Markets Remain Behind-The-Curve On The Economic Outlook; Citadel Macro Guru Warns Of Re-Inflation Risk

Authored by Nohshad Shah via Citadel Securities,

FED INDEPENDENCE IS SACROSANCT FOR MARKETS.

This is a phrase I have often used and one I stand by unequivocally.

The market’s relatively sanguine reaction to recent events should not be mistaken for indifference to central bank independence.

Rather, it reflects several mitigating factors.

-

First, the facts remain unclear: recent reporting suggests the legal process was triggered only after multiple unanswered outreach attempts to the Fed…and it seems unlikely that any case against Chair Powell would have strong legal grounding or meaningful support from Congress. Attention now turns to upcoming Supreme Court hearings – most notably whether the President can remove Governor Lisa Cook “for cause,” and the related Trump v. Slaughter FTC case – which will ultimately define the permissible scope of political interference.

-

Second, and perhaps more importantly, we are not currently in a moment where central bank credibility is being tested by crisis. Historically, it is only under stress that any erosion of independence becomes market relevant.

Why does Credibility matter? Because monetary policy is most effective when it operates incrementally and predictably; the more credible a central bank, the less force it needs to apply.

This is why markets devote such energy to parsing every word of Fed communications (something which many readers have no-doubt spent hours doing!). By contrast, the loss of Fed credibility during the Burns–Nixon era in the early 1970s required aggressive and destabilizing rate hikes to re-anchor inflation expectations. The problem with this is that large policy moves introduce second-order risks that are difficult to anticipate…a concern that is especially acute given today’s highly indebted US economy. Whilst this week’s challenge to Fed independence may ultimately prove overblown in terms of immediate outcomes, investors should not be complacent. Even absent near-term consequences, it has materially complicated the task of the next Fed Chair, particularly in managing the FOMC and building consensus…both critical to effective policy. Ironically, one could argue that these developments reduce, rather than increase, the probability of rate cuts – an odd outcome given Chair Powell’s own dovish pivot late last year, when he delivered 75bps of insurance cuts.

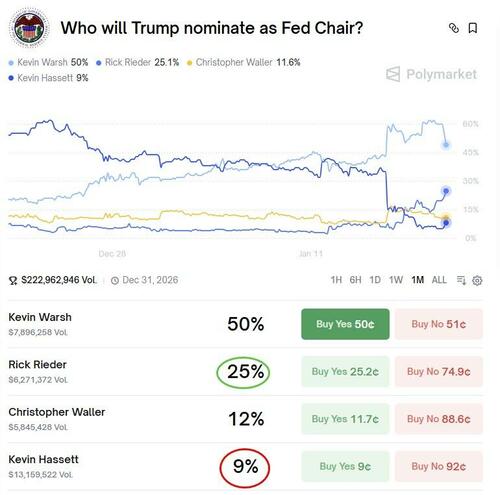

In sum, the Federal Reserve remains one of the world’s strongest and most consequential institutions. Whilst this week’s events are undoubtedly unhelpful, I firmly believe that – like much of America’s political architecture – it was deliberately designed with checks and balances to prevent the concentration of power in any single individual, and it will ultimately endure. In fact, it’s possible that the own goal with respect to the Fed indictment has changed the calculus for President Trump…the market reaction and congressional support for Fed independence skews momentum away from Kevin Hassett, who is seen as the least independent choice.

Prediction markets now reflect ~50% probability of Kevin Warsh getting the job after Trump seemed to imply a preference for keeping Hassett in place.

The market reaction – which saw flatter curves, less rate cuts priced, a stronger dollar, lower gold and lower stocks all reflect a market that sees Warsh as more credible (and more hawkish) than Hassett.

Having said all of this, Trump’s tendency to change his mind has whipsawed markets time and time again, so let’s wait to see if this is indeed the last act of the Fed chair nomination saga.

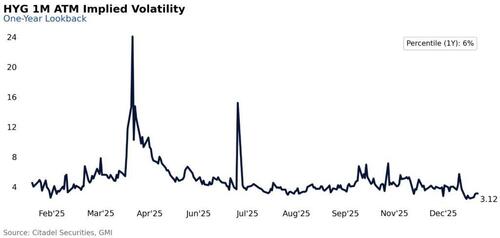

THE YEAR THUS FAR HAS BEEN CHARACTERIZED BY A TIGHT TRADING RANGE IN GLOBAL MACRO...

