As Midterms Loom, Goldman Suggests Hedging "AI Politicization"

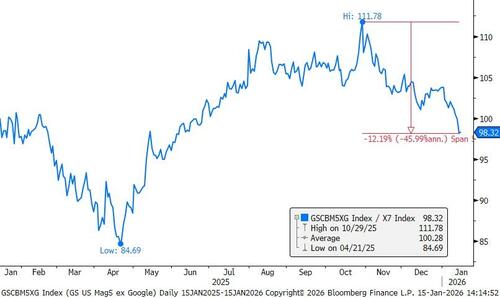

We have seen multiple corrections in the AI ecosystem.

The last correction lasted a little over thirty days where our Broad AI basket (GSTMTAIP) underperformed the SPX Index excluding the Mag7 (X7) by ~12pp.

This is not the worst correction we have seen in the last 2 years and we have not fully recovered yet.

As tech has underperformed, Goldman's trading desk has been fielding questions regarding the broadening out trade away from AI into remaining parts of the equity market.

There are a few reasons that come up:

(1) companies have invested significant cash flows into data center infrastructure and concerns continue to grow regarding the returns on investments expected, sometimes debt is used for funding some of these projects,

(2) are we measuring the demand for data center capacity correctly, what if there is oversupply, and

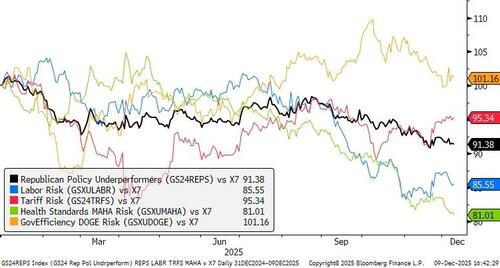

(3) the midterm elections could introduce regulatory controls on where data centers are located and controls on utility bill inflations.

Goldman's trading desk does not expect the first two topics to drive a sell-off in the AI space in 2026.

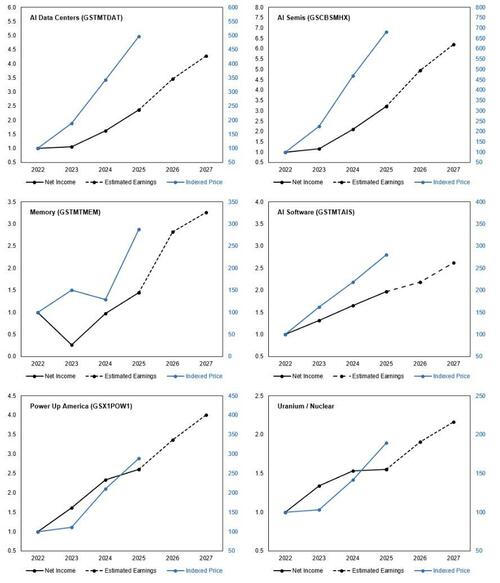

They report that their earnings and valuation analysis shows that all categories of AI are reasonably priced and are not comparable to historical bubbles (dotcom / GFC).

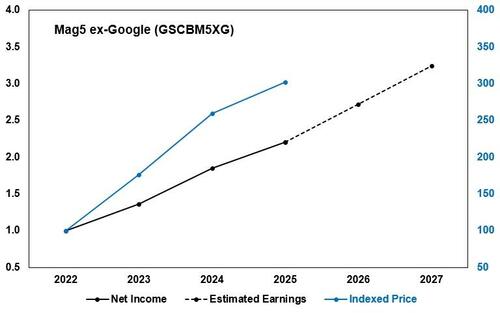

The Mag5 companies ex-Google (GSCBM5XG) have underperformed while earnings growth remain healthy.

While their conviction on AI’s infrastructure remains bullish considering the demand for hardware and power continues to grow, they also do expect the midterm elections to focus on this topic .

Our preferred angle to the broadening trade is focusing on the companies that have efficiently implemented AI into their business models, in non-tech related industries.

Equity investors face challenges in figuring out who the real beneficiaries of AI are.

Our AI productivity basket (GSXUPROD), launched in November, is composed of non-Tech and non-AI companies that have mentioned specific plans to implement AI into their workflows, allowing them to reduce costs and improve margins, across (1) banks and insurance companies, (2) retailers and warehouse operators, (3) transportation and logistics sector, (4) health care services, and (5) restaurants.

Goldman's preferred trades in the short term include buying the dip in AI or the Mag5 and the long-term broadening trade includes buying AI Productivity:

1. Long non-Tech and non-AI companies that are becoming more productive by implementing AI (GSXUPROD)

2. Long Mag5 excluding Google (GSCBM5XG)

But, they also note a third trade that seems more strategic

3. Long AI Volatility (GSVIAIV1) to hedge the risk of “AI politicization” as we approach the midterm elections

A number of US policy makers have publicly raised concerns about the energy consumption of data centers, especially as AI-driven data-center build-outs accelerate: Edward J. Markey (MA Senator) wrote a letter to the Federal Energy Regulatory Commission (FERC) calling on it to prevent data-center growth from “dramatically hiking energy costs for American families” in November, noting that data centers are driving rising demand for electricity, which could burden households via increased utility bills. The letter was signed by six other senators. DeSantis, who backed state law changes in 2024 to make cost and reliability the focus of Florida's energy goals, has blasted data centers and artificial intelligence driving energy use in remarks throughout the summer. BusinessInsider also reported on the impact data centers have on US households.

Goldman's equity research team explains residential utility bill inflation has accelerated in certain regions, raising concerns about customer affordability. A few states in the Northeast/Mid-Atlantic have seen accumulated bill inflation of 29% in the past three years (20pp above CPI), which has been a function of (1) tighter regional power markets as demand inflects from electrification, data centers, and reshoring, and as coal units are retired, driving higher capacity prices that are passed onto customers, (2) volatility in natural gas prices as well as supply constraints on domestic natural gas flows in certain regions, (3) public benefits charges that support state/federal mandates around energy efficiency, wildfire mitigation, and clean energy goals increasing on bills, and (4) higher delivery charges, as utilities invest in aging grid infrastructure.

In the states that have seen lower inflation, robust local resource availability (coal/wind/gas) have helped keep electricity rates lower with ample supply.

Policies of the new administration have impacted unexpected pockets of the equity market…could AI become one too? The top performing themes in the equity market have been dominated by AI infrastructure leaders:

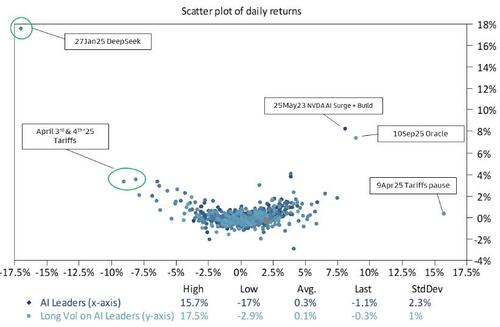

Our favorite implementation to hedge this dynamic is going long AI volatility (GSVIAIV1): the strategy aims to provide convexity regardless of direction of the moves of the underlying stocks by purchasing delta-hedged strangles on the 10 most liquid AI companies.

This overlay provides convexity to gaps regardless of direction

This offers a better cost of carry over time than rolling puts as it neutralizes exposure to underlying stocks via daily delta-hedging, while continuous trading of options mitigates path dependency associated with a static rolling options position.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal