Noncommittal Fed Sparks Battle Across Russell 2000 Traders

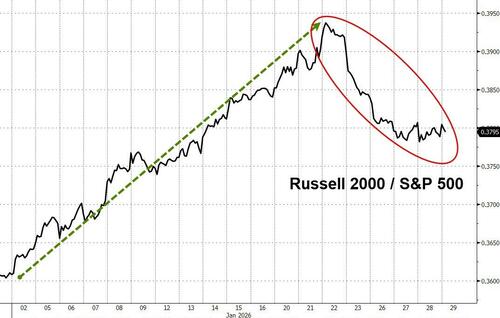

After 14 straight days of outperformance, the Russell 2000 has underperformed the S&P 500 for the last five days...

Tow big legs down in the last two days have hurt but we note the 'non-committal' Fed prompted only volatility and not a directional play yesterday...

As a reminder, Fed Chair Powell's December 2025 press conference sparked buying in Russell 2k futures which generally persisted through mid-January.

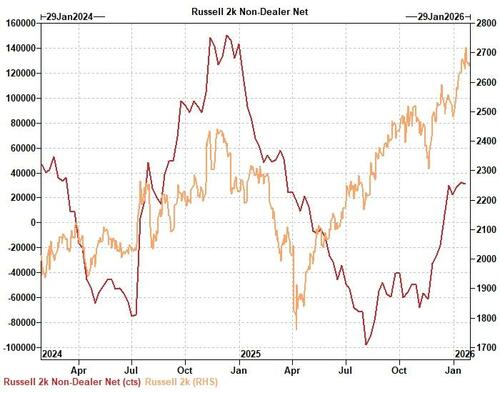

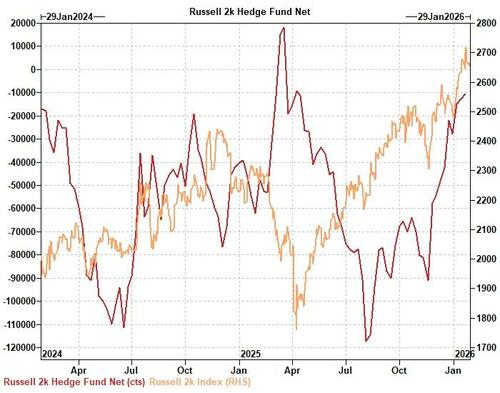

As top Goldman Sachs futures trader Robert Quinn highlighted this morning, according to Commitment of Traders (COT), Non-Dealers purchased +$3.1bn during December 9th - 16th, marking the 2nd largest amount for the previous year. This week encapsulated the December Fed decision and press conference, where Powell expressed concern over the labor market and confidence on inflation deceleration.

Non-Dealers bought in 3 of the 5 subsequent weeks through January 20th for a cumulative +$6.2bn since December 9th.

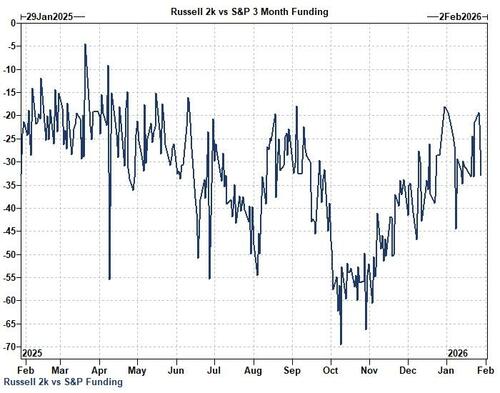

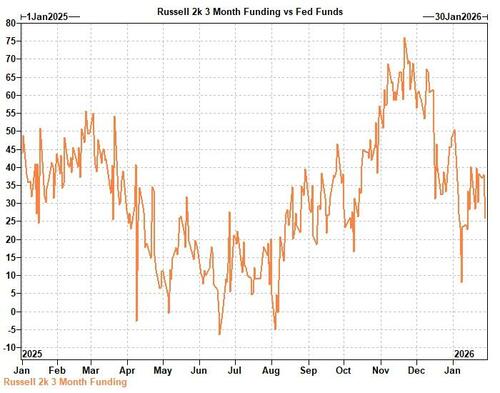

Furthermore, support potentially extended in the days uncaptured by COT. Consider Russell 2k's funding discount to S&P 500 narrowed over January 20th - 27th.

That said, recall the categorical breakdown became less constructive with more volatile categories posturing for easier monetary policy into a backdrop of cyclical strength.

Hedge Fund emerged as the largest buyer; new gross longs jumped +$4.2bn.

Since early 2024, the standard deviation of Hedge Fund gross long changes was ~3.5x that of Asset Manager.

Through a largely noncommittal January Fed announcement plus Powell Q&A, Russell 2k sentiment seemingly wavered.

On January 28th, the Fed signaled cautious optimism, lowering the probability of imminent rate reductions.

As a result, Russell 2k underperformed in price terms with bearish leveraged flows manifesting.

Consider Russell 2k 3 month funding registered a decent drop in outright and relative terms.

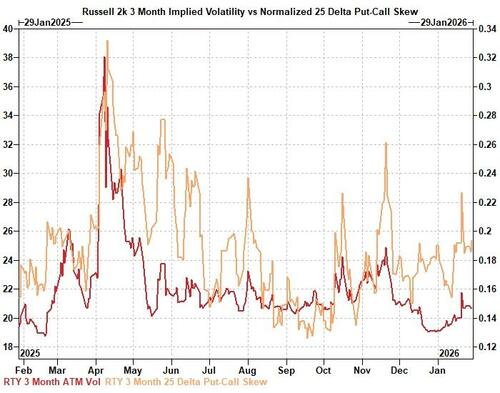

In addition, 3 month normalized 25 delta put-call skew richened.

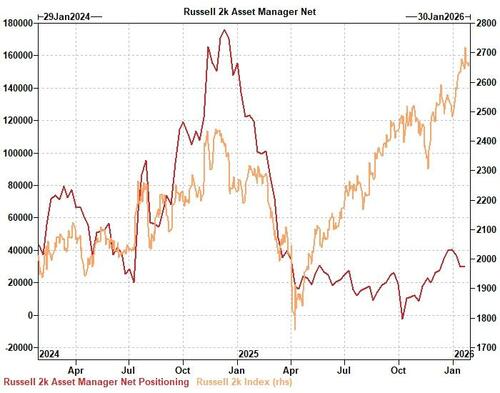

The key question is whether Asset Manager absorbs any Hedge Fund profit taking.

As of January 20th, Asset Manager net length resided at an underwhelming 44% 2 year rank.

For now, we'd say, the hedgies are winning!

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal