The "Rate Check" And The Yen: Here's How To Trade Coordinated Global Currency Intervention

On Sunday, we shared our thoughts on Friday's yen "rate check" by the NY Fed which sparked the biggest surge in the yen since Liberation Day, as well as how the coordinated efforts to hammer the USD reek of a new Plaza Accord.

For those who missed it, on Friday we were the first to report that the NY Fed and the Bank of Japan engaged in verbal warnings - including rate checks - signaling verbal potential "action" without actual intervention (i.e. central bank jawboning). As we discussed, it is very rare for the US Treasury to be intervening in FX markets. The last time it happened was March 2011 (Japanese earthquake) and in September 2000

following the launch of the euro. In both instances the intervention was multilateral and involved co-ordination with G7 partners. In this instance, the (verbal) intervention appears to be confined to a potential bilateral co-ordination with Japan rather than other central banks.

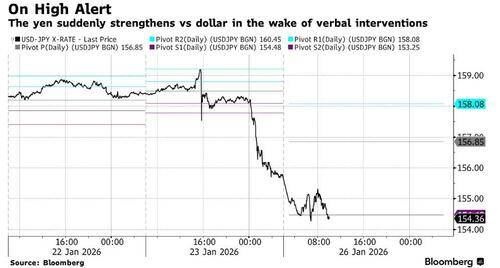

The dollar-yen pair broke below most key supports, forming a downward channel with lower highs and lows. At the same time, the front-end inversion in the options curve signals heightened near-term risks before the Fed rate decision on Wednesday. Adding to tensions, Japan's Finance Minister Satsuki Katayama said that the government is responding to currency moves in line with the US-Japan joint statement, amid speculation the two countries coordinated on rate checks to prop up the yen on Friday.

Below we dig deeper into this critical topic, as it now seems like currency wars are set to emerge, just ahead of the capital wars predicted by Ray Dalio.

First we excerpt some of the key points from Goldman FX trader Adam Crook (full note available to pro subs):

- a vocal rate-check is the most powerful tool in the arsenal short of actual intervention and is often followed by actual intervention (within about a week) if it is not successful. The signal this time is even stronger than in 2022 or 2024 because of the US participation

- Interventions with sufficient credibility generally are successful in curbing short-term moves

- JPY interventions in recent years have temporarily diminished FX sensitivity to rates moves; rather than ‘turning’ the currency, they tend to slow it down and give a chance for new catalysts to take over

- Longer-term, intervention does not solve the root cause of JGB volatility/JPY weakness; Japan remains in a "suboptimal" policy regime, and intervention is at best a temporary solution while markets await a new macro driver. If one doesn't come, expect new yen/JGB lows in the medium-term.

Looking at the bigger picture, if the BOJ and the NY Fed are indeed acting in concert, it would underscore an exceptionally tight alignment between Tokyo and Washington. This would come as a major surprise to most investors and is poised to drive heavy yen-buying pressure.

The possibility of coordinated intervention introduces a new layer of uncertainties for the markets:

- Given how rarely such actions occur, speculators now face high uncertainty regarding the timing and scale of potential moves, making it increasingly risky to ramp up short-yen positions.

- This is also likely to force a rethink among commercial and real-money players; exporters and life insurers may now feel a sense of urgency to increase their FX hedge ratios, adding further tailwinds to the yen.

In short, as we commented tongue-in-cheek, Japan is terrified to raise rates - which is the only thing that could conceivably lead to a sustainable rise in the yen - and instead is punting to the Fed to do its dirty work for it.

