Prepare For The Unexpected: These Are Deutsche Bank's 2026 Curveballs

With 2026 approaching, it’s worth remembering that very few years proceed as expected.

That’s been particularly true this decade.

So, with that in mind, Deutsche Bank's Jim Reid drops this chart pack looking at potential curveballs that could change the direction of travel.

Examples of the unexpected this decade include:

-

In 2020 the pandemic meant the year-ahead outlooks were redundant by the end of Q1.

-

In 2021 a surge in inflation surprised the vast majority.

-

In 2022 markets were caught off guard by the most aggressive rate-hiking cycle since the 1980s.

-

In 2023 the consensus wrongly expected a US recession.

-

In 2024 barely anyone thought the S&P 500 would rise over +20% for a second year running.

-

In 2025 the Liberation Day turmoil led to the biggest market volatility since Covid and a huge surge in the US effective tariff rate. Then the positive bounceback was one of the fastest recoveries on record.

So as we look forward to 2026, it’s safe to say that the most surprising thing would actually be a lack of surprises.

And in light of this, Reid and his team got thinking about some potential curveballs (both positive and negative) that could change the global outlook again next year...

Positive Curveballs

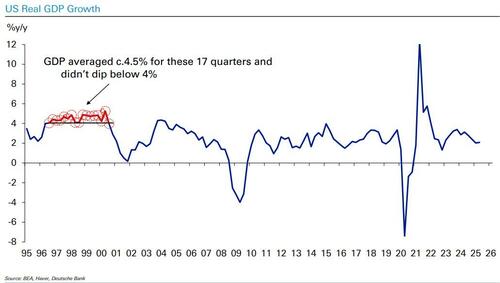

Between Q2 1996 and Q3 2000, every quarter saw US growth at an annualised rate of over 4% with an average rate around 4.5%. In this cycle, US growth has been strong since Q1 2023 but has only averaged 2.6% annualised. Could AI Capex and productivity gains take us back to those rates from the late-1990s, whether prolonged or temporarily due to a bubble?

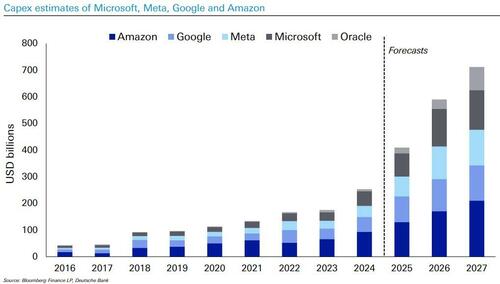

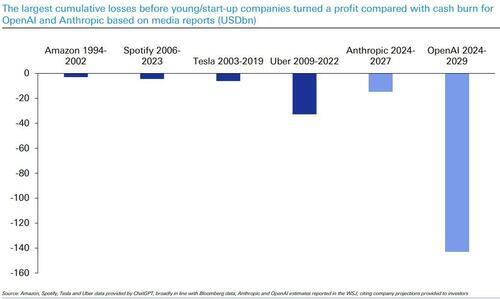

Are we still in the early days of an AI Capex Boom that will drive activity? Most of these companies are earnings and/or cash rich so the Capex plans here are largely underwritten

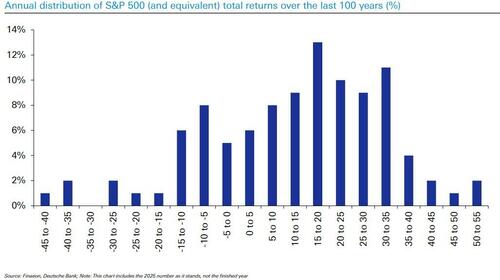

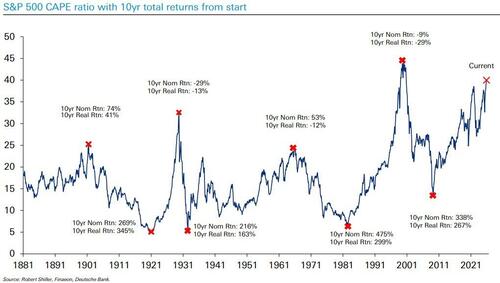

Our US equity strategists’ target of 8,000 for the S&P 500 implies a return of ~17% in 2026. Interestingly 15-20% is the most common return over the last century, and nearly 40% of years have a larger gain. So, whatever you might think of that target, it’s not statistically outlandish at all. And even if you think we’re in a bubble, it’s worth noting that during the dot com bubble, the rally went on for another year after the CAPE ratio had got to current levels.

