"Cracks Appearing": Another Catastrophic Day For Multi-Strats Means Basis Trade Suddenly In Jeopardy

Earlier today, we reported (see below) that heading into today, every major institutional investor type - from systematics, to L/S hedge funds, to multi-strat pods - had suffered immensely, with Goldman's Prime desk writing that more than two thirds of funds in each index were down, and that the last time all three strategies were down more than 75 bps in a single day happened during COVID sell-off, back in 2020.

Fast forward one day to Thursday's rout, which saw a historic plunge in bitcoin, but also continued selling across momentum, software, and semi names. Still, away from the brutal rout in crypto and silver, we did see less violent factors moves even as the market sell-off continued.

After the close, Goldman's Prime Brokerage published the following estimates for today's action:

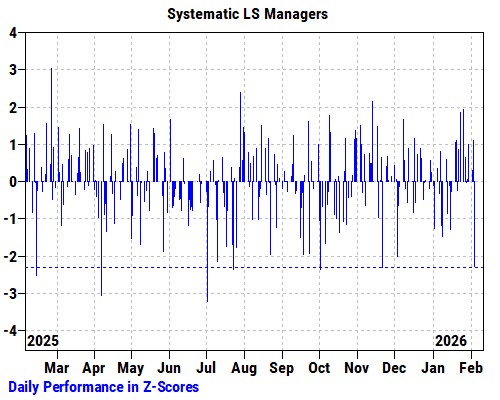

- Systematic L/S slightly up (+0.2%). A small rebound from yesterday with US driving the positive returns partially offset by EM Asia and Europe.

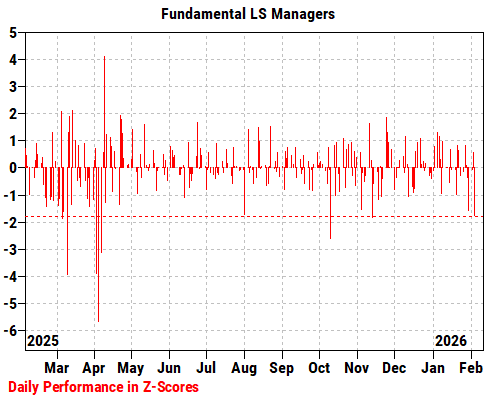

- Fundamental L/S down 0.8% mainly driven by market/beta. TMT managers down another 1.7% today.

So far so good. But the last of the three, perhaps the most important one, had an even worse day than Wednesday.

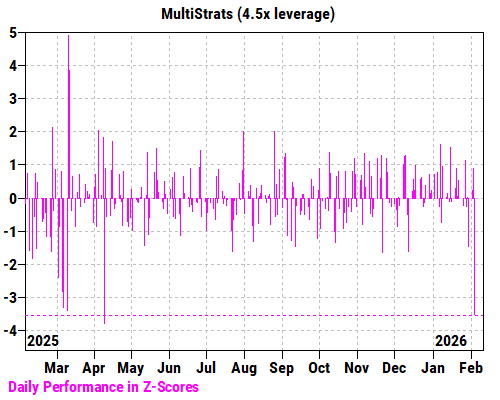

- MultiStrats down 1.2% volatility, crowded shorts and profitability among negative drivers.

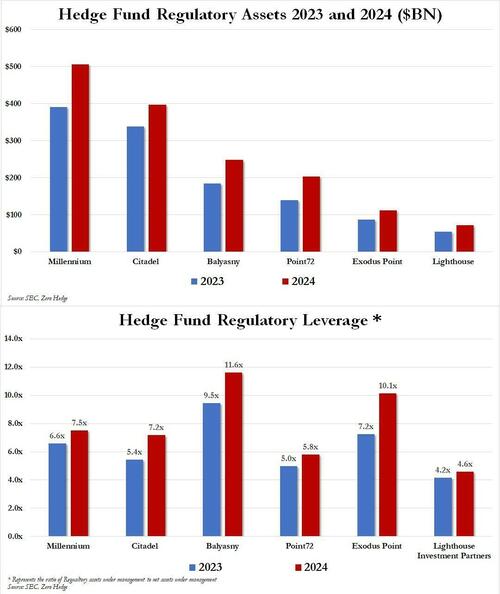

Why is this important? Because as we explained most recently last April, in "Absolutely Spectacular Meltdown": The Basis Trade Is Blowing Up, Sparking Multi-Trillion Liquidation Panic", multi-strat funds like Millennium, Citadel, Point72 and Balyasny apply massive leverage via repos to multiply their assets under management into regulatory assets which in some cases are 11x higher.

