ADP Employment Report Signals Rebound In Labor Market; Claims Confirm Resilience

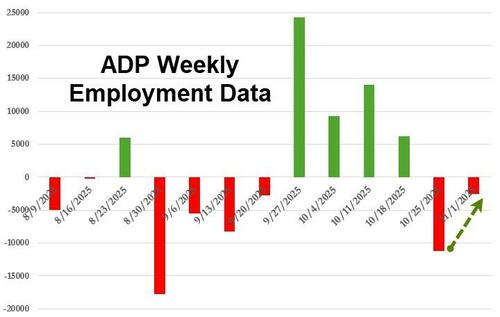

For the four weeks ending Oct. 31, 2025, private employers shed an average of 2,500 jobs a week, according to ADP's new weekly employment report update, suggesting that the labor market improved significantly in the last week (from an 11,250 average drop during the prior week).

Extrapolating with some simple math that implies a monthly drop of 10,000 jobs...

While job growth is admittedly sluggish, ADP reports that new hires are on the upswing:

In October, new hires accounted for 4.4 percent of all employees, ADP payroll data shows, up from 3.9 percent a year ago.

This growing share of new hires would seem to run counter to the slowed pace of hiring. That contradiction tells us a lot about today’s jobs market.

New hires typically fluctuates with the business cycle, but the aging U.S. workforce means that demographics have begun playing a bigger role in hiring decisions.

Employers are hiring to replace existing workers, not increase headcount.

ADP continues to note that employers are taking on a bigger share of new hires, even amid a slowdown in job creation.

This suggests that more workers are heading for the exits.

Demographic data also suggests that the drop in new hires isn’t due to normal business cycle dynamics. Thirty-six percent of U.S. workers are 55 or older. In 2015, less than 25 percent U.S. workers were that old.

This change has put employers on new footing. Increasingly, hiring is no longer driven primarily by customer demand and economic fluctuations, but by a need to replace a growing number of departing workers.

Additionally, after more than six weeks of government shutdown, official macro data is starting to flow... but it's lagged.

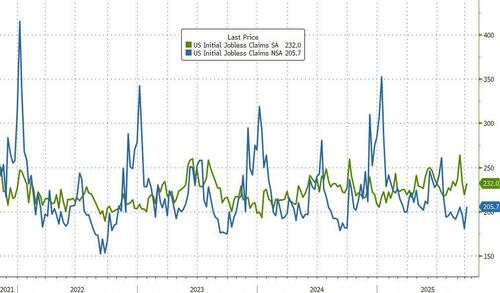

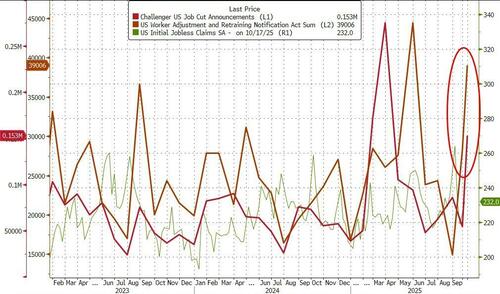

The number of Americans applying for jobless benefits for the first time totaled 232,000 in the week ended Oct. 18, according to the Labor Department website. This print certainly shows no sign of the potential weakness that many have anticipated (but then again it's a month old).

Source: Bloomberg

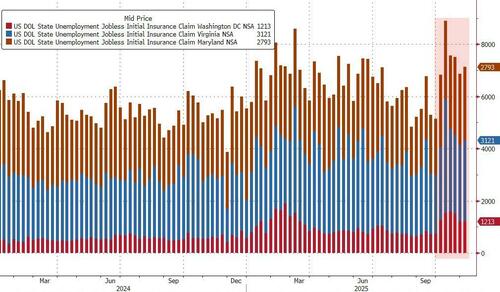

However, unadjusted state-level claims data was released, and that confirmed a pick up in initial jobless benefit demands... especially in the 'Deep TriState'...

Source: Bloomberg

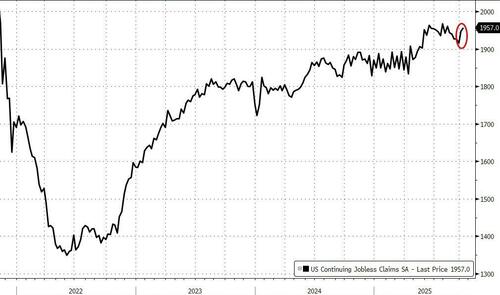

Continuing jobless claims picked up, but remains below mid-summer highs...

Source: Bloomberg

So, now we know that a month ago, claims data showed a still resilient labor market.. but we also know - based on private data suppliers - that job cut announcements have accelerated notably...

Source: Bloomberg

So, choose your own adventure with this data. We suspect there will be a lot more of this in the next few days as more and more (delayed) data is released.