Morgan Stanley Explains Why AI Disruption Will Unleash A Day Of Reckoning For Credit

By Vishwanath Tirupattur, head of North America fixed-income research at at Morgan Stanley

For much of 2025, markets debated whether AI was just hype or a technology that could transform the economy and markets in a meaningful way. We have entered 2026 with that debate firmly tilted against the 'hype' argument. 4Q earnings reports from the large hyperscalers show unambiguous, escalating commitments to AI and the infrastructure powering it, evidence that AI is real and transformative.

At the same time, markets are flashing another signal. The sell-off that started in software and is now bleeding into other sectors reflects a growing recognition that AI is not just an opportunity but potentially a disruptor, challenging business models across the corporate landscape. This week’s Sunday Start connects these two threads – the surge in AI capex investment and the widening cracks in equity and credit markets –to explore how the engine of future productivity is catalyzing near-term market stress. As credit strategists, we approach this moment with a sharp focus on the mounting strains within credit markets.

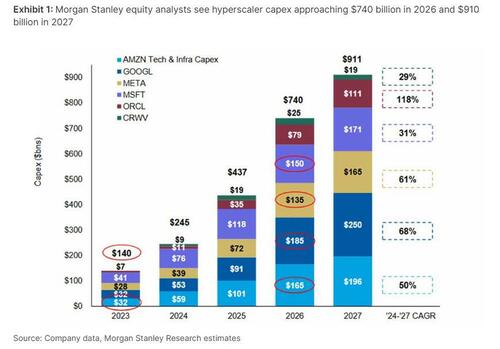

As Brian Nowak, our internet equity analyst, emphasizes, the large hyperscalers’ 4Q earnings calls make one thing clear: the biggest, most data-rich platforms with both the capacity and the conviction to invest are pulling even further ahead. Their flywheels are accelerating, and their competitive lead over smaller tech players is widening faster than even a few weeks ago. In response to the updated guidance from these calls, our equity analysts have raised estimates meaningfully (Exhibit 1). They now forecast $740 billion of hyperscaler capex for 2026, up sharply from the $570 billion projected at the start of the year. The fundamental premise behind these upward revisions remains unchanged: demand for compute continues to exceed supply by a wide margin.

Against this backdrop, two points about AI-related capex stand out.

- First, with less than 20% of forecast AI investment by 2028 spent so far, the vast majority remains in front of us.

- Second, unlike spending in 2025 and earlier, the next phase of this build-out should rely far more on credit markets across the spectrum – public and private, unsecured, secured, securitized, structured, and JV formats. The scale of forthcoming capex is simply too large for equity funding alone, pulling credit into a central, systemic financing role.

That funding need is poised to reshape issuance dynamics. We expect IG bond issuance to hit a record $2.25 trillion in 2026, driven by AI-related capex requirements as well as a pick-up in M&A activity (see "Bond Market Faces Historic Shock As Mag 7 Giants Turn Cash Flow Negative To Fund CapEx Tsunami").

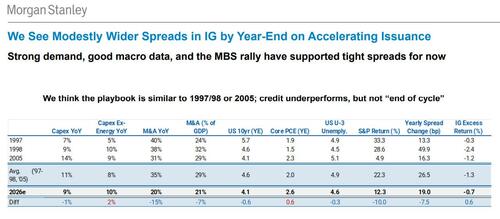

This surge in supply should push IG spreads modestly wider by year-end, but in our view the pattern looks more like 1997-98 or 2005 – periods when credit spreads widened, diverging from rising equity markets but hardly signaling anything close to an 'end of cycle' dynamic.

All this is occurring just as markets grow more attuned to – and more anxious about – AI’s disruption risks. These concerns are rooted not in skepticism but the recognition that AI’s power to transform is real, and the scale of capex suggests that potential will be realized. Recent reports that advanced AI models are close to performing most software engineering tasks were a wake-up call, prompting investors to reassess how quickly disruption could hit the software sector – and how broadly disruption could ripple outward.

In equities, the software sector has already taken a substantial hit. The S&P Software Index is down 23% year to date, while the broader S&P 500 is roughly flat, a stark divergence that underscores how quickly disruption fears have taken hold. This equity weakness is now bleeding into credit, particularly US leveraged loans and BDCs, the pockets most exposed to software. Software loans are down ~3.4% year to date, dragging overall leveraged loan performance into the red ( -0.4%), even as high yield – with less software exposure – continues to deliver positive excess and total returns. (For a comprehensive discussion of software exposure across leveraged finance and the investment implications, see Mapping Software Exposure in Leveraged Credit.)

For credit markets more broadly, assessing software-related risks is both critical and difficult.

- Critical because the sector’s rapid expansion in recent years has been disproportionately concentrated in lower-rated, highly leveraged issuers.

- Difficult because, unlike equities, leveraged credit exposure is overwhelmingly tied to financial sponsor-backed private companies, where transparency is limited and access to financials or operating fundamentals is restricted – precisely the data needed to gauge exposure to AI-driven disruption.

Where do we go from here?

Sector sentiment is likely to remain weak, and it’s unclear what the next 'positive circuit breaker' could be. Credit investors may need time or a more meaningful price reset before stepping back in. Defaults remain low for now, but ongoing price declines could broaden and deepen as AI adoption progresses and uncertainty lingers over which companies face existential risk. When defaults do rise, we expect recoveries to be well below historical averages, given the asset-light nature of these companies.

More in the full Sunday Start note available to pro subs.