Morgan Stanley Quants Warn Of Billions In Levered ETF And Systematic Selling, No Retail Buyers

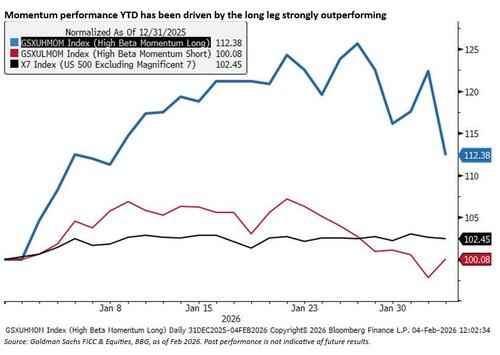

As we wrote extensively earlier (here and here and elsewhere), today was a Momentum VaR shock driven by the long leg.

According to Morgan Stanley's Quant team (QDS) crowded positioning coincided with an air pocket in demand, leaving consensus longs without a marginal buyer. A snapback in Momentum and consensus longs is possible after today, but QDS would sell any bounce in Momentum, given

- HF positioning is unlikely to be fully cleaned up in a single day, and

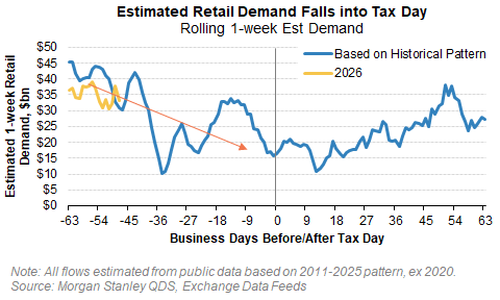

- retail demand risk into Tax Day is still a near-term overhang.

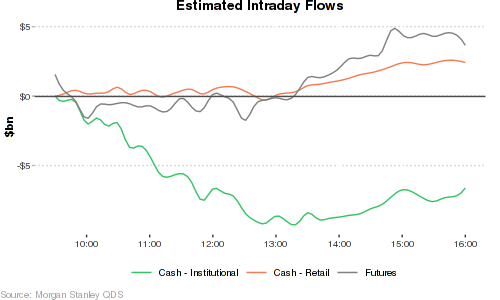

More ominously, retail did not buy today’s dip until the afternoon, alongside the market bounce, with net retail demand ending in just the 16th 1y percentile. Institutions were net sellers across cash and futures in the morning though futures demand recovered in the afternoon. On the day, institutional cash supply ended in the 11th 1y percentile while futures demand ended in the 65th 1y %ile. Below-average retail demand alongside institutional cash supply left consensus longs without a marginal buyer, pressuring AI (MSXXAI), National Security (MSXXNSEC), Rare Earths (MSXXRMAT), and Retail Favorites (MSXXRFLO). With High Short Interest stocks (MSXXSHRT) underperforming (-1 z-score move) and breadth narrow, today reads as concentrated long reductions rather than broad L/S de-grossing.

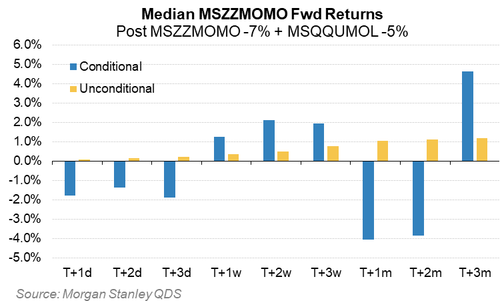

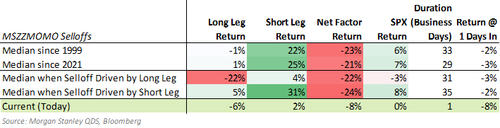

Today’s price action was notable given the magnitude of the L/S Momentum move and how concentrated the pair’s performance was driven by the long leg. Morgan Stanley's L/S Momentum pair – MSZZMOMO – fell 7.7%, a 4 sigma move with Momentum longs accounting for the bulk of that (MSQQUMOL -5.7%, a -2.5 z-score move) vs Momentum shorts that were up only a small amount (MSQQUMOS +1.9%, +1 z-score). Historically, MSZZMOMO 1-day selloffs of -7% or more that coincide with long-leg weakness (MSQQUMOL down -5% or more the same day) have been a negative signal for MSZZMOMO in the subsequent few days, but returns were choppier over longer time horizons. In the median 1-2m, performance was typically negative before turning positive on a 3m basis, although the sample size is small (just 10 other times since 2000: 4/3/00, 4/10/00, 4/12/00, 4/24/00, 5/23/00, 11/9/20, 2/22/21, 3/3/21, 3/24/21, and 1/27/25).

While a Momentum snapback is possible, Morgan Stanley's Quants see potential for continued weakness in Momentum and related themes in the next couple of months given still-stretched HF positioning and the potential for a retail slowdown, both of which are correlated to Momentum. Historically, when Momentum selloffs are long-led, the median selloff has lasted ~28 trading days with a median peak-to-trough MSZZMOMO drawdown of roughly -22%.

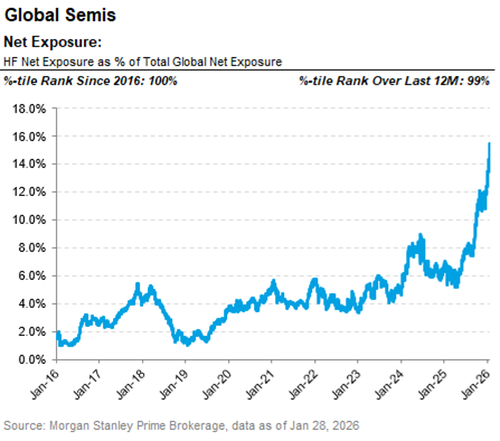

Contributing to the velocity and contagion of today’s moves has been the massive crowding in the global Semis trade: coming into today, Global Semis accounted for 16% of HF books vs 6% a year ago. The total $ amount bought globally across Semis YTD is (A) >5x larger in $ terms than any other industry YTD (across all sectors), (B) ~half of what was bought within Semis throughout all of 2025, and (C) larger than demand for any other industry in all of 2025 (excluding Semis). In that context, it is not surprising that AMD’s shock propagated quickly.

Institutions are hurting, but retail is hurting even more:retail participation was notably absent compared to prior sessions as demand sat in the lower quartile, a sharp contrast to the aggressive retail bid seen during last week’s rallies and even during yesterday’s Software-led selloff. Retail Favorites (MSXXRFLO) are now -11% in the last week. QDS has been highlighting the risk of a retail slowdown into Tax Day off the historic pace of retail demand in January. Today’s extremely light retail demand also weighed on Momentum given the overlap between L/S Momentum and MSXXRFLO is in the 84th %ile since 2017. While retail ended the day as a small net buyer of stocks, it was well below the 1y average pace (16th %ile). Had they ended the day as net sellers, it would have been the first day of retail supply since September 4th, 2025.

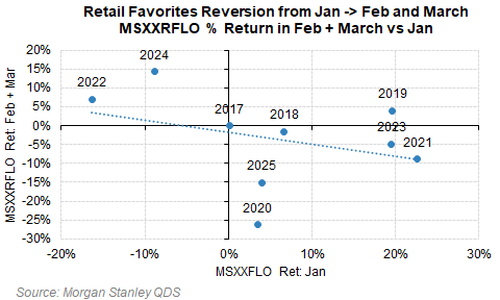

Here an important note on seasonality: there is a notable seasonal pattern in retail performance: MSXXRFLO returns in January are negatively correlated with returns in February + March (~ -34%). In practice, strong January retail-led performance often sees reversion in the following two months, consistent with retail demand fading as tax-related liquidity pressures build. Retail Favorites (MSXXRFLO) were +14% YTD through Jan 28th, and Retail Favorites are now -11% in the last week. YTD, Retail Favorites are now up just 2%.

