Morgan Stanley On Opportunities Amid Venezuela's Shock, Markets' Calm

By Vishwanath Tirupattur, Chief Fixed Income Strategist and Director of Quantitative Research at Morgan Stanley

Despite the far-reaching geopolitical implications of last weekend’s developments in Venezuela, financial markets have been strikingly calm – even optimistic. Oil prices have barely budged, global equities have rallied, and even safe-haven US Treasuries showed a muted reaction. In this week’s Sunday Start, we discuss the market response to this complex development and examine the opportunities and risks it presents.

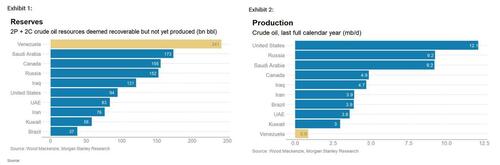

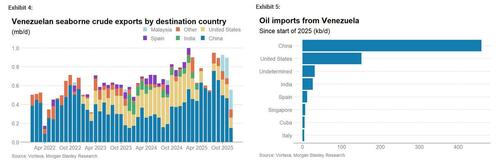

Start with oil – the commodity most exposed to the situation in Venezuela. Near-term supply appears manageable. As Morgan Stanley’s chief commodities strategist Martijn Rats notes, the market entered 2026 oversupplied, and inventories remain flush. That cushion explains why Brent barely budged, and why Martijn sees prices sliding into the mid-US$50s in coming months. The bigger story is medium term: the prospect of reviving Venezuela’s oil industry tilts production risks higher. Despite holding over 300 billion barrels, the world’s largest reserves, current output of just 0.8-1.0 million barrels per day makes Venezuela the smallest producer among major reserve holders.

More Venezuelan barrels hitting global markets could keep prices soft, even against a backdrop of geopolitical tension. For oil, near-term price risk is low while medium-term risks lean bearish.

In line with the expectations of our equity energy analysts led by Devin McDermott, energy equities have largely responded favorably, reflecting the potential for increased oil supply and specific company opportunities. US refiners stand out as poised to gain: a post-Maduro Venezuela could mean higher crude exports of the heavy, sour oil that these refiners are built to process. More imported heavy crude is a clear tailwind for US Gulf Coast refiners like Valero (VLO) and Marathon Petroleum (MPC), potentially lowering their input costs and improving margins.

As Devin and team anticipated, Chevron (CVX), the only US major still operating there under a sanctions waiver, rallied sharply. ConocoPhillips (COP) and ExxonMobil (XOM) also climbed on prospects of regaining access to Venezuelan reserves or securing compensation for past nationalizations. So, while the geopolitical story is complex, the market’s message in energy stocks is straightforward: the prospect of greater supply is good news, and some companies appear uniquely positioned to gain as Venezuela’s next chapter unfolds.

Nowhere has the market reaction been more dramatic than in Venezuela’s own sovereign debt. As Simon Waever, Morgan Stanley’s global head of sovereign credit strategy anticipated, prices of Venezuela’s defaulted bonds – both the government (VENZ) and state oil company PDVSA – soared to multi-year highs following the weekend’s events. The Venezuela/PDVSA bond complex has already rallied 26% since last weekend to reach an average price of US$35, thanks to the increased likelihood of a creditor-friendly transition. A clearer path for a potential debt restructuring deal improves the prospects for future debt recovery. We expect further upside as the markets price a higher recovery rate if Venezuela’s oil production increases. Also, there’s more value in the front-end, lower cash price bonds as even a modest recovery would imply outsized gains from current distressed prices. Simon expects PDVSA bonds to outperform sovereigns, given the likelihood of similar treatment in an eventual restructuring. The current PDVSA discount versus VENZ should narrow, with PDVSA gaining more on a percentage basis.

While Venezuela bonds dominated headlines, the potential for greater US-aligned political stability across Latin America adds a positive undertone for EM sovereign credit. Simon highlights Argentina and Ecuador among lower-rated credits, and Mexico/Pemex and Chile among higher-rated names. For EM debt broadly, this is a marginal positive – one less extreme outlier – rather than a source of instability.

Bottom line: Last weekend’s developments in Venezuela are a major geopolitical event, but the financial markets’ reaction reflects both the contained nature of the shock and the prospect of constructive outcomes ahead (more oil supply, creditor-friendly debt resolution). Oil markets are signaling that global supply can weather the storm, equity investors are cheering beneficiaries like refiners and seeing the broader risk backdrop as unchanged, and bond investors are selectively adding Venezuela’s beaten-down debt on hopes of an eventual recovery. We will continue monitoring the situation closely. For now, the takeaway is that this political event has not affected the market’s positive momentum – if anything, it has created pockets of opportunity and reinforced prevailing trends (ample oil, strong credit appetite). As always, we’ll keep you informed of any material changes.

Enjoy your Sunday.

More in the full Sunday Start note available to pro subs.