The Market Is Positioned For An Impossible Outcome

Authored by Simon White, Bloomberg macro strategist,

Economic forecasts imply that a highly pro-cyclical Federal Reserve under increasing government duress will manage to deter a recession without generating inflation. That leaves stocks and bonds vulnerable to a significant repricing and higher volatility.

Markets can’t have their cake and eat it: either a greater chance of recession needs to be priced in via lower yields and stock prices, or higher inflation should be reflected in higher yields, and likely equities too. Both ways, this has volatility written all over it.

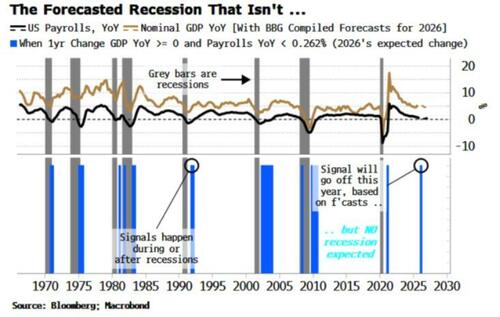

The expectation is that AI will lead to a productivity-driven increase in economic growth this year, without also sinking employment. But the anticipated combination of rising real GDP, slowing inflation and improving payrolls has only ever occurred during or after economic slumps.

Recession indicators, however, show a very low chance of one, at least through the first half of the year. That contradiction is resolved by the belief that the Fed will behave in a way it hasn’t for decades, by loosening policy regardless of economic re-acceleration risk.

Somehow this is not expected to generate inflation. Believing in two mutually-exclusive things is fine if you’re in Wonderland, but in the real world the inconsistency is likely to play havoc with asset prices.

The chart above shows the previous occasions when nominal GDP and annual payrolls growth have been what they are expected to be this year: all occurred either during or just after recessions — in other words, at the very start of cycles, not in the middle of them.

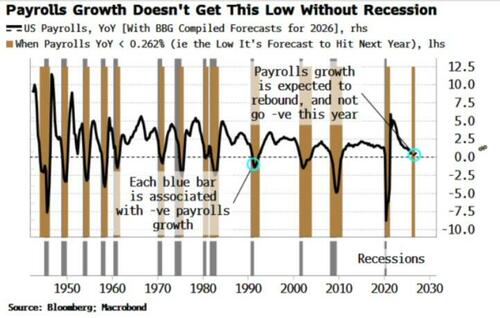

What payrolls alone is expected to do is unprecedented. Its growth has never been as low as it’s seen reaching in 2026 and then reversed course. It has always subsequently fallen further and into contraction territory, signaling an imminent recession.

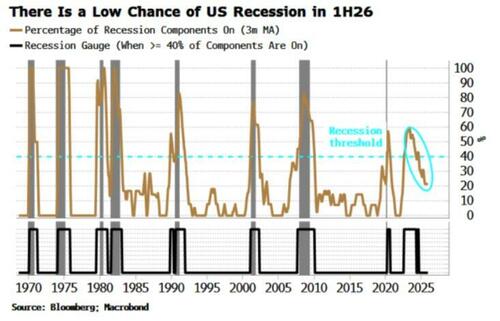

It’s possible, of course, that payrolls will behave in a way they haven’t done before, but in that case a downturn would be a near-run thing. Yet the data gives barely a hint of an economic contraction at the moment. We can see that in my Recession Gauge, which consists of 14 submodels covering a wide array of sentiment, economic and market data, each giving an on/off signal as to whether a downturn is likely in the next 3-4 months. Only three out of the 14 models are currently activated.