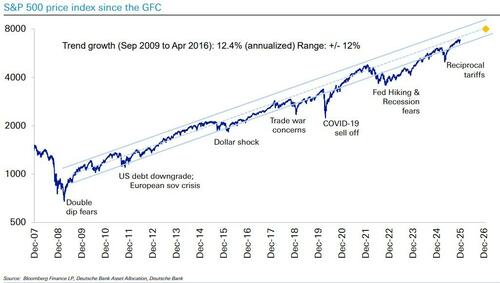

Interestingly, another S&P 500 gain in 2026 would mark a 4th consecutive annual gain for the first time since the GFC. But this would still keep the index within its post-GFC trend channel. Moreover, equity positioning is only modestly overweight, so it’s not like late-2021 when positioning was heavily overweight before the 2022 bear market. In addition, US consensus growth expectations are at +2.0% for 2026, below our US economists’ +2.4% forecast.

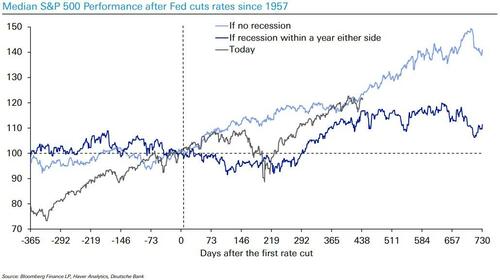

A continued bull market would be entirely in keeping with the historic pattern when the Fed has cut rates into a soft landing. The median increase is around 50% two years after the first cut in the cycle when there is no recession. We’re currently exactly in line with the median. After a Dec ‘25 cut, the Fed will have delivered 175bps of cuts since September 2024, with more expected to come. That’s the fastest pace of cuts outside a recession since the 1980s…

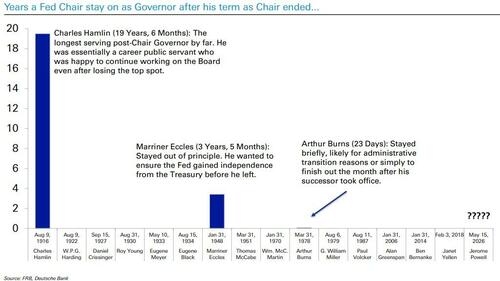

2026 will be a big year for the Fed with a new Chair. But for all the concerns about central bank independence, there’s still 7 on the Board of Governors, and even more on the wider FOMC, so a new Chair can’t change everything. Indeed, Fed Chair Powell still has a separate 14-year term as Governor that lasts until 2028, and it’s possible he stays on, like Eccles in 1948 to protect Fed Independence, meaning the new Chair would have to take Governor Miran’s seat. Meanwhile, if Governor Lisa Cook wins the Supreme Court case and remains in post, that would make it even more difficult to adjust the board anytime soon.

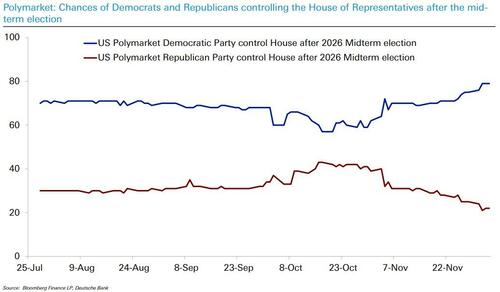

Could we get more tariff relief ahead of the midterm elections…? Already, we’ve seen exemptions for products like coffee and beef, and the political incentive to lower inflation will rise as the midterms approach. The Democrats are currently the favourite to retake the House of Representatives and many cite the cost-of-living concerns for recent Democratic election successes…

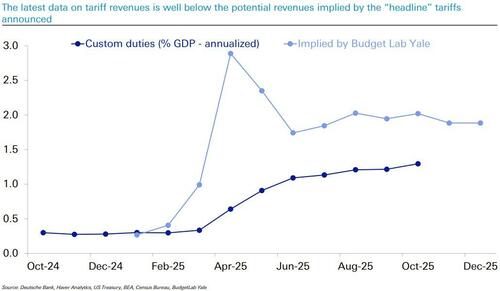

Tariffs being collected have been well below the potential revenues implied by the headline rates. The bark has been worse than the bite. If the exemptions increase, then that could provide downside risk on the inflation side and ease trade uncertainty concerns. Perhaps the incentives are there to do so given mid-terms and the cost-of-living issues.

