Market Risk Returns As Tariff Shock Jolts Stocks; Goldman Maps Three Retaliation Paths Against Trump Over Greenland

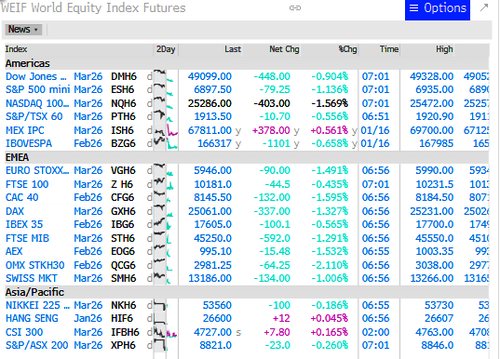

The Euro Stoxx 50 is down 1.5% on elevated volumes, while Nasdaq 100 futures are also lower amid overnight risk-off across Western markets. The selloff follows the latest trade escalation after President Trump said he would impose a 10% tariff on imports from eight European countries in retaliation for their opposition to U.S. control over Greenland.

On Sunday, Trump wrote on Truth Social that beginning on February 1, Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland will be charged with a 10% tariff on all goods sent to the US. That tariff rate would be increased to 25% by June 1.

"This Tariff will be due and payable until such time as a Deal is reached for the Complete and Total purchase of Greenland. The United States has been trying to do this transaction for over 150 years. Many Presidents have tried, and for good reason, but Denmark has always refused. Now, because of The Golden Dome, and Modern Day Weapons Systems, both Offensive and Defensive, the need to ACQUIRE is especially important," Trump said.

European countries released a joint statement opposing US control of Greenland, blasting Trump's move, saying the president's threats "undermine transatlantic relations and risk a dangerous downward spiral."

The statement from the European countries said that troops deployed to Greenland for the operation "Arctic Endurance" pose "no threat to anyone."

Late Sunday, Trump posted on Truth Social that "NATO has been telling Denmark for 20 years that you have to get the Russian threat away from Greenland. Unfortunately, Denmark has been unable to do anything about it. Now it is time, and it will be done!!! — President Donald J. Trump."

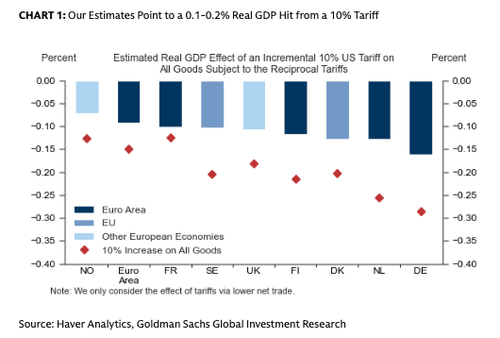

It's important to note that Europeans cannot compete militarily, but Brussels can wield reciprocal tariffs and other economic weapons. This tariff threat prompted Goldman analyst Adam Crook to tell clients Monday that a 10% tariff rate on EU goods would "lower real GDP in the affected European countries by 0.1-0.2% via lower exports. The inflation effects would likely be very small and a Taylor rule would point to modestly lower policy rates, all else equal."

Crook outlined three potential levels of EU trade retaliation:

-

stalling the implementation of last year's EU-US trade deal,

-

imposing counter-tariffs on US goods, and

-

launching the Anti-Coercion Instrument, which would allow for a broader range of non-tariff retaliation options

Also on Sunday, Treasury Secretary Scott Bessent defended Trump's proposal to impose tariffs on the European countries. He told NBC News' "Meet the Press" that the move to acquire Greenland is to avert a future national emergency.

"It is a strategic decision by the president," Bessent said. "This is a geopolitical decision, and he is able to use the economic might of the U.S. to avoid a hot war."

In response to Trump's tariff threat, European Council President António Costa told EU members that he would convene "an extraordinary meeting of the European Council in the coming days" (more details here).

Commentary from Deutsche Bank's chief FX strategist George is key (view note here):

Europe owns Greenland, it also owns a lot of Treasuries. Saravelos spent most of last year arguing that for all its military and economic strength, the US has one key weakness: it relies on others to pay its bills via large external deficits. Europe, on the other hand, is America's largest lender: European countries own $8 trillion of US bonds and equities, almost twice as much as the rest of the world combined.

. . .

Remember the Munich Security Conference. It was the US Vice President's Munich speech last year that proved the proxy catalyst for an acceleration in European defence spending. Could it be Greenland this year that catalyses an acceleration in European political cohesion?

UBS analyst Joe Dickinson told clients earlier, "The renewed trade conflict also feeds broader geopolitical concerns, including NATO cohesion and the durability of US defence guarantees, with probabilities of a Russia‑Ukraine ceasefire continuing to drift."

Major European stock indexes were hit by overnight tariff headlines, as were US main equity index futures (US holiday)...

The US-EU spat over Greenland underscores how rapidly escalating geopolitical tensions are reshaping the Western hemisphere in the era of the 'Donroe Doctrine.'