indexed to 100 on January 1st, 2025

Source: Datastream, Goldman Sachs Global Investment Research

At the same time, technology remained strong, but many "old economy" sectors performed equally well. Value stocks began to stage a recovery, particularly outside the US, highlighting the renewed benefits of diversification across geography, sector, and factor, a trend that has continued into the current year.

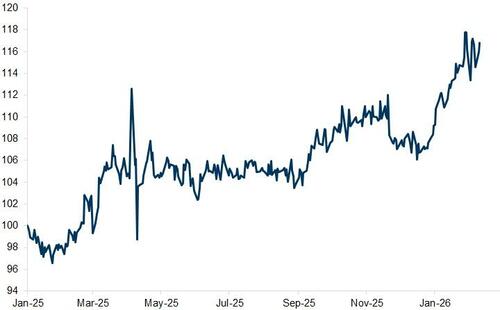

3. This broadening of geographic returns has led to rising equity valuations globally, with much of last year's non-US returns driven by multiple expansion. Consequently, while the US equity market remains historically expensive (due to record earnings and Return on Equity), all major equity markets are now trading at valuations well above their long-term averages (Exhibit 4).

Exhibit 4: Equity valuations across regions are now at historical highs

12m fwd P/E multiple. MSCI Regions, STOXX 600 for Europe and S&P 500 for US. Data for the last 20 years

Source: FactSet, Goldman Sachs Global Investment Research

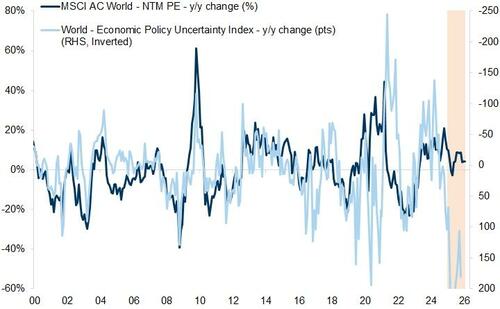

For many investors, this equity resilience seems to contradict the significant geopolitical events and upheavals of recent years. Despite a surge in policy uncertainty, equities have largely shrugged off these concerns (Exhibit 5).

Exhibit 5: The rise in policy uncertainty has been shrugged off by markets

MSCI AC World 12m fwd PE and world economic policy uncertainty index, GDP weighted (RHS, Inverted)

Source: Datastream, Goldman Sachs Global Investment Research

4. This "complacency" can be attributed to two main factors:

First, geopolitical surprises have not yet dramatically impacted macro conditions; in fact, global economic confidence has strengthened, evidenced by Cyclicals outperforming Defensives (Exhibit 6).

Exhibit 6: Cyclicals outperform Defensives as growth hopes rise

MSCI Indices relative price return (USD); indexed to January 1st, 2025

Source: Datastream, Worldscope, Goldman Sachs Global Investment Research

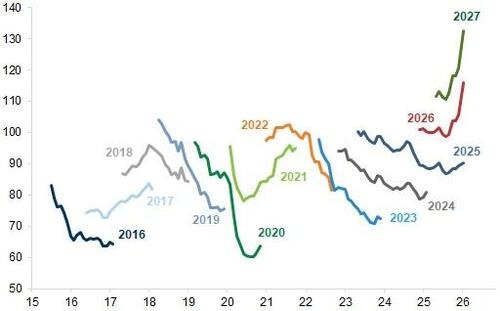

Second, underlying profit growth remains robust. US earnings growth has been strong again this season, with a +12% increase (5 pp above consensus expectations), marking the fifth consecutive quarter of double-digit growth. Unlike previous periods dominated by large tech, current numbers are broadly based, with the median S&P company growing 9% year-over-year and 59% beating estimates. Consensus estimates for 2026 full-year forecasts are also unusually being raised in the first quarter (Exhibit 7).

Exhibit 7: Consensus estimates for 2026 full-year forecasts are unusually being raised in Q1...

Consensus estimates in USD for S&P 500

Source: FactSet, Datastream, STOXX, Goldman Sachs Global Investment Research

This trend is even stronger in Emerging Markets with MSCI EM being sharply revised higher since the start of the year (Exhibit 8).

Exhibit 8: ... and this trend is even stronger in Emerging Markets

Consensus estimates in USD for MSCI EM

Source: FactSet, Datastream, STOXX, Goldman Sachs Global Investment Research

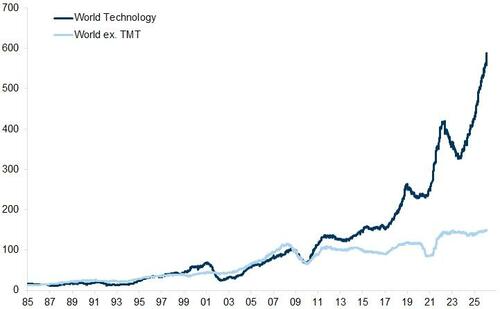

5. However, the strong returns at the index level, and the wider geographical participation, conceal significant rotations unfolding within equity markets. The most dramatic shifts reflect investors' evolving assessment of AI's potential winners and losers. For most of the post-Financial Crisis era, technology outperformed due to profits and returns on investment significantly outpacing other sectors (Exhibit 9), largely explaining the S&P's persistent outperformance.

