Macro Vs Markets: Goldman On What This Tension Tells Us Today

The tension between the economy and markets performance has emerged as a dominant theme over the past few weeks, as investors navigate increasing volatility in some pockets of US equities (Software and Private Credit come to mind) and pretty good macro data.

Markets are treating the Supreme Court’s striking down of President Trump’s IEEPA tariffs as a reset rather than a repeal, adding to a increasingly uncertain macro backdrop.

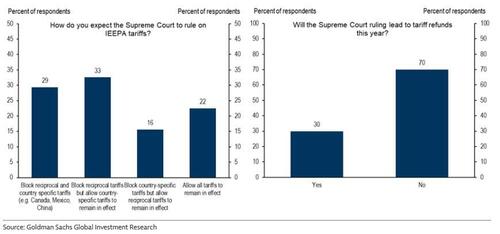

Equities bounced on the prospect of tariff relief, but, as Bloomberg's Michael Ball notes, it’s unclear how much benefit they’ll actually get, since the incremental tariff rate will only fall marginally - especially after Trump said he would institute a global 10% rate (now 15%) - and refunds are still uncertain.

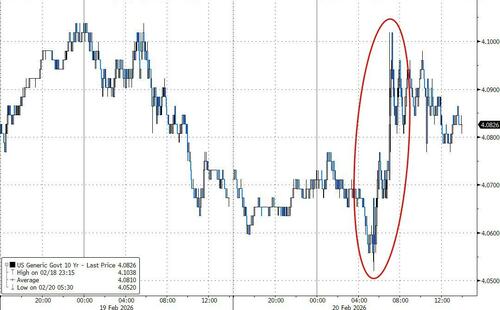

Treasuries cheapened, albeit only slightly, as the high court ruling makes deficit projections harder to model.

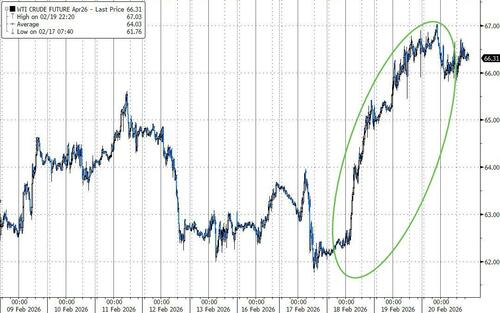

Meanwhile, the risk of a possible limited US strike in Iran overhung the market Friday.

It’s the kind of catalyst that flips the market quickly - risk-off, higher energy inflation, and a better bid for the US dollar if crude spikes.

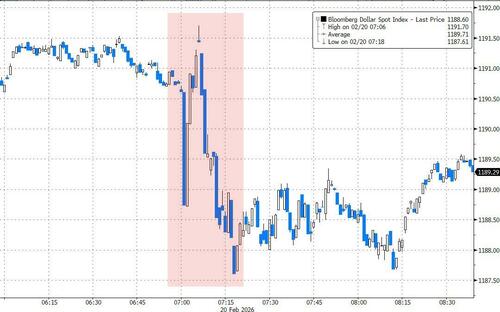

That’s why Friday’s FX price action looked two-way: The dollar dipped on tariff-revenue uncertainty hurting the deficit, but the moves were limited and retraced.

In fact, one-month risk reversals on Bloomberg’s dollar index nudged back into bullish territory for the first time since mid-January. But, Trump’s initial comments after the tariff ruling (and today's further aggression) are likely to renew policy risks as an overhang on the dollar going forward.

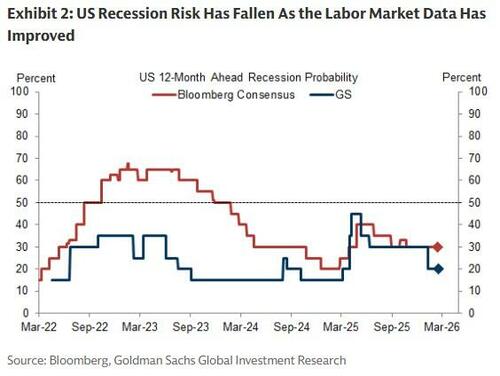

The data this month has been good: the labor market is starting to stabilize, inflation moderated, GDP growth is solid, and Corporate America is hanging tough (as of last Friday, S&P 500 EPS are on track to grow +12% yoy growth in 4Q25, and forward-looking guidance is also higher). At the same time, volatility has risen (the VIX is at 20.23) and the S&P 500 index is practically flat this year.

So Goldman's Chris Hussey asks: what does this tension tell us today?

The economic outlook is still good.

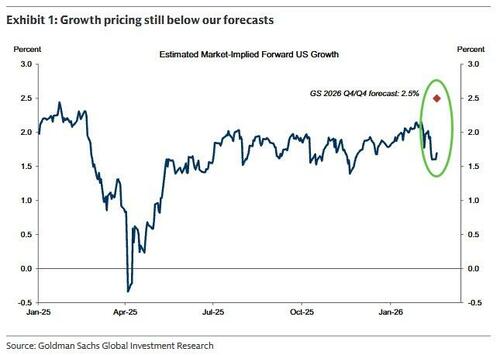

As Jan Hatzius discussed in a Global Views earlier this week, Goldman's optimistic outlook for 2026 remains largely unchanged...

