The Market's 0DTE Underbelly Just Got Exposed

The Market's 0DTE Underbelly Just Got Exposed

Last week reminded us just how fast market stability can give way to volatility.

After trading near all-time highs at 7,000, the S&P 500 fell 3% in just three sessions, closing Thursday at 6,798 amid weakness in software and crypto. Our last Sunday Newsletter focused specifically on how this type of fragility underscores today's market. This past week's selloff exposed how much of the market's recent support was transient, built around 0DTE options activity that can fade as quickly as it appears.

At the core of this dynamic is dealer positioning, and the role of gamma. In positive gamma environments, dealers hedge their options exposure by buying market dips and selling rallies, which keeps volatility contained. When gamma positioning flips negative, those same hedging flows reverse — adding selling pressure during declines and buying pressure during rallies, giving the market further momentum in either direction.

This dynamic remains in place for 0DTE options, yet the key issue is timing. Because these contracts expire at the end of the trading day, the stabilizing influence of positive 0DTE gamma disappears overnight. Each session effectively starts fresh, often without the same underlying support.

Market behavior on Wednesday and Thursday provide a prime example of how 0DTE options create these transient effects. The below chart of SpotGamma's TRACE shows how positive gamma (purple) at SPX 6,850 provided critical stability and support on Wednesday afternoon. However, by Thursday morning that support disappeared as SPX tumbled another 100 pts intraday.

This daily "reset factor" is becoming more important as participation in 0DTE options continues to grow. Last week, Mag7 options began trading with Monday and Wednesday expirations. For TSLA in particular, same-day contracts have already begun to make up significant options volume. As more traders concentrate their activity into ultra-short-dated options, we expect the broader market risks of 0DTE trading to become more apparent.

Software Sells Off With Crypto as a Casualty

Software stocks experienced the week's largest declines, with IGV down ~23% year-to-date. We can use our four-quadrant Compass to visualize how the market is pricing in volatility (IV Rank, y-axis) and directional risk (Risk Reversal Rank, x-axis).

As shown below, nearly every major software name is now clustered in the top-left quadrant with elevated implied volatility and downside skew — signaling traders have aggressively bought puts. This crowded downside positioning created a self-reinforcing selloff early last week within the sector, even as the S&P 500 remained within ~1% of all-time highs.

Bitcoin exhibited particularly extreme volatility, with vol remaining elevated throughout the week. BTC broke below Strategy's (MSTR) estimated cost basis near $76k and traded down toward $70k by Friday. Viewing crypto through IBIT, we observed an IV Rank near 100% alongside put skew in the 99th percentile, reflecting both extreme implied volatility and heavy downside positioning.

In contrast to the extreme volatility in crypto and software, index and Mag7 volatility remains relatively subdued despite the broader selloff. On the skew front, select energy names continue to exhibit call-skewed structures (notably USO and OXY), highlighting pockets of bullish optionality amid broader dispersion.

The Week Ahead: CPI and Software Earnings

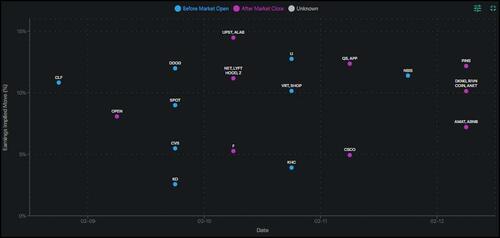

Next week brings both CPI and NFP on the macro side, alongside a heavy slate of software and crypto-adjacent earnings. Implied moves for several of these names are pricing in 10–15% swings.

-

Tuesday (2/10): HOOD earnings

-

Wednesday (2/11): Nonfarm Payrolls (Jan), SHOP / APP earnings

-

Thursday (2/12): Initial Jobless Claims, COIN earnings

-

Friday (2/13): CPI

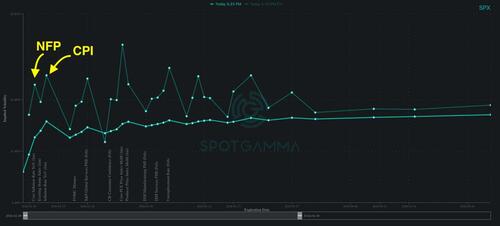

We also note that the SPX term structure has shifted back into contango after this week's vol reset. With macro data, earnings, and Fed-related events ahead, this structure suggests an environment prone to event-driven risk.

Interestingly, there is a pronounced IV spike centered on 2/13 (CPI). Forward-adjusted IV is near 19% while actual IV sits closer to 14%, indicating that traders might yet be underpricing jump risk around the event.

Closing the week below our Risk Pivot level of SPX 6,950 provides no signal of forward stability. The current regime remains defined by intraday spasms that mean-revert, as we have seen for the past two weeks.

The risk we see is that one of these vol spasms could fail to snap back — triggering a liquidity cascade through negative gamma. In that scenario, we see 6,650 as the downside target, with VIX potentially pushing to 30. Until 6,950 is reclaimed, that risk deserves respect.

Optimize your trades with SpotGamma. Choose the Plan that's right for you.