Precious Metals Dominate Chaotic Week As AI Reality-Checks Steal Fed's Dovish-Gifts

Well that was a chaotic week full of ups (mostly positive macro and dovish Fed surprises) and downs (mostly AI narrative challenges) that left us with a mixed picture across stocks and bonds, dollar down bigly, and precious metals to the moon.

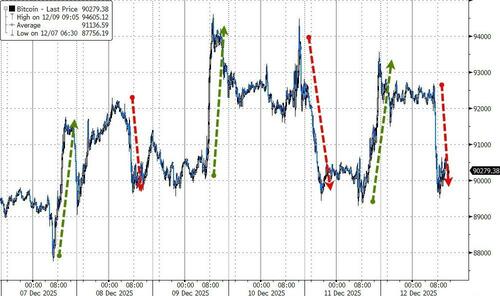

Perhaps the most optically clear expression of the chaos was in crypto markets as bitcoin pinballed between $90,000 and $94,000 non-stop... only to end unchanged on the week...

Source: Bloomberg

In equity-land, results for the week 'varied' with Nasdaq the biggest loser (along with the S&P) while Small Caps and The Dow put in a solid performance (more on the rotation at the end)...

Source: Bloomberg

ORCL dominated headlines in the latter half of the week (breaking down below its 200DMA once again), spoiling The Fed's Xmas Party...

With its CDS closing at its widest since the GFC...

Source: Bloomberg

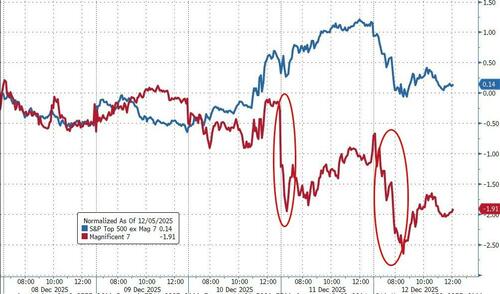

Mag7 stocks dramatically underperformed the S&P 493 as the ORCL/AVGO results rippled through the AI narrative...

Source: Bloomberg

After a big rebound following Fed's Williams dovish comments in late Nov, AI stocks were rug-pulled in the last couple of days as AVGO and ORCL provided AI reality checks...

Source: Bloomberg

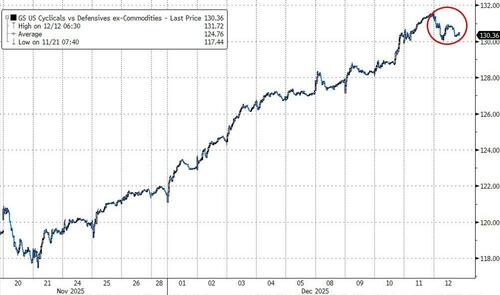

After an unprecedented record 15-day win-streak, today saw Cyclicals underperform Defensives...

Source: Bloomberg

Tech stocks were the worst performers on the week along with Utes (oddly) while Materials and Financials dominated gains...

Source: Bloomberg

Bonds were as mixed as stocks with the short-end dramatically outperforming the rest of the curve...

Source: Bloomberg

The yield curve obviously steepened dramatically (with the shortest end 3m2Y erasing its inversion rapidly)...

Source: Bloomberg

...with 2s30s breaking back to its steepest since Nov 2021...

Source: Bloomberg

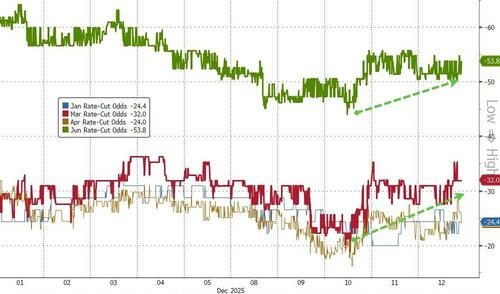

Rate-cut odds rose modestly this week, with June remaining the market's best bet for the next cut (after Powell's replacement takes the helm)...

Source: Bloomberg

The dollar traded down against its fiat peers for the third straight week, breaking back down below all its major technical levels and back to near 3-month lows...

Source: Bloomberg

Both Gold and Silver ended at record weekly closes...

Gold topped $4300 before being sold today...

Source: Bloomberg

Silver neared $65 (a new record intraday high) before the selling hit today...

Source: Bloomberg

Oil prices tumbled this week - the worst week in two months - with WTI back to a $57 handle...

Source: Bloomberg

Finally, Bloomberg macro strategist, Michael Ball, is optimistic for the rest of the year, noting that despite coming under some pressure this morning, the recent equity rotation has been a clearly bullish development for the broader market. Until the data points otherwise, the rotation is a vote of confidence that the building fiscal and monetary pulse will support a real pickup in activity in the first half of next year.

The tape has favored small caps and cyclicals over the Mag7 since the start of November as investors lean into a growth re-acceleration theme. The more dovish December FOMC messaging -- especially alongside the stealth-like quantitative easing via reserve management purchases -- only added to this outperformance.

Source: Bloomberg

This was clear in Thursday’s under-the-hood price action, which turned steadily more bullish as the session unfolded. This looks to be the story on Friday, with a similar setup as Broadcom mirrors Oracle in disappointing on the AI front. As a result, large-cap tech and growth are underperforming small caps, value, and year-to-date laggards.

The expansion in positive participation builds a healthier base than the narrow AI-led melt-up into November and reinforces the idea that the rally is now anchored on better future real activity versus an uncertain secular AI buildout.

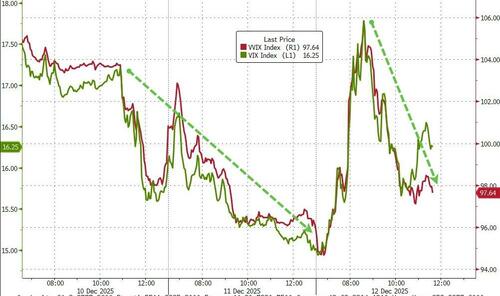

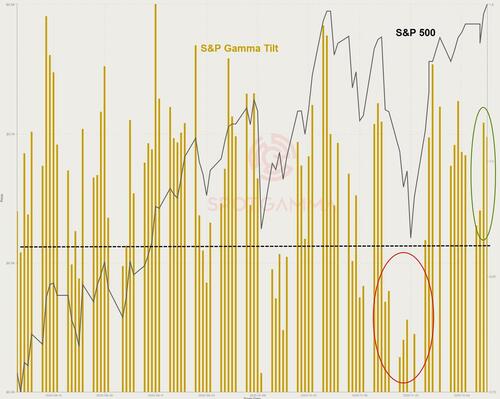

Option positioning and implied volatility are lining up behind that story. The SPX has moved into a strong positive gamma zone between 6,850-6,900, which is pinning the tape even as tech is again under pressure. Implied vols keep trending lower, with Thursday’s positive reversal crushing the VIX to recent lows. Further, the decline in the VVIX, or “vol of vol,” shows the post-FOMC bid for downside protection via upside VIX calls has faded.

Source: Bloomberg

Shortened holiday calendars and upcoming December option expiries following the recent positive FOMC results are all encouraging option and vol selling again, leaving both upside calls and hedging puts screening objectively cheaper, according to SpotGamma.

This has flipped the deeply negative gamma backdrop in November to mildly positive one, pinning intraday moves and allowing CTAs to re-lever and vol-control funds to add risk as realized volatility drifts lower.

Simply put, the broadening rally is creating a sturdier pillar for further upside until the reacceleration narrative is meaningfully challenged by new negative data.