For context, just the "big 6 multi-strat hedge funds have $1.5 trillion in regulatory assets between them, the result of roughly 5x leverage to their AUM, and all of it invested in just one trade: basis trade.

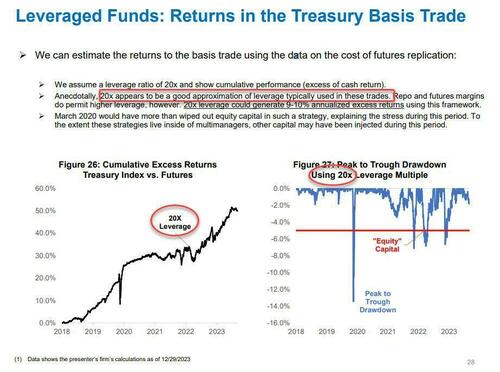

Think of the basis trade as the great liquidity sponge inside the hedge fund community: if hedge funds are allowed by their generous repo counterparties to lever up, they do just that anywhere between 20x and 54x...

... and park the proceeds in basis trades which print money when market dynamics are going according to plan, but leads to catastrophic consequences when there is a violent shock to the system, rapid deleveraging, both of which lead to forced degrossing and unwinds of basis trades.

That's precisely what happened in March 2020, and forced the Fed to step in with $1 trillion daily repo and massive QE to help ease the sudden unwind of basis trades, which would have cost the hedge fund community hundreds of billions in losses had it not been for Fed intervention.

We urge readers to re-read our analysis of what happens when the basis trade blows up (as happened last April and almost forced the Fed to once again step in with emergency measures), and we bring it up again now, because on days - and weeks - like today when multi-strat hedge funds suddenly suffer major losses, their back office clerks (there is nothing scarier in the world than having to explain why your VaR profile exceeds the ceiling to the Millennium back office risk managers) unleash a furious deleveraging wave among Porfolio Managers, which eventually cascades over into the core basis trades that make multi-strat funds so profitable.

It's also why we said after the close that "Multistrats are down so much, their degrossing will hit basis trades next. Then all bets are off"...

Update:

— zerohedge (@zerohedge) February 5, 2026

MultiStrats down 1.2% volatility, crowded shorts and profitability among negative drivers: GS

Multistrats are down so much, their degrossing will hit basis trades next.

Then all bets are off. https://t.co/2vHAEyBfEw

... and it's also why sh0ortly after our observation, Bloomberg's resident market plumbing guru, Edward Bolingbroke, pointed to the recent moves in the swap spreads widener trade, and warned that "Cracks appearing now though and early signs of deleveraging underway. Balance sheet uncertainty and expected vol uptick playing into unwinds…"

Dollar swap spread widener has been a staple trade since the April blowout

— Edward Bolingbroke (@EddBolingbroke) February 6, 2026

Cracks appearing now though and early signs of deleveraging underway. Balance sheet uncertainty and expected vol uptick playing into unwinds… pic.twitter.com/nM7rHlx8lt

A previous report by Bolingbroke cited a December BIS report which calculated that the value of the cash component of the swap spread trade at around $631 billion, more than doubling from $281 billion in the first quarter of 2024 and largely driving the growth of hedge fund exposure to Treasuries. That’s less than helf the much more popular basis trade strategy, which bets on discrepancies between cash bond yields and futures. Morgan Stanley recently reported the cash-versus-futures basis trade close to $1.5 trillion.