US Recession Risk Has Fallen As the Labor Market Data Has Improved

...and they remain above-consensus for GDP in most economies, despite elevated geopolitical risk and sharp sector rotations in the equity market.

See "Early Steps Toward Labor Market Stabilization"

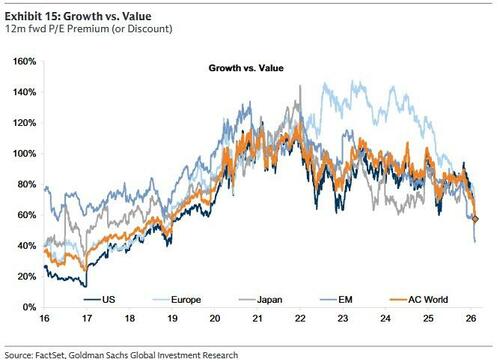

Cyclicals still have room to go.

Classically cyclical assets, including EM equities, copper, and 'old economy' sectors like capital goods and materials, have outperformed in response to inflecting ISM indices, positive US data surprises, and a stabilizing labor market, as Dominic Wilson and Kamakshya Trivedi discuss in a Global Market Views overnight, "Cyclical Tailwinds, Valuation Headwinds."

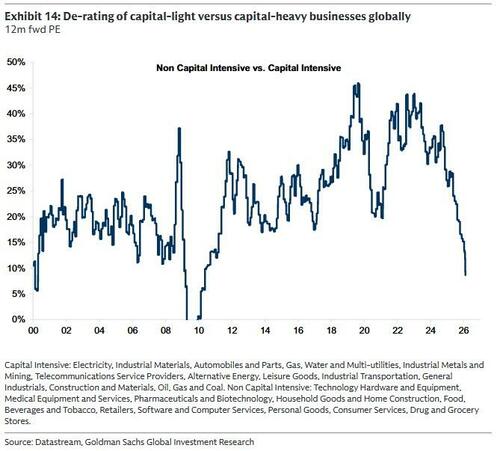

The search for relative insulation from AI-related disruption has also helped drive an acceleration into cyclicals, supporting companies levered to the 'real economy' as well as hard assets as Ben Snider discussed in a Feb-5 US Macroscope, "AI disruption risk and the Software sell-off" and Daan Struyven discussed in a Feb-8 Commodity Analyst, "The Boost From the Hard Assets Rotation."

Virtual meet physical.

An interesting dynamic that is also playing out in markets is the intersection between technology and physical assets. For the first time since the internet's commercialization a quarter-century ago, future technology growth prospects are increasingly dependent on physical assets, like data centers and energy supplies, as Peter Oppenheimer discussed in a Feb-12 Global Strategy Views, "Getting Real – The Return of Physical Assets."

Hyperscaler capex -- which remains a sticking point for investors -- has spilled over into the physical world, as investment in AI infrastructure, coupled with the renewed boost in defense spending, has re-igniting returns on investment in many of the physical assets that had long lagged behind, just as investors fear the slowing of returns from record high levels in the technology space.

This also presents a bit of a Catch-22 for markets: at the same time higher-than-expected capex from hyperscalers is raising questions about an AI bubble, a decline in hyperscaler capex could signal slowing demand and less confidence in future returns.

New risks are old risks.

Geopolitics and policy are always relevant to markets and the economy, but if it feels like they've taken up a larger than usual piece of yours (and markets) mental real estate over the past year, you might not be wrong. Tariffs, tensions in the Middle East, South America, and just about everywhere else have played out in markets pretty much since Liberation Day last year.

