Is PPI Masking Some Unwelcome Surprises For Treasuries?

Authored by Simon White, Bloomberg macro strategist,

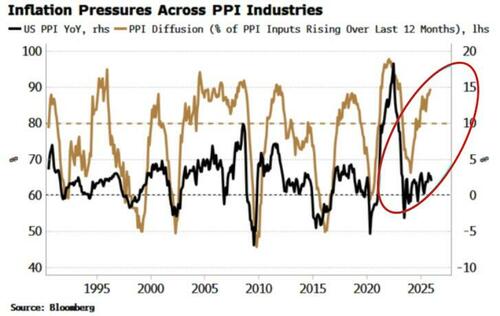

December’s higher-than-expected PPI caused an initial swing in bonds before they pared most of the move.

That could be because there’s still some skepticism on the data after the government shutdown.

Nonetheless, it’s emanating some undeniable inflation pressures under the surface that may weigh on Treasuries.

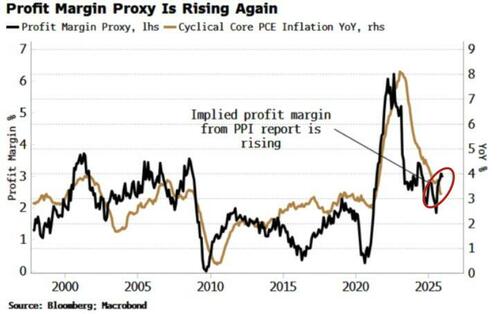

The primary services component is a proxy for the profit margin for the industry types covered in the PPI report.

The indicator in the chart below takes the median of the primary services components across all industries. It has very clearly been rising again.

Profit margins rose sharply in the pandemic, and haven’t returned to the levels seen before.

This is likely one of the reasons for sticky inflation.

The profit margin proxy closely tracks cyclical core PCE, i.e. those parts of PCE most correlated with Fed policy.

The conclusion: with a malleable Federal Reserve, profit margins aren’t likely to come down. I doubt Kevin Warsh will make much difference to this.

He is set to have a difficult task whatever happens, either defending cutting rates when it’s clear inflation is a problem, or suggesting to President Donald Trump that a hike is necessary.

With inflation pressures building across the board (see chart below), doing nothing won’t be an option in perpetuity.

As mentioned earlier, hedge funds look like they have been getting longer Treasuries, but given burgeoning inflation pressures they may find themselves the wrong way around.