And while Trump's recent moves to deregulate the market, as well as inject more liquidity (most recently through his $200BN MBS Trump QE), have herded most managers and banks into the trade, Bolingbroke warns that the trade does not come without risks. "In April, it violently blew-up as firms looked to unwind positions amid margin calls after Trump’s tariff liberation day announcement roiled markets. A similar shock or policy shifts could again threaten to unravel the bets."

Needless to say, multi-strat funds experiencing deleveraging the likes of which we haven't seen since covid, certainly falls in the "similar shock" category.

Ironically, a basis trade meltdown, one which promptly forces the Fed to act once again, will be precisely the event that short-circuits the relentless meltdown in high beta momentum, and of course crypto, which has been melting down ever since Trump picked Kevin Warsh as the next Fed chair, and even though he will never actually do it, the mere fear that Warsh may one day shrink the Fed's balance sheet (spoiler alert: this will never happen), is what led to bitcoin losing 30% of its value in the days since.

So if Warsh needs a very harsh reminder just why the Fed's balance sheet can and will grow, but can never shrink, this may be just the opportunity.

* * *

Reported previously

The brutal rotations below the market surface, which first hit software now down 8 days in a row, and then spilling over to semi, are finally spilling over into the broad market. As Goldman's Prime Brokerage desk writes today (note available to pro subs), both hedge and systematic funds are having a very ugly day which, if left unchecked, could lead to painful degrossing. Here are the details:

HF Performance: Broad-based drawdown across all major equity strategies as noted by Goldman's Mario Laicini (full note here)

- Systematic L/S (Quant) down 82 bps, worst day since 10/2/25, driven by momentum sell-off and crowded short squeezing. Losses are coming from both Europe and US books. The only saving grace: still up 2.5% YTD.

- Fundamental L/S down 93 bps (alpha: -65 bps), worst day since 11/13/25, driven by momentum sell-off and concentrated longs sell-off. Now up 2.2% YTD. US-Focused managers down 93 bps (now up 0.7% YTD) and TMT focused managers down 319 bps.

- Multi-Strat equity portfolios (assuming 4.5x leverage) down 190 bps, worst day since 4/9/25 driven by momentum sell-off, concentrated longs sell-off and crowded short squeezing. Losses coming mainly from US slice of their book. Now up 3.9% YTD.

As Goldman's Mario Laicini writes, Wednesday's moves severely impacted all equity strategies simultaneously with more than two thirds of funds in each index down. Last time all three strategies were down more than 75 bps in a single day happened during COVID sell-off, some years ago.

Going back to the Goldman prime desk, it next looks at overall risk exposures:

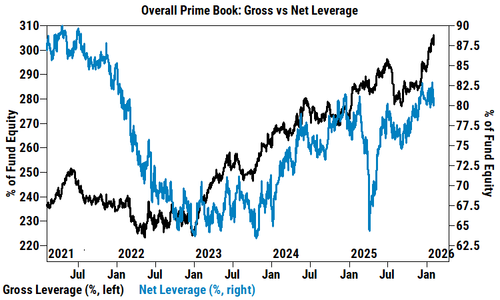

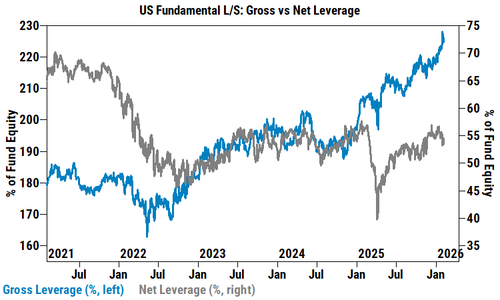

Overall Gross leverage rose +1.7 pts (driven by mark-to-market) to 306%, while US L/S Gross leverage fell -0.8 pts to 225% (98th percentile one-year). Both Gross and Net exposures remain elevated vs. the past year. Some more details:

- Full PB Book (all strategies): Gross leverage rose +1.7 pts day/day, driven entirely by positive impact of +2.2 pts from mark-to-market (i.e., price declines/PnL loss making the denominator smaller in the leverage calculation), which outweighed the -0.6 pts impact from activity. Net leverage fell -0.5 pts day/day, driven by both mark-to-market and activity.