...compressed implied vols, a global hunt for carry, credit spreads at the lows, and an insatiable appetite to buy the dip.

I find that concerning in the context of the first 16 days of the year seeing substantive policy volatility with the Venezuela military operation (and all its implications), talk of intervention in Iran, the President reasserting a desire to take control of Greenland, the announcement of $200bn in MBS purchases, the Federal Reserve receiving a grand jury subpoena from the DOJ, a proposed cap on credit card interest, an imminent ruling on the legality of IEEPA authority for tariffs, and large swings in the implied odds on who will be the next Fed Chairman.

On a more structural basis, markets are grappling with the impact of generational technological change in AI and gargantuan amounts of investment in data centres and compute power. Moreover, we are now confronting the inverse of the “global savings glut” that characterized the pre-GFC early 2000s…a period marked by excess private and foreign saving, persistent current-account surpluses, and strong demand for safe-haven assets such as US Treasuries, all of which suppressed real interest rates and term premia.

Today, by contrast, advanced economies are firmly oriented toward fiscal expansion and private investment as tools to drive productivity and economic growth. In the US, this translates into persistent and sizable fiscal deficits even at full employment, heavy Treasury (and IG) issuance, and, ultimately, higher equilibrium real rates and term premia. The binding constraint has shifted from insufficient demand for capital to the sustainability and pricing of fiscally driven supply.

In the current regime, strong risk-asset performance is THE key driver of easy financial conditions, which in turn supports economic growth and corporate profitability. This feedback loop sustains risk appetite and enables firms to finance the investment needed to generate productivity gains – ultimately (hopefully) delivering the uplift in trend growth required to render persistent fiscal deficits manageable.

However, let’s remember that higher real interest rates pose a direct headwind to risk-asset valuations by raising the discount rate applied to future cash flows.

This introduces a critical circularity: if real rates rise rapidly or persistently in a way that overwhelms productivity-driven growth gains, financial conditions will tighten materially, undermining investment, growth, and the very mechanism needed to stabilize fiscal dynamics.

Put simply, a sizeable and sustained increase in yields…regardless of the catalyst…would represent a significant risk to the US economic outlook.

MARKETS REMAIN BEHIND THE CURVE ON THE ECONOMIC OUTLOOK...

...and I have argued for some time that US growth is likely to be very strong this year. Against that backdrop, I remain concerned about the risk of inflation re-accelerating. Stepping back, the policy mix is clearly inflationary: restrictive immigration policy, a procyclical tax cut, rising protectionism, pressure to onshore production, the aforementioned $200bn in government-directed mortgage purchases, and a central bank that has delivered 175bp of rate cuts despite inflation running above target for 57 consecutive months. It is difficult to view this combination as anything other than demand-pull and cost-push inflationary. Whilst the latest CPI report appeared reassuring – core CPI rose 24bp m/m, below expectations – the underlying details were far less benign. Highly cyclical components showed notable strength, with hotel prices +3.5% m/m and recreation services +1.8%. There was also evidence of ongoing shutdown-related distortions, where expected payback was weaker than anticipated. Importantly, the softness was narrow, concentrated in a small number of categories rather than broad-based.

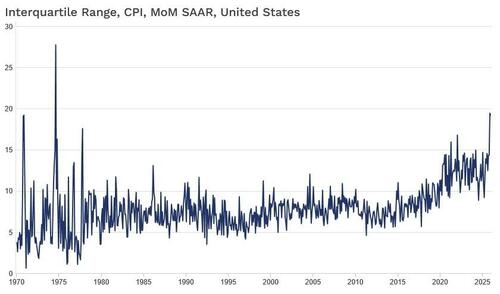

These concerns are reinforced by a sharp rise in inflation dispersion…the degree to which price pressures are uneven across the CPI basket. Measured by the interquartile range, dispersion is now at its highest level in 35 years (chart below), suggesting inflation is becoming more uneven and less predictable rather than smoothly converging to target.

The takeaway is that markets should be far more open to upside inflation risks…elevated dispersion challenges the prevailing narrative of benign, linear disinflation…particularly in an environment characterized by strong growth and an unequivocally inflationary policy mix.

To be clear, medium-term I am open to the idea that AI driven productivity could save the day (and some of the leading companies in the world are no doubt adopting AI quickly); but the “facts-on-the-ground” around immigration and the risk of a positive output gap with the “run it hot” policy outlook, mean that inflation resurgence is more likely than not.