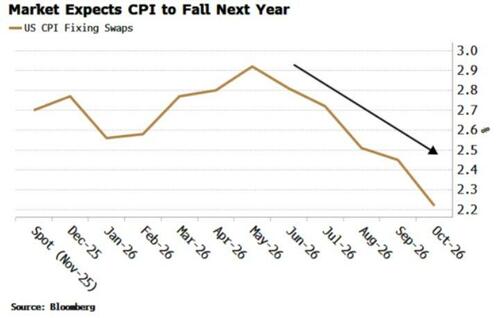

It’s only the deus ex machina of the Fed that could pull off such a feat of nixing a recession despite the forecasts implicitly being consistent with one. That implies greater inflation risks - yet economists are untroubled, with Bloomberg-compiled forecasts showing CPI remaining steady through the first half of the year, then falling in the second half. The market-based view using CPI-fixing swaps is the same.

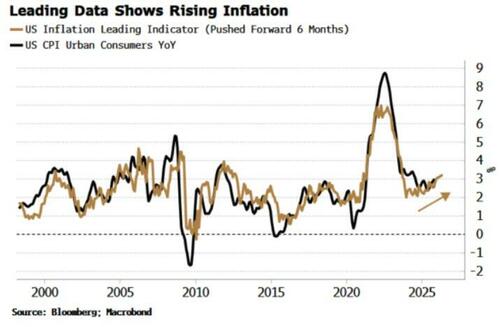

That’s hard to square with the increasing government dominance of monetary policy. The pro-cyclical easing that’s expected to see off a recession is also likely to inflame price pressures. Inflation risks are already rising regardless of the threats to Fed independence, as shown by my leading indicator consisting of manufacturing data, money growth and metals prices.

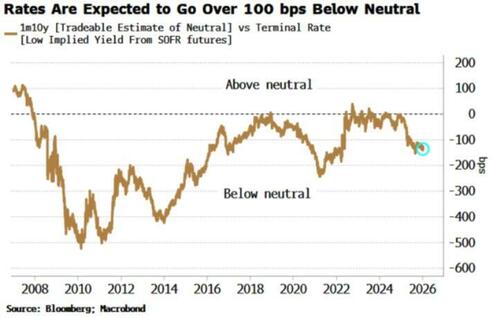

The market anticipates that rates will be cut below most estimates of neutral. The recent legal action taken against the Fed will remind investors that the White House means business in its assault on the institution, leaving even lower rates than currently priced as a plausible outcome. That’s a recipe for inflation and higher yields.

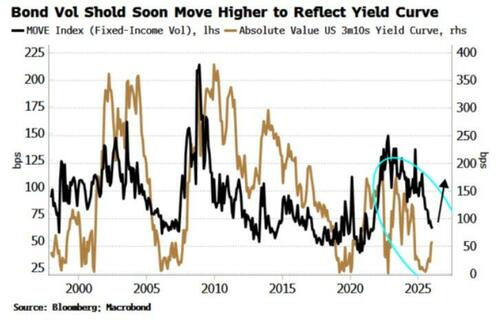

Furthermore, greater fiscal interference in monetary policy will lead to higher volatility, which also points to higher yields. Bond vol has been repressed in part due to an increased preference for funding at the shorter end of the curve. That strategy contains the seeds of its own destruction though: the steeper yield curve that’s likely to result is a volatility machine, as the scope of potential paths between forward and spot rates widens.

Adding to pressures, we may also see more dissension at the FOMC. Even if the committee steamrollers rates lower, there might be more members willing to publicly voice their objection. Historically that has meant more upwards volatility in rates.

Higher rate and bond volatility in the absence of a recession means higher yields, as bond investors demand more risk premium to hold Treasuries.

Stock-market volatility is also low, exacerbating the risk of bigger moves. Without a recession, that’s more likely to mean higher prices. How long that lasts depends on when the penny drops that chronic inflation is a swindle for real returns, and investors rotate to lower-duration stocks and those that stand to benefit from real assets, or increase exposure to real assets themselves.

What is less likely is that stocks and bonds can go on pricing an outcome that’s not too hot to reinvigorate inflation, and not too cold to mean a collapse in job growth and a recession, but just the right temperature. Goldilocks is, after all, only a fairytale.