"Adult Swim Only" Goldman Trading Desk Warns As Investors Approach "Max Fear"

This week’s tape can only be categorized as adult swim... and then some, according to Goldman Sachs Flow of Funds gurus Lee Coppersmith, Gail Hafif, and Brian Garrett.

It's a busy day so here's the headlines:

a. Systematics: supply unleashed by index trigger levels breached.

b. Liquidity and gamma: these dynamics will result in choppier and more challenged trading in both directions.

c. PB: Hedge funds positioning is getting cleaner but the road ahead is bumpy.

d. Seasonality: February historically is a weaker month for both the S&P and NDX.

e. Retail: BTC hit and “dip-buying” watch.

f. Thematics/Sector: whippy price action led by the broadening out of thematic trading. Phone a sector expert?

Below they outline all 10 of their major areas of focus:

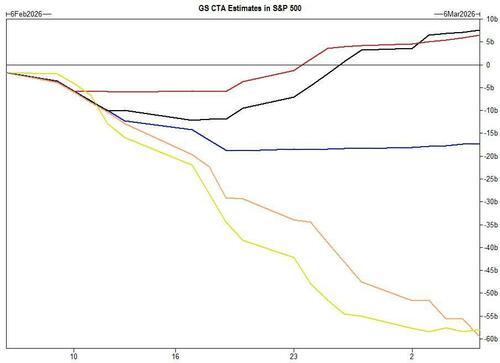

1. CTAs

This will be the most asked about flows question today, so let’s get into it.

Global CTA positioning is sitting right below the 90th percentile on a 5y lookback.

CTAs have sold $6.25bn in US equities since the start of the year and positioning now sits in the 70s percentile range on both a 1y and 5y lookback.

Over the next 1 week…

-

Flat tape: Sellers $19.5B ($15.37B out of the US)

-

Up tape: Sellers $8.7B ($6.96B out of the US)

-

Down tape: Sellers $58.61B ($32.5B out of the US)

Over the next 1 month…

-

Flat tape: Sellers $21.24B ($25.67B out of the US)

-

Up tape: Buyers $20.96B ($9.34B into the US)

-

Down tape: Sellers $213.33B ($79.78B out of the US)

We’ve blown past the short-term threshold in the S&P and are less than 1.5% from the medium-term threshold (6707).

Source: Goldman Sachs FICC and Equities

Should we breach that level and further down, we estimate up to $80bn of supply will be unlocked over the next 1m.

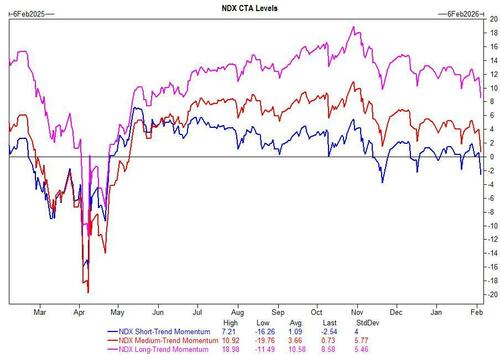

We are ~410 handles from the NDX medium-term threshold, but we currently estimate the majority of CTA supply is concentrated to the S&P.

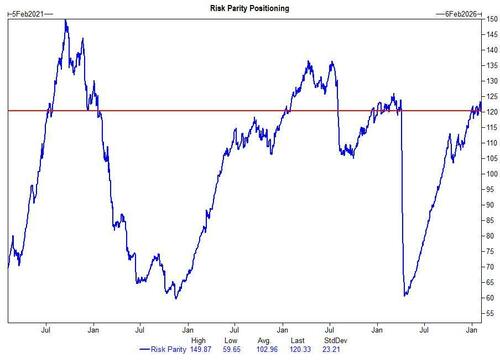

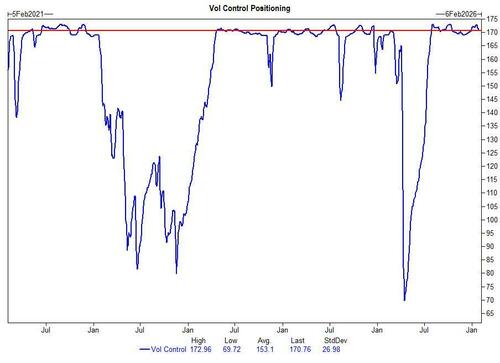

2. The Other Systematics

With risk parity positioning in the 81st percentile and vol control positioning in the 71st percentile on a 1y lookback, these systematic cohorts have room to sell US equities.