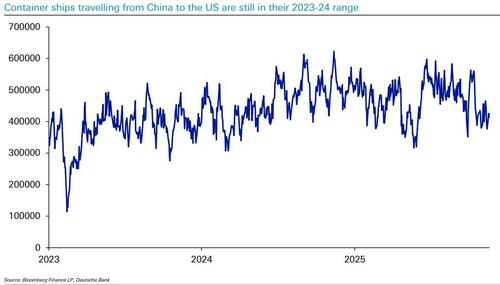

What if US-China trade tensions improved…? The current trade truce lasts until 10 November 2026, but that’s been extended before. Indeed, in Trump’s first term, the US and China reached a Phase One trade deal just before the pandemic. And despite expectations for a collapse in bilateral trade as tariffs surged, the number of container ships going from China to the US has remained within its range over 2023-24.

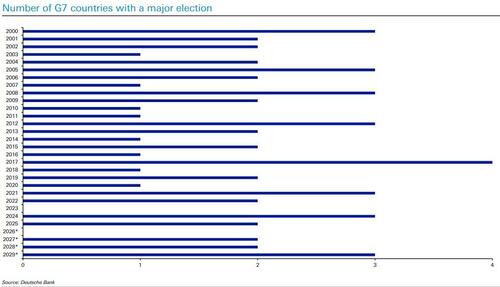

Political stability beckons…? Assuming no snap elections are held, 2026 will be just the 2nd time in the 21st century with no major G7 elections scheduled. That would make a change from the last couple of years, which have seen new administrations in the US, UK and Germany.

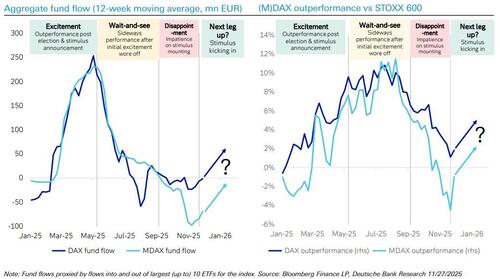

Our European equity strategists think markets are underestimating the positive impact of German reforms, and the mix of low positioning and the fiscal impulse will prove very supportive…

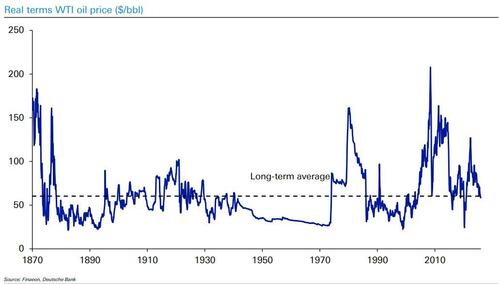

Oil prices have been coming down continuously since the 2022 spike, and are now around their lowest in nearly five years. But over the long run they only keep pace with inflation, which they are now at. Perhaps it’s in Trump’s interest in 2026 with mid-terms and cost-of-living concerns to encourage it even lower.

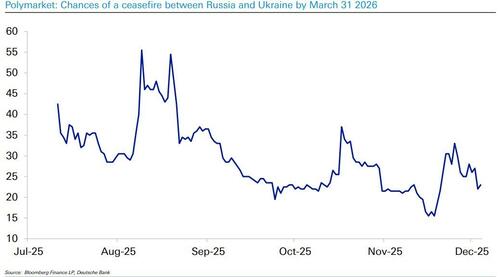

Prediction markets still think a ceasefire agreement is unlikely in the next few months… so any progress (which seems to be more likely now than for much of the past 4 years) could see a big reaction in European markets, and more downward pressure on oil prices…