- US Fundamental L/S: Gross leverage fell -0.8 pts day/day to 225% (98th percentile one-year, 100th percentile five-year), while Net leverage rose +1.0 pts day/day to 54.5% (74th percentile one-year, 56th percentile five-year).

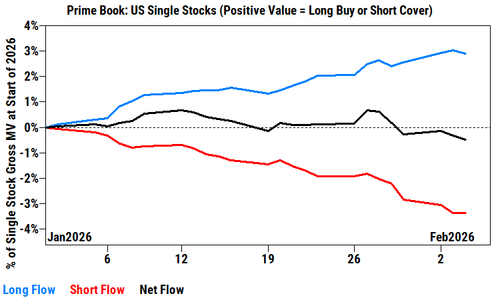

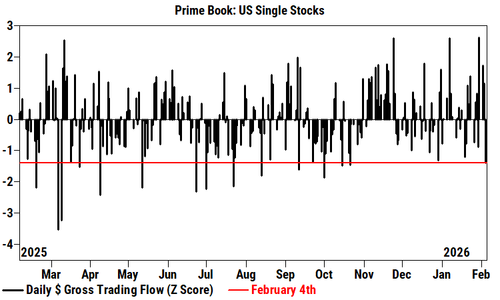

As noted above, until now the selling within sectors was contained but no more, and US Trading Flow is starting to get hit at the market level: Single Stocks saw the largest $ de-grossing activity since October according to Goldman, led by risk unwinds in Industrials, Info Tech, and Materials

Overall US equities were modestly net sold on Wed (-0.7 SDs one-year), driven by short sales and to a lesser extent long sales (3.2 to 1). Single Stocks and Macro Products were both net sold and made up 79% and 21% of the total $ net selling, respectively.

- HFs net sold Single Stocks for a second straight session (5 of last 6, -1.1 SDs one-year), driven mainly by long sales. While Wed's $ de-grossing in US Single Stocks was the largest in more than three months (-1.4 Z score one year), it was not yet extreme (e.g., early March 2025) and relatively modest vs. the sharp price moves seen across multiple factors.

- 5 of 11 sectors saw de-grossing activity, led in $ terms by Industrials (long sales > short covers), Info Tech (long sales > short sales), and Materials (long sales > short covers). On the other hand, Financials (long buys), Staples (long buys > short sales), and Comm Svcs (long buys) saw the largest $ increase in gross trading activity.

- Within Info Tech, Semis & Semi Equip, Comms Equip, and Tech Hardware were the most net sold subsectors on Wed, all led by long sales, while IT Services and to a lesser extent Software were the most net bought, both driven by long buys, which points to (1) factor rotation, and (2) nascent signs of increased long side offense in select Information Services and Software names that have been heavily net sold YTD.

Finally, taking a closer look at the worst performers today, it will come as little surprise that the software selloff extends to an eights day, as Factor volatility continues, and so do the rotations: Cyclicals lag Defensives {UBPTCYDE}, down 2%, after a string of weaker Challenger and JOLTS data. Tech pressure continues, particularly in Software.

As UBS S&T writes, Value is up 4.1%, Quality is up 4.1%, Crowding is up 3% and Volatility is down 6.6% with all seeing over 2 sigma moves. All are directionally in line with yesterday’s moves. Only Momentum up 90bp after yesterday's historic rout.

Alphabet is driving Mag7 lower, down 1.5%, after last night’s capex bombshell. However, AI-Semis, up 50bps, manage to eek out positive performance, even after ARM and Qualcomm earnings failed to inspire. Alt Asset managers – particularly those most exposed to the Tech complex - fall further, down 5.5%. Next up is Amazon earnings.

The Software selloff enters its eighth consecutive session...

... as UBS warned the sector is facing an “unresolvable existential threat" as EPS revisions breadth remain strong but valuations are collapsing. The Software ETF (IGV) has not been this oversold since 2006, and yet it can keep getting oversold even more until something short circuits the liquidation narrative.

More in the full Goldman notes (here and here) available to pro subs.