Exhibit 9: Tech earnings have outstripped those of the global market

12m trailing EPS (USD). Indexed to 100 on Jan-2009

Source: Datastream, Worldscope, Goldman Sachs Global Investment Research

The scaling effects of technology led to greater sector concentration, with a few companies dominating their markets, exemplified by the "Magnificent 7" narrative. Confidence was further boosted post-ChatGPT's release, as these companies possessed the profitability, balance sheet strength, and cash flows to dominate in this new area of growth.

6. As we have seen in past technology revolutions, rapid innovation attracts significant capital and the initial excitement which drives up the price and valuation of anything deemed to be associated with the innovation is ultimately undermined as a combination of new competition and lower returns either (or both) deflates valuations and increases the spread between relative winners and losers. Consensus estimates for 2026 AI hyperscaler capex have increased to $659 billion, reflecting 60% growth vs. 2025, up from $539 billion at the start of earnings season. We expect further upward revisions to capex estimates but believe the growth rate of hyperscaler capex will likely decelerate this year. More recently, the surge in AI capex by the hyperscalers has prompted investors to question their ability to collectively generate adequate returns on investment, prompting the pace of performance to slow, and the dispersion of returns within the technology sector to widen. For instance, "Magnificent 7" returns jumped 75% in 2023 (the year immediately after ChatGPT was launched), moderated to around 50% in 2024, and was less than 25% in 2025.

Simultaneously, the spread of returns within the group increased as investors reassessed which companies are best positioned to capture future returns. In 2025, Google generated roughly 66% returns, accounting for 15% of the S&P total, while Microsoft, Meta, and Tesla saw low double-digit returns, and Apple and Amazon were in single digits (underperforming the market). Stock correlations among hyperscalers have sharply fallen (Exhibit 10).

Exhibit 10: The large AI hyperscalers have become less correlated to each other

3-month realised average pairwise correlation of large public AI hyperscalers (AMZN, GOOGL, META, MSFT, ORCL) stock returns

Source: FactSet, Goldman Sachs Global Investment Research

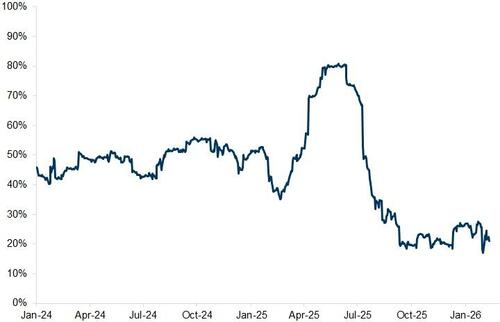

7. Historically, new technologies have also disrupted existing technology companies, even ones that have been dominant in previous innovation cycles. This fear has been reflected in the concern generated by announcements of new agent platforms, such as Anthropic's Claude Cowork and OpenAI's Frontier, regarding disruption to other technology business models, particularly in software. Coming into this year, consensus estimates projected two-year forward Software revenue growth at 15%, more than double the 6% modeled for the median S&P 500 stock and the highest expected growth in at least 20 years. Last week's 15% drop in the US software sector (nearly 30% from September highs) reflects a downgrading of investor expectations for record-high profit margins and growth estimates (Exhibit 11).

Exhibit 11: Software valuation de-rating implies a sharp decline in growth expectations

Software = iShares Expanded Tech-Software Sector ETF (IGV) of North American equities

Source: FactSet, Goldman Sachs Global Investment Research

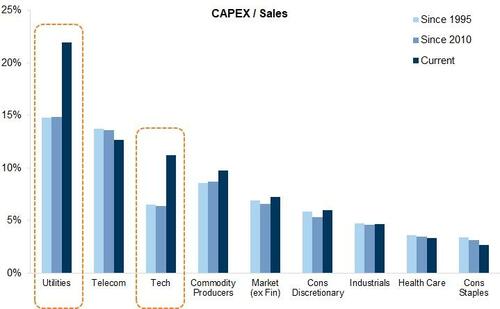

8. While emerging AI innovations are increasing the dispersion of returns within technology, they are also reconnecting the virtual and physical worlds. For the first time since the internet's commercialization a quarter-century ago, future technology growth prospects are increasingly dependent on physical assets like data centers and energy supplies. As hyperscaler capex has surged, it has spilled over into higher capex in other industries (Exhibit 12), such as Utilities, which are building the foundational infrastructure upon which the dominant tech giants' future growth depends.

Exhibit 12: Rising hyperscaler capex is spilling into increased spending in adjacent sectors

CAPEX-to-Sales ratio of Developed Markets

Source: Datastream, Goldman Sachs Global Investment Research

Many "old economy" industries dominated by low-multiple "Value" stocks, have been starved of capex since the Financial Crisis (Exhibit 13) due to overcapacity and historically low returns. Investment in AI infrastructure coupled with the renewed boost in defense spending are re-igniting returns on investment in many of the physical assets that had long lagged behind, just as investors fear the slowing of returns from record high levels in the technology space.