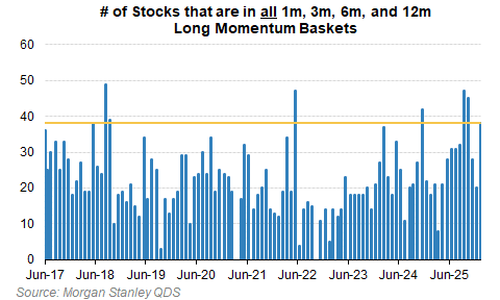

Additionally, crowding risk in the market is also amplified by overlap across Momentum tenors, which is back to historically high levels. Currently, 38 names appear in all four tenors of Long Momentum baskets (1m, 3m, 6m, 12m). Historically, when overlap across all four tenors is high (>35 stocks), Long Momentum (MSQQUMOL) subsequent returns have been negative over the next 1-3m (sample size = 9). And the three biggest stocks that are in all 4 tenors of the MS Long Momentum baskets are Semis names. Ask for the list of stocks in all 4 tenors of Long Momentum.

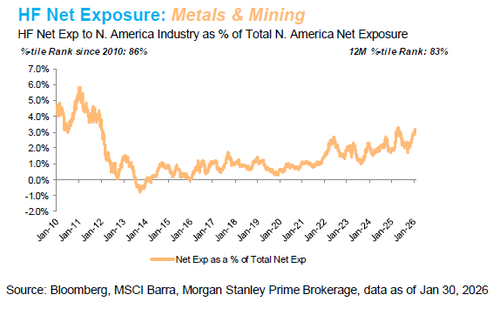

Another increasingly painful pressure point is that Hedge Funds, retail, and Momentum have increasing exposure to Metals and Mining, especially gold and silver. Hedge Fund exposure to Metals and Mining stocks was near the highs heading into today (86th %ile since 2010 per MS PB Content).

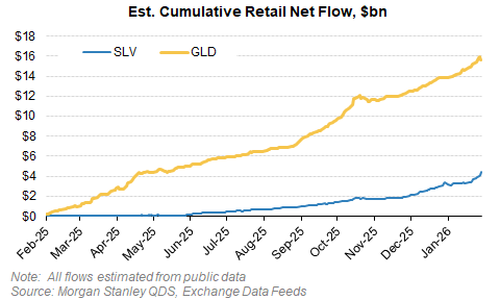

Retail has bought >$20bn of GLD and SLV over the last year on QDS estimates based on public data, with demand accelerating more recently (until last Friday). The Retail Favorites basket – MSXXRFLO – now includes ~7 Metals and Mining stocks, more than double the average from 2017-2024. Plus, MSZZMOMO has a net +11% long industry exposure to Metals and Mining given that Metals and Mining stocks account for 11% of the long leg (MSQQUMOL) and 0% of the short leg (MSQQUMOS).

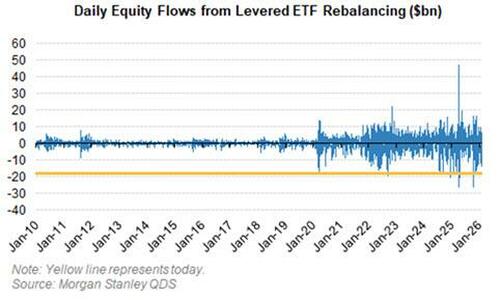

Finally, mechanical supply also exacerbated today’s moves and has the potential to do so going forward: Levered ETF rebalancing translated to roughly $18bn of US equity supply on the day — placing today in the top 10 largest levered ETF supply days on record, with a large share concentrated in NDX/Tech/Semis and meaningful single-name impacts (TSLA, NVDA, MU, PLTR, AMD, IREN each >$100mm).

Dealer gamma dynamics offer limited relief: while dealers remain long gamma in options, that exposure has fallen meaningfully, and once offset by levered ETF short gamma, the street was effectively net short gamma, exacerbating intraday moves as selling pressure built. Looking ahead, systematic supply remains a risk, with $10bn estimated over the coming week, particularly if volatility remains elevated and equity leverage — still sitting near the upper end of historical ranges — begins to unwind more forcefully.

More in the full Morgan Stanley QDS note available to pro subs.