*JAPAN PM: WILL TAKE MEASURES AGAINST SPECULATIVE MARKET MOVES

— zerohedge (@zerohedge) January 24, 2026

cry to the Fed to hammer JPY shorts since Japan doesn't have the guts to raise rates

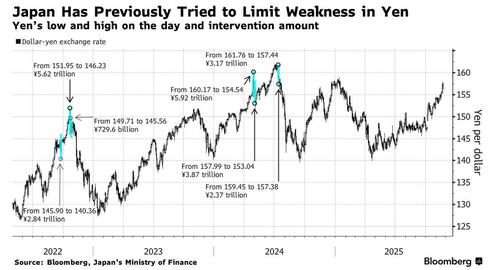

What is also notable is that Japan’s yen-buying interventions since 2022 have been only unilateral. To find a precedent for coordinated action, one has to look back to the 2011 G-7 yen-selling operation after the Fukushina disaster which sparked a historic repatriation wave which sent the yen soaring. For a coordinated yen-buying operation, there was one instance in 1998, and before that, it would trace back to the Plaza Accord (which is precisely why so many are wondering if the time of Plaza Accord II has come).

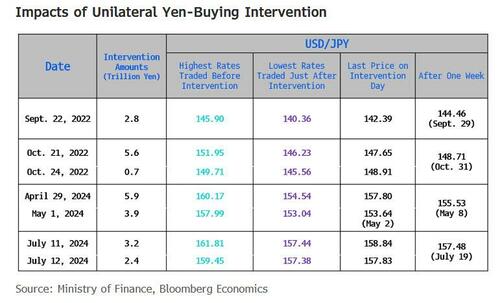

As shown below, impacts of unilateral yen interventions are mixed: after a sharp, initial drop in the USDJPY proportional to the amount of intervention unleashed by the BOJ/MOF, the pair then eventually recovers all losses and rises above the previous intervention level (hence, why it recently was trading just below 160 despite multiple interventions in recent years).

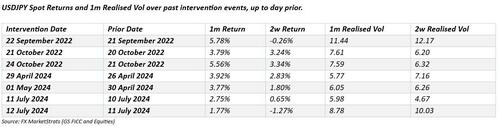

USDJPY spot returns and 1m Realized Vol over past intervention events, up to day prior:

Turning to markets, below we share several takes from Wall Street traders and strategists, but we start with Goldman's Adam Crook who says that while previously he had seen "zero interest in buying USDJPY-dips from the franchise, other than light profit-taking on existing cash shorts", that mindset/strategy has entirely gone. The Goldman trader suspects any intervention this time would have a much more lasting impact; given other G10 currencies are ~10% stronger versus the Dollar, and he doesn’t expect committed buyers until the 147/149 region more medium-term. That said, Goldman's clients caution that given strain on balance-sheets due to JGB-related issues, there remains considerable doubt as to whether local-clients can actively take on new FX risk in the current environment; this is also an attractive opportunity for Japanese importers to structure TARF trades, and Adam would not be surprising to see a reasonable amount of export-side selling flow as well.

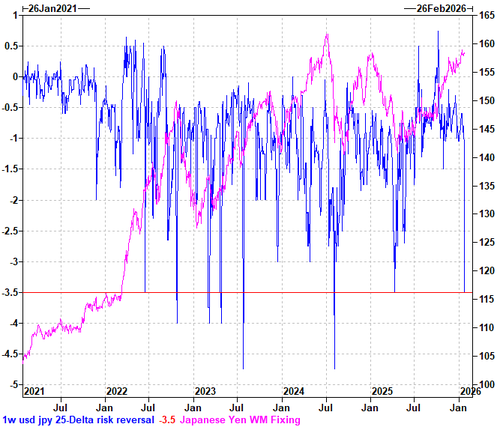

Turning to the options market, here we saw a repricing of front-end USDJPY skew significantly higher on Friday afternoon; 1w 25d RR closing 3.5v. Effectively the market has largely priced intervention premium into the curve near-term, with the skew at equivalent past intervention levels and sitting just below levels we saw in the July/August 2024 Yen carry unwind episode.

From here, Goldman likes playing downside USDJPY via fading this front-end surface level -> Buy digital put spreads like 1m 151/147 binary put @ 15% with ~147 the level 10y real rate differentials imply the fair level of USDJPY.

Next, we go around the Goldman FX trading desk for specific trader comments:

FX Strategy:

Mike Cahill (Senior FX Strategist):

“The vocal rate check is essentially the most powerful tool in the arsenal short of actual intervention. It is often followed by actual intervention (within about a week) if it is not successful. In this case, the signal is even stronger than in 2022 or 2024 because of the US participation.

Interventions with sufficient credibility are generally successful in curbing short-term moves. When measuring the effectiveness of Yen interventions in recent years, we have frequently noted that they tend to at least temporarily diminish the FX sensitivity to rates moves. In effect, this means interventions don't turn the currency, but they do slow it down and give a chance for new catalysts to take over. With the election approaching, that seems a sufficient goal.

However, in our view intervention does not solve the root cause, and we remain in a suboptimal policy regime where the BoJ hinted at actions that would limit JGB volatility, which would transfer the pressure to FX, while FX interventions transfer the volatility back to FI. So, this is a temporary solution while we await a new macro driver.

There is clear potential for this to have a broader impact on the Dollar. First, it demonstrates that the US administration is taking a more active approach to FX (and they are not the only ones--FX has been influencing policy decisions more in places like Korea and China lately too). Second, the Yen moves can have a knock-on effect across other key crosses like EUR and CNH which recently have also found macro sources of support. We saw something similar, in the opposite direction, in October when the Japan election helped catalyse a broad turn in USD. “

FX Trading:

Kristian Brauten-Smith (G10 FX Trading):

“We are reluctant to focus too much on historical interventions and their average impacts on the Yen. The dynamics this time round feel very different - USDJPY has already traded from 159.23 highs post the BOJ on Friday to below 154 Monday morning, but excess volumes stand at a fraction of the previous intervention days. Additionally, it was widely reported Friday evening that the Federal Reserve performed a rate check on behalf of the US Treasury – this is very different to the “usual” Japanese official led rate checks and interventions.

With the above two points in mind we suspect any intervention this time would have a much more lasting impact, and given other G10 currencies are ~10% stronger versus the Dollar this time round, we don’t expect committed buyers until the 147/149 region more medium term. If lifers are tempted to hedge it could end up being even lower over the coming months, but this would require a helping hand from a weaker Dollar more generally. We are not saying we will get there in one round of intervention (which may only come on a move back higher anyway), but a new balance could be a long way lower from here.

After the move over Friday’s session we suspect very few account to follow the playbook mapped out at the beginning of the year which was more akin to “buy a dip into the low 154s”. We noted around a week ago a substantial change in EURUSD orderbook dynamics, and the Dollar bid there ended at a very similar time to USDJPYs meteoric rise – we have zero interest in buying USDJPY dips other than to take profit on existing cash shorts.”

Masaaki Shinotsuka (G10 FX Trading):

“The typical local RM stance of "buying on dips" — for example, viewing the low-150s as a buy-on-dip zone or below 150s— would not be surprising. However, given the strain on balance sheets due to JGB-related issues, there remains considerable doubt as to whether they can actively take on new FX risk in the current environment.

At the same time, this kind of market environment can be seen as an attractive opportunity for Japanese importers to structure TARF trades and given that we are in a correction phase from recent highs, it would not be surprising to see a reasonable amount of export-side selling flow as well. That said, the dollar/yen market remains largely speculator-driven at this juncture, and once a certain amount of position unwinding has run its course, there is a strong chance that price action will temporarily calm down. However, with the threat of FX intervention hanging over the market, the topside is likely to remain heavy for a while.

In addition, with Japan heading into an election phase, the price action from last Friday through today may well have been a timely "warning" ahead of the election campaign. Given that the market had once swung toward dollar strength and yen weakness following Governor Ueda’s dovish press conference, the subsequent adjustment triggered by this series of events has resulted in a relatively large swing.

What is notable this time is that the dollar in general is being sold. The DXY has clearly broken below its downside support line, making the technical picture for the dollar increasingly one-sided toward further selling pressure. A cynical interpretation would be that "the U.S. may be tolerating a weaker dollar," but at this stage it seems premature to jump to such a conclusion. That said, if the U.S. side is indeed showing some tolerance for dollar weakness, this could create a more favorable environment for the BOJ to proceed with policy normalization or rate hikes.”

