No, Europe Is Not About To Sell Its Treasuries En Masse

Authored by Simon White, Bloomberg macro strategist,

Any potential threat by Europe to sell its Treasuries in retaliation for President Donald Trump’s aim to annex Greenland is likely to be an empty one.

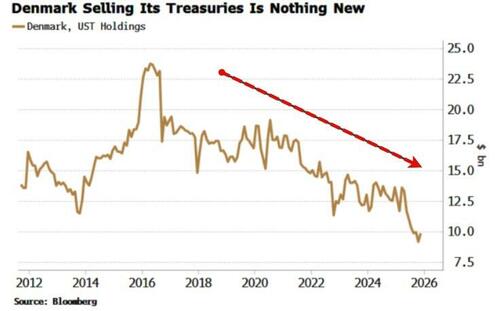

A Danish pension firm’s announcement that it would sell its Treasury holdings has added sustenance to the notion that Europe more broadly will start selling its holdings en masse.

But unless they want to cut off their nose to spite their face, they won’t, for several reasons.

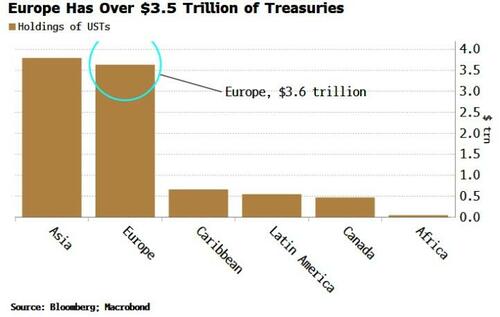

First, Europe is the second largest holder of Treasuries, with more than $3.5 trillion, just shy of Asia’s total, but unlike in Asia, the majority of Treasuries in Europe are not held by central banks.

It would take a corralling of private holders to force a coordinated sale, less likely than governments ordering their central banks to do so.

Second, the rise in US yields it would precipitate would be a problem for everyone.

The global cost of funding would rise, and this would have a greater impact on Europe’s less-strong economy than the US’s.

Thirdly, who would buy Europe’s Treasuries at current prices?

Emerging central banks mainly in Asia are the largest foreign holder of Treasuries, and they have stopped accumulating them.

And in the US, positioning shows a reluctance to own USTs, at least at their current price. Europe would have to sell its holdings at a hefty discount.

Fourthly, what would Europe do with the proceeds?

Buying European assets would mean pushing the euro higher, very problematic in a highly competitive world, perhaps at the onset of another trade war.

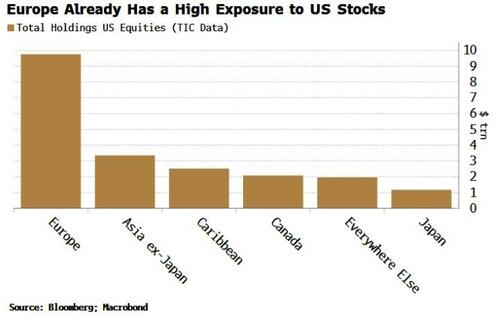

And buying US stocks won’t seem attractive given the very action of Europe selling their Treasuries would be bad for risk markets.

Moreover, the continent is already the largest foreign holder of US stocks, with almost $10 trillion of them.

So Treasury Secretary Scott Bessent is correct to say the narrative of Europe selling its Treasuries is a false one.

As with the frequent suspicions that China would actively sell its Treasuries, it’s a story that’s unlikely ever to play out.