As a reminder, these strategies react to changes in volatility on a longer horizon than their CTA counterparts, so their impact will be more visible on sustained and structural shifts in market volatility.

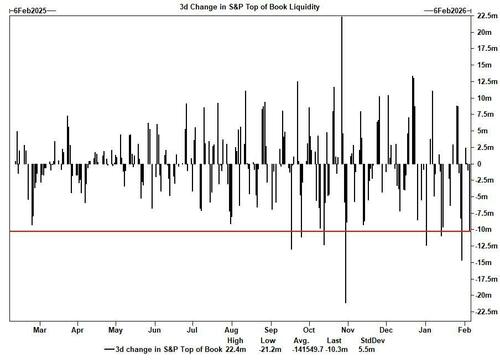

3. Liquidity

As we alluded to in the last piece, liquidity has deteriorated quickly.

S&P Top of Book liquidity has decreased to $4.11mm - or 333% - from the YTD average of $13.69mm.

The inability to transfer risk quickly lends itself to a choppier intraday tape and delays stabilization in overall price action.

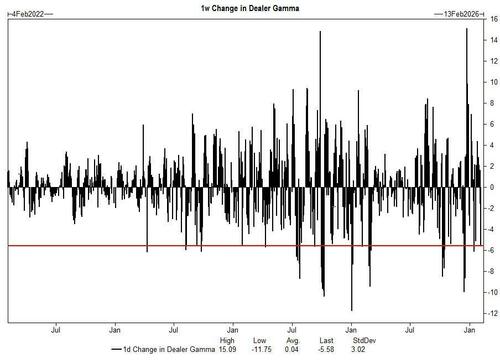

4. Gamma

After sitting in a dealer long gamma pocket that prevented the market from breaching the 7k level, this week’s selloff has flipped dealers to flat/short gamma positioning right around here.

We estimate dealers are about flat at spot and get longer on rallies and shorter on selloffs.

Although we don’t anticipate dealers being max short, coupled with low liquidity, this will exacerbate market moves and magnify swings in both directions – buckle up.

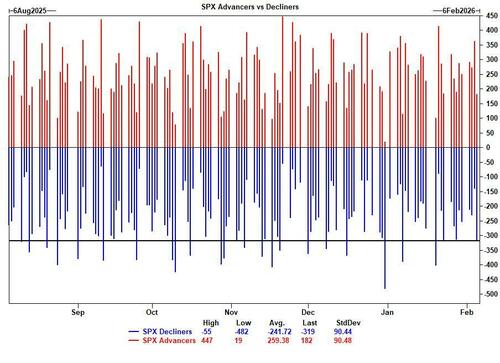

5. Breadth

137 more companies in the S&P were down on the day yesterday than up. The spread is widening out as investors continues to trade thematically, but these levels are not overly concerning at the moment.

We will continue to watch this spread and breadth (% between the S&P 52 week high from its median constituent) for alarm bells that would indicate a larger shift in the marketplace.

6. PB Analytics – putting the pain in trade

As of Wednesday, Gross leverage rose +1.7 pts day/day, driven entirely by positive impact of +2.2 pts from mark-to-market (i.e., price declines/PnL loss making the denominator smaller in the leverage calculation), which outweighed the -0.6 pts impact from activity.

Net leverage fell -0.5 pts day/day, driven by both mark-to-market and activity.

Wednesday's moves severely impacted all equity strategies simultaneously with more than two thirds of funds in each index down.

Last time all three strategies were down more than 75 bps in a single day happened during COVID sell-off (i.e., 6 years ago).