G10 Vol Trading:

Jemima Currie (G10 FX Option Trading):

“The step up rhetoric this weekend after PM Takaichi warned on Sunday against speculative moves, following a large yen reversal and rate-check expectations late Friday afternoon has brought JPY intervention top of mind. Historical factors to watch out for:

- Level: JPY TWI is back near 2024 interventions levels

- Pace of move and volatility: The extent of the USDJPY move higher over short periods reached going into prior interventions are shown below. This is often quoted as a defining factor for intervention however this was not a good guide over 2024 episodes.

- Verbal Intervention: A step up in rhetoric this weekend after PM Takaichi warned on Sunday against speculative moves following Foreign Minister Katayama issuing fresh warnings this month that they are "prepared to take decisive action, including all available options."

- Rate checks: There have been few occasions of rate checks when interventions did not follow within subsequent months in Japan. A rate check has historically preceded actual intervention (see this FX Trader for more), though the last reported rate check came in the middle of the July 2024 operations that occurred over two days. The rate check prior to that, on September 14, 2022, came about a week before intervention.

Given high probability of intervention post a rate check, the market has repriced front end skew significantly higher on Friday afternoon; 1w 25d RR closing 3.5v. Effectively the market has largely priced this intervention premium into the curve near term with the skew at equivalent past intervention levels and is sitting just below levels we saw in the July/August 2024 Yen carry unwind episode. From here we like playing downside USDJPY via fading this front-end surface level. Buy digital put spreads like 1m 151/147 binary put @ 15% with ~147 the level 10y real rate differentials imply the fair level of USDJPY.

1w 25d RR closing 3.5V

Next, we turn to Deutsche Bank's chief FX strategist George Saravelos (who will be delighted to pivot away from the topic of potential European sales of US assets), and who writes that it is unclear whether the Federal Reserve would participate in intervention (excerpted from his note, available to pro subs).

By long-standing convention, any FX intervention conducted by the US historically takes place via an equal funding split between the US Treasury Exchange Stabilization Fund (ESF) and the Federal Reserve Balance sheet (printing dollars). Given the potential bilateral (rather than multi-lateral) nature of any potential intervention and broader questions around Fed independence, the market will be keenly focused on whether any possible intervention maintains this convention.

What about the macroeconomic justification for intervention?

Unclear: on the one hand, it is widely agreed that the JPY is extremely cheap, and it has also dislocated from its interest rate differential signal. On the other hand, the main driver behind JPY weakness is exceptionally negative real rates and a central bank widely perceived as being behind the curve.

Putting it all together, Saravelos sees two broad takeaways from Friday's episode:

- On the US side, the bar to deploy FX intervention appears to be set lower compared to historical precedent. It is reasonable for the market to assume that the US may be willing to help other large economies wishing to prevent currency weakness (most notably Korea), and by extension is also reasonable to take this as a broader signal towards prioritizing a softer USD. We wrote in our FX Blueprint that Asia FX needs to take the lead for broad dollar weakness this year and if the US assists in this objective it would certainly be supportive of our weaker USD view for 2026. The support extended to Argentina and this Friday's rate check shows that the US may be increasingly willing to intervene in international markets to achieve domestic policy priorities, with the administration making it clear that JGB market volatility was unwelcome this week.

- On the Japanese side, it is unclear as to whether this signal (or eventual intervention) is going to be sufficient to turn the JPY. Front-end Japanese real rates are still very negative, and the capacity of the US to push through a weaker USD is constrained via the limited firepower of the ESF (roughly $200bn). Intervention would certainly be more powerful if there was a quid pro quo with the BoJ for a more hawkish turn in policy, though this was not delivered at Friday's meeting. It is the long-awaited repatriation of Japanese capital that will ultimately trigger JPY strength and we will be closely watching Japanese capital flow data in coming weeks for hints this may be materializing.