Exhibit 13: Markets outside Tech have been starved of capex since the Financial Crisis

CAPEX-to-Sales ratio of Developed Markets

Source: Datastream, Goldman Sachs Global Investment Research

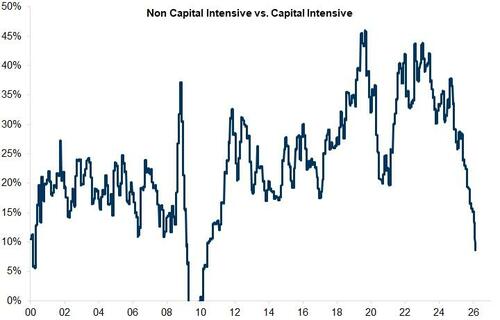

The shift in prospective relative returns has resulted in a de-rating of capital-light versus capital-heavy businesses (Exhibit 14).

Exhibit 14: De-rating of capital-light versus capital-heavy businesses globally

12m fwd PE

Capital Intensive: Electricity, Industrial Materials, Automobiles and Parts, Gas, Water and Multi-utilities, Industrial Metals and Mining, Telecommunications Service Providers, Alternative Energy, Leisure Goods, Industrial Transportation, General Industrials, Construction and Materials, Oil, Gas and Coal.

Non Capital Intensive: Technology Hardware and Equipment, Medical Equipment and Services, Pharmaceuticals and Biotechnology, Household Goods and Home Construction, Food, Beverages and Tobacco, Retailers, Software and Computer Services, Personal Goods, Consumer Services, Drug and Grocery Stores.

Source: Datastream, Goldman Sachs Global Investment Research

9. This re-evaluation of prospective growth rates in some technology areas, persistent inflation and higher real rates, has re-awakened investors to opportunities in Value parts of the market that have long been neglected as ‘value traps’ (Exhibit 15). Some are successfully transitioning into "value creators" by generating higher cash flows and returning more capital to shareholders through dividends and buybacks.

Exhibit 15: Growth vs. Value

12m fwd P/E Premium (or Discount)

Source: FactSet, Goldman Sachs Global Investment Research

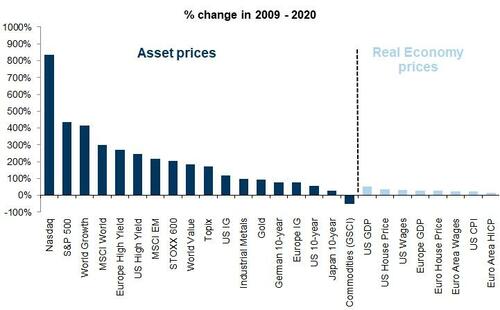

10. The post-Financial Crisis era through the end of the pandemic was dominated by exceptional technology growth coupled with a shift towards zero interest rates, driving a record gap between the returns of financial assets and physical assets. Abundant liquidity and historically low capital costs meant that the longest-duration investments—the Nasdaq, S&P 500, and technology stocks—performed best, while gold, commodities, and ‘old economy’ value underperformed (Exhibit 16). Low inflation meant nominal GDP, wages, and returns on physical assets were very poor.

Exhibit 16: Wide dispersion between the returns of financial assets and physical assets post GFC

Total return performance in local currency - where applicable

Source: Datastream, Haver Analytics, FRED, Goldman Sachs Global Investment Research

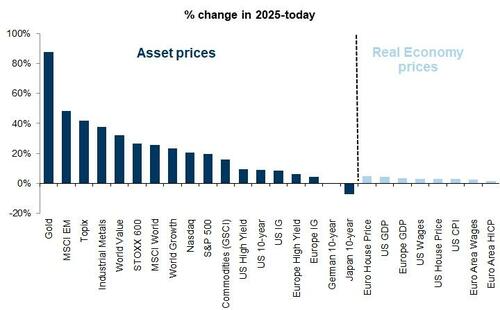

The pattern since early 2025 has been markedly different: Gold, Emerging Markets, Topix, industrial metals and Value have performed best (Exhibit 17).

Exhibit 17: Gold, Emerging Markets, Topix, and Value have performed best since 2025

Total return performance in local currency - where applicable

Source: Datastream, Haver Analytics, FRED, Goldman Sachs Global Investment Research

Bond markets, particularly in Japan and Germany, where rising fiscal spending and nominal GDP are at the poorer end of financial returns.

Equities are likely to remain the best-performing asset class, in our view, but the drivers and return opportunities are fundamentally broadening.

While aggregate index returns are likely to slow, we believe there are greater opportunities to diversify generating better prospects for risk-adjusted returns and alpha generation.

Professional subscribers can read the full note "Getting Real – The Return of Physical Assets " here at our new Marketdesk.ai portal