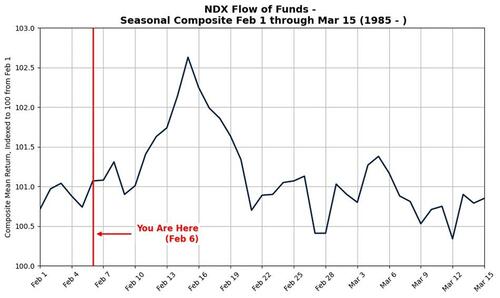

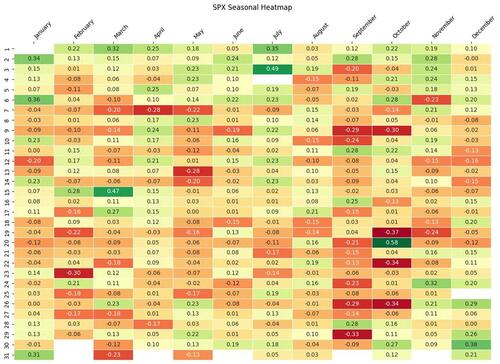

7. Seasonality

The mid-February slump came early but it should come as no surprise for the month according to history.

Removing key supportive flows from the market (ie 401k/Retail/etc) post-January contributes to a softer February but also bursts of relief.

Source: Goldman Sachs FICC and Equities

The mean NDX return from mid-February (March 17) to March first is down 1.19% and down 1.36% out to mid-March.

February has typically seen a choppier mid-month and leans negatively to end off the month.

Source: Goldman Sachs FICC and Equities

We expect this to continue until investor positioning has gotten cleaner and market froth has been comfortably flushed out.

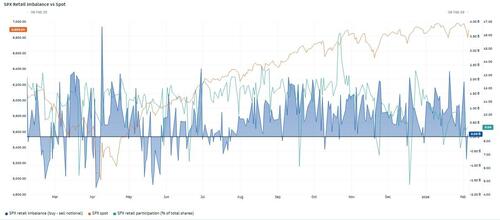

8. Retail

Coming off a year of remarkably robust retail flow, the cohort has already demonstrated less willingness to “buy all dips” as seen by the latest 2-day net imbalance of $690mm to sell but so far they've remained active.

Retail favorites, like crypto and crypto-linked stocks, have been hit extremely hard to start the year, and a rotation out of US equities will mark a notable departure from the path of last year’s trading.

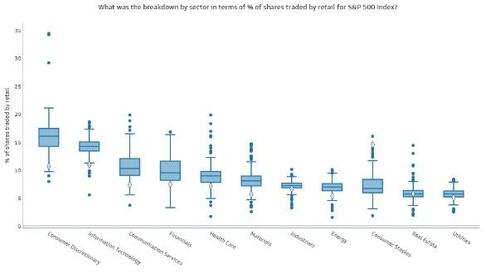

9. Sector / Thematics

This market is rapidly growing in its thematic focus – the desk has seen ETFs track to up to nearly ~40% of the tape this week highlighting the use of macro products to express sector and thematic views.

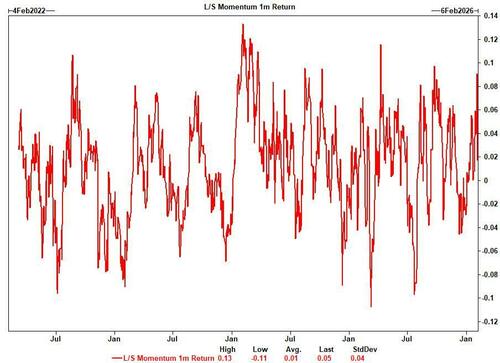

Momentum has gotten crushed this week with our Momentum Long basket (GSCBHMOM) down almost 8.5% over the last three days.