We also excerpt some of the key points from an FX note by Jefferies (full note available to pro subs), which first looks at the impact on the JGB market:

We have been short the JGB market and continue to do so. We are staying away from the long end of the curve. With the caveat that we are not political experts, a Takaichi victory will reignite fiscal concerns in the market and continue to pressure the long end of the curve. The long end does not have natural buyers. One of the popular trades during BoJ QE days was to buy the long end of the curve and benefit from the carry and roll down as the 10Y was pegged by the BoJ. We do not believe that the positioning overhang has been cleaned. One way to support the long end would be to switch away from foreign bond holdings and into JGBs. This would pressure on the long end of US and European curves. Any pressure on long end JGBs supports our view of staying away from the long end in fixed income globally. In our view, a key level to watch is the level of hedged 10Y JGB yields relative to 10Y Bunds. With the recent sell-off that level has been reached and 10Y JGB yields are now higher than 10Y Bunds yields. Even though we don't see large scale selling from the Japanese investors, any further sell-off in JGBs will shift the preference of Japanese investors towards domestic markets relative to US or Europe for any new money.

Here is Jefferies on implications for equities:

We have been long Japanese equities and maintain the view. A shift towards easier fiscal policies with a not so aggressive hiking path

from the BoJ should continue to support Japanese equities. However, the policy mix should offer opportunities across sectors. We remain long financials. A hiking environment with a favourable corporate reform process should support financials. Paradoxically we believe that an aging population supports the big banks relative to the smaller banks and should also support the consolidation story. Older generation is spread over the countryside and have accounts with the regional banks. Younger generation tends to live in larger cities and banks with the megabanks. A transfer of wealth from the older generation to the younger generation should favor the megabanks. Areas which would be considered critical for increasing self-reliance would also be an overweight in our portfolio. These include semiconductors, defence and technology which should see increased focus from economic polices going forward.

As for the yen...

We are short USDJPY with a target of a move below 150. From a fundamental perceptive we see the nominal and the real spread differential between the US and Japanese rates reducing sharply over time. BoJ is in a hiking cycle and the Fed (we believe) is in an easing cycle. We also believe that JPY should benefit from the USD diversification trade that started with the tariff wars and is likely to extend this year with more uncertainty in the US policy framework. As events since the start of the year have shown, Trump policies have become more interventionist and which should further help the US diversification trade. Our view remains that the USD diversification trade should be relative to precious metals and vs Asian currencies. It's not just the JPY, we should also see other Asian currencies including KRW, TWD and SGD strengthen vs USD.

Finally, here is the post mortem from Spectra Markets' Brent Donnelly, who was the first to bring attention to the rate check on Friday:

Still no actual USD selling, but we’ve now covered exactly the standard move for USDJPY intervention. 152.86 / 153.65 is the 3.5%/4.0% standard move off the 159.23 high, and our low so far is 153.30. Pretty much perfect. I have covered this fact of the 3.5%/4.0% move a bunch of times in am/FX (i.e., this is not hindsight).

The price action is incredibly calm, and there are no bounces. This is strange to me because many fast money traders / spot traders would have gone short at 155.50/156.00 on the rate check news and yet there has been very little in the way of upside spikes or retracements. I suppose real money and macro hedge funds are TWAPping the whole way down as they attempt to exit the Takaichi fiscal blowup trade... Or... There is some kind of stealth intervention TWAP going through. This is much less likely.

I will say, though, that with this being such an obvious and epic trade setup for fast money/spot traders on Friday, USDJPY shorts are going to start to get nervous if we don’t see any follow-up from the authorities by tonight. It would seem odd for them to intervene way down here, but then again if they don’t, we’re going to be back at 158 pretty quick. USDJPY’s path over the next 48 hours is not at all obvious. There are massive real money USDJPY longs, and large fast money USDJPY shorts at this point. Shorts need a catalyst soon.

Brent was also kind enough to share his views on the odds off fvarious FX scenario outcomes (read all about them here).

Much more in the full Goldman, Jefferies, and Deutsche Bank note, all available to pro subs.