Precious Metals Puke, Bonds Bid As Stocks Give Up Santa's Gains

...as we traverse the deep mid-winter of thin liquidity conditions, charts from crude to crypto are starting to reflect the panicky year-end moves of olde...

Goldman's Chris Hussey says markets are kicking off this final, holiday-shortened week with a bit of trepidation.

Consumer Discretionary, Tech, and Materials are the worst performing sectors today.

Conversely, Utilities, Real Estate, and Consumer Staples -- all traditional areas of relative safety -- are outperforming.

This Scrooge-like underperformance isn't completely surprising: Santa rallies seem to fizzle or stall a bit right around this time most years.

Today's pause could be the result of end of year re-positioning or it could reflect some of the key considerations facing investors as we head into 2026, including the next phase of the AI revolution, the Fed's path, market concentration, plus the ever evolving policy landscape in the US.

But, it is the precious metals markets that warrant our first attention today with silver and gold pumped (to new record highs) then dumped (at multi-year scale) amid 'no smoking gun' per se (fragile liquidity, export controls, margin hikes, ETF extremes, China liquidations)...

Gold tagged $4550 overnight before puking all the way back to almost $4300...

Source: Bloomberg

Silver was even more dramatic, surging up to $84 at the Sunday open before plunging back near $70 as the US opened. There was some stability during the US session as silver managed to get back up to $72 (but the fun and games will likely begin as China opens tonight)..

Source: Bloomberg

While these moves are significant - and grab headlines during a holiday shortened week - we do note the context that this 'collapse' merely dragged PM prices back to 3-4 day lows.

On the bright side, Silver is no longer officially 'overbought'...

Source: Bloomberg

Copper and Platinum were also crushed today...

Source: Bloomberg

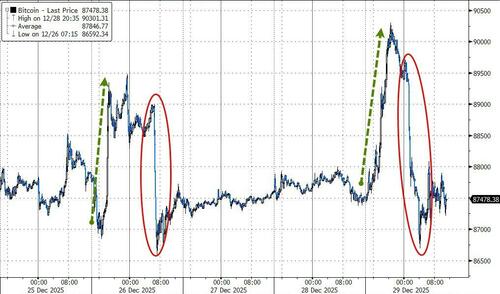

It wasn't just precious metals that were punished, crypto markets were pumped (BTC back above $90k) and dumped (BTC back below $87k) within 12 hours...

Source: Bloomberg

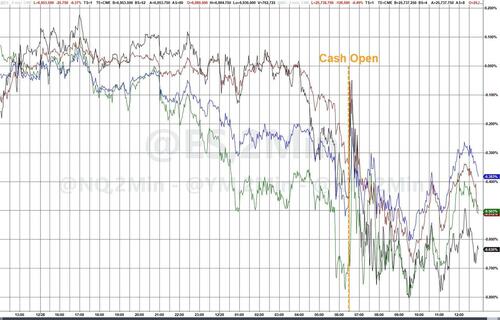

Stocks also suffered today with Small Caps and Nasdaq lagging...

...and erasing most (or all for Small Caps) the gains from the 'Santa Claus' rally... for now...

Interestingly, UBS's US retail market making clients had $172 mn of inflows on Friday as the holiday shortened week had retail pause from seasonal year-end selling and jumping back into equities with largest weekly equity inflows since March.

Retail were buying US Large Cap ETFs with VOO ($84 mn of inflows) far and away the most the bought stock by UBS RMM Clients last week.

AI Semis had only its third week of net buying since September led by inflows of Micron ($39 mn of inflows) which has seen continued inflows since earnings and was most bought single stock for the week.

Outside of AI Semis there were also pockets of buying across other stocks with AI exposure led by Google ($29 mn of inflows) and Amphenol ($22 mn of inflows).

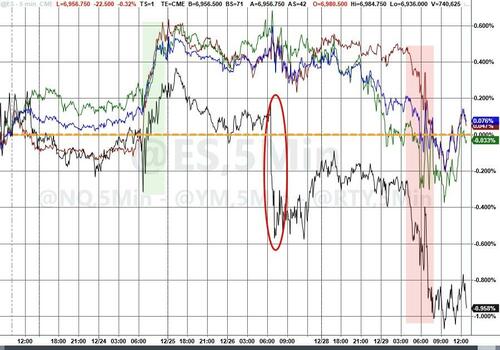

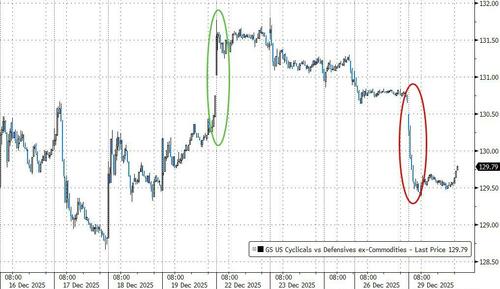

Defensives dominated Cyclicals again...

Source: Bloomberg

VIX has been edging higher in the last couple of days - with an opening surge met with a wall of vol-sellers...

Bonds were bid with the main buying happening as Asia closed and Europe opened. The short-end of the curve outperformed...

Source: Bloomberg

The dollar inched higher in a choppy low-vol FX market...

Source: Bloomberg

While crude prices were higher (as some suggested the peace talks are in trouble after Zelensky took a shot at Putin's palace), they also reflect the low liquidity period, erasing much of Friday's pre-Z plunge...

Source: Bloomberg

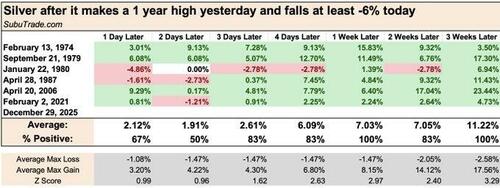

Finally, back to where we started... With Silver having 'collapsed' to 3-day lows, the question is - do you buy the dip?

Here's every case when Silver fell more than -6% from a 1 year high (h/t @SubuTrade): Silver up 6 out of 6 times, 1 week later...

Be careful about buying that dip in gold. When gold hits a 1 year high yesterday and falls at least -4.1% today, it fell more over the next 4 days.