Negative Curveballs

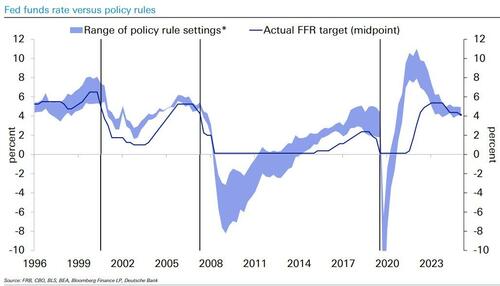

What if the next Fed move is (or needs to be) a hike? Inflation will remain above target in 2026 and policy rules currently suggest rates are at the lower end of where they should be. It wouldn’t take much momentum to suggest a hike. That narrative switch would likely upend markets and could occur as a new dovish Fed Chair is installed to add confusion. DB’s US economists have more on policy rules in their chartbook

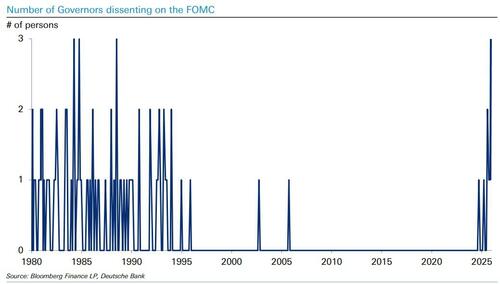

Could we be about to enter a more turbulent era for FOMC harmony after a long calm period. Much depends on the direction the new Fed Chair takes the committee and how much its composition changes…

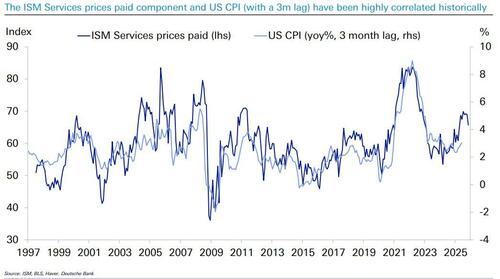

Unless oil spikes a lot lower or if we see an economic shock, it doesn’t take a huge leap of faith to believe US inflation will stay above target as far as the eye can see...

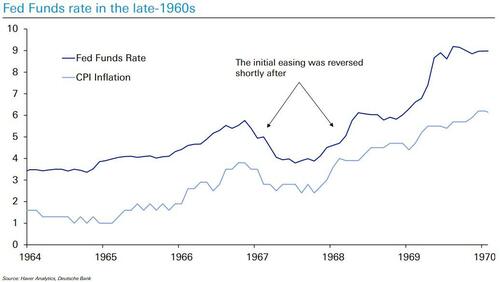

We’ve just had the fastest Fed easing outside a recession since the 1980s… could this end up as a policy mistake that gets reversed like the 1960s? Inflation is already running above target to start with, and plenty of tariff pressures are still filtering through.

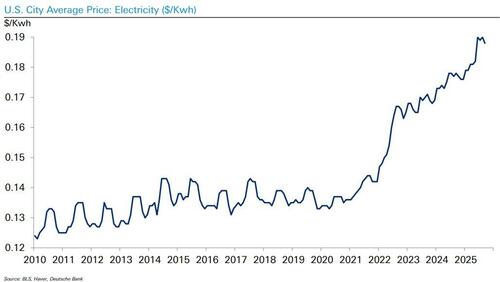

Could there be a macro sting in the data center boom’s tail? Electricity prices are climbing rapidly….

What if this is just the most obvious bubble in history? US valuations are at levels only previously seen at the height of the dot com bubble. To believe it’s not a bubble you are saying that the US market is in a better earnings place than its entire 150-year history of global exceptionalism where it's had transformative innovation, the strongest companies, best economic growth and has been the epitome of capitalism..

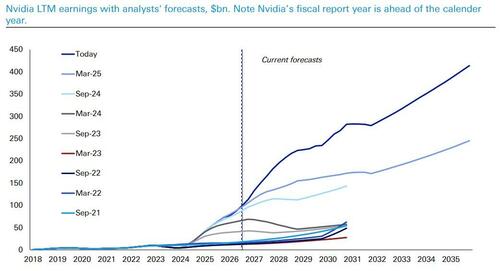

Nvidia earnings progression over the last three years has been phenomenal. But expectations for the next 10 years are equally so. What if the earnings forecasts flatten considerably? It would question the whole AI trade and global market optimism..