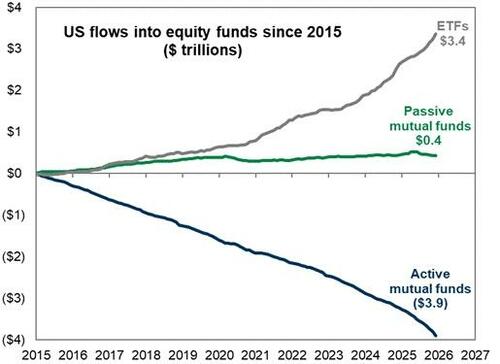

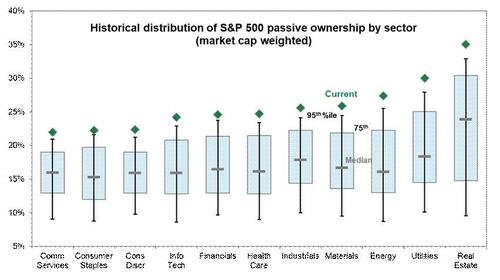

The rise in ETFs and passive funds increases the emphasis on those flows...

...we’ve identified the historical distribution of sector ownership by passive funds below:

Source: Goldman Sachs FICC and Equities

10. Markets Talking

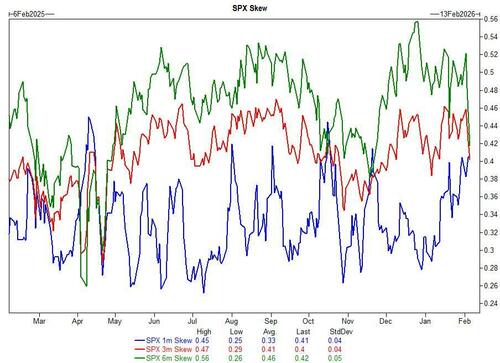

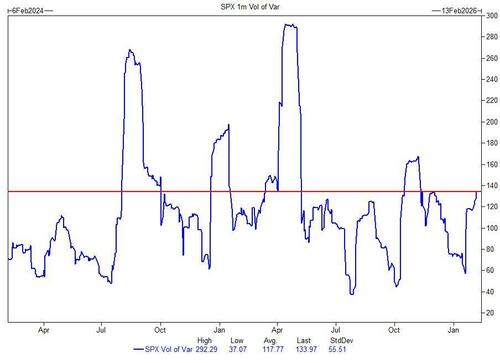

Listen close and you can hear it. Front-end SPX skew has gone turbo bid over the past few days with investors rolling and monetizing their hedges.

As told by vol, we think trading will continue to be challenged until risk premium is eventually taken out post an event-driven spike in VIX to fuel a relief rally.

Source: Goldman Sachs FICC and Equities

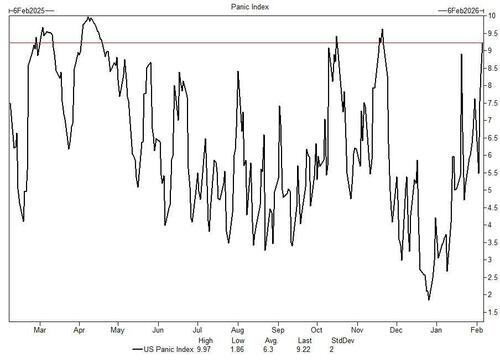

Our favorite indicator: the last reading of the GS Panic Index was 9.22 based on 1-month S&P implied volatility, VIX volatility, S&P 1m put-call skew, and the S&P term structure slope (1m vs. 3m).

These vol metrics indicate that "investors are not far off from max fear."

* * *

Finally, with all that in mind, these are Goldman's traders' best trade ideas:

-

SPX Dec26 7600 digi call (continuous KO until 31mar26 at 7200): indicatively18% offer (vs 36.25% offer on standard digi call)

-

SPX May26 95% 80% KO put: 55bps offer (vs 1.32% on the equivalent put spread)

-

GSXUPROD>SPX: (conditional iterations available)

-

3m 105% outper call @ 3.30%

-

6m 105% outperf call @ 5.4%

-

Max loss = premium paid

"Good luck out there," they conclude optimistically, adding that "we will keep an eye out for the technical set up to change."

A view that is echoed by the ZeroHedge crew too.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal