Morgan Stanley Quants: A 2% Drop Will Trigger $45BN In Forced Selling

Following today's sudden - and massive - deleveraging blast, which at its peak wiped out $2.5 trillion in value from gold...

$2.5 trillion wiped out in 30 minutes. That's roughly the entire market cap of crypto. https://t.co/3ErXptZarH pic.twitter.com/WtT1A2OXJy

— zerohedge (@zerohedge) January 29, 2026

... not to mention slamming tech stocks and crushing bitcoin (which has become the anti-anti risk asset, sold during both risk on and risk off episodes), we have seen an outpouring of questions from readers about when/where will automatic sell triggers kicking, whether among the vol control, CTA or levered ETF communities.

Below we excerpt from today's Morgan Stanley QDS note, which answers all your pressing questions:

-

Equity supply from systematic macro strategies (CTAs, vol control, risk parity) has the potential to grow alongside the equity selloff given elevated equity leverage sitting in the 90th %ile vs the last 5 years.

-

If SPX ends the day at -1%, equity supply in the next week is still modest at -$15bn (-0.5 z-score magnitude), but at -1.5%, that grows to $25-30bn (-0.9 z-score magnitude), and at -2% that grows to $40-45bn in the next week (-1.3 z-score magnitude), some today but mostly spread over the next few days.

-

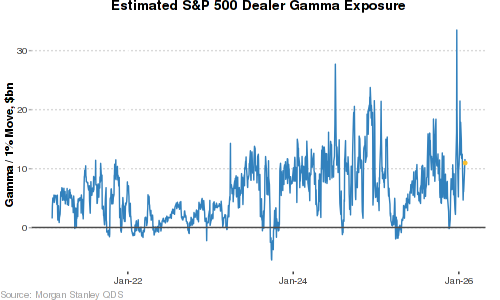

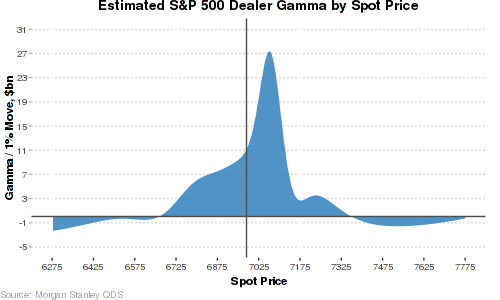

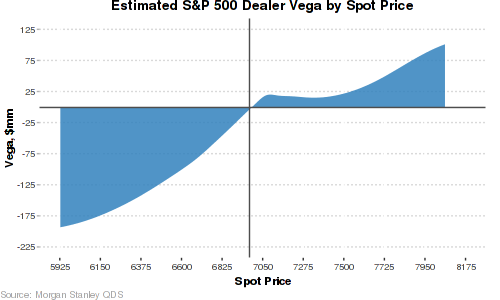

We flagged previously that S&P 500 option dealers are long $7-8bn of gamma / 1% move at spot (or about $10bn of delta demand with SPX at -1.4%), which can provide some intraday cushion to US equities...

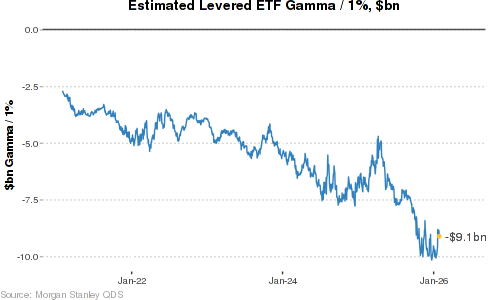

- ... but levered ETF rebalancing flow is expected to be larger, given much of the levered ETF short gamma is benchmarked to Tech, which is underperforming.

MS leaves the scariest observation for last:

- With NDX -2.2% and SPX -1.4%, levered ETF rebalancing supply is est. to be in the top 20 largest days on record on QDS’s estimates.

The good news is that since the note was sent out, both the S&P and the Nasdaq are well off the lows, which means that the levered ETF rebal which takes place in the last 30 minutes of trading, will not be as big a wrecking ball as it would have been absent the bounce.

Professional subscribers can read much more from Morgan Stanley's team here at our new Marketdesk.ai portal