What if the market appetite for funding loss-making companies suddenly dries up? Maybe this is more of an issue for the private market but then the lack of transparency could create some panic..

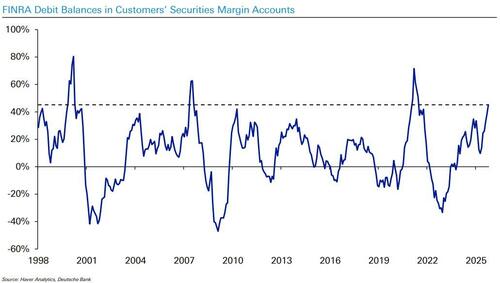

Margin debt has seen spikes consistent with late-stage bull markets. This is the total of all debit balances in securities margin accounts reported by FINRA. As our credit strategists have outlined in more depth, the speed with which investors are levering up on stocks compares to the end of the dot com bubble, the pre-GFC period, and the post-Covid stimulus-fuelled rally.

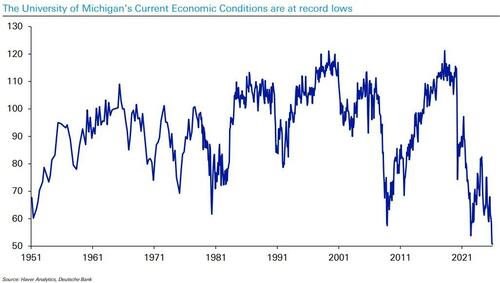

This US expansion is now as long as the post-war average…. Are we getting late-cycle…? There are clear cracks under the surface, and the University of Michigan’s current conditions measure has never been this bad, whilst US unemployment is the highest since October 2021. Moreover, it’s not hard to think of catalysts that could drive a downturn, like fears around private credit after the failures of Tricolor and First Brands.

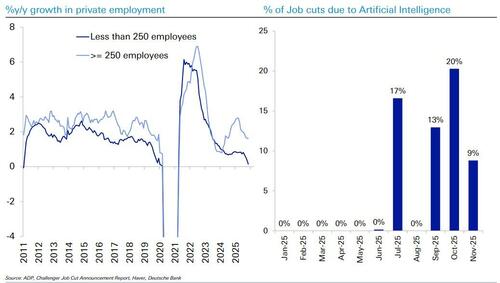

Are AI-related job losses set to pick up in 2026… small business hiring is really struggling, and larger corporates are picking up the pace of AI adoption? Could unemployment rise for a while with the economy growing? Then more negative feedback loops could emerge.

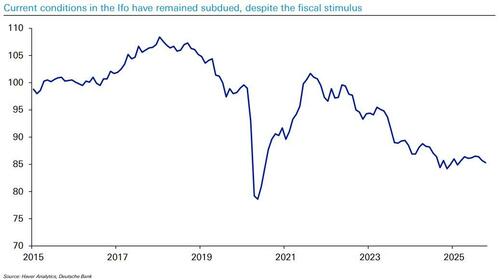

Despite high hopes earlier this year, will the German fiscal stimulus ultimately prove a disappointment…? Germany hasn’t grown for 6 years and we haven’t yet seen a particular uptick in growth, and the historic precedents for huge fiscal stimulus aren’t universally positive, particularly in economies with supply constraints. This pattern has been echoed before in other contexts, and US inflation began to surge during the WWII military buildup, at the time of the Korean War, and again as the Vietnam War escalated.

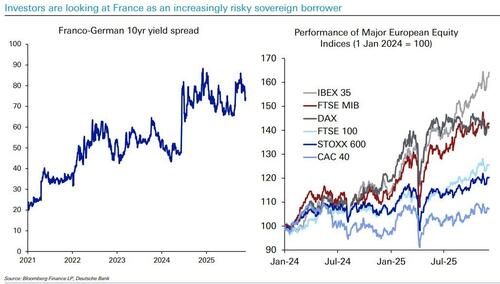

Will we finally hit the endgame on the French political stalemate? French assets have struggled as they’ve faced multiple credit rating downgrades, and the 10yr yield is above Italy’s. On Polymarket, there’s a 37% chance given that another legislative election is called by the end of June, and the risk is that opens the way to further instability. After all, the peak in spreads have been at moments of maximum uncertainty, e.g. right after PM Lecornu’s resignation in early October, and when it became clear in Dec 2024 that Barnier’s government would fall. By end-2026, the next presidential election in 2027 will also be coming into focus…