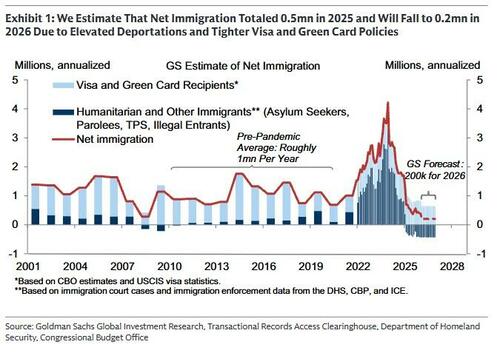

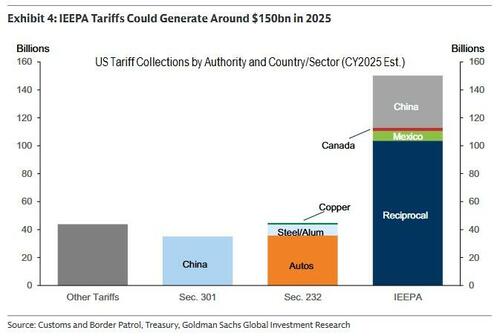

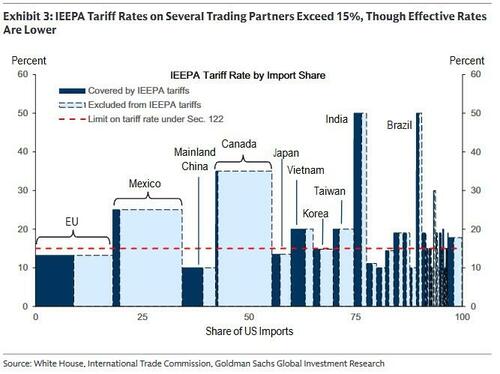

Yesterday morning, the Supreme Court struck down the Trump administration’s tariffs imposed under the International Emergency Economic Powers Act (IEEPA); IEEPA-based tariffs account for around 7.5pp of the 11.4pp increase in the effective tariff rate in 2025. We'd previously assumed that the Supreme Court would likely rule that at lease some of the tariffs were illegal (see Alec Phillips' Dec-16 US Economics Analyst, "Tariffs and Fiscal Policy Ahead of the Midterms").

And while the White House will likely seek to reimpose tariffs under different authorities (President Trump exclaimed today that the Administration will impose a flat 15% levy on foreign goods) the risks nevertheless lean toward lower tariff rate than before.

Tariff rebuke ramifications?

Yesterday morning's ruling does raise some questions about the macro outlook.

On the one hand, it means potentially less revenue flowing into the US Treasury, and actually some revenue outflow should there be tariff refunds.

On the other, it could lower the price of goods -- a good thing for corporate earnings and for individual US consumers, but a potential challenge for the Fed as lower prices could act as a form of fiscal stimulus, potentially reigniting inflation concerns just as the labor market is beginning to stabilize.

Also, see this morning's survey of ~200 investors, "Investor Expectations for Policy in 2026."

Most Investors Expected A Ruling Against Tariffs, But Not Refunds...

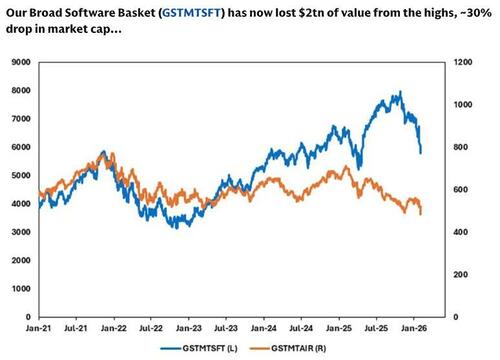

Software is dead, long live software.

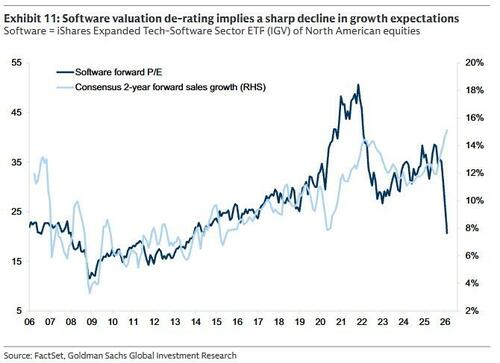

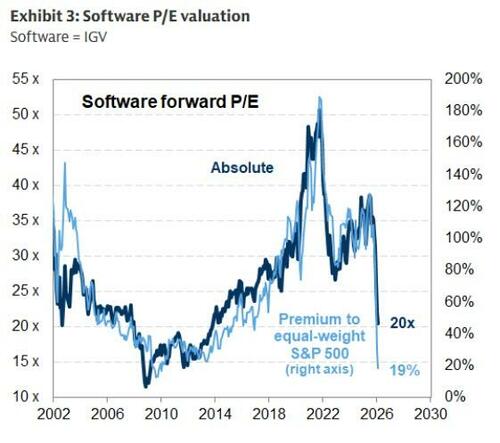

Software stocks have plunged ~24% over the past the three months, even as 2-year forward earnings estimates for the stocks have risen by 5%, and the broader group of industries recently perceived to face the most risk from AI disruption reported double-digit earnings growth in 4Q and experienced positive revisions to 2026 EPS estimates (see Ben Snider's Feb-13 US Weekly Kickstart, "Current earnings strength versus the narrative of future AI earnings disruption").

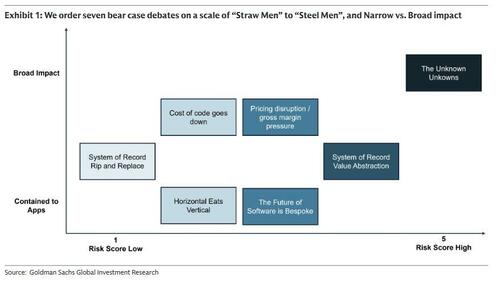

And while it's challenging to disprove a negative, Gabriela Borges and team think software (some parts of it, at least) is more defensible than investors currently think (see Feb-16's "Revisiting Moats Part I: Exploring AI Steel Men Arguments".

We're unlikely to get a clear answer in the near term, but we will get further data in the coming weeks as more software companies (including CRM next week) report results.

This tension is a reminder of something that is occasionally forgotten by Wall Street:

...while the economy and markets often have a symbiotic relationship, the market is not the economy.

Equities are, of course, forward-looking instruments, while economic data is backward looking, reflecting things that have already happened.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal