NS

NSNovo's Wegovy pill approved in the US as the first oral GLP-1 treatment; JPY outperformer following further jawboning - Newsquawk EU Market Open

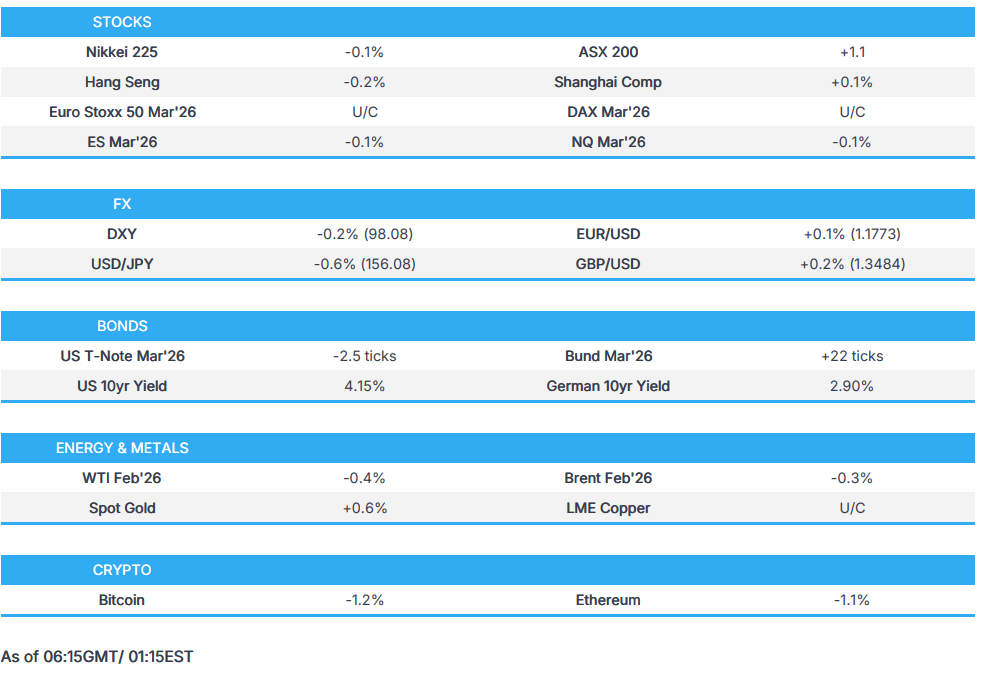

- APAC stocks eventually traded mixed after initially taking their cue from Wall Street, although volumes and news flow remained subdued as markets wound down for the holiday period.

- JPY extended its prior session’s advances, and USD/JPY eventually dipped under 156.00, whilst the CNH saw notable strength.

- US President Trump said the US will keep the ships and oil seized near Venezuela.

- Novo Nordisk (NOVOB DC) said the Wegovy pill is approved in the US as the first oral GLP-1 treatment for weight management.

- European equity futures are indicative of an uneventful cash open with the Euro Stoxx 50 U/C after cash closed -0.3% on Monday.

- Looking ahead, highlights include German Import Prices (Nov), Spanish GDP Final (Q3), US Richmond Fed (Dec), Durable Goods (Oct), GDP Advance (Oct), PCE Prices (Q3), Industrial Production, Consumer Confidence, Canadian GDP, BoC Minutes (Dec Meeting), Supply from US.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks trended higher through the European and US sessions before paring modestly into the close, with the Russell leading the advance.

- Sector-wise, Materials, Financials and Energy outperformed; Materials were supported by strength in metals prices, while Energy was underpinned by firmer crude amid escalating geopolitical tensions.

- SPX +0.56% at 6,873, NDX +0.46% at 25,462, DJI +0.47% at 48,363, RUT +1.08% at 2,557.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Bank of America (BAC) CEO Moynihan said the bank is projecting a strong economy for 2026. Expects 2.4% growth next year, up from about 2%. Unemployment numbers are normalising after a tight market.

NOTABLE US EQUITY HEADLINES

- Warner Bros Discovery (WBD) confirms receipt of amended, unsolicited tender offer from Paramount Skydance (PSKY).

- NVIDIA (NVDA) reorganises Cloud division, effectively ending direct competition with AWS (AMZN), according to The Information; DGX Cloud team shifts focus to internal NVDA engineering needs. Cloud division head Alexis Black Bjorlin seeks a new internal role.

- Democratic lawmakers want the Commerce Department to disclose all requests for licenses for NVIDIA (NVDA) to ship H200 AI chips to China.

APAC TRADE

EQUITIES

- APAC stocks eventually traded mixed after initially taking their cue from Wall Street, although volumes and news flow remained subdued as markets wound down for the holiday period.

- ASX 200 was underpinned by strength in gold miners after the yellow metal printed a fresh all-time high near USD 4,500/oz, supported by a softer USD and ongoing geopolitical tensions.

- Nikkei 225 initially saw shallower gains than peers as a firmer yen, following official jawboning, capped upside for the index, whilst further gains in the JPY later took the index into the red.

- KOSPI extended its tech-led rally, with Samsung Electronics shares pushing toward near all-time highs.

- Hang Seng and Shanghai Comp initially tracked the broader risk tone, while fresh region-specific catalysts remained scarce. Hang Seng later gave up earlier gains.

- US equity futures resumed trading on a flat footing before briefly adopting a mild upward bias in line with the constructive tone across APAC. Futures then tilted lower as some APAC benchmarks turned mixed.

- European equity futures are indicative of an uneventful cash open with the Euro Stoxx 50 U/C after cash closed -0.3% on Monday.

FX

- DXY remained subdued towards the bottom end of a 98.037–98.237 range amid holiday-thinned conditions, with upside capped by persistent yen strength. The index extended the prior session’s downside pressure, driven by gains in both JPY and AUD, with the latter supported by strength in gold and copper.

- JPY extended its prior session’s advance following remarks from Japanese Finance Minister Katayama, who noted the Ministry of Finance had a “free hand” to take bold action on the currency. USD/JPY drifted lower to a dip under 156 from an earlier high of 157.07.

- CNH firmed alongside the yen but retreated from its best levels after the PBoC fixing came in weaker than expected, despite marking its strongest level since late September 2024. CNH later notably re-strengthened, pushing to fresh intraday highs.

- AUD remained underpinned by continued record highs in gold, trading near USD 4,500/oz, alongside recent gains in copper prices. Markets showed little reaction to the RBA minutes, which indicated the Board debated whether a rate increase might be required at some point in 2026, while also noting that maintaining the cash rate for an extended period could be sufficient to keep the economy in balance. NZD/USD briefly popped higher after clearing the 0.5800 level.

- EUR and GBP were largely uneventful amid a dearth of meaningful catalysts as markets wound down for the holiday period, with both pairs moving broadly in line with the USD.

- PBoC set USD/CNY mid-point at 7.0523 vs exp. 7.0267 (Prev. 7.0572); strongest fix since Sept 30 2024.

FIXED INCOME

- 10yr UST futures traded with a modest upward bias after previously tracking JGB weakness during Monday’s APAC session, before seeing limited follow-through in US trade. Global debt contracts held a broadly firmer tone overnight, albeit in an environment notably devoid of fresh catalysts.

- Bund futures moved in step with their peers, with price action remaining tentative amid a lack of clear drivers as markets headed into the holiday period.

- 10yr JGB futures outperformed, at one point rising by around 36 ticks after underperforming the prior session, while the yen simultaneously reversed its early-week weakness following verbal jawboning from Japanese Finance Minister Katayama. JGB futures then rose further after Japanese PM Takaichi said Japan's national debt is still high, and rejected any "irresponsible bond issuance or tax cuts", via a Nikkei interview.

- US sold USD 69bln of 2-year notes; tails 0.3bps. Tail: 0.3bps (prev. 0.0bps, six-auction average -0.4bps); WI: 3.496%. High Yield: 3.499% (prev. 3.489%, six-auction average 3.652%). B/C: 2.54x (prev. 2.68x, six-auction average 2.61x). Dealer: 12.7% (prev. 11.2%, six-auction average 11.2%). Direct: 34.1% (prev. 30.7%, six-auction average 31.7%). Indirect: 53.2% (prev. 58.1%, six-auction average 57.1%).

COMMODITIES

- Crude futures consolidated after the prior session’s geopolitically driven gains, with prices largely flat throughout the APAC session.

- Spot gold extended its relentless advance, underpinned by ongoing geopolitical risks and a softer USD, with prices trading a whisker below USD 4,500/oz after having cleared USD 4,400/oz in the prior session.

- Copper futures remained broadly flat despite the weaker dollar and constructive risk tone across APAC, with 3M LME copper hovering just below USD 12,000/t and closer to USD 11,900/t.

- Cheniere Energy (LNG) completes Train 4 at the Corpus Christi liquefaction Stage 3 project in Texas.

CRYPTO

- Bitcoin was subdued, slipping back below USD 88,000 amid a sparse catalyst landscape and light directional drivers.

CENTRAL BANKS

- ECB's Schnabel said one should not expect a rate hike at present or in the foreseeable future, according to Faz; believes there are more inflationary than disinflationary forces at work. At some point will need to raise rates, but not in the foreseeable future.

- Bank of Korea board member Chang said Efforts will be maintained to stabilise the forex market. Market-stabilising measures will be proactively sought if needed. It is necessary to remain cautious about financial instability. Volatility is increasing in financial and forex markets. One-sided FX moves are expected to ease going forward on policy measures.

- RBA Minutes: Board discussed whether a rate increase might be needed at some point in 2026; holding the cash rate steady for some time could be sufficient to keep the economy in balance. October CPI suggested a risk that Q4 inflation could also be higher than forecast. The board discussed whether a rate increase might be needed at some point in 2026. Recent data suggested risks to inflation had lifted to the upside.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama declined to comment on forex levels or interest rates, and said Japan will take appropriate action. She reiterated they have a "free hand" to respond to excessive moves in the JPY. she added that FX moves after the BoJ press conference are speculative and not reflecting fundamentals, and the market has stabilised somewhat since yesterday.

- Japan is likely to assume long-term interest rates of around 3% for its FY2026 budget, the highest level in 29 years, according to Reuters sources.

- Japanese PM Takaichi said Japan's national debt is still high, and rejected any "irresponsible bond issuance or tax cuts", according to a Nikkei interview.

- China held a policy conference on housing on Dec 22–23, state media reports; will focus on stabilising the real estate market and will take steps to destock and optimise housing supply; Will implement city-specific policies to control new housing supply, and will vigorously implement urban renewal in 2026.

- ByteDance reportedly plans USD 23bln AI spending spree to keep pace with US rivals, according to the FT.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukrainian President Zelensky said "Negotiations to end the war are “close to achieving a result" according to Sky News Arabia.

- Russia's Kremlin states Ukraine peace talks over the weekend did not achieve a breakthrough.

- Russia needs to understand to what extent the US’ work with Ukraine and Europe on a peace plan corresponds to the spirit of the earlier Putin-Trump Alaska summit, via TASS.

- Odesa regional governor said Russian forces launch new evening drone attack on Ukraine's Odesa, damaging port facilities and a civilian ship.

- US VP Vance said he doesn’t have “confidence” there will be a peaceful solution to the Russia/Ukraine conflict, said but negotiations will continue and thinks progress has been made.

- Russia conducted airstrikes on the Ukrainian capital Kyiv, according to Ukraine's military. Russia is again attacking Ukraine’s energy infrastructure, according to Ukraine’s energy ministry.

- US President Trump said Ukrainian talks are going along; talks are going "okay".

MIDDLE EAST

- US and its allies are renewing their push to hold a conference on Gaza reconstruction, via Bloomberg.

- Israeli PM Netanyahu said Israel knows Iran is conducting 'exercises' recently, and basic expectations from Iran have not changed. Iran's nuclear activities will be discussed with Trump.

- "Israel's Channel 12: Israel fears miscalculation with Iran, assures Washington that it will not take risks", via Sky News Arabia.

US-VENEZUELA

- US President Trump said US will keep ships and oil seized near Venezuela.

OTHERS

- US Southern Command said a joint task force carried out a lethal kinetic strike on a low-profile vessel in international waters, killing one male, with no US military forces harmed.

- US President Trump says he approved plans for the Navy to start building two new battleships; will work to increase the number of aircraft carriers; will be "100 times more powerful than any battleship ever built". The new ships we will build will ensure our military superiority.

- US President Trump said "we need Greenland".

EU/UK

NOTABLE EUROPEAN EQUITY HEADLINES

- Novo Nordisk (NOVOB DC) said Wegovy pill is approved in the US as the first oral GLP-1 treatment for weight management after showing 16.6% weight loss in the Oasis 4 trial, and said it plans to launch the drug in the US in January 2026. US-listed shares +5% after market.

- US President Trump said he told French President Macron that France has to raise its drug prices.

- EU is preparing checks on imported plastics and other measures to shore up its recycling industry, according to FT.