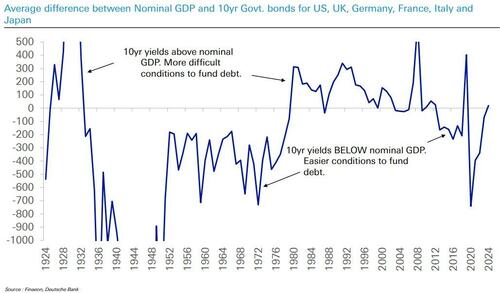

DM Funding costs (10yr ylds as a proxy) overall are now getting close to Nominal GDP. In the post GFC period of high debt and financial repression, yields were consistently below nominal GDP helping the funding situation.... This period is over. Average funding rates will still be lower but if long-end yield stay elevated this will increase from here.

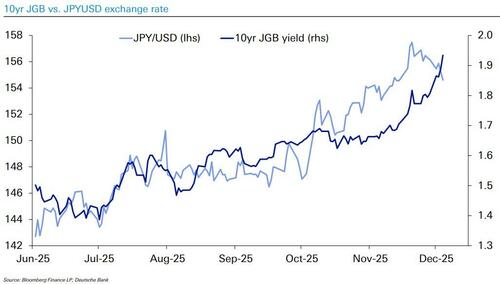

Japan's government bond market is the largest in the world as a share of GDP, and Japanese households are one of the wealthiest. This combination of high public debt and high private saving keeps the domestic capital market stable. But it is stability in inflation expectations that ultimately keeps the whole system together. If domestic confidence in the government and Bank of Japan's commitment to low inflation is lost, the reasons to buy JGBs disappear, and more disruptive capital flight ensues...

Extremes

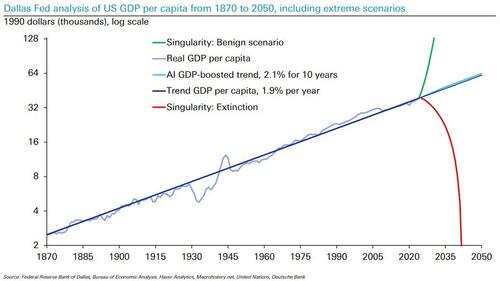

When the Fed (Dallas Fed here) start putting out these type of graphs we know that most people don’t have a clue about how AI is going to change our lives, the economy and markets...

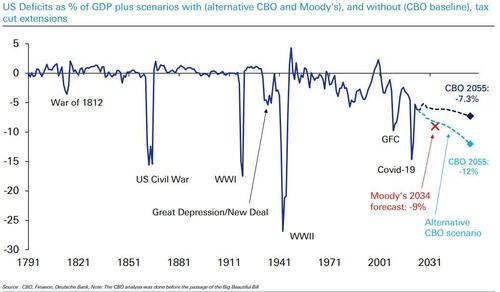

Surely this can’t go on forever....? The US is running sustained deficits at levels historically seen only in major wars or huge economic crises… Remember as well that the CBO’s analysis was last done just before the Big Beautiful Bill, so the Alternative Scenario looks more plausible for the next few years as it stands…

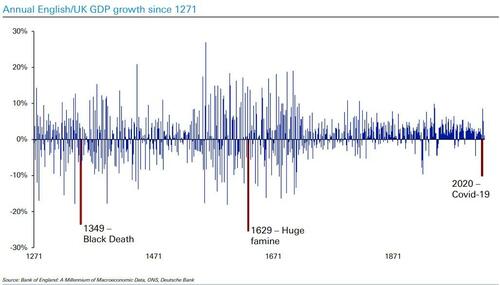

And finally!!!! What if we get another huge tail risk like a pandemic, a solar flare or megavolcanic eruption…?

In any year, it’s possible something makes baseline forecasts redundant, like Covid-19 in 2020. Another example was 1815, when the eruption of Mount Tambora occurred, and the subsequent volcanic winter meant 1816 was known as the “Year Without a Summer”, causing extensive crop failures, hardship and famine.

Professional subscribers can find the full note at our new Marketdesk.ai portal