NS

NSPrecious metals back underpressure; Crude falls as US-Iran talks are to proceed - Newsquawk EU Market Open

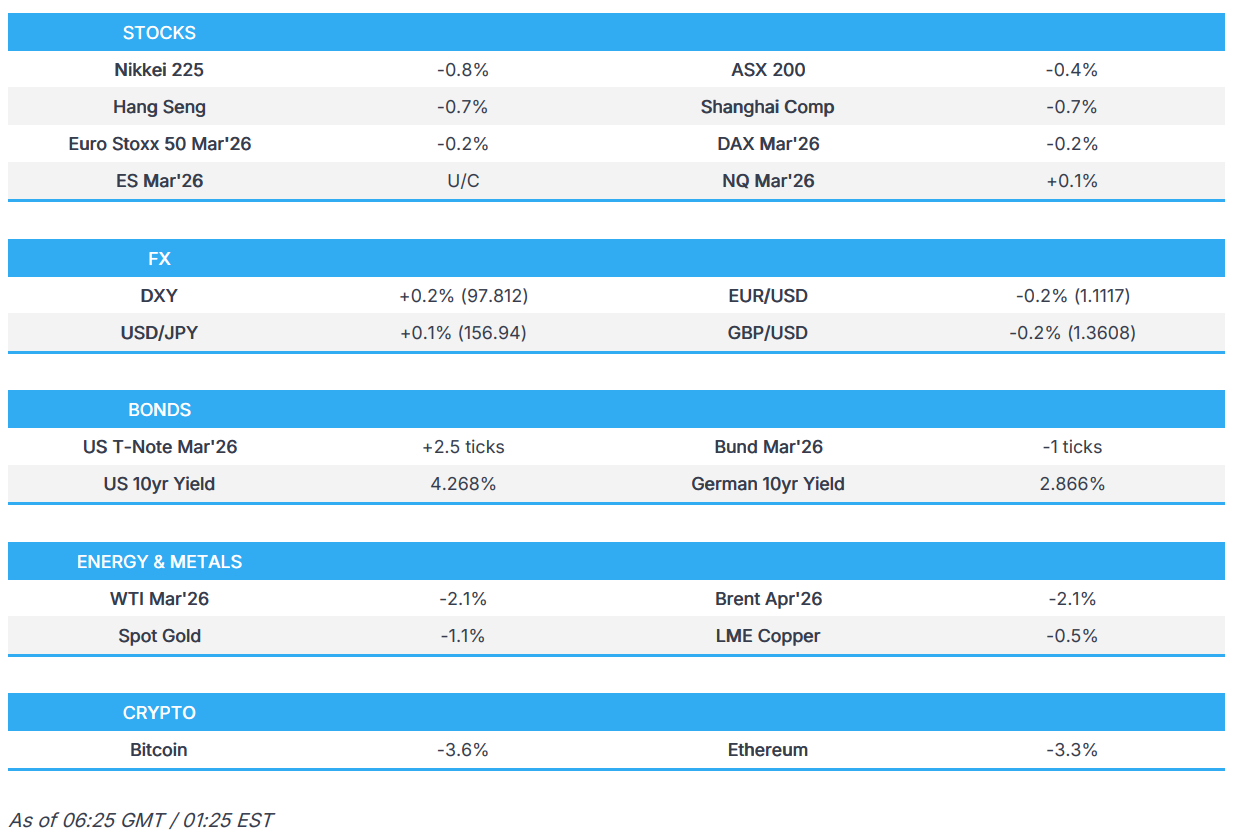

- APAC stocks were mostly lower following the continued tech selling stateside and flip-flopping regarding US-Iran talks, while commodities were pressured overnight with silver prices dropping by a double-digit percentage.

- Earnings saw Alphabet shares fall 2.0%, ARM Holdings slip 8.6%, and Qualcomm slump 10.3% after market.

- US President Trump said not much doubt that interest rates will be lowered and thinks that Warsh wants to cut rates anyway.

- US BLS rescheduled the January employment report for Feb. 11th, while it rescheduled December job openings and labour turnover report for February 5th, and rescheduled January CPI to February 13th.

- Looking ahead, highlights include German Factory Orders (Dec), EZ Retail Sales (Dec), US Challenger (Jan), Weekly/Continuing Jobless Claims, Revelio PLS, ECB Announcement, BoE Announcement & MPR, Banxico Announcement, CNB Announcement. Speakers include BoE’s Bailey, ECB’s Lagarde, Fed’s Bostic, BoC’s Macklem & RBA's Bullock. Supply from Spain & France.

- Earnings from Amazon, Strategy, Roblox, Reddit, Bloom Energy, ConocoPhillips, Bristol Myers Squibb, Barrick Mining, Cigna, Linde, Shell, Unilever & UniCredit.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stock indices finished mostly lower on Wednesday, primarily due to losses in AI-related names, with semiconductors, software, memory and robotics pressured. That said, breadth was very strong, highlighted by gains in the Equal-Weight RSP, while Energy, Materials, and Staples, the best three performing sectors YTD, continued to see gains given their little exposure to the AI complex, while Healthcare was boosted by a strong Eli Lilly (LLY) earnings report.

- Furthermore, AMD earnings contributed to downside in the tech space, as valuation concerns lingered, particularly over expenses, despite beating on quarterly metrics and guidance. Precious metals also saw downside at the US equity open alongside crypto, with gold reversing earlier gains, albeit losses were limited given the increased US-Iran tensions.

- SPX -0.51% at 6,883, NDX -1.77% at 24,891, DJI +0.53% at 49,501, RUT -0.90% at 2,625.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump's administration is said to be willing to allow ByteDance to buy NVIDIA's (NVDA) H200 chips, although the Co. has not agreed to the proposed conditions.

- USTR said the US and Mexico are to explore border-adjusted price floors for critical minerals imports over the next 60 days, and are consulting on how price floors could be included in a plurilateral agreement on trade in critical minerals.

- EU Commission President von der Leyen said the next step is a bilateral EU-US agreement on raw materials following the EU, Japan, and US plurilateral trade initiative on critical minerals

NOTABLE HEADLINES

- US President Trump said not much doubt that interest rates will be lowered and thinks that Warsh wants to cut rates anyway. Trump added that Warsh would not have gotten the job had he said he wanted to raise rates, according to NBC.

- US President Trump said the Fed is, in theory, an independent body and stated he is looking at tariff rebate checks very seriously, but hasn't committed to tariff rebate checks yet, while he discussed expanding immigration operations to five cities.

- US Treasury Secretary Bessent said he has no opinion on whether Trump has the authority to fire the Fed chair or a board member over a policy disagreement. Bessent also said that he thinks they can continue to see the 10yr yield tick down and noted that foreign inflows into USTs remain strong and massive flows continue into US equities.

- US Senate Banking Committee Chairman Tim Scott (R) said he wasn’t aware of any statement Fed Chair Powell had made during his testimony last year that would be evidence of perjury, according to WSJ.

- Fed's Cook (voter) said she is focused on inflation risks and noted that when considering the proper stance of monetary policy, she sees risks to both sides of the dual mandate. Cook stated that progress on inflation has stalled and that such a plateau is frustrating after seeing significant disinflation in the preceding few years. Furthermore, she said it is essential that they maintain credibility by returning to a disinflationary path, while she hopes that goods inflation will dissipate quickly, and said once it does, they should be back on the disinflationary path.

- Federal Reserve finalised the big bank stress test criteria, in which it voted to keep the current capital buffer, while Fed's Bowman said that freezing bank capital levels allows Fed to correct any "deficiencies" in stress test models.

- White House said President Trump is to make an 'announcement' on Thursday at 19:00 Eastern Time (00:00GMT).

- US BLS rescheduled the January employment report for Feb. 11th, while it rescheduled December job openings and labour turnover report for February 5th, and rescheduled January CPI to February 13th.

NOTABLE EARNINGS

- Alphabet Inc. (GOOGL) Q4 2025 (USD): EPS 2.82 (exp. 2.64), Revenue 113.8bln (exp. 111.29bln) Shares fell 2.0% after market.

- ARM Holdings (ARM) Q3 2026 (USD): Adj. EPS 0.43 (exp. 0.41), Revenue 1.24bln (exp. 1.23bln) Shares fell 8.6% after market.

- QUALCOMM (QCOM) Q1 2026 (USD) Adj. EPS 3.50 (exp. 3.39), Revenue 12.25bln (exp. 12.21bln) Shares fell 10.3% after market.

APAC TRADE

EQUITIES

- APAC stocks were mostly lower following the continued tech selling stateside and flip-flopping regarding US-Iran talks, while commodities were pressured overnight with silver prices dropping by a double-digit percentage.

- ASX 200 was dragged lower by weakness in mining and resources stocks after underlying commodities prices took a hit, but with the losses in the index stemmed by resilience in financials and consumer stocks.

- Nikkei 225 saw early indecision but eventually slipped below the 54,000 level alongside the downbeat mood in the region.

- Hang Seng and Shanghai Comp declined with notable weakness in miners, property names and insurers, while an increased liquidity effort by the PBoC and reports of an 'excellent' call between Trump and Xi failed to spur risk appetite.

- US equity futures were lacklustre amid recent tech woes and after the latest big tech earnings did little to boost futures.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.2% after the cash market finished with losses of 0.4% on Wednesday.

FX

- DXY kept afloat following yesterday's mild gains, but with the upside limited following mixed data releases stateside and with plenty of focus on geopolitics amid reports that US-Iran talks scheduled for Friday were off, and on again, while there were comments from Fed's Cook who said that she is focused on inflation risks and that progress on inflation has stalled.

- EUR/USD marginally softened with the single currency not helped by the recent weaker-than-expected EU services PMI data and softer core inflation, while participants await the ECB policy announcement due later today.

- GBP/USD trickled lower with very few catalysts for the UK ahead of the BoE policy announcement, while Services PMI data missed estimates and reports noted that PM Starmer is to conduct a reshuffle and 'reset' in a bid to save his premiership.

- USD/JPY took a breather after climbing to just shy of the 157.00 handle with yen weakness persisting throughout the week ahead of the snap elections on Sunday.

- Antipodeans declined amid headwinds from the subdued risk appetite and selling pressure in commodities.

- PBoC set USD/CNY mid-point at 6.9570 vs exp. 6.9468 (Prev. 6.9533).

FIXED INCOME

- 10yr UST futures were uneventful as price action remained confined to within a narrow range after recent mixed data stateside and with a lack of surprises from the Quarterly Refunding Announcement, which was set at USD 125bln, as expected.

- Bund futures lingered around the 128.00 level after the prior day's advances, and with participants awaiting German Factory Orders and the ECB policy announcement.

- 10yr JGB futures eked mild gains in choppy trade amid the absence of any tier-1 data releases overnight and following mixed results from this month's 30yr JGB auction.

COMMODITIES

- Crude futures gave back the prior day's gains, which had initially been spurred by news that talks between the US and Iran on Friday were cancelled due to Iran's refusal to engage in non-nuclear issues. However, oil prices then reversed overnight after it was reported that US-Iran talks were back on again and will be conducted on Friday in Oman.

- Spot gold was choppy and initially reclaimed the USD 5,000/oz status before wiping out all its gains and more shortly after SHFE and LME trading got underway, despite a lack of obvious drivers, but coincided with a broad sell-off in precious metals, including a 15% collapse in silver prices which dropped aggressively after stalling around the USD 90/oz level.

- China's gold consumption fell by 3.6% Y/Y to 950 tons in 2025, and its total gold production rose 3.4% Y/Y to 552 tons.

- Copper futures retreated amid the downbeat risk tone and selling across the commodities complex.

CRYPTO

- Bitcoin steadily retreated throughout the session to below the USD 71,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 118.5bln via 7-day reverse repos with the rate at 1.40% and injected CNY 300bln via 14-day reverse repos with the rate at 1.65%, ahead of the Chinese New Year/Spring Festival holidays.

DATA RECAP

- Australian Balance of Trade (Dec) 3.37B vs. Exp. 3.325B (Prev. 2.94B, Low. 2.6B, High. 4.0B)

- Australian Exports M/M (Dec) M/M 1.0% (Prev. -2.9%)

- Australian Imports M/M (Dec) -0.8% (Prev. 0.2%)

GEOPOLITICS

MIDDLE EAST

- Iran-US nuclear talks for Friday were initially reported to have been cancelled due to the Iranians' refusal to engage in non-nuclear issues. However, reports later stated that plans for US-Iran nuclear talks in Oman on Friday are back on, after several Arab and Muslim leaders urgently lobbied the Trump administration on Wednesday afternoon not to follow through on threats to walk away, according to US officials cited by Axios.

- US President Trump said Iran's Supreme Leader should be very worried now, while Trump also stated that he warned the Iranians about building a new nuclear facility.

- Iran's Foreign Minister Araqchi said nuclear talks with the US are to be held in Muscat at about 10am on Friday.

- Iranian sources said they will not allow demands to be raised outside the framework of the nuclear dossier in negotiations with the US.

- US military said it conducted five strikes against multiple Islamic State targets across Syria in late January and early February.

RUSSIA-UKRAINE

- US official said conversations between the US, Ukraine, and Russia were productive and will continue on Thursday morning, while Ukraine's top negotiator Umerov also said today's meetings in Abu Dhabi were productive and substantive.

- Russian Foreign Ministry said Russia has not received a formal response from the US on the expiring START treaty, while it added that the US approach to Russia's initiative on a new START treaty